- Continued strong organic revenue growth across all regions

- Record growth in home dialysis in North America

- Improved earnings growth despite negative ESCO effect

- Cost optimization initiatives on track

- Outlook 2019 confirmed

Rice Powell, Chief Executive Officer of Fresenius Medical Care, said: “In the third quarter Fresenius Medical Care once again achieved stable, healthy growth. Our underlying business continues to develop according to plan and we are working successfully to provide even more patients with ever better and more individualized treatment options. In North America we have seen record growth in the number of home dialysis patients supported by the effective roll-out of the NxStage product range. In China we have launched the 4008A, our dialysis machine specially developed for emerging markets. Based on the company’s continuing organic revenue growth and accelerated earnings growth despite the unplanned negative effect of the ESCOs this year, we confirm our outlook for 2019.”

Record growth in home dialysis in North America

In the first seven months following the acquisition of NxStage Medical Inc., Fresenius Medical Care reported a record growth in home dialysis and now treats more than 25,000 patients at home in North America. From March through September 2019, the growth rate for home dialysis was nine times the rate of in-center dialysis. In addition to the NxStage acquisition, training facilities, education and distribution are important areas of investment as part of Fresenius Medical Care’s initiative to promote dialysis in the home setting.

4008A dialysis machine launched in China

In September 2019, Fresenius Medical Care launched the 4008A dialysis machine in China, laying an important foundation for the further development of the world’s fastest-growing dialysis market. The 4008A is specifically designed to incorporate high-quality standards while reducing costs for health care systems, to meet the needs of emerging markets. Fresenius Medical Care is dedicated to contributing to the ‘Healthy China 2030’ initiative of the Chinese government, of which the development of professional dialysis centers is one element. Therefore, the company is focusing on expanding its production capacities, research and development activities, and on strengthening the services business. Fresenius Medical Care intends to build a network of around 100 renal facilities in China over the next five years.

Continued strong organic growth

Revenue in the third quarter 2019 increased by 9% (+6% at constant currency) compared to the previous year’s quarter and amounted to EUR 4,419 million. Organic growth remained strong at 5%. Adjusted for the effect of the IFRS 16 implementation and the contribution of NxStage, revenue increased by 8% (+5% at constant currency) to EUR 4,375 million.

Health Care Services revenue increased by 7% to EUR 3,492 million (+4% at constant currency), largely due to growth in same market treatments (volume growth), acquisitions, and an increase in dialysis days, partially offset by a revenue recognition adjustment for accounts receivable in legal dispute of EUR 84 million3 and the effect of closed or sold clinics. Health Care Products revenue grew by 16% to EUR 927 million (+13% at constant currency), mainly driven by higher sales of home hemodialysis products (supported by the effective roll-out of the NxStage product range), dialyzers as well as hemodialysis solutions and concentrates, partially offset by lower sales of machines.

In the first nine months of 2019 revenue increased by 5% to EUR 12,897 million (+1% at constant currency). Adjusted for the effects of the NxStage acquisition, the implementation of IFRS 16 and the contribution of the divested company Sound Physicians in 2018, revenue rose by 9% (+5% at constant currency) and amounted to EUR 12,784 million. Overall organic growth amounted to 5% in the first nine months. Health Care Services revenue grew by 4% (stable at constant currency), while Health Care Products revenue increased by 10% (+8% at constant currency).

Improved earnings growth momentum

In the third quarter of 2019 total EBIT increased by 13% to EUR 595 million (+9% at constant currency), resulting in an operating income margin of 13.5% compared to 13.0% in the previous year’s quarter. The improved overall profitability was mainly driven by a prior-year accrual for an FCPA related charge, the remeasurement effect on the fair value of the investment in Humacyte, Inc. and higher utilization of oral based ancillaries with favorable margins. This was partially offset by higher personnel expenses, a revenue recognition adjustment for accounts receivable in legal dispute as well as the reduction in patient attribution and a decreasing savings rate for ESCOs, based on recent reports under discussion for current and prior plan years (“ESCO effect”). Adjusted EBIT grew by 1% to EUR 599 million (-3% at constant currency). For a detailed reconciliation, please refer to the table at the end of the press release. The adjusted operating income margin decreased from 14.6% to 13.7%.

In the first nine months of 2019, EBIT decreased by 32% to EUR 1,653 million (-35% at constant currency). The most significant reason for the decline is the positive prior year EBIT increased as a consequence of the divestiture of Sound Physicians, Inc. On an adjusted basis, EBIT decreased by 1% (-5% at constant currency).

Net income2 grew by 17% to EUR 333 million (+12% at constant currency) in the third quarter of 2019. Adjusted net income2 increased by 6% (+2% at constant currency) mainly supported by lower interest expense. For details please refer to the table at the end of the press release.

In the first nine months of 2019, net income declined by 45% to EUR 857 million (-47% at constant currency). Also here the most significant reason for the decline is the positive prior year contribution from the divestiture of Sound Physicians, Inc. Net income grew on an adjusted basis by 2% (-3% at constant currency).

Based on approximately 301.4 million shares (weighted average number of shares outstanding), basic earnings per share (EPS) grew by 19% to EUR 1.10 (+14% at constant currency). On an adjusted basis, basic EPS amounted to EUR 1.21, representing an increase of 8% (+4% at constant currency). The development was supported by the current share buy-back program.

Negative ESCO effect – recent reports under discussion

The ESCO effect in Q3 2019 had a negative impact on revenue as well as on EBIT of EUR 46 million (EUR -44 million at constant currency). Net income was reduced due to this effect by EUR 33 million (EUR -31 million at constant currency).

In the first nine months of 2019, the ESCO effect on revenue as well as on EBIT was negative with EUR 87 million (EUR -82 million at constant currency) while net income was EUR 60 million (EUR -56 million at constant currency) lower due to this effect.

Healthy Dialysis Care growth across all segments

North America revenue, which represents 70% of total revenue, increased by 8% to EUR 3,073 million in the third quarter of 2019 (+3% at constant currency). Organic growth was 3%. Dialysis Care revenue grew by 8% to EUR 2,522 million (+4% at constant currency), mainly due to same market treatment growth (volume growth) of 3%, increases in organic revenue per treatment, contributions from acquisitions and an increase in dialysis days, partially offset by the revenue recognition adjustment for accounts receivable in legal dispute. At the same time, Care Coordination revenue decreased by 9% to EUR 273 million (-13% at constant currency) due to lower organic growth, including the ESCO effect, and the disposal of MedSpring Urgent Care Centers in the U.S., partially offset by contributions from acquisitions. This resulted in a Health Care Services revenue of EUR 2,795 million in total, representing an increase of 6% (+2% at constant currency).

In the U.S., the average revenue per treatment decreased by USD 9 to USD 347 (-3%) compared to the previous year’s quarter. The development was mainly attributable to a revenue recognition adjustment for accounts receivable in legal dispute.

Cost per treatment in the U.S., adjusted for the implementation of IFRS 16, increased from USD 290 in the previous year’s quarter to USD 292 in the third quarter of 2019 (+1%). This increase was largely driven by higher personnel expense and the impact from the acquisition of NxStage, partially offset by lower costs for health care supplies.

Health Care Product revenue increased by 30% to EUR 278 million (+24% at constant currency, +10% organic) in the third quarter, driven by higher sales of home hemodialysis products supported by the effective roll-out of the NxStage product range, renal pharmaceuticals and dialyzers, partially offset by lower sales of machines, mainly as a result of changes in the accounting treatment for sale-leaseback transactions due to the IFRS 16 implementation.

Total EBIT of the North America segment decreased by 9% to EUR 477 million (-13% at constant currency). The operating income margin further improved from 14.0% in the second quarter to 15.5% in the third quarter of 2019, but was 3.0 percentage points lower than in the third quarter of 2018. Dialysis operating income margin decreased by 1.3 percentage points to 17.9%. This was mainly due to higher personnel expense, a revenue recognition adjustment for accounts receivable in legal dispute, the negative impact from income attributable to a consent agreement on certain pharmaceuticals in the prior year, costs in connection with the cost optimization program and the integration and operational costs associated with NxStage. These effects were partially offset by the remeasurement effect on the fair value of the investment in Humacyte, Inc. and a favorable impact from higher utilization of oral based ancillaries with favorable margins. Care Coordination operating income margin decreased by 20.4 percentage points, mainly due to the ESCO effect, lower gains from divestitures of Care Coordination activities and unfavorable margins for oral based ancillaries, partially offset by higher volumes for vascular services.

In the first nine months of 2019, North America revenue increased by 5% to EUR 9,021 million (-1% at constant currency, +4 organic). On an adjusted basis, revenue grew by 10% (+4% at constant currency) from EUR 8,073 million to EUR 8,908 million. The operating income margin decreased from 25.3% to 14.2%. On an adjusted basis, operating income margin decreased from 16.5% to 14.4%.

As of September 30, 2019, Fresenius Medical Care was treating 209,633 patients (+4%) at 2,585 clinics (+4%) in North America. Dialysis treatments increased by 4% in the first nine months.

EMEA revenue increased by 10% to EUR 683 million (+9% at constant currency, +9% organic) compared to the previous year’s quarter, driven by a positive business development in both Health Care Services and Health Care Products. Health Care Services revenue grew by 9% (+8% at constant currency), as a result of growth in same market treatments, increases in organic revenue per treatment, contributions from acquisitions, and an increase in dialysis days, partially offset by the effect of closed or sold clinics. The 11% growth in Health Care Products revenue (+10% at constant currency) was mainly driven by an increase in dialysis product revenue of 11% (+10% at constant currency) due to higher sales of dialyzers, bloodlines as well as hemodialysis solutions and concentrates.

Non-dialysis product revenue grew by 14% compared to the previous year’s quarter (+14% at constant currency) and amounted to EUR 20 million.

EBIT of the EMEA segment grew by 14% to EUR 100 million (+14% at constant currency) in the third quarter of 2019. The operating income margin was 14.6%, representing an increase of 0.5 percentage points compared to the previous year’s quarter. This improvement was mainly driven by the impact from higher product sales and favorable foreign currency transaction effects, partially offset by higher bad debt expense and higher personnel expense in certain countries.

In the first nine months of 2019, EMEA revenue grew by 4% (+4% at constant currency, +4% organic) to EUR 1,984 million, while EBIT increased by 11% (+11% at constant currency) to EUR 334 million. The improved profitability was mainly driven by a reduction of a contingent consideration liability related to Xenios in the first quarter of 2019, a positive impact from acquisitions and a favorable outcome in a legal proceeding, partially offset by higher bad debt expense as well as higher personnel expense in certain countries.

As of September 30, 2019, Fresenius Medical Care was treating 66,259 patients (+3%) at its 784 dialysis clinics (+2%) in the EMEA region. Dialysis treatments increased by 3% in the first nine months.

Asia-Pacific revenue increased by 13% to EUR 475 million (9% at constant currency, +8% organic) in the third quarter, driven by a positive business development in both Health Care Services and Health Care Products. Due to growth in same market treatments, contributions from acquisitions, and an increase in dialysis days, partially offset by missing contributions from closed or sold clinics, Dialysis Care revenue grew by 13% to EUR 159 million (+7% at constant currency). Care Coordination revenue increased by 20% to EUR 64 million (+16% at constant currency), mainly driven by organic revenue growth and contributions from acquisitions. This resulted in a total Health Care Services revenue of EUR 223 million, representing an increase of 15% (+9% at constant currency) compared to the previous year’s quarter. Health Care Products revenue grew by 11% (+9% at constant currency), resulting from increased sales of dialyzers, bloodlines as well as hemodialysis solutions and concentrates, partially offset by lower sales of machines.

EBIT of the Asia-Pacific segment grew strongly by 36% (+32% at constant currency) and amounted to EUR 90 million. The resulting operating income margin was 19.0%, representing an increase of 3.3 percentage points compared to the third quarter of 2018. This improved profitability was due to the impact of business growth and favorable foreign currency transaction effects, partially offset by an unfavorable mix effect from acquisitions with lower margins as well as higher start-up and operating costs in the Care Coordination business.

In the first nine months of 2019, Asia-Pacific revenue grew by 10% to EUR 1,360 million (+7% at constant currency, +7% organic). Operating income increased by 17% to EUR 254 million (+14% at constant currency).

As of September 30, 2019, Fresenius Medical Care was treating 32,239 patients (+3%) at its 401 clinics (+3%) in the Asia-Pacific region. Dialysis treatments increased by 5% in the first nine months.

Latin America revenue increased by 7% to EUR 182 million (+20% at constant currency). Organic growth amounted to 15%. Health Care Services revenue grew by 8% and amounted to EUR 131 million (+26% at constant currency). The increase at constant currency was a result of higher organic revenue per treatment, contributions from acquisitions, growth in same market treatments, and an increase in dialysis days.

Health Care Products revenue grew by 3% (+5% at constant currency), mainly driven by increased sales of hemodialysis solutions and concentrates as well as machines, partially offset by lower sales of dialyzers.

EBIT of the Latin America segment amounted to EUR 11 million (Q3 2018: EUR -1 million). The operating income margin was 5.8% (Q3 2018: -0.9%). This was mainly due to reimbursement rate increases that mitigated inflationary cost increases.

In the first nine months of 2019, Latin America revenue grew by 2% to EUR 516 million (+20% at constant currency). Operating income increased by 17% (stable at constant currency) to EUR 28 million, resulting in an improved operating income margin (5.4%) compared to the first nine months of 2018 (4.7%).

As of September 30, 2019, Fresenius Medical Care was treating 34,357 patients (+7%) at its 233 clinics (+3%) in the Latin America region. Dialysis treatments increased by 6% in the first nine months.

Net interest expense increased by 38% to EUR 105 million (+33% at constant currency) in the third quarter. The increase was primarily due to the IFRS 16 implementation, a higher debt level and interest income on the proceeds from the disposal of Sound Physicians in the comparable period, partially offset by the replacement of high interest bearing bonds repaid in 2018 by debt instruments at lower interest rates.

Income tax expense decreased by 3% to EUR 98 million in the third quarter of 2019, which translates into an effective tax rate of 20.2% (Q3 2018: 22.7%). This improvement was largely driven by the prior year impacts from non-tax-deductible expenses, mainly related to the FCPA related charge, and U.S. ballot initiatives, partially offset by the favorable prior year effects of the U.S. tax reform.

Strong Cash-flow development

In the third quarter 2019 Fresenius Medical Care generated EUR 868 million of operating cash flow (Q3 2018: EUR 753 million). This corresponds to 19.7% of revenue (Q3 2018: 18.6%). The increase was largely driven by the IFRS 16 implementation leading to a reclassification of the repayment portion of rent to financing activities. As of September 30, 2019, the number of days sales outstanding (DSOs) improved to 73 (June 30, 2019: 77). Free cash flow (net cash used in operating activities, after capital expenditures, before acquisitions and investments) amounted to EUR 584 million (Q3 2018: EUR 496 million). Free cash flow was 13.2% of revenue (Q3 2018: 12.2%).

Outlook4,5

For 2019, Fresenius Medical Care expects adjusted revenue to grow between 3% and 7% and adjusted net income2 to develop in the range of -2% to 2%. The company previously pointed out that adjusted net income2 is likely to be at the lower end of the range.

For 2020, Fresenius Medical Care expects adjusted revenue as well as adjusted net income to grow at a mid to high single digit rate.

To make the business performance in the respective periods comparable, these targets as well as the 2018 base are and will be adjusted for items such as: FCPA related charges, the IFRS 16 implementation, the contributions from Sound Physicians in the first half 2018, the gain (loss) related to divestitures of Care Coordination activities and expenses for the implementation of the cost optimization program. All effects from the acquisition of NxStage Medical Inc. are excluded from the targets for 2019 and 2020.

Number of employees increased

As of September 30, 2019, Fresenius Medical Care had 120,734 employees (full-time equivalents) worldwide, compared to 112,134 employees as of September 30, 2018. This increase of 8% was mainly attributable to the NxStage acquisition.

1 For a detailed reconciliation, please refer to the table at the end of the press release

2 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

3 This adjustment results from a material weakness in our internal controls over financial reporting regarding accounts receivable and revenue recognition specific to fee-for-service in legal dispute. The company does not expect a restatement of its financial statements previously filed with the SEC. The Company is taking steps to remediate the control weakness.

4 Numbers at constant currency

5 Reported revenue 2018 of EUR 16,547 million adjusted for Sound H1 2018; reported net income 2018 of EUR 1,982 million adjusted for Sound H1 2018, the gain (loss) related to divestitures of Care Coordination activities and the 2018 FCPA related charge

Conference call

Fresenius Medical Care will host a conference call to discuss the results of the third quarter today at 3:30 p.m. CEDT / 10:30 a.m. EDT. Details will be available on the company’s website. A replay will be available shortly after the call.

Please refer to our statement of earnings included at the end of the PDF-files for a complete overview of the results for the third quarter 2019.

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to various factors, including, but not limited to, changes in business, economic and competitive conditions, legal changes, regulatory approvals, results of clinical studies, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius Medical Care, the world’s leading provider of dialysis products and services, announced today the appointment of Dr. Frank Maddux, 61, the company’s Global Chief Medical Officer, to the Management Board. He will start in his new position on January 1, 2020.

Dr. Maddux was appointed Global Chief Medical Officer in March of this year with the goal of enhancing cooperation and the exchange of medical knowledge across the Fresenius Medical Care network, in order to ensure high-quality outcomes for patients worldwide. Now, by adding this position to the Management Board, Fresenius Medical Care is further underlining its commitment to applying clinical science at an ever-higher level.

Dr. Maddux is a physician, IT entrepreneur and healthcare executive with more than 30 years of experience in healthcare. He has been with Fresenius Medical Care since 2009. Before his appointment as Global Chief Medical Officer, he served as Executive Vice President for Clinical & Scientific Affairs and Chief Medical Officer for Fresenius Medical Care North America, where he was responsible for the delivery of high-quality, value-based care for the largest integrated renal care network in the United States. His great expertise and research interests have focused on the quality of care for chronic kidney disease patients.

Stephan Sturm, Chairman of the Supervisory Board of Fresenius Medical Care Management AG, said: “As Global Chief Medical Officer, Dr. Frank Maddux enjoys an outstanding reputation both inside and outside of Fresenius Medical Care. With his proven medical competence and experience, which he can contribute, he will be a great addition to the company’s Management Board.”

Rice Powell, Chief Executive Officer of Fresenius Medical Care and Chairman of the Management Board, said: “Dr. Frank Maddux will be key to our ability to drive value for our patients by pursuing new and evolving medical opportunities, such as a more-focused home therapies offering, regenerative medicine, and enhancing our Care Coordination business model throughout the world. We are fortunate to have a Global Chief Medical Officer as qualified and experienced as Dr. Maddux joining our Management Board.”

Dr. Maddux said: “The well-being of our patients is our priority, and key to our company’s success. To continuously deliver on this global commitment, I am moved by the power of ideas, conceived by individuals, molded by collective intelligence and brought to life by investment in a higher purpose that is dedicated to improving the lives of people. I am proud of the importance that medical science has for Fresenius Medical Care.”

Diese Mitteilung enthält zukunftsbezogene Aussagen, die gewissen Risiken und Unsicherheiten unterliegen. Die zukünftigen Ergebnisse können erheblich von den zurzeit erwarteten Ergebnissen abweichen, und zwar aufgrund verschiedener Risikofaktoren und Ungewissheiten wie z.B. Veränderungen der Geschäfts-, Wirtschafts- und Wettbewerbssituation, Gesetzesänderungen, Ergebnisse klinischer Studien, Wechsel-kursschwankungen, Ungewissheiten bezüglich Rechtsstreitigkeiten oder Untersuchungsverfahren und die Verfügbarkeit finanzieller Mittel. Fresenius Medical Care übernimmt keinerlei Verantwortung, die in dieser Mitteilung enthaltenen zukunftsbezogenen Aussagen zu aktualisieren.

Fresenius Medical Care, the world’s leading provider of dialysis products and services, today announced the publication of its 2019 global annual medical report. Titled “Global Insights, Local Promise: Transforming Healthcare Through Interconnected Intelligence,” it outlines how the company is harnessing the power of an increasingly interconnected world to pioneer solutions that can have a large-scale impact on patient care.

The report also explores ways to apply insights gained in different markets on a global level, and how best practices can be adapted to specific market needs.

In addition to articulating experiences in dialysis care across diverse regions, the report delves deeper into several focus areas relevant to the healthcare industry and the evolution of kidney care:

- Expanding home therapies to give dialysis patients more control of their lives and improve treatment outcomes.

- Improving transplant access through open communication and collaboration among multiple stakeholders.

- Embracing diversity and an interdisciplinary approach to improve value-based care in kidney disease.

- Developing predictive models to identify dialysis clinics that are encountering problems or in need of additional support, and,

- Clarifying and explaining the role of nutrition in the prevention and treatment of chronic kidney disease.

Dr. Frank Maddux, Global Chief Medical Officer of Fresenius Medical Care, said: “Interconnected thinking is central to our way of working at Fresenius Medical Care and it demonstrates our commitment to making a difference in the lives of patients. The people of Fresenius Medical Care, all around the world, have always been our greatest asset. Harnessing the full potential of their interconnected intelligence can boost innovation, advance medical progress, develop better therapies, and help drive the transformation of healthcare systems worldwide.”

Spectra Laboratories, a wholly-owned subsidiary of Fresenius Medical Care North America, broke ground on a 200,000-square-foot (approx. 18,500 square meters) laboratory in Southaven, Mississippi yesterday. The project is expected to create more than 300 jobs over the next three years. Spectra Laboratories offers renal-specific laboratory services, using state-of-the-art equipment, automated specimen processing, and reporting applications. At Spectra’s new build-to-suit facility, employees will conduct comprehensive testing, analysis, and reporting to ensure the best possible outcomes for patients.

Fresenius Medical Care, the world’s leading provider of dialysis services and products, plans to invest EUR 60 million in its independent affiliate Unicyte AG in a Series A financing round. Unicyte, a leading regenerative medicine company with translational programs in the field of kidney disorders and other diseases, will primarily use the capital to start clinical trials of its first product candidates in 2020 and to establish the required manufacturing processes.

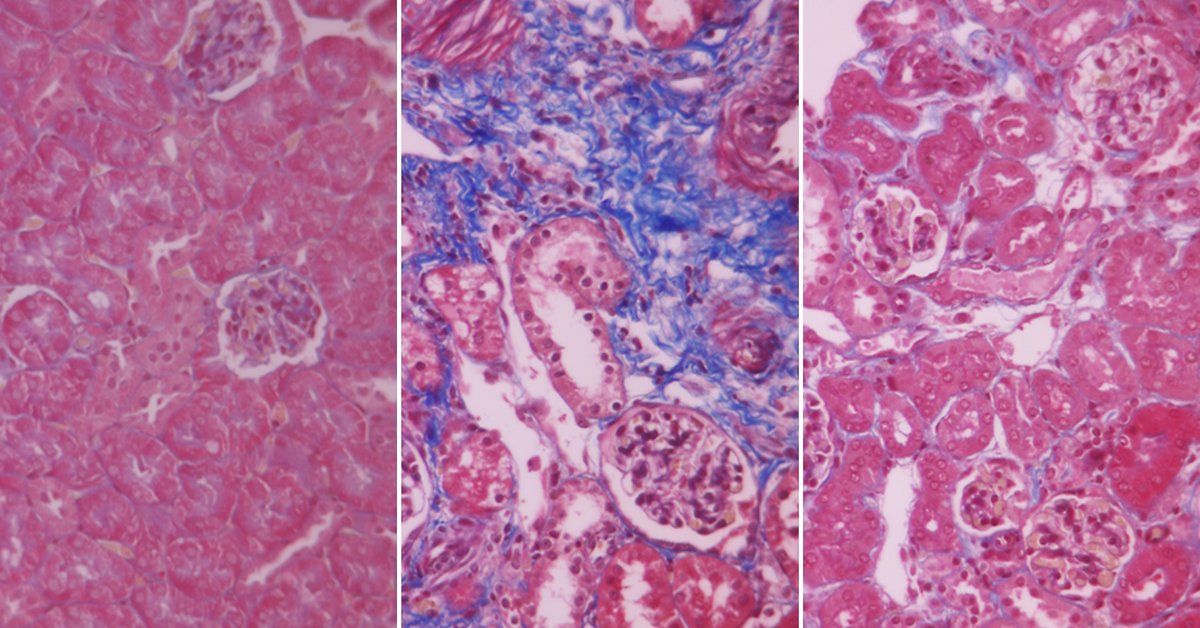

Over the last four years, Unicyte has created a unique set of proprietary technology platforms of human liver stem cells (HLSCs), HLSC-derived islets and nano-Extracellular Vesicles (nEVs). nEVs are stem cell-derived particles that support communication between cells.

Unicyte succeeded in confirming the disease-modifying potential of its nEVs in various preclinical models of chronic kidney disorders. Combined results of these studies demonstrate nEVs’ efficacy and underlying mechanism of action in preventing renal fibrosis and its subsequent progression to end-stage renal disease.

“Regenerative medicine could provide highly innovative therapies to chronic kidney disease patients and is becoming increasingly important for our industry. Driving regenerative therapies not only addresses the U.S. administration’s initiative to improve the prevention of end-stage renal disease, but can help us to significantly slow the progression of kidney disease and make the most innovative therapies available to our patients,” said Rice Powell, CEO of Fresenius Medical Care.

Dr. Olaf Schermeier, Fresenius Medical Care’s CEO for Global Research and Development, said: “This continued investment in Unicyte shows our commitment to developing the best treatment options for our patients across the renal care continuum. At the same time, it puts Fresenius Medical Care at the forefront of innovation in the field of regenerative renal stem cell therapy.”

“Based on our preclinical results, the commitment of Fresenius Medical Care is a strong driver for Unicyte’s next milestone, the start of clinical development with the required organizational structure. It will also provide a solid data package for our non-kidney product candidates to seek strategic partnerships as the next step,” said Florian Jehle, CEO of Unicyte.

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius Medical Care, the world’s leading provider of dialysis products and services, has appointed Helen Giza (51) as Chief Financial Officer as of November 1, 2019. She will succeed Mike Brosnan who announced his retirement from the Company earlier this year after serving as CFO since January 2010.

Helen Giza has been Chief Integration and Divestiture Management Officer at Takeda Pharmaceuticals since 2018. Before joining the Takeda Corporate Executive Team, she served as Chief Financial Officer of Takeda’s U.S. business unit since 2008. Prior to that she held a number of key international finance and controlling positions, amongst others at TAP Pharmaceuticals and Abbott Laboratories. Helen Giza is a U.K. Chartered Certified Accountant and holds a Master of Business Administration from the Kellogg School of Management at Northwestern University in Evanston, Illinois, USA.

Stephan Sturm, Chairman of the Supervisory Board of Fresenius Medical Care Management AG, said: “Helen Giza is a very skilled financial executive with extensive management experience in the healthcare industry. She will be a great addition to our team and we are very pleased to welcome her to Fresenius Medical Care’s management board.”

Rice Powell, Chief Executive Officer of Fresenius Medical Care and Chairman of the Management Board, said: “We look forward to welcoming Helen to our team. Along with her international financial expertise, Helen brings great experience in the area of acquisitions and successful integration within the healthcare sector.”

Helen Giza said: “I am excited to be joining Fresenius Medical Care, the market leader in dialysis. This new role is a wonderful opportunity to be part of Fresenius Medical Care's continued success.”

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

-

Underlying business development in line with expectation

-

Continued strong organic revenue growth

-

Healthy growth in the U.S. dialysis business

-

Negative effect from ESCOs, based on recent reports for prior plan years

-

Increasing earnings growth momentum expected

-

Outlook 2019 confirmed

Rice Powell, Chief Executive Officer of Fresenius Medical Care, said: “We have delivered a solid second quarter with continued strong organic revenue growth. Net income in our underlying dialysis business developed in line with our expectations. We are confident to accelerate earnings growth over the second half of the year toward achieving our full-year targets. Due to ongoing delays in reconciliation of generated savings in the value-based ESCO pilot program and differing views with regard to the measurement mechanisms, it is prudent to adjust the rate of savings we applied to accrue revenues and earnings. While views differ on the magnitude of savings generated, it is clear that we have realized meaningful savings in the ESCO pilot as well as other value-based arrangements. We moved quickly and maintained tremendous focus since 2014. We are uniquely positioned with our vast experience to impact cost and quality of care in kidney disease. We remain committed to value-based care.”

1 For a detailed reconciliation, please refer to the table at the end of the press release

2 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

Home dialysis strategy reinforced by President Trump’s Executive Order

Fresenius Medical Care continues to achieve an increase in the number of treatments being carried out in the home setting in North America. The investments in training facilities, education and distribution are important areas of investments this year. Concurrently, the company is investing around EUR 100 million in 2019 as part of the Cost Optimization Program to optimize its US services footprint. The company´s execution of its home strategy is additionally supported by the Executive Order on Advancing Kidney Health. Fresenius Medical Care has intensified its initiatives to promote home dialysis, improve access to transplants, and develop value-based care models for chronic kidney disease patients.

Continued strong organic growth

Revenue in the second quarter 2019 increased by 3% to EUR 4,345 million (stable at constant currency). Organic growth continued to be strong at 4%. Adjusted for the Q2 2018 revenue contribution from Sound Inpatient Physicians (“Sound”, divested effective end of Q2 2018) as well as the impact from the IFRS 16 implementation and the revenue contribution from NxStage, revenue increased by 8% (+5% at constant currency).

Health Care Services revenue increased by 2% to EUR 3,455 million ( 2% at constant currency). Growth was constrained by missing revenue from the divested Sound activities and closed or sold clinics. Growth in same market treatments (volume growth), acquisitions and increases in organic revenue per treatment had a positive impact. Health Care Products revenue increased by 7% to EUR 890 million (+6% at constant currency), mainly driven by higher sales of home hemodialysis products (supported by the acquisition of NxStage), products for acute care treatments, peritoneal dialysis products, and renal pharmaceuticals, partially offset by lower sales of machines as a result of changes in the accounting treatment for sale-leaseback transactions due to the IFRS 16 implementation and in EMEA lower sales of dialyzers.

In the first half 2019, revenue increased by 4% to EUR 8,478 million (-1% at constant currency). Excluding the effects from Sound, the IFRS 16 implementation and NxStage, revenue was up by 9% (+5% at constant currency). Organic growth was 5%. Health Care Services revenue grew by 3% (-2% at constant currency). Health Care Products revenue increased by 7% (+5% at constant currency).

In the second quarter 2019 total EBIT decreased by 63% to EUR 521 million (-65% at constant currency), resulting in an operating income margin of 12.0% (compared to 33.3% in the previous year). The strong result in the previous year was driven by the gain related to divestitures of Care Coordination activities. On an adjusted basis, EBIT decreased by 12% to EUR 491 million (-17% at constant currency) and operating income margin decreased from 14.1% to 11.5% driven by higher personnel expense and the reduction in patient attribution and a decreasing savings rate for ESCOs, based on recent reports for prior plan years (“ESCO effect”).

In the first half 2019, EBIT decreased by 44% to EUR 1,058 million (-47% at constant currency). Adjusted for the effects described above, EBIT decreased by 2% (-7% at constant currency).

Net income2 decreased by 74% to EUR 254 million (-76% at constant currency) in the second quarter 2019. On an adjusted basis, net income2 decreased by 9% (-14% at constant currency).

Based on approximately 303.5 million shares (weighted average number of shares outstanding), basic earnings per share (EPS) decreased by 74% to EUR 0.84 ( 76% at constant currency). On an adjusted basis, basic EPS amounted to EUR 0.92, representing a decrease of 9% (-14% at constant currency).

Strong Dialysis Care Growth

In the second quarter 2019 North America revenue, which represents 70% of total revenue, increased by 3% to EUR 3,061 million (-3% at constant currency). Organic growth in North America was 4%. Health Care Services revenue increased by 1% to EUR 2,789 million (-5% at constant currency). Dialysis Care revenue increased by 13% (6% at constant currency) to EUR 2,511 million. The growth was mainly due to increases in same market treatments (volume growth), increases in organic revenue per treatment, and contributions from acquisitions, partially offset by the effect of closed or sold clinics. Same-market treatment growth in the US again accelerated and reached 4.1%. Care Coordination revenue decreased by 47% to EUR 278 million (-50% at constant currency), mainly due to the divestiture of Sound in the previous year.

In the U.S., the average revenue per treatment increased by USD 4 to 358 USD (+1%). The development was mainly attributable to higher utilization of oral based ancillaries and an increase in the ESRD PPS base rate, partially offset by lower revenue from commercial payors.

Cost per treatment in the U.S., adjusted for the implementation of IFRS 16, increased from USD 289 to USD 297. This increase was largely driven by higher personnel expense as well as increased costs for occupancy and health care supplies.

Health care product revenue increased by 29% to EUR 272 million (+21% at constant currency), driven by higher sales of home hemodialysis products supported by the NxStage acquisition, renal pharmaceuticals and peritoneal dialysis products, partially offset by lower sales of machines as a result of changes in the accounting treatment for sale-leaseback transactions due to the IFRS 16 implementation.

Total EBIT of the North America segment decreased by 67% to EUR 429 million (-68% at constant currency). The strong results in the previous year were mainly driven by the gain related to the divestiture of Care Coordination activities. The operating income margin sequentially improved from 12.9% in the first quarter 2019 to 14.0% in the second quarter of 2019. The dialysis operating income margin decreased period over period by 1.7 percentage points to 15.4%. This was driven by higher personnel expense, the integration and operational costs associated with NxStage and the prior year income attributable to a consent agreement on certain pharmaceuticals, partially offset by higher utilization of oral based ancillaries with favorable margins and a positive effect from the IFRS 16 implementation.

In the first half 2019, North America revenue increased by 4% to EUR 5,948 million (-3% at constant currency). Adjusted for the H1 2018 revenue contribution from Sound as well as the impact from IFRS 16 and NxStage, revenue grew by 12% (5% at constant currency). Mainly driven by the gain related to divestitures of Care Coordination activities in the previous year as well as higher personnel expenses, integration and operational costs associated with NxStage and the ESCO effect, partially offset by higher utilization of oral based ancillaries with favorable margins, the operating income margin decreased from 28.7% in the first half 2018 to 13.5% in the first half 2019.

As of the end of June 2019, the company was treating 208,019 patients (+4%) at its 2,583 clinics (+6%) in North America. Dialysis treatments increased by 4%.

In the second quarter 2019 EMEA revenue decreased by 1% to EUR 648 million (stable at constant currency), driven by a positive business development in Health Care Services, offset by lower sales of Health Care Products. Health Care Service revenue increased by 6% (+7% at constant currency) as a result of growth in same market treatments, contributions from acquisitions, and increases in organic revenue per treatment, partially offset by the effect of closed or sold clinics. Health Care Product revenue decreased by 7% (-7% at constant currency). Dialysis product revenue decreased by 7% (-7% at constant currency) due to lower sales of dialyzers, bloodlines, hemodialysis solutions and concentrates and machines mainly in North Africa and the Middle East.

Non-Dialysis product revenue decreased by 8% to EUR 17 million (-8% at constant currency) from EUR 18 million.

EBIT decreased by 8% to EUR 96 million (-8% at constant currency). The operating income margin was 14.9% in the second quarter 2019, a decrease of 1.2% from the second quarter 2018, mainly driven by lower product sales, an unfavorable impact from an inventory revaluation, higher personnel expense in certain countries and unfavorable foreign currency transaction effects, partially offset by higher other income related to a favorable outcome in a legal proceeding, a favorable impact from acquisitions and a positive effect from the IFRS 16 implementation.

In the first half 2019, EMEA revenue increased by 1% (+2% at constant currency) to EUR 1,301 million, while EBIT of EUR 235 million was up by 9% (+10% at constant currency). The improved profitability was mainly driven by a reduction of a contingent consideration liability related to Xenios in the first quarter of 2019.

As of the end of June 2019, the company was treating 65,871 patients (+4%) at its 783 dialysis clinics (+3%) in the EMEA region. Dialysis treatments increased by 4%.

In the second quarter 2019 Asia-Pacific revenue increased by 8% to EUR 458 million (+7% at constant currency), driven by a positive business development in both Health Care Services and Health Care Products. Organic growth was 7%. Health Care Services revenue increased by 10% to EUR 210 million (+7% at constant currency). Dialysis Care revenue increased by 8% to EUR 153 million (+4% at constant currency), mainly as a result of growth in same market treatments and contributions from acquisitions, partially offset by missing contributions from closed or sold clinics and a decrease in organic revenue per treatment. Care Coordination revenue increased by 16% to EUR 57 million (+15% at constant currency). The revenue growth was driven by contributions from acquisitions and organic revenue growth. Health Care Product revenue increased by 7% (+7% at constant currency) resulting from increased sales of dialyzers, products for acute care treatments, bloodlines, hemodialysis solutions and concentrates as well as machines.

An important area of investments of Fresenius Medical Care in 2019 is the expansion of production capacities and the ramp up of the dialysis services business in China to capture the growing demand in the country with the most dialysis patients worldwide. As part of the 2019 investment initiatives this impacts, as expected, the earnings growth in the region.

EBIT decreased by 11% (-12% at constant currency) to EUR 69 million. The resulting operating income margin was 15.1% (Q2 2018: 18.4%) due to an unfavorable impact from growth in lower margin businesses and unfavorable foreign currency transaction effects, partially offset by a positive effect from the IFRS 16 implementation.

In the first half 2019, Asia-Pacific revenue increased by 9% to EUR 886 million (+6% at constant currency). Operating income increased by 8% to EUR 164 million (+6% at constant currency).

As of the end of June 2019, the company was treating 31,845 patients (+4%) at its 399 clinics (+4%) in the Asia-Pacific region. Dialysis treatments increased by 4%.

In the second quarter 2019 Latin America revenue increased by 5% to EUR 172 million (+26% at constant currency). Organic growth was 24%. Health Care Services revenue increased by 2% to EUR 121 million (+28% at constant currency). The increase at constant currency was mainly a result of increases in organic revenue per treatment, contributions from acquisitions and growth in same market treatments, partially offset by the effect of closed or sold clinics.

Health Care Product revenue increased by 14% (20% at constant currency), mainly driven by increased sales of machines, peritoneal dialysis products, hemodialysis solutions and concentrates.

EBIT decreased by 47% to EUR 6 million (-81% at constant currency). The operating income margin was 3.4% (Q2 2018: 6.8%). The decline was mainly driven by hyperinflation in Argentina.

In the first half 2019, Latin America revenue was stable at EUR 334 million (an increase of 20% at constant currency). Operating income decreased by 32% (-49% at constant currency) to EUR 17 million. The operating income margin decreased from 6.8% to 3.4%, mainly driven by hyperinflation in Argentina.

As of the end of June 2019, the company was treating 33,815 patients (+7%) at its 231 clinics (-1%) in the Latin America region. Dialysis treatments increased by 5%.

Net interest expense increased in the second quarter by 35% to EUR 114 million (+30% at constant currency). The increase was primarily due to the IFRS 16 implementation and a higher debt level, partially offset by the replacement of high interest bearing senior notes repaid in 2018 by debt instruments at lower interest rates. Income tax expense significantly decreased by 65% to EUR 92 million for the second quarter of 2019, which translates into an effective tax rate of 22.7% (Q2 2018: 19.8%), driven by the prior year impacts from the gain related to the divestiture of Care Coordination activities as well as favorable implications of the US Tax Reform.

Strong cash-flow development

In the second quarter 2019 the company generated EUR 852 million of operating cash flow (Q2 2018: EUR 656 million). This corresponds to 19.6% of revenue (Q2 2018: 15.6%). The increase was largely driven by the IFRS 16 implementation leading to a reclassification of the repayment portion of rent to financing activities. The number of days sales outstanding (DSOs) improved to 77 days (June 30, 2018: 82 days). Free cash flow (net cash used in operating activities, after capital expenditures, before acquisitions and investments) amounted to EUR 559 million (Q2 2018: EUR 429 million). Free cash flow was 12.9% of revenue (Q2 2018: 10.2%).

Outlook confirmed3,4

For 2019, Fresenius Medical Care expects adjusted revenue to grow between 3% and 7% and adjusted net income2 to develop in the range of -2% to 2%.

For 2020, Fresenius Medical Care expects adjusted revenue as well as adjusted net income to grow at a mid to high single digit rate.

In order to make the business performance in the respective periods comparable these targets as well as the 2018 base are and will be adjusted for items such as: FCPA related charges, the IFRS 16 implementation, the contributions from Sound in the first half 2018, the gain (loss) related to divestitures of Care Coordination activities and expenses for the implementation of the cost optimization program. All effects from the acquisition of NxStage Medical Inc. are excluded from the targets for 2019 and 2020.

3 Numbers at constant currency

4 Reported revenue 2018 of EUR 16,547 million adjusted for Sound H1 2018; reported net income 2018 of EUR 1,982 million adjusted for Sound H1 2018, the gain (loss) related to divestitures of Care Coordination activities and the 2018 FCPA related charge

Number of employees increased

As of June 30, 2019, Fresenius Medical Care had 119,631 employees (full-time equivalents) worldwide, compared to 111,263 employees as of June 30, 2018. This increase of 8% was mainly attributable to the NxStage acquisition.

Conference call

Fresenius Medical Care will host a conference call to discuss the results of the second quarter today at 3:30 p.m. CEDT / 9:30 a.m. EDT. Details will be available on the company’s website. A replay will be available shortly after the call.

Please refer to the PDF for a complete overview of the results for the second quarter 2019.

Disclaimer: This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to various factors, including, but not limited to, changes in business, economic and competitive conditions, legal changes, regulatory approvals, results of clinical studies, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

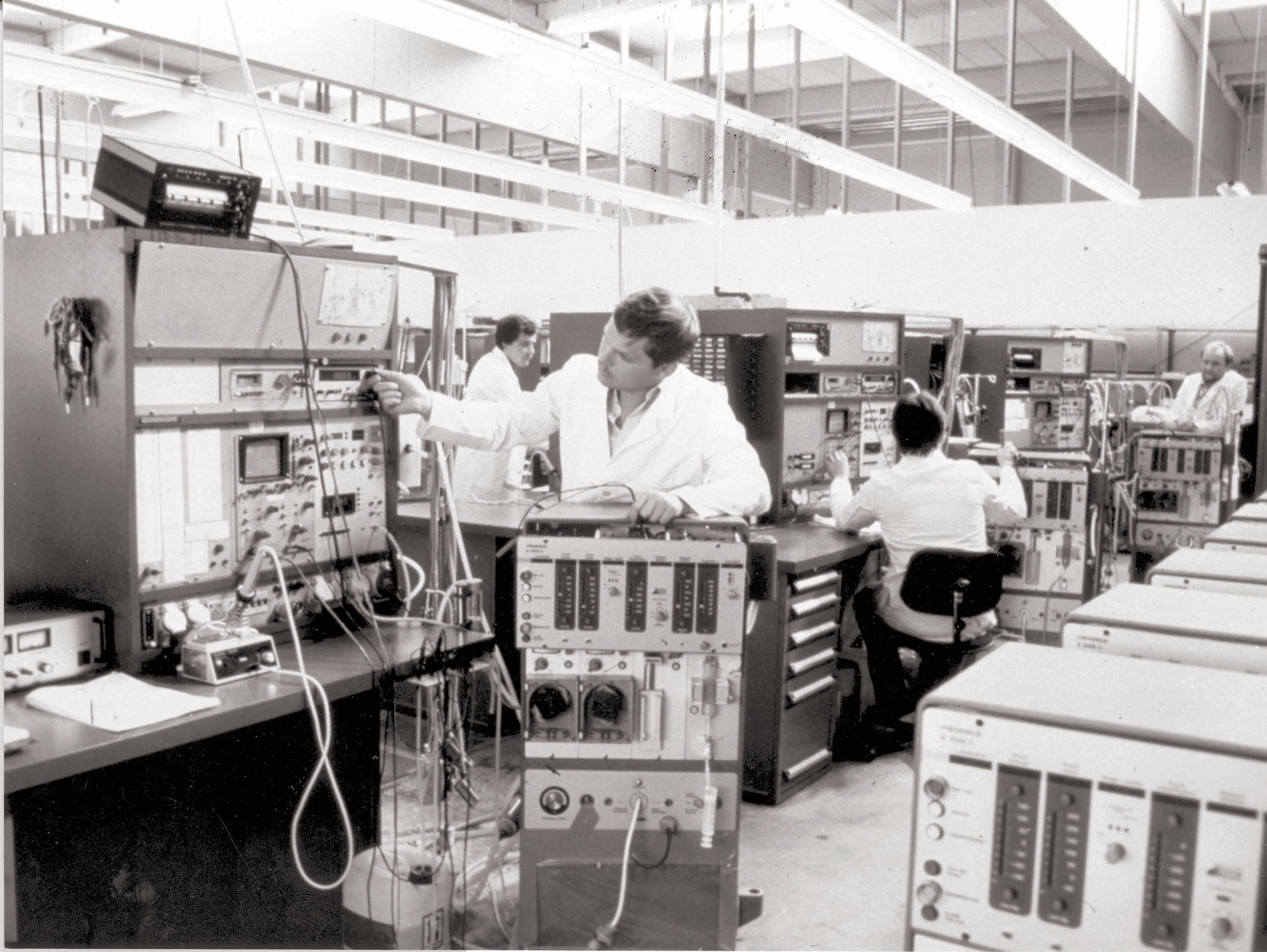

Fresenius Medical Care, the world’s largest provider of dialysis services and products, celebrated today the 40th anniversary of the company’s Schweinfurt, Germany plant. Joining employees and their family members for the festivities were numerous business and political representatives, including Schweinfurt Mayor Sebastian Remelé.

Schweinfurt is Fresenius Medical Care’s largest development and manufacturing facility for dialysis machines and other medical technology devices. Over the past four decades more than 800,000 dialysis machines have been made at the site, where the company is now investing some €20 million in a new, 8,000-square-meter (86,000-square-foot) technology center. The Schweinfurt facility’s workforce now numbers more than 1,200, with about a third of the employees involved in research and development.

“Schweinfurt is a huge success story – not just for Fresenius Medical Care, but even more so for our patients around the world,” said Rice Powell, CEO of Fresenius Medical Care. “For 40 years now, we have been developing life-sustaining products here at the very highest level, and we’re doing our best to continue writing new chapters in that success story. With the building of the new technology center, we are working to mesh development and production at this site even closer together, so that we can provide even better dialysis machines for our patients in the future.”

“I am very proud that Fresenius Medical Care is established in Schweinfurt and from here developed into the world market leader for dialysis machines,” said Mayor Remelé. “These dialysis systems are used to treat several hundred thousand patients with chronic kidney failure. In the name of the city of Schweinfurt, and personally, I want to wish Fresenius Medical Care continued great success in this important field.”

The plant’s history dates back to 1979 and the acquisition of a vacant factory building in a Schweinfurt industrial zone. There, under the business name MTS Medizin-Technische Systeme Schweinfurt GmbH, 40 employees began producing the first dialysis machine developed by Fresenius – the A2008C, which won the gold medal for technical innovation at the Leipzig Trade Fair that same year. By 1984, every second dialysis machine produced in Germany was “Made in Schweinfurt.” The A2008C would go on to become the world’s leading and best-selling dialysis machine, a position Fresenius Medical Care still holds following the introduction of the A2008C’s successor models. Today, more than half of all dialysis machines sold worldwide are made by Fresenius Medical Care.

Dialysis machines, bloodline systems and dialyzers – the latter often dubbed “artificial kidneys” because this is where the blood is cleaned – are the most important products for treating chronic kidney disease. During treatment, the dialysis machine pumps the patient’s blood through bloodlines, monitors its circulation through the dialyzer, and adds anti-coagulants. Treatments are generally carried out three times weekly, taking between three and six hours each.

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius Medical Care, the world’s largest provider of dialysis products and services, is pleased the U.S. administration’s plans for changing the way care is provided to people with kidney disease supports its existing strategy. The company has long worked on various initiatives to promote home dialysis, improve access to transplants, and develop new, value-based care models for chronic kidney disease patients.

Rice Powell, CEO of Fresenius Medical Care, said: “We congratulate the Administration on today’s announcement and celebrate the proposed initiatives as a win for our patients and for the 30 million Americans living with kidney disease. We are committed to continuously improving the quality of life of patients affected by kidney disease and have already established initiatives to improve prevention, offer more flexible treatment options, introduce value-based care models and promote organ donation –in the United States and abroad.

We share the U.S. Administration’s commitment to expanding access to home dialysis, transplantation and new models of value-based care for chronic kidney disease, and we see it as an endorsement of our initiatives. We invest constantly in innovation and will continue to do so in order to further develop the healthcare system. The proposed reimbursement models and new incentives will help foster further innovation and support a healthcare delivery system structure that is closely attuned to the needs of our patients.

Our recent merger with NxStage, which makes the leading hemodialysis machine for home use, is just one piece of a focused effort to educate patients and physicians around the benefits of home treatment and provide industry leading solutions to enable them to do so. We are also investing in technologies for the future, including new innovations for remote patient monitoring and telehealth that, combined with predictive analytics and artificial intelligence, will make it easier to help patients between visits to a doctor and avoid unnecessary hospitalizations.

We welcome reimbursement reforms that facilitate investments in care models designed to improve outcomes and help reduce costs, two goals to which more use of home dialysis and transplants can equally contribute. We will carefully review the U.S. administration’s proposal and contribute to developing the framework that offers the best possible conditions and greatest benefit for patients.”

Fresenius Medical Care's Global Medical Office conducts research in various fields of prevention and the use of clinical data to develop optimal treatment paths while avoiding unnecessary and expensive complications.

The company is also active in the field of regenerative medicine, and is a pioneer in testing flat-rate and value-based reimbursement models. The End Stage Renal Disease Seamless Care Organizations (ESCOs) of Fresenius Medical Care, which were established in close cooperation with the U.S. Centers for Medicare & Medicaid Services (CMS), have already achieved improved treatment outcomes and cost savings.

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius Medical Care North America (FMCNA) has announced an investment in BioIntelliSense, a Denver-based company that is developing a medical grade data services platform for continuous remote health monitoring, predictive analytics and algorithmic clinical insights. FMCNA is committed to bringing its expertise in advanced analytics and artificial intelligence to the development and deployment of this system in cooperation with BioIntelliSense. The aim is to jointly create clinical pathways that can alert clinicians to the need for early intervention, potentially preventing patients from complications and, thus, reducing unnecessary as well as costly hospitalizations. The investment, therefore, supports Fresenius Medical Care’s strategic goal to improve monitoring, interventions and outcomes for patients living with kidney disease and other chronic illnesses in order to increase their quality of life.