Fresenius Medical Care, the world’s largest provider of dialysis products and services, is expanding its clinical research activities. Frenova Renal Research (Frenova), previously a Fresenius Medical Care North America subsidiary, will now offer its services worldwide and will be integrated into the new Global Medical Office headed by Dr. Frank Maddux, Chief Medical Officer.

Frenova offers services for the clinical development of medicines and medical products in the field of kidney research. This offering, previously limited to North America, will now be linked with the corresponding services of Fresenius Medical Care’s Europe, Middle East and Africa (EMEA) and Latin America regions and bundled under Frenova. This will enable the company to draw on a network of more than 550 researchers at over 350 locations.

“Frenova is active at the intersection of clinical research and patient care,” said Dr. Maddux. “No other provider of clinical development services understands the medical needs of people living with kidney disease as well as we do. By making this expertise available worldwide, we will enable a faster, more efficient development of medications and other products. This is an additional, important building block for improving their quality of life.”

Disclaimer

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius Medical Care, the world’s largest provider of dialysis products and services, yesterday successfully placed bonds with an aggregate principal amount of USD 500 million. The bonds have a maturity of 10 years and an annual coupon of 3.750%. The issue price is 98.461%, resulting in a yield of 3.938%.

The proceeds will be used for general corporate purposes, including the refinancing of outstanding indebtedness.

Application will be made for admission to trading of the bonds on the regulated market of the Luxembourg Stock Exchange.

Disclaimer

This announcement does not contain or constitute an offer of, or the solicitation of an offer to buy or subscribe for, securities to any person in Australia, Canada, Japan, or the United States of America (the “United States”) or in any jurisdiction to whom or in which such offer or solicitation is unlawful. The securities referred to herein have not been and will not be registered under U.S. Securities Act of 1933, as amended (the “Securities Act”) and may not be offered or sold in the United States or to, or for the account or benefit of, U.S. persons, absent such registration, except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. Subject to certain exceptions, the securities referred to herein may not be offered or sold in Australia, Canada or Japan or to, or for the account or benefit of, any national, resident or citizen of Australia, Canada or Japan. The offer and sale of the securities referred to herein has not been and will not be registered under the Securities Act or under the applicable securities laws of Australia, Canada or Japan. There will be no public offer of the securities in the United States.

This announcement has been prepared on the basis that any offer of Notes in any Member State of the European Economic Area (EEA) which has implemented the Prospectus Directive (2003/71/EC), as amended (each, a Relevant Member State) will be made pursuant to an exemption under the Prospectus Directive, as implemented in that Relevant Member State, from the requirement to publish a prospectus for offers of securities. Fresenius Medical Care AG & Co. KGaA has not authorized, nor does it authorize, the making of any offer of securities in circumstances in which an obligation arises for Fresenius Medical Care AG & Co. KGaA or any other person to publish or supplement a prospectus for such offer.

This announcement is directed at and/or for distribution in the United Kingdom only to (i) persons who have professional experience in matters relating to investments falling within article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) or (ii) high net worth entities falling within article 49(2)(a) to (d) of the Order (all such persons are referred to herein as “relevant persons”). This announcement is directed only at relevant persons. Any person who is not a relevant person should not act or rely on this announcement or any of its contents. Any investment or investment activity to which this announcement relates is available only to relevant persons and will be engaged in only with relevant persons.

This announcement contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this announcement. In furnishing our website address in this announcement, we do not intend to incorporate any information on our website into this announcement.

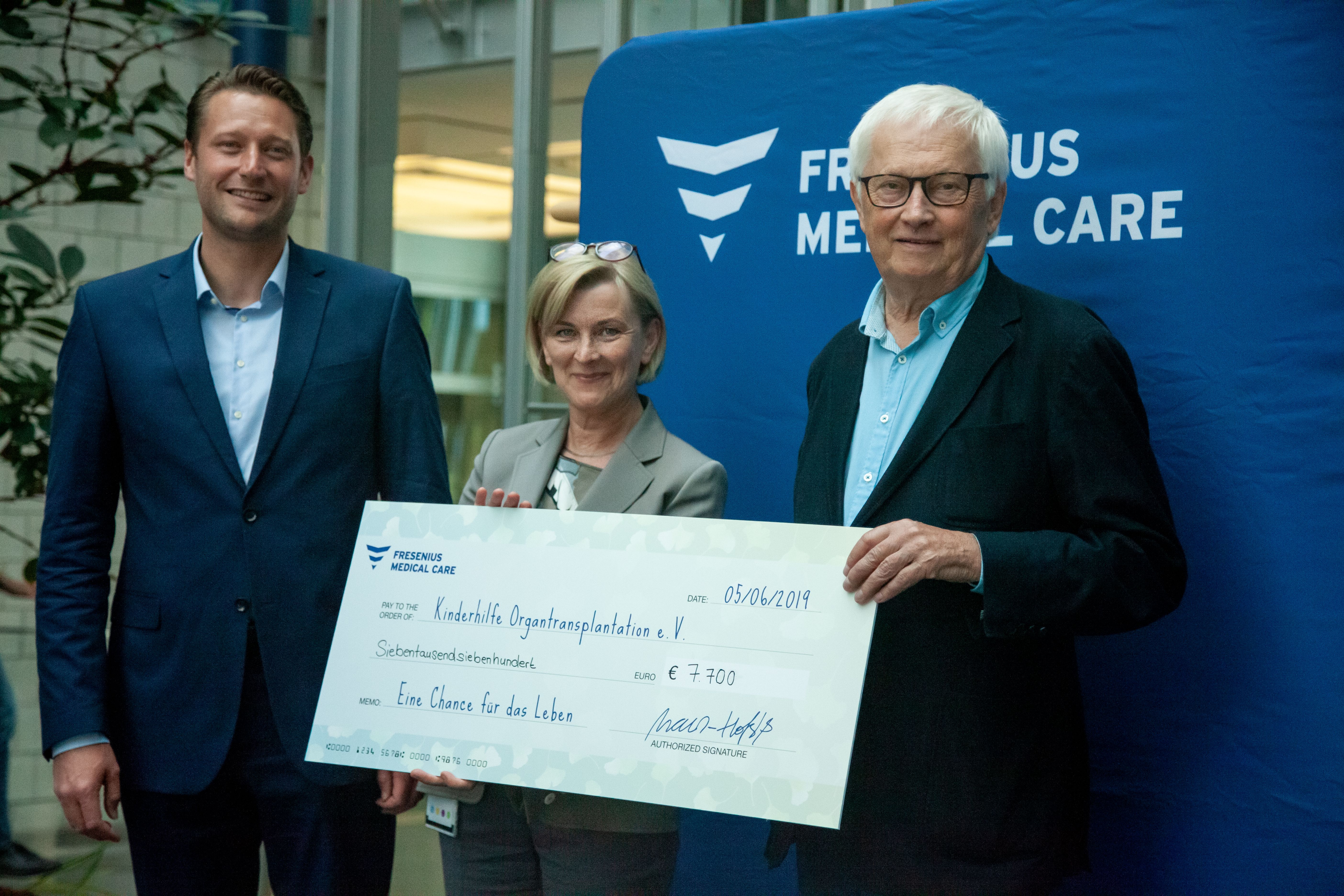

"Give life a chance" was the motto under which Fresenius Medical Care, the world’s largest provider of dialysis products and services, informed employees in Bad Homburg yesterday about organ donation. Individuals not only need to be well informed and carefully consider whether or not they wish to make an organ donation: Above all, they need to make a decision.

"Fresenius Medical Care supports organ transplantation,” said Dr. Katarzyna Mazur-Hofsäß, Fresenius Medical Care's Chief Executive Officer for Europe, Middle East and Africa. “For our patients with chronic kidney disease, a future worth living includes hope for a transplant, and that is exactly what we are preparing our patients for in our dialysis clinics. We want to educate and inform today, because during their lifetimes many people do not make a decision about a possible donation of their organs.”

Mayor Alexander Hetjes of Bad Homburg welcomed Fresenius Medical Care’s support for organ transplantation. “I’m very happy when companies in Bad Homburg also get involved in debates about social issues,” the mayor said. “To me it’s important to talk with many people about organ donation, so that we can all be better informed when making this very personal decision.”

Two organ donor recipients reported on their experiences via video, and medical information was explained to the employees by Dr. Anja Brückel of the German Organ Transplantation Foundation. "In Germany, more than 9,000 seriously ill people are waiting for a donor organ,” Dr. Brückel said. “For them, transplantation is the only way to survive or significantly improve their quality of life. However, this is only possible if people are willing to donate their organs. That’s why it is important to address the issue of organ donation during one’s lifetime, make close relatives aware of the decision, and fill out an organ donor card.”

The foundation made organ donation cards available to interested employees. Mayor Hetjes, Dr. Mazur-Hofsäß and Dr. Brückel together planted a traditional gingko, the tree of life, in front of Fresenius’ new EK3 headquarters building. And after a raffle among employees raised €770 the company announced it would increase that amount 10-fold, for a total donation of €7,700 to Kinderhilfe Organtransplantation, a German charity that supports children undergoing transplants and their families.

Fresenius Medical Care, the world’s largest provider of dialysis products and services, today announced that Standard & Poor’s has upgraded Fresenius Medical Care’s corporate credit rating to BBB with a stable outlook from BBB- with a positive outlook. Fresenius Medical Care is rated investment grade by the three leading rating agencies Standard & Poor’s (BBB/stable), Moody's (Baa3/stable) and Fitch (BBB-/stable).

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

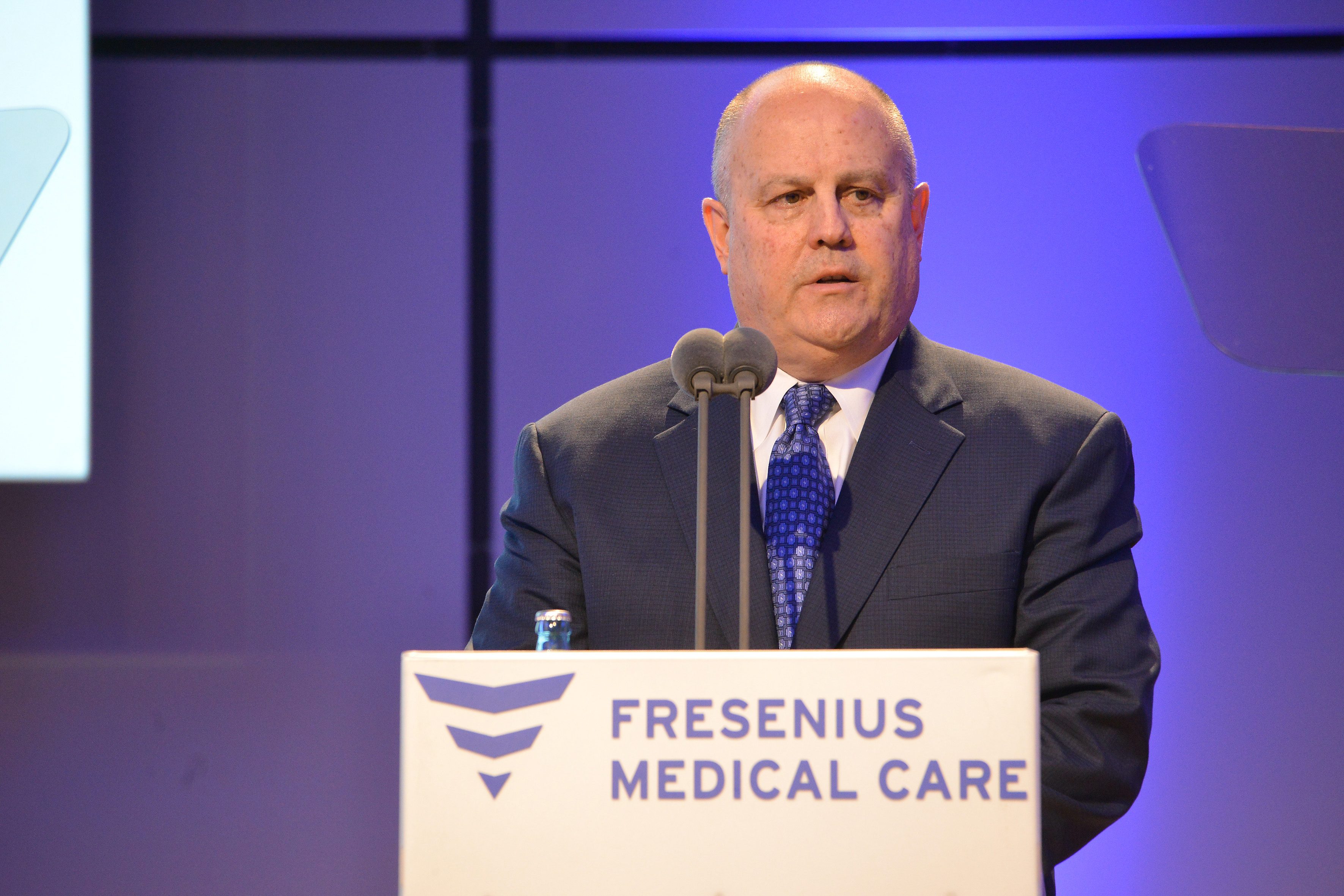

Fresenius Medical Care, the world’s largest provider of dialysis products and services, is investing in further growth. At the Annual General Meeting in Frankfurt today, CEO Rice Powell explained the company's growth strategy: “We will be investing to the benefit of our patients – in innovation, efficiency and areas of growth. We have already taken important steps in this direction: We want to continuously improve dialysis care in a number of ways. Because we are vertically integrated, we are ideally placed to develop innovations for a range of applications, from diagnosis to treatment.”

A large shareholder majority of 89.78 percent approved the company’s 22nd consecutive dividend increase. The dividend will be raised from €1.06 to €1.17, an increase of 10 percent.

With large majorities, the Annual General Meeting elected two new members as shareholder representatives to the Supervisory Board: Dr. Dorothea Wenzel, Executive Vice President and Head of the Global Business Unit Surface Solutions at Merck KGaA, and Professor Dr. Gregor Zünd, Chief Executive Officer of the University Hospital of Zurich. The two by-elections were necessitated by the departures of Dr. Gerd Krick and Deborah Doyle McWhinney from the Supervisory Board last year.

Shareholder majorities of 56.81 and 52.32 percent, respectively, approved the actions of the General Partner and the Supervisory Board in 2018.

At the Annual General Meeting, 76.68 percent of the subscribed capital was represented.

The next Annual General Meeting is scheduled for May 19, 2020.

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

- Underlying business developed as expected

- Earnings supported by agreements that materialized earlier than planned

- Cost optimization program initiated

- Integration of NxStage successfully started

- Non-prosecution agreement concluded with U.S. government

- Outlook confirmed

The outlook provided by Fresenius Medical Care refers to adjusted revenue and adjusted net income2.

1 For a detailed reconciliation, please refer to the table in the PDF

2 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

“In the first quarter we achieved healthy organic growth across all regions,” said Rice Powell, Chief Executive Officer of Fresenius Medical Care. “All of our major initiatives are underway. We have completed the acquisition of NxStage, and started its integration process as well as an expansion of the infrastructure necessary for home dialysis. We are very well positioned to reach the investment milestones set for 2019, and to meet our full-year targets.”

Investment year underway

Fresenius Medical Care continues its investments in the USA to increase the number of treatments being carried out in a home setting. Investments in training facilities, education and distribution infrastructure are a part of the initiative.

Expanding the production facilities in China is underway to cover for the growing product demand in the country with the most dialysis patients worldwide. Fresenius Medical Care´s development of its footprint in the services business is also progressing including the acquisition of selected hospitals to support renal care and the construction of clinics.

The investments of around EUR 100 million in 2019 as part of the Cost Optimization Program include as a major part the optimization of the US services footprint. The corresponding investments will ramp-up throughout the remainder of the year.

Key financials developed in line with expectations

Revenue in the first quarter 2019 increased by 4% to EUR 4,133 million (-1% at constant currency). Adjusted for the Q1 2018 revenue contribution from Sound Inpatient Physicians (“Sound”, divested effective end of Q2 2018) as well as the impact from the IFRS 16 implementation and the revenue contribution from NxStage following the closing, revenue increased by 11% (+6% at constant currency). Health Care Services revenue increased by 3% to EUR 3,317 million (-2% at constant currency). The decrease at constant currency was largely due to decreases attributable to prior year activities associated with Sound as well as the effect of closed or sold clinics and a decrease in dialysis days, partially offset by growth in same market treatments, increases in organic revenue per treatment and contributions from acquisitions. Health Care Products revenue increased by 6% to EUR 816 million (+4% at constant currency), mainly driven by higher sales of home hemodialysis products, largely as a result of the NxStage acquisition, dialyzers, products for acute care treatments, solutions and concentrates, and bloodlines, partially offset by lower sales of machines as a result of changes in the accounting treatment of sale-leaseback transactions related to the IFRS 16 implementation.

Total EBIT increased by 8% and reached EUR 537 million (+3% at constant currency), resulting in an operating margin of 13.0% (+50 basis points). On an adjusted basis, EBIT increased by 9% (+4% at constant currency). The adjusted EBIT margin decreased from 13.6% to 13.4% (-20 basis points).

Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA decreased by 3% to EUR 271 million (-6% at constant currency). On an adjusted basis, net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA increased by 8% (+3% at constant currency).

Earnings growth in the first quarter was supported by agreements that have been realized earlier in the year than planned. In North America the annual positive impact from income attributable to a consent agreement on certain pharmaceuticals supported the earnings growth. In EMEA earnings growth was supported by the reduction of a contingent consideration liability related to Xenios, which was under discussion at the time the outlook for 2019 was issued.

Based on the number of approximately 306.7 million shares (weighted average number of shares outstanding), basic earnings per share (EPS) decreased by 3% to EUR 0.88 (-7% at constant currency). On an adjusted basis, basic EPS amounted to EUR 1.04, representing an increase of 8% (+3% at constant currency).

Healthy organic growth across all regions

North America revenue, which represents 70% of total revenue, increased by 4% to EUR 2,887 million (-4% at constant currency). Organic growth in North America was 6%. Health Care Services revenue increased by 3% to EUR 2,680 million (-4% at constant currency). On an adjusted basis, Health Care Services revenue increased by 14% (+6% at constant currency), driven by a 14% increase of Dialysis Care revenue to EUR 2,372 million (+6% at constant currency). The positive development at constant currency was mainly driven by increases in organic revenue per treatment, growth in same market treatments and contributions from acquisitions, partially offset by the impact of one less dialysis day. Same-market treatment growth in the US was 3.7%, a sequential improvement of 40 basis points. Care Coordination revenue decreased by 40% to EUR 308 million (-45% at constant currency), mainly due to the divestiture of Sound. On an adjusted basis, Care Coordination revenue increased by 17% to EUR 308 million (+8% at constant currency), mainly driven by increased member months for health plan services and increased volumes for vascular services.

As of the end of March 2019, the company was treating 205,775 patients (+4%) at its 2,559 clinics (+6%) in North America. Dialysis treatments increased by 3%.

In the U.S., the average revenue per treatment increased by USD 7 to USD 355 (+2%). The increase was mainly driven by higher utilization of calcimimetics and an increase in the ESRD PPS base rate, partially offset by lower revenue from commercial payors.

Cost per treatment in the U.S., adjusted for the implementation of IFRS 16, increased from USD 289 to USD 301 (+4%). This increase was largely driven by higher utilization of calcimimetics and higher personnel expense.

Health Care Products revenue increased by 12% to EUR 207 million (+4% at constant currency) due to higher sales of home hemodialysis products, products for acute care, and bloodlines, all largely as a result of the NxStage acquisition, partially offset by lower sales of machines as a result of changes in the accounting treatment of sale-leaseback transactions related to the IFRS 16 implementation.

Total EBIT of the North America segment increased by 3% to EUR 372 million (-4% at constant currency), resulting in an EBIT margin of 12.9% compared to 13.1% in the first quarter 2018. The EBIT margin decrease was mainly driven by higher personnel expense, the integration of and operational costs associated with NxStage and an unfavourable impact from legal settlements, partially offset by the positive impact from income attributable to a consent agreement on certain pharmaceuticals, increases in the Care Coordination margin, a favourable effect from the IFRS 16 implementation and a favourable impact from manufacturing. On an adjusted basis, EBIT increased by 5% (-1% at constant currency). The adjusted EBIT margin was 13.6% compared to 14.7% in the first quarter 2018.

EMEA revenue increased by 3% to EUR 653 million (+4% at constant currency), driven by a positive business development in both Health Care Services and Health Care Products. Organic growth was 4%. Health Care Services revenue increased by 3% to EUR 324 million (+5% at constant currency), resulting from growth in same market treatments, contributions from acquisitions and increases in organic revenue per treatment, partially offset by the impact of one less dialysis day. Health Care Products revenue increased by 2% to EUR 329 million (+3% at constant currency). Dialysis Product revenue increased by 3% (+3% at constant currency) mainly due to higher sales of machines and dialyzers, hemodialysis solutions and concentrates as well as renal pharmaceuticals, partially offset by lower sales of products for acute care treatments. Non-Dialysis Products revenue decreased by 3% to EUR 19 million (-3% at constant currency).

EBIT increased by 26% to EUR 138 million (+27% at constant currency). Consequently, the EBIT margin was 21.1%, an increase from 17.1% in the first quarter 2018, mainly driven by a reduction of a contingent consideration liability related to Xenios, partially offset by higher bad debt expense, higher rent expense, and the impact from one less dialysis day.

As of the end of March 2019, the company was treating 65,833 patients (+4%) at its 782 clinics (+4%) in the EMEA region. Dialysis treatments increased by 4%.

Asia-Pacific revenue increased by 9% to EUR 428 million (+6% at constant currency), driven by a positive business development in both Health Care Services and Health Care Products. Organic growth was 6%. Health Care Services revenue increased by 8% to EUR 199 million (+4% at constant currency). Dialysis Care revenue increased by 7% to EUR 147 million (+1% at constant currency), mainly as a result of growth in same market treatments and contributions from acquisitions, partially offset by missing contributions from closed or sold clinics, a decrease in organic revenue per treatment and a decrease in dialysis days. Care Coordination revenue increased by 14% to EUR 52 million (+12% at constant currency), driven by contributions from acquisitions and organic revenue growth. Health Care Products revenue grew by 10% to EUR 229 million (+8% at constant currency), mainly driven by increased sales of dialyzers and machines.

EBIT increased by 28% to EUR 95 million (+25% at constant currency). The resulting EBIT margin was 22.1% (Q1 2018: 19.0%), mainly driven by favorable foreign currency transaction effects and a positive impact from business growth.

As of the end of March 2019, the company was treating 31,674 patients (+5%) at its 398 clinics in the Asia-Pacific region (+3%). Dialysis treatments increased by 4%.

Latin America delivered revenue of EUR 161 million, a decrease of 5%, but a significant increase of 14% at constant currency. Organic growth was 13%. Health Care Services revenue decreased by 5% to EUR 114 million (+20% at constant currency). The increase at constant currency was mainly a result of increases in organic revenue per treatment and contributions from acquisitions. Health Care Products revenue decreased by 5% to EUR 47 million (+1% at constant currency).

EBIT decreased by 19% to EUR 11 million (-24% at constant currency). The resulting EBIT margin was 7.1% (Q1 2018: 8.3%). The decline was mainly driven by hyperinflation in Argentina.

As of the end of March 2019, the company was treating 33,434 patients (+6%) at its 232 clinics in Latin America (+0%). Dialysis treatments increased by 4%.

Net interest expense increased in the first quarter by 30% to EUR 108 million (+24% at constant currency). The increase was primarily due to the IFRS 16 implementation and the acquisition of NxStage, partially offset by the replacement of high interest bearing senior notes repaid in 2018 by debt instruments at lower interest rates and interest income from the investment of the Sound proceeds. Income tax expense increased by 20% to EUR 101 million for the first quarter of 2019, which translates into an effective tax rate of 23.5% (Q1 2018: 20.3%). The increase was largely driven by the prior year impact in 2018 caused by favorable implications of the US tax reform.

Cash flow in line with expectations

The company generated EUR 76 million of operating cash flow (Q1 2018: EUR -45 million). The increase was largely driven by the IFRS 16 implementation leading to a reclassification of the repayment portion of rent to financing activities. The number of days sales outstanding (DSOs) increased to 83 days as compared to 75 days at December 31, 2018. Free cash flow (net cash used in operating activities, after capital expenditures, before acquisitions and investments) amounted to EUR -123 million (Q1 2018: EUR -263 million). Free cash flow was -3.0% of revenue (Q1 2018: -6.6%).

Outlook confirmed3,4

For 2019, Fresenius Medical Care expects adjusted revenue to grow between 3% and 7% and adjusted net income4 to develop in the range of -2% to 2%.

For 2020, Fresenius Medical Care expects adjusted revenue as well as adjusted net income2 to grow at a mid to high single digit rate.

In order to make the business performance in the respective periods comparable these targets as well as the 2018 base are and will be adjusted for items such as: FCPA Related Charges, the IFRS 16 implementation, the contributions from Sound in the first half year of 2018, the gain (loss) related to divestitures of Care Coordination activities and expenses for the implementation of the cost optimization program. All effects from the acquisition of NxStage Medical Inc. are excluded from the targets for 2019 and 2020.

3 Numbers at constant currency

4 Reported revenue 2018 of EUR 16,547 million adjusted for Sound H1 2018; reported net income 2018 of EUR 1,982 million adjusted for Sound H1 2018, the gain (loss) related to divestitures of Care Coordination activities and the 2018 FCPA related charge

NxStage Update

The table below shows the previously communicated estimated effects of the NxStage acquisition on Fresenius Medical Care´s outlook for 2019 and 2020. The numbers exclude effects from the IFRS 16 implementation and integration costs of approximately EUR 50 to 75 million over the three years following the closing of the transaction. The company assumes the full year effect of incremental intangible assets amortization to be in the range of EUR 70 to 80 million for the first two years, then drop to EUR 45 to 55 million thereafter. The company will update estimates after a detailed assessment, if required.

2019 estimates cover the period starting on February 21, 2019 (closing date) until year-end 2019.

Fast implementation of the share buy-back program

In March 2019 Fresenius Medical Care started the first phase of its announced share buy-back program. The first phase runs from March 12, 2019 to May 10, 2019. It allows for a maximum of 6,000,000 shares to be repurchased. Until March 31, 2019, Fresenius Medical Care repurchased 1,629,240 shares, for an average stock price of EUR 69.86.

Non-prosecution agreement concluded with U.S. government

In March 2019, Fresenius Medical Care entered into a Non-Prosecution Agreement with the U.S. Department of Justice and a separate agreement with the Securities and Exchange Commission to resolve matters governed by the U.S. Foreign Corrupt Practices Act (FCPA). In 2012, the Company had voluntarily notified the U.S. government about internal investigations into conduct in countries outside the U.S. that might violate the FCPA.

Number of employees increased

As of March 31, 2019, Fresenius Medical Care had 118,308 employees (full-time equivalents) worldwide, compared to 114,831 employees at the end of March 2018. This increase of 3% was mainly attributable to the NxStage acquisition.

Conference call

Fresenius Medical Care will host a conference call to discuss the results of the first quarter today at 3:30 p.m. CEDT / 9:30 a.m. EDT. Details will be available on the company’s website www.freseniusmedicalcare.com in the “Investors/Events” section. A replay will be available shortly after the call.

Please refer to the PDF for a complete overview of the results for the first quarter 2019.

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to various factors, including, but not limited to, changes in business, economic and competitive conditions, legal changes, regulatory approvals, results of clinical studies, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius Medical Care, the world’s largest provider of dialysis products and services, announced today that it has entered into a Non-Prosecution Agreement with the U.S. Department of Justice (DOJ) and a separate agreement with the Securities and Exchange Commission to resolve matters governed by the U.S. Foreign Corrupt Practices Act (FCPA).

In 2012, Fresenius Medical Care had voluntarily notified the U.S. government about internal investigations into conduct in countries outside the U.S. that might violate the FCPA.

Fresenius Medical Care will pay a combined total in disgorgement and penalties of approximately $231.7 million to the two US agencies in connection with these resolutions, which was reserved and announced by the company last year. Given these accruals already made, the resolutions will have no effect on the company’s 2019 and 2020 outlook. The company has also agreed to engage an independent compliance monitor for a period of two years, after which it will self-report for one year.

Rice Powell, CEO of Fresenius Medical Care, said: “We are pleased to have concluded these investigations and to have resolved the issues that we identified and voluntarily disclosed to the U.S. authorities. Since the investigation began we have taken extensive steps to further a culture of ethical business behavior throughout the entire company and to strengthen our compliance programs and internal controls. And we will continue to do so in close cooperation with the authorities. Enhancing these programs is an ongoing effort that will also help us to improve our service to our patients, which is our primary mission.”

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to various factors, including, but not limited to, changes in business, economic and competitive conditions, legal changes, regulatory approvals, results of clinical studies, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius Medical Care, the world’s largest provider of dialysis products and services, announced today that it has appointed Dr. Frank Maddux as Global Chief Medical Officer. With this newly created position the company further advances the great importance of applying clinical science at an ever-higher level. This includes also the facilitation of enhanced cooperation and exchange of knowledge across the entire Fresenius Medical Care network to ensure high-quality outcomes for patients worldwide.

Rice Powell, Chief Executive Officer of Fresenius Medical Care and Chairman of the Management Board, said: “Each of us understands that the well-being of our patients is our priority, and key to the company’s success all over the world. To continuously deliver on this commitment, it is becoming increasingly important that we also coordinate the interpretation of clinical science and medical practice patterns on a global basis. With Dr. Maddux we have a Global Chief Medical Officer with a well-deserved, excellent reputation inside and outside our company. He will ensure that we utilize the benefits of our global, vertically integrated approach to achieve the best clinical outcomes for our patients, their families and the payor community as well. Our Medical Office led by Dr. Maddux will be key to our ability to drive value for our patients by pursuing new and evolving medical opportunities, such as a more focused home therapies offering, regenerative medicine or enhancing our care coordinated business model throughout the world.”

Dr. Maddux is a physician, IT entrepreneur and health care executive with more than 30 years of health care experience. He has been working for Fresenius Medical Care since 2009. Most recently Dr. Maddux served as Executive Vice President for Clinical & Scientific Affairs and Chief Medical Officer for Fresenius Medical Care North America with responsibility for the delivery of high-quality, value-based care for the largest integrated renal care network in the U.S. His outstanding expertise and research interests have been focused on the quality of care for chronic kidney disease patients.

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to various factors, including, but not limited to, changes in business, economic and competitive conditions, legal changes, regulatory approvals, results of clinical studies, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius Medical Care, the world’s largest provider of dialysis products and services, has successfully completed the acquisition of NxStage Medical, Inc. (NxStage), following approval by antitrust authorities in the United States.

NxStage develops, produces and markets an innovative product portfolio of medical devices for use in home dialysis and critical care. The acquisition will enable Fresenius Medical Care to leverage its manufacturing, supply chain and marketing competencies across the dialysis products, services and Care Coordination businesses in a less labor- and capital-intensive care setting.

“The closing of this transaction is an important milestone in enhancing our patients’ choice of dialysis treatment modality,” said Rice Powell, Chief Executive Officer of Fresenius Medical Care. “By combining NxStage’s capabilities with our broad product and service offering, we can help patients to live even more independently. In addition to broadening our product portfolio, this acquisition positions Fresenius Medical Care to benefit from the growing trend toward home-based therapies.”

Bill Valle, Chief Executive Officer of Fresenius Medical Care North America, said: “It’s a great pleasure to welcome our new NxStage colleagues. With their strong culture of innovation and transformation, they will help us to realize our vision of delivering access to superior patient care and outcomes in a lower-cost-of-care home setting to all the patients we care for. We are excited to execute on a strategy that is good for patients, the healthcare system and us.”

NxStage, which just like Fresenius Medical Care North America has its headquarters in the Boston, Massachusetts area, was founded in 1998 and has approximately 3,800 employees worldwide. In 2017, NxStage delivered USD 394 million in revenue.

The company now expects lower total integration costs of around EUR 50 to EUR 75 million over the three years following the closing of the transaction1. The table below provides the estimated effects of the NxStage acquisition on Fresenius Medical Care excluding these integration costs. The company assumes the full year effect of incremental intangible assets amortization to be in the range of EUR 70 to 80 million for the first two years, then drop to EUR 45 to 55 million thereafter. The company will update those numbers after a detailed assessment, if required.

Revenues provided in the table below are lower than the historical reported revenues of NxStage due to the elimination of Fresenius Medical Care’s contribution to these revenues, upon consolidation. Operating income is expected to improve from 2020 onwards due to realization of the anticipated synergies from the acquisition.

All effects from the NxStage acquisition are excluded from the company’s communicated targets 2019 and 2020.

|

EUR million2 |

2019 |

2020 |

|

Revenue |

240 to 260 |

310 to 330 |

|

Operating income (EBIT) |

(30) to (20) |

20 to 30 |

|

Interest |

(75) to (65) |

(85) to (75) |

|

Net Income |

(75) to (65) |

(40) to (30) |

1The total integration costs are lower than previously communicated mainly due to costs that will be considered pre-merger expenses of NxStage, certain other costs that qualify for purchase accounting or as capital expenditures and previously recognized transaction and legal costs.

2The numbers are excluding effects from the implementation of IFRS 16 and excluding integration costs. 2019 estimates cover the period starting on February 21, 2019 (closing date) until year-end 2019.

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to various factors, including, but not limited to, changes in business, economic and competitive conditions, legal changes, regulatory approvals, results of clinical studies, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius Medical Care, the world’s largest provider of dialysis products and services, today announced that CFO Michael Brosnan plans to retire from the Company after his successor has been identified and transitioned into the role. Fresenius Medical Care expects to name a new Chief Financial Officer by the end of this year.

Michael Brosnan said: “My career at Fresenius Medical Care has been a fulfilling and challenging part of my professional life. I have worked with many wonderful people and I admire them for their dedication to the Company and thank them for the strong company that has continued to grow with their contributions.”

Rice Powell, Chief Executive Officer of Fresenius Medical Care and Chairman of the Management Board, said: “We thank Mike for his many years of valuable work and for his significant contributions to the success of Fresenius Medical Care. We wish him all the best in his retirement.”

Stephan Sturm, Chairman of the Supervisory Board of Fresenius Medical Care Management AG, said: “On behalf of the entire Supervisory Board, I would like to thank Mike Brosnan for the tireless efforts that he has dedicated to our company over the years. I wish Mike all the best for the new phase in his life that he will be entering after his retirement from Fresenius Medical Care.”

Michael Brosnan has been Global CFO of Fresenius Medical Care since January 2010. Previously, he served as CFO of Fresenius Medical Care North America for seven years. He joined the company in 1998 as Vice President of Finance and Administration for the company’s laboratory services organization and then assumed several key executive positions at Fresenius Medical Care in North America. Prior to joining the company, he held senior financial positions at Polaroid Corporation and was an audit partner at KPMG.

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to various factors, including, but not limited to, changes in business, economic and competitive conditions, legal changes, regulatory approvals, results of clinical studies, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.