Fresenius Medical Care, the world’s leading provider of products and services for individuals with renal diseases, has successfully signed a new syndicated revolving credit facility with a group of 34 core relationship banks. It has a volume of EUR 2 billion with a term of five years plus two one-year extension options (“5+1+1” years) and can be drawn in different currencies.

The new credit facility replaces the existing USD 900 million and EUR 600 million revolving credit facilities, initially signed in 2012 and amended from time to time, and will serve as a backup line for general corporate purposes. The increased volume will further strengthen Fresenius Medical Care’s liquidity profile and enhance the company’s financial flexibility.

Supporting the company’s commitment to create value in ecological, social and economic terms, a sustainability component has been embedded in the credit facility. Based on this structure, the credit facility’s margin will rise or fall depending on the company's sustainability performance. This is Fresenius Medical Care’s first sustainability-linked financing instrument.

Helen Giza, Chief Financial Officer of Fresenius Medical Care, said: “With the refinancing of the credit agreement we have further optimized our financing structure. The new facility improves Fresenius Medical Care’s liquidity profile and gives us greater financial flexibility for our long-term growth strategy. It also extends our focus on sustainability to our financing instruments. By linking the new credit agreement to our sustainability efforts, we are underlining our integrated approach to sustainability throughout all aspects of the business.”

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to various factors, including, but not limited to, changes in business, economic and competitive conditions, legal changes, regulatory approvals, impacts related to the COVID-19 pandemic results of clinical studies, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius Medical Care has joined econsense, a network of German companies joined in the goal of shaping the transformation to a sustainable economy and society. The dialogue and cross-industry exchange of practical expertise within econsense, which now counts 40 major companies as members, will support Fresenius Medical Care’s sustainability management. Sustainability is an integral part of Fresenius Medical Care’s mission and vision and is also reflected in the corporate strategy. For the company, successful sustainability management means creating long-term economic, ecological and social value in order to provide patients with high-quality products and services while minimizing the impact of our activities on the environment.

Fresenius Medical Care, the world's leading provider of products and services for individuals with renal diseases, expects continued challenges due to the ongoing COVID-19 pandemic yet remains confident about the future. At today’s Annual General Meeting, Chief Executive Officer Rice Powell confirmed the company’s targets for 2025: In the coming five years the company expects compounded annual growth rates in the mid-single-digit percentage range for revenue and in the high-single-digit percentage range for net income.

In his speech to shareholders, Powell outlined the FME25 program to increase profitability, which was announced in February: “In a rapidly changing environment, I believe that it is crucial for us as a company to become more agile, more capable of adapting faster. As CEO of Fresenius Medical Care, this is my responsibility towards our patients and employees. We intend to achieve this by transforming and adapting our operating model. I am looking forward to helping to shape this change and create an even better future for Fresenius Medical Care and its patients.”

The company, which is celebrating its 25th anniversary this year, operates the leading and largest dialysis network worldwide. Powell emphasized: “We will not rest in our efforts to provide ever better services for our patients, payors and health care systems. A new leap in renal care is imminent – and with our innovative and dedicated team of more than 125,000 employees, Fresenius Medical Care is at the forefront of progress.”

A large shareholder majority of 99.27 percent approved the company’s 24th consecutive dividend increase. The dividend will be raised by 12 percent, from €1.20 to €1.34 per share.

Shareholders also approved by large majorities the proposals for the regular elections to the Supervisory Board: Dr. Dieter Schenk, Rolf A. Classon, Dr. Dorothea Wenzel, Pascale Witz and Prof. Dr. Gregor Zünd were re-elected, while Gregory Sorensen, CEO of DeepHealth, Inc., is replacing William P. Johnston, who is leaving the board for age reasons.

Shareholder majorities of 99.69 and 95.64 percent, respectively, approved the actions of the General Partner and the Supervisory Board in 2020.

At the Annual General Meeting, 81.50 percent of the registered capital was represented. Because of the pandemic, the meeting was held as a purely virtual event in order to protect the health of everyone involved.

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to various factors, including, but not limited to, changes in business, economic and competitive conditions, legal changes, regulatory approvals, impacts related to the COVID-19 pandemic results of clinical studies, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius Medical Care, the world’s leading provider of products and services for individuals with renal diseases, has agreed to issue bonds with an aggregate principal amount of USD 1.5 billion across two tranches:

- USD 850 million bonds with a maturity in December 2026 and an annual coupon of 1.875% and

- USD 650 million bonds with a maturity in December 2031 and an annual coupon of 3.000%.

The proceeds will be used for general corporate purposes, including the refinancing of outstanding indebtedness.

The expected settlement date is May 18, 2021.

This announcement does not contain or constitute an offer of, or the solicitation of an offer to buy or subscribe for, securities to any person in Australia, Canada, Japan, or the United States of America (the “United States”) or in any jurisdiction to whom or in which such offer or solicitation is unlawful. The securities referred to herein have not been and will not be registered under U.S. Securities Act of 1933, as amended (the “Securities Act”) and may not be offered or sold in the United States or to, or for the account or benefit of, U.S. persons, absent such registration, except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. The securities are being offered only to persons reasonably believed to be qualified institutional buyers in reliance on Rule 144A under the Securities Act and outside the United States, only to certain non-U.S. investors pursuant to Regulation S. Subject to certain exceptions, the securities referred to herein may not be offered or sold in Australia, Canada or Japan or to, or for the account or benefit of, any national, resident or citizen of Australia, Canada or Japan. The offer and sale of the securities referred to herein has not been and will not be registered under the applicable securities laws of Australia, Canada or Japan. There will be no public offer of the securities in the United States.

This announcement has been prepared on the basis that any offer of bonds in any Member State of the European Economic Area (each, a Member State) will only be made pursuant to an exemption under Regulation (EU) 2017/1129 (as amended, the “Prospectus Regulation”), from the requirement to publish a prospectus for offers of securities. Fresenius Medical Care has not authorized, nor does it authorize, the making of any offer of securities in circumstances in which an obligation arises for Fresenius Medical Care or any other person to publish or supplement a prospectus for such offer.

This announcement is directed at and/or for distribution only to persons who (i) are outside the United Kingdom; (ii) who have professional experience in matters relating to investments falling within article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”), (iii) are high net worth entities falling within article 49(2)(a) to (d) of the Order; or (iv) other persons to whom it may otherwise be lawfully communicated (all such persons together being referred to as “relevant persons”). This announcement is directed only at relevant persons. Any person who is not a relevant person should not act or rely on this announcement or any of its contents. Any investment or investment activity to which this announcement relates is available only to relevant persons and will be engaged in only with relevant persons.

This announcement has been prepared on the basis that any offer of bonds in the United Kingdom will only be made pursuant to an exemption under Section 86 of the Financial Services and Markets Act 2000 from the requirement to publish a prospectus for offers of securities. Fresenius Medical Care has not authorized, nor does it authorize, the making of any offer of securities in circumstances in which an obligation arises for Fresenius Medical Care or any other person to publish or supplement a prospectus for such offer.

This announcement contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. impacts of COVID-19, changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius Medical Care does not undertake any responsibility to update the forward-looking statements in this announcement.

The information contained in this announcement is for background purposes only and does not purport to be full or complete. No reliance may be placed for any purpose on the information contained in this announcement or its accuracy or completeness. The information in this announcement is subject to change.

- Organic treatment growth impacted by COVID-19 pandemic as expected

- Reported revenue and earnings continued to be adversely affected by exchange rate effects

- Earnings development supported by phasing and expected lower SG&A expense anticipated to reverse throughout the year

- Vaccination of patients accelerated to 51 percent globally

- Financial targets for FY 2021 confirmed

Rice Powell, Chief Executive Officer of Fresenius Medical Care, said: “The COVID-19 pandemic continues to plague our societies and especially our vulnerable patients. We are very grateful that we are increasingly allowed to directly vaccinate our dialysis patients in our clinics. By doing so, we can support healthcare systems, contribute to saving lives and overcoming this health crisis as fast as possible. While we have seen significant progress in the roll-out and adoption of vaccinations globally, COVID-19 infection rates in several countries remain high. This will, unfortunately, continue to affect many of our patients. Consequently, this will also continue to impact our organic growth and weigh on our earnings development throughout the year. As the underlying development in the first three months was in line with our expectations, we confirm our guidance for the full year 2021.”

1 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

COVID-19 impact on organic growth continues to accumulate as expected

The adverse COVID-19 impact on organic growth in the Health Care Services business amounted to around 350 basis points in the first quarter. While monthly excess mortality continuously declined since February, it is expected to further accumulate and peak in the second quarter.

Besides Fresenius Medical Care’s comprehensive measures to reduce infection risks and maintain safe operations in its dialysis centers, vaccinations are crucial for containing the COVID-19 pandemic. In several countries, Fresenius Medical Care has made its dialysis clinics available for the direct vaccination of patients and, where requested, the general public. At the end of March, the U.S. government agreed to directly allocate COVID-19 vaccine to dialysis centers nationwide. At Fresenius Medical Care’s U.S. facilities, more than 64% of patients and 47% of dialysis center staff have been at least partially vaccinated. The Company is making further progress every day. On a global basis, about 51 percent of Fresenius Medical Care’s patients have received at least one vaccination.

Outlook

Fresenius Medical Care confirms its outlook for FY 2021 as outlined on February 23, 2021. The Company expects revenue to grow at a low- to mid-single digit percentage rate and net income to decline at a high-teens to mid-twenties percentage rate against the 2020 base.2

2 These targets are based on the 2020 results excluding the impairment of goodwill and trade names in the Latin America Segment of EUR 195 million. They are inclusive of anticipated COVID-19 effects, in constant currency and exclude special items. Special items include costs related to FME25 and other effects that are unusual in nature and have not been foreseeable or not foreseeable in size or impact at the time of giving guidance.

The Company continues to monitor closely the latest COVID-19-related developments in respect to additional variants of the virus and potential surges in different regions.

Fresenius Medical Care will experience an adverse earnings effect due to the U.S. government delaying the CKCC models (Comprehensive Kidney Care Contracting) by nine months to January 1, 2022. This effect will be offset by the further extension of the U.S. Medicare sequestration relief from April 1, 2021 until the end of 2021.

To support its 2025 strategy, further strengthen profitability and compensate for the negative earnings effects of the COVID-19 pandemic, Fresenius Medical Care has initiated the FME25 program. The Company is currently undergoing a detailed review of its global operating model and will provide an update in the second half of 2021.

Driving value-based care

Fresenius Medical Care aims to build sustainable partnerships with payors to support the transition from a fee-for-service to a pay-for-performance healthcare system. This applies equally to reimbursement models of commercial and public insurers. In the U.S., Fresenius Medical Care recently extended its value-based arrangement with Aetna, Inc., a provider of health insurance and related services and subsidiary of CVS Health Corporation, to include patients enrolled in Medicare Advantage. In late 2020, Fresenius Medical Care expanded its cooperation with health insurer Humana and thereby implemented the existing clinical network contract as a value-based payment model.

Revenue and earnings impacted by COVID-19 and exchange rate effects

Revenue declined by 6% to EUR 4,210 million (+1% at constant currency). Organic growth amounted to 1%.

Health Care Services revenue decreased by 7% to EUR 3,325 million (+1% at constant currency, +1% organic). The decline was mainly due to a negative exchange rate effect, the absence of a prior-year partial reversal of a revenue recognition adjustment, the impact from COVID-19 and lower reimbursement for calcimimetics.

Health Care Products revenue declined by 1% to EUR 885 million (+4% at constant currency, +5% organic). Headwinds from exchange rates and lower sales of acute care products as well as in-center disposables were partially offset by higher sales of machines for chronic treatment, peritoneal dialysis products and home hemodialysis products.

Operating income decreased by 15% to EUR 474 million (-8% at constant currency), resulting in a margin of 11.3% (Q1 2020: 12.4%). The decrease was mainly driven by effects from COVID-19 across all regions, higher personnel expenses and a significant negative exchange rate effect. In addition, operating income was negatively affected by a positive prior-year effect from the divestiture of cardiovascular clinics and a prior-year partial reversal of a revenue recognition adjustment. These negative effects were partially offset by an improved payor mix, mainly driven by Medicare Advantage, and expected lower SG&A expense, which are anticipated to reverse in the remainder of the year.

Net income1 declined by 12% to EUR 249 million (-6% at constant currency). Besides the above-mentioned operating earnings effects, net income was supported by a 27% decrease of net interest expense to EUR 76 million (Q1 2020: EUR 104 million).

The first quarter 2020 included negative COVID-19 effects that reversed in Q2 2020, including the compensation received under the CARES Act, and therewith increase the base for the second quarter 2021. These base effects impact the phasing of net income growth in 2021.

Basic earnings per share (EPS) decreased by 10% to EUR 0.85 (-4% at constant currency). The decline as a result of the above-mentioned earnings effects was partially offset by a decrease in the average weighted number of shares outstanding due to the redemption of shares following the completed share buyback program.

Cash flow development

Fresenius Medical Care generated EUR 208 million of operating cash flow (Q1 2020: EUR 584 million), resulting in a margin of 4.9% (Q1 2020: 13.0%). The decline was driven by the seasonality in invoicing and periodic delays in payment of public health care organizations.

Free cash flow3 amounted to EUR 29 million (Q1 2020: EUR 304 million), resulting in a margin of 0.7% (Q1 2020: 6.8%).

3 Net cash used in operating activities, after capital expenditures, before acquisitions, investments and dividends

Regional developments

In North America, revenue declined by 9% to EUR 2,899 million (-1% at constant currency, -1% organic). Besides a sizable negative exchange rate effect, this was mainly due to a substantial negative impact of COVID-19 on the Services business and lower reimbursement for calcimimetics.

Operating income in North America declined by 14% to EUR 399 million (-6% at constant currency), resulting in a margin of 13.7% (Q1 2020: 14.5%). The decrease was mainly due to the effects of COVID-19, higher personnel expense, headwinds from exchange rates, a positive prior-year effect from the divestiture of cardiovascular clinics, a prior-year partial reversal of a revenue recognition adjustment and a lower contribution from calcimimetics. This was mitigated by an improved payor mix, mainly driven by an increased Medicare Advantage share, contributions from acquisitions and lower SG&A expense due to favorable phasing.

Revenue in EMEA decreased by 1% and amounted to EUR 670 million (+1% at constant currency, +1% organic). This was mainly driven by the unfavorable effects of COVID-19 and negative exchange rate effects.

Operating income in the EMEA region declined by 21% to EUR 80 million (-21% at constant currency), resulting in a margin of 11.9% (Q1 2020: 14.9%). The prior-year base benefitted from the revaluation of an investment. In addition, the decline was mainly driven by an unfavorable country mix in the Products business, a decrease in dialysis days as well as higher cost for personnel and supplies in certain countries. This was partially offset by lower bad debt expense.

In Asia-Pacific, revenue increased by 6% to EUR 471 million (+10% at constant currency, +11% organic), mainly due to organic growth in the Services and Product businesses as well as contributions from acquisitions. This was partially offset by the effect of clinics closed or sold in the prior year.

Operating income grew by 11% to EUR 85 million (+14% at constant currency), resulting in a margin of 18.1% (Q1 2020: 17.3%). The prior-year base benefited from a gain from the deconsolidation of clinics. The increase was mainly driven by business growth and a favorable impact from manufacturing.

Including a very significant headwind from exchange rates and a negative effect from COVID-19, Latin America revenue decreased by 5% to EUR 159 million (+17% at constant currency, +15% organic). Operating income in Latin America declined by 3% to EUR 7 million (+3% at constant currency), resulting in a margin of 4.2% (Q1: 2020: 4.1%).

Patients, Clinics and Employees

As of March 31, 2021, Fresenius Medical Care treated 344,476 patients in 4,110 dialysis clinics worldwide. At the end of the first quarter, the Company had 124,995 employees (full-time equivalents) worldwide, compared to 121,403 employees as of March 31, 2020.

Conference call

Fresenius Medical Care will host a conference call to discuss the results of the first quarter of 2021 on May 6, 2021 at 3:30 p.m. CET / 9:30 a.m. ET. Details will be available on the company’s website www.freseniusmedicalcare.com in the “Investors” section. A replay will be available shortly after the call.

Please refer to our statement of earnings included in the PDF-file for a complete overview of the results of the first quarter of 2021. Our 6-K disclosure provides more details.

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to various factors, including, but not limited to, changes in business, economic and competitive conditions, legal changes, regulatory approvals, impacts related to the COVID-19 pandemic results of clinical studies, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius Medical Care, the world’s leading provider of products and services for people with chronic kidney failure, has opened a new technology center for developing dialysis machines at its Schweinfurt, Germany production and development site. About 220 employees from different departments will work together on a project basis in the new 7,500-square-meter (81,000-square-foot) building, in which the company has invested about €22 million.

Due to the pandemic, the opening ceremony was a purely digital event. The online conference included a video tour through the building. In addition, employees presented their future workstations in the technical, laboratory and testing areas, as well as offices, break spaces and conference rooms.

“As much as virtual cooperation from home office works well: In combination with virtual networking, person-to-person interactions on site are irreplaceable, and so I am really looking forward to the cooperation in our new technology center,” said Johann Brede, Project Director of the technology center. “With short and direct access ways and corridors, and an open structure, the entire building is designed for networking and exchanges between different disciplines and teams. This way, we can develop for our patients even better dialysis machines that will also cost less.”

Construction of the five-floor building, which required some 5,700 cubic meters of concrete and 900 tons of steel, took three years. The technology center is built to modern environmental standards and includes, among other features, a “green roof.”

The plant in Schweinfurt, which was established in 1979, is Fresenius Medical Care’s largest development and production facility for dialysis machines and other medical devices. The company now employs more than 1,200 people in the city in northern Bavaria, about 120 kilometers (75 miles) east of Frankfurt. About a third of them work in research and development.

Dialysis machines are among the most important products for treating chronic kidney disease. During treatment, the dialysis machine pumps the patient’s blood through bloodlines, monitors its circulation through the dialyzer, and adds anti-coagulants. Treatments are generally carried out three times weekly, and take between three and six hours each.

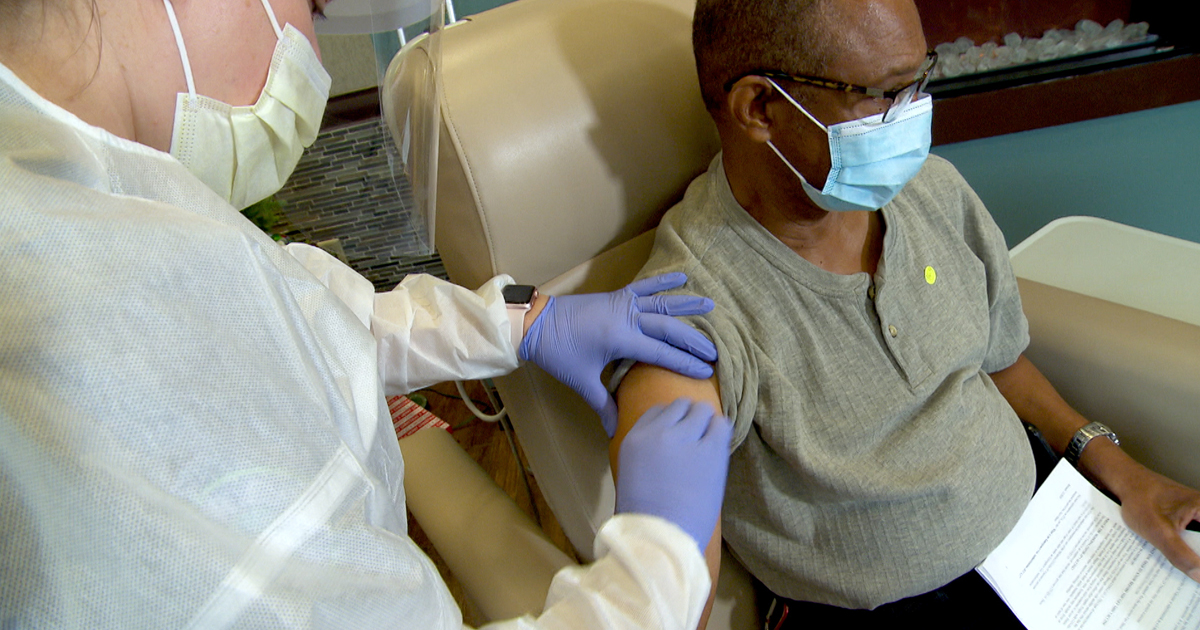

Fresenius Medical Care, the world’s leading provider of products and services for people with chronic kidney failure, is making its own dialysis clinics available for the vaccination of its patients against COVID-19. Dialysis patients are an especially high-risk group: They are on average over 65, and often have other diseases and a weakened immune system. Dialysis patients suffering from COVID-19 therefore have a significantly higher mortality risk.

Medical personnel in Fresenius Medical Care dialysis clinics regularly vaccinate patients against influenza, hepatitis B and pneumococci, and the company is already vaccinating against COVID-19 in several countries including Portugal and the United States. About 90 percent of all patients needing dialysis visit a dialysis clinic several times weekly for treatment.

In Europe specifically, Fresenius Medical Care and other dialysis providers have been vaccinating patients in Portugal under a plan, authorized by the country’s government, that ensures the proper storage and safe administration of the vaccines. The first patients were vaccinated in late January, and almost all Fresenius Medical Care patients in Portugal have since received their second and final dose of the vaccine.

“Social distancing and self-isolation are practically impossible for dialysis patients. In our dialysis clinics we can quickly and professionally vaccinate them against COVID-19 and effectively protect them,” said Dr. Katarzyna Mazur-Hofsäß, Fresenius Medical Care’s Chief Executive Officer for Europe, Middle East and Africa region. “This can save many lives. We have the infrastructure and the medical expertise and are happy to make both available to speed vaccination campaigns. We would gladly expand this successful model, in close cooperation with the health authorities, to other countries where we treat dialysis patients.”

The European Kidney Patients’ Federation, the umbrella organization for 23 national associations representing people receiving dialysis, supports Fresenius Medical Care’s offer to make its existing infrastructure available to accelerate the vaccination of dialysis patients across Europe.

Fresenius Medical Care treats more than 66,000 patients in its Europe, Middle East and Africa region, in over 800 dialysis clinics some 30 countries. The company has taken extensive measures to prevent the infection of patients within its more than 4,000 dialysis clinics worldwide since the beginning of the pandemic. These include the provision of personal protective equipment and setting up isolation units. The company is also expanding home dialysis.

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to various factors, including, but not limited to, changes in business, economic and competitive conditions, legal changes, regulatory approvals, impacts related to the COVID-19 pandemic results of clinical studies, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

- 2020 financial targets achieved: 5% revenue and 12% net income growth

- Reported earnings in Q4 negatively impacted by impairment in the Latin America region and accelerated excess mortality due to COVID-19

- Growth in home dialysis on track

- 24th consecutive dividend increase planned to be proposed

- FME25 – transforming global operating model to sustainably reduce cost

Rice Powell, Chief Executive Officer of Fresenius Medical Care, said: “The COVID-19 pandemic might be the most decisive challenge the world has faced in recent decades. I am incredibly proud of our employees and their tireless efforts to provide our patients with their life-sustaining treatments. Accelerated infection rates at the end of 2020 resulted in significant excess mortality in the dialysis patient population and this is expected to continue into 2021. What saddens me deeply is the human tragedy – when people we have cared for are dying. With an increasing number of vaccines being approved, there is a way out of the pandemic, but it is far from over. By using all our levers, further driving our efficiency measures and with governmental support, we managed to almost compensate the financial effects of COVID-19 in 2020. But the effects of the recent significant increase in cases and subsequent excess mortality cannot be compensated and will affect our earnings development in 2021. To overcome the impact on our 2025 growth ambitions, we have decided to launch a material transformation of our global operating model while executing on our mid-term strategy.”

COVID-19 pandemic affects business development

While the pandemic has not sustainably affected the fundamental development in the number of new patients starting dialysis, excess mortality of dialysis patients significantly accelerated in the U.S. and in EMEA, particularly in November and December 2020, and accumulated to approximately 10,000 patients over the pre-pandemic baseline.

In order to maintain safe operations in its more than 4,000 dialysis centers and 44 manufacturing sites, Fresenius Medical Care has taken comprehensive measures, including the provision of personal protective equipment for employees and patients as well as higher compensation for employees working in isolation clinics. These measures have resulted in significantly increased costs in the Dialysis Services business, which in 2020 was largely compensated by governmental support, in particular in the U.S., accelerated efficiency measures and a strong products business development.

Growth in home dialysis continued

In 2020, Fresenius Medical Care provided more than 14% of its dialysis treatments in the U.S. in a home setting. This implies a 14% increase in the number of home treatments compared to the previous year, with home hemodialysis growing at 37%.

Dividend increase in line with sustainable distribution policy

Based on the strong results for 2020 and in line with the Company’s dividend policy, it is planned to propose a dividend of EUR 1.34 per share to the Annual General Meeting in May 2021. This proposal would result in the 24th consecutive dividend increase.

FME25: Transforming global operating model to strengthen profitability

To support its 2025 strategy, further strengthen profitability and compensate for the negative earnings effects of the COVID-19 pandemic, Fresenius Medical Care will launch the FME25 program. The program will focus on the simplification of the Fresenius Medical Care operating model. This shall include streamlining and transforming the Company’s global operating model, applying learnings from the “new normal” and accelerating the digitalization agenda. Until 2025 the Company plans to invest up to EUR 500 million in FME25 to sustainably reduce the cost base. The Company expects for each euro invested in FME25 to sustainably reduce the annual cost and minimally improve operating income by the same amount by 2025.3

2021 targets and assumptions

Excess mortality of dialysis patients due to the COVID-19 pandemic is continuing in 2021 and is expected to have a significant adverse effect on treatment volumes and additional COVID-19 related costs. This additionally affects the utilization of Fresenius Medical Care’s clinic network and thereby limits the ability to mitigate fixed cost and wage inflation.

Against this backdrop, Fresenius Medical Care expects revenue to grow at a low- to mid-single digit percentage rate and net income to decline at a high-teens to mid-twenties percentage rate against the higher than expected 2020 base.4

These targets are based on the following assumptions:

- Excess mortality is expected to continue to accumulate for the first half of 2021, depending on the adoption and speed of the roll-out of vaccinations of our worldwide patient population.

- COVID-19-related additional costs, such as costs for personal protective equipment or increased personnel costs in the Dialysis Services business, are assumed to remain on a high level.

- Besides the extended suspension of the U.S. Medicare sequestration (until end of March 2021), no further public relief funding is assumed.

2025 targets confirmed

Fresenius Medical Care confirms its 2025 targets that are based on the Company’s mid-term strategy. Fresenius Medical Care assumes that FME25 compensates for the anticipated COVID-19-related effects. Until 2025 the company expects compounded annual average increases in the mid-single-digit percentage range for revenue and in the high-single-digit percentage range for net income.5

Robust earnings growth in FY 2020 despite COVID-19 pandemic

Due to a sizable headwind from exchange rates, revenue declined by 4% in the fourth quarter and amounted to EUR 4,400 million (+4% at constant currency). Organic growth of 1% was realized including the expected negative impacts from lower reimbursement for calcimimetics (“calcimimetics effect”) and COVID-19-related slower treatment growth.

Health Care Services revenue decreased by 6% to EUR 3,406 million (+2% at constant currency). This was only partially offset by the positive development in the Products business. Driven by strong organic growth, Health Care Products revenue grew by 2% to EUR 994 million (+9% at constant currency).

In the full year, revenue increased by 2% to EUR 17,859 million (+5% at constant currency), with organic growth of 3%. Health Care Services revenue grew by 2% to EUR 14,114 million (+5% at constant currency). This was mainly driven by organic growth of 3%, which was achieved despite the above-mentioned calcimimetics effect. Health Care Products revenue increased by 4% to EUR 3,745 million (+7% at constant currency). Important drivers were sales of products for acute care treatments and in-center disposables.

Operating income declined by 25% to EUR 462 million (-18% at constant currency), resulting in a margin of 10.5% (Q4 2019: 13.5%). This decrease was mainly due to a macro-economically driven impairment of goodwill and trade names in the Latin America segment, unfavorable COVID-19 effects and a lower reimbursement for calcimimetics. Excluding the Latin America impairment and on an adjusted 2019 basis6, operating income decreased by 1% to EUR 657 million (+5% at constant currency), resulting in a margin of 14.9% (Q4 2019: 14.5%).

In the full year, operating income grew by 2% to EUR 2,270 million (+4% at constant currency), resulting in a margin of 12.9% (FY 2019: 13.0%). Excluding the Latin America impairment and on an adjusted 2019 basis, operating income increased by 6% to EUR 2,499 million (+8% at constant currency) resulting in a margin of 14.0% (FY 2019: 13.5%).

Net income1 declined by 48% to EUR 177 million (-43% at constant currency); basic earnings per share (EPS) decreased by 47% to EUR 0.61 (-42% at constant currency). Excluding the Latin America impairment and on an adjusted 2019 basis, net income grew by 1% to EUR 372 million (+6% at constant currency). The resulting increase in EPS by 3% to EUR 1.27 (+8% at constant currency) was also supported by the Company’s completed share buyback program.

In the full year, net income declined by 3% to EUR 1,164 million (-1% at constant currency). EPS remained stable at EUR 3.96 (+2% at constant currency). Excluding the Latin America impairment and on an adjusted 2019 basis, net income grew by 10% to EUR 1,359 million (+12% at constant currency), resulting in a 13% increase in EPS to EUR 4.62 (+15% at constant currency).

Strong operational cash-flow development in FY 2020

Fresenius Medical Care generated EUR 584 million of operating cash flow (Q4 2019: EUR 771 million), resulting in a margin of 13.3% (Q4 2019: 16.8%). In the full year, operating cash flow increased to EUR 4,233 million (FY 2019: EUR 2,567 million). In addition to the strong underlying performance, this increase was supported by the U.S. federal relief funding and advanced payments under the CARES Act as well as other COVID-19 relief, including lower tax payments in the U.S. This was partially offset by an increase in inventory levels.

Free cash flow7 amounted to EUR 283 million (Q4 2019: EUR 434 million), resulting in a margin of 6.4% (Q4 2019: 9.5%). In the full year, the Company generated a free cash flow of EUR 3,197 million (FY 2019: EUR 1,454 million).

Regional developments

In North America, revenue declined by 6% to EUR 2,983 million (+2% at constant currency), mainly due to a sizable negative exchange rate effect and a substantial negative impact of COVID-19 on the Services business, resulting in organic growth of -1%. This was only partially offset by the negative prior-year effect resulting from a revenue adjustment for accounts receivable in legal dispute as well as higher sales of products for acute care treatments, renal pharmaceuticals and PD products. In the full year, North America revenue increased by 2% to EUR 12,478 million (+4% at constant currency, +2% organic).

Despite the mentioned headwinds from exchange rates, operating income in North America grew by 3% to EUR 533 million (+11% at constant currency), resulting in a margin of 17.9% (Q4 2019: 16.2%). The margin increase was mainly driven by negative prior-year earnings effects and higher reimbursement rates, partially offset by the unfavorable impact of the COVID-19 pandemic and the calcimimetics effect. In the full year, operating income rose by 18% to EUR 2,120 million (+20% at constant currency), resulting in a margin of 17.0% (FY 2019: 14.7%).

Revenue in EMEA grew by 1% and amounted to EUR 715 million (+7% at constant currency, +5% organic). Higher sales of in-center disposables as well as products for acute treatments and home hemodialysis were largely offset by a negative exchange rate effect and the impact of COVID-19 on the Services business. In the full year, EMEA revenue increased by 3% to EUR 2,763 million (+5% at constant currency, +4% organic).

Operating income in the EMEA region rose by 17% to EUR 134 million (+22% at constant currency), resulting in a margin of 18.7% (Q4 2019: 16.1%). The margin increase was mainly driven by a favorable impact from equity method investees. This was partially offset by unfavorable currency transaction effects. In the full year, operating income declined by 8% to EUR 412 million (-6% at constant currency), resulting in a margin of 14.9% (FY 2019: 16.6%).

In Asia-Pacific, revenue increased by 4% to EUR 517 million despite a negative exchange rate effect (+7% at constant currency, +8% organic). This was mainly driven by organic growth in the Services business as well as higher sales of products for acute treatments, in-center disposables and PD products. In the full year, revenue grew by 2% to EUR 1,894 million (+3% at constant currency, +4% organic). Organic growth in the Services business as well as higher sales of products for acute care treatments and in-center disposables were largely offset by the effect of closed or sold clinics.

Operating income grew by 43% to EUR 107 million (+45% at constant currency), resulting in a margin of 20.6% (Q4 2019: 15.0%). The increase in margin was mainly driven by favorable Product business growth in China and cost optimization measures. In the full year, operating income rose by 4% to EUR 344 million (+5% at constant currency), resulting in a margin of 18.1% (FY 2019: 17.7%).

Including a very significant headwind from exchange rates, Latin America revenue declined by 9% to EUR 177 million (+16% at constant currency, +9% organic). In the full year, revenue decreased by 3% to EUR 684 million (+21% at constant currency, +15% organic).

Operating income in Latin America was heavily impacted by the impairment of goodwill and trade names as a result of a macro-economic downturn and increasing risk adjustment rates for certain countries. It amounted to EUR -186 million. Excluding the impairment, operating income declined by 39% to EUR 9 million (-40% at constant currency), resulting in a margin of 5.1% (Q4: 2019: 7.6%). Operating income for the full year amounted to EUR -157 million. Excluding the impairment, operating income decreased by 11% to EUR 38 million (-2% at constant currency), resulting in a margin of 5.5% (FY 2019: 6.0%).

Patients, Clinics and Employees

As of December 31, 2020, Fresenius Medical Care treated 346,553 patients in 4,092 dialysis clinics worldwide. At the end of the year, the Company had 125,364 employees (full-time equivalents) worldwide, compared to 120,659 employees as of December 31, 2019.

Press conference

Fresenius Medical Care will hold a virtual press conference to discuss the results of the fourth quarter and full year 2020 on February 23, 2021 at 12:00 p.m. CET / 6:00 a.m. ET. The press conference will be webcasted on the Company’s website www.freseniusmedicalcare.com in the “Media” section. A replay will be available shortly after the conference.

Conference call

Fresenius Medical Care will host a conference call to discuss the results of the fourth quarter and full year 2020 on February 23, 2021 at 3:30 p.m. CET / 9:30 a.m. ET. Details will be available on the company’s website www.freseniusmedicalcare.com in the “Investors” section. A replay will be available shortly after the call.

1Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

2Special item: impairment of goodwill and trade names in the Latin America Segment; for a reconciliation of 2020 figures excluding special items and 2019 adjusted figures, please refer to the table at the end of the press release

3Cost in association with FME25 will be treated as a special item.

4These targets are based on the 2020 results excluding the impairment of goodwill and trade names in the Latin America Segment of EUR 195 million. They are inclusive of anticipated COVID-19 effects, in constant currency and exclude special items. Special items include costs related to FME25 and other effects that are unusual in nature and have not been foreseeable or not foreseeable in size or impact at the time of giving guidance.

5These targets are in constant currency and exclude special items. Special items include costs related to FME25 and other effects that are unusual in nature and have not been foreseeable or not foreseeable in size or impact at the time of giving guidance.

6Please see the table at the end of the press release for a detailed reconciliation

7Net cash used in operating activities, after capital expenditures, before acquisitions, investments and dividends

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to various factors, including, but not limited to, changes in business, economic and competitive conditions, legal changes, regulatory approvals, impacts related to the COVID-19 pandemic results of clinical studies, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

- Based on preliminary numbers financial targets for 2020 achieved with net income slightly above the top end of the target range

- Reported earnings in Q4 impacted by macro-economic driven impairment in the Latin America segment

- Accelerated COVID-19 related excess mortality of dialysis patients and continued related higher direct costs negatively affects 2021 business development

- Relevant further developments, including effects of adoption and speed of the roll out of vaccinations and availability of government support, are closely monitored and analyzed

- Cost-base adjustments and restructuring initiatives under evaluation

- Mid-term targets confirmed as defined in October 2020

Throughout 2020, Fresenius Medical Care, the world’s leading provider of products and services for individuals with renal diseases, reported COVID-19 affecting patients with advanced kidney disease and, in particular, the severity of illness resulting in an increased mortality. The excess mortality trend significantly accelerated in the U.S. and in EMEA in particular in November and December 2020 and accumulated to approximately 10,000 patients in 2020 over the pre-pandemic baseline.

In order to protect patients during the COVID-19 pandemic and maintain safe operations in the Company’s more than 4,000 dialysis centers and 45 manufacturing sites, comprehensive measures had been taken. These measures included the provision of personal protective equipment for employees and patients as well as higher compensation for employees working in the isolation clinics. These measures have resulted in significantly increased costs in the Dialysis Services business, which in 2020 was largely compensated by governmental support, in particular in the U.S., accelerated efficiency measures and a strong products business development.

Despite those negative impacts of the COVID-19 pandemic, Fresenius Medical Care has achieved - based on the preliminary and unaudited financials - its revenue target and slightly exceeded its net income1 targets for 20202.

The previously flagged impairment of goodwill and tradenames in the Latin America segment has materialized with an impact of approximately EUR 195 million as a consequence of the macro-economic downturn and increasing risk adjustment rates for certain countries in Latin America and will be treated as a special item.

The accelerating effects of excess mortality due to the COVID-19 pandemic are continuing into 2021 and are expected to have a significant adverse annualization effect on treatment volumes. This also negatively impacts the operating leverage on clinic utilization and downstream effects on complementary assets.

Against this backdrop, Fresenius Medical Care anticipates, based on the currently available information and status of analysis, revenue growth of up to mid-single digits and assumes net income1 before potential restructuring measures to decline by up to 25 percent.3

This current estimate is based on the following high-level assumptions:

- Excess mortality to continue to accumulate for the first half of 2021 depending on the adoption and speed of the roll out of vaccinations to our worldwide patient population

- COVID-19-related additional costs, such as for personal protective equipment or increased personnel costs in the Dialysis Services business, to remain on high level

- Besides the extended suspension of the U.S. Medicare sequestration (until end of March 2021), no further public relief funding assumed for dialysis providers

Fresenius Medical Care continues to monitor closely the development of mortality, including the adoption and speed of roll out of vaccinations to its patient population, as well as potential availability of government relief. Additionally, potential cost efficiency and restructuring measures to further adjust the cost base are under close evaluation.

The final results for the financial year 2020 and the targets for 2021 will be published, as scheduled, on February 23, 2021.

Fresenius Medical Care’s mid-term targets until 2025 as defined in October 2020, remain unchanged.

Conference call

Fresenius Medical Care will host a public presentation on the early indication for 2021 on February 3, 2021 at 2:00 p.m. CET / 8.00 a.m. ET. Please find the registration link here. The quiet period will end with the publication of the results of the fourth quarter and full year 2020 on February 23, 2021.

1Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA.

22020 targets are inclusive of anticipated COVID-19 effects, in constant currency and exclude special items. Special items are effects that are unusual in nature and have not been foreseeable or not foreseeable in size or impact at the time of giving guidance. Special item in 2020: impairment in Latin America segment.

3These early indications for 2021 are inclusive of anticipated COVID-19 effects, in constant currency and exclude special items such as restructuring costs. They are based on the preliminary and unaudited operational 2020 results excluding special items.

Disclaimer:

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to various factors, including, but not limited to, changes in business, economic and competitive conditions, legal changes, regulatory approvals, impacts related to the COVID-19 pandemic results of clinical studies, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius Medical Care, the world’s leading provider of products and services for people with chronic kidney failure, announced today that the company’s Frenova division has enrolled the first participants in its new initiative to develop the largest renal-focused genomic registry in the world.

Along with this key milestone, the company also announced that Ali Gharavi, MD, Chief of the Division of Nephrology at Columbia University Irving Medical Center and Professor of Medicine at Columbia University Vagelos College of Physicians and Surgeons, will lead the project and provide scientific guidance as Principal Investigator.

As a contract clinical development services company dedicated exclusively to medicines and medical products in renal research, Frenova orchestrates studies within the clinical footprint of Fresenius Medical Care, which provides dialysis treatments to about 350,000 patients around the globe. The renal-focused genomic registry represents a new business line within Frenova, which is based in Fresenius Medical Care’s Global Medical Office.

As part of its growth strategy 2025, Fresenius Medical Care is using digital technologies and the capability to analyze huge amounts of data to develop new forms of renal therapy.

Nephrology has been under-represented in clinical research, even as rapid progress in gene sequencing and analysis has led to advances in precision medicine and individualized care in oncology, cardiology and other medical areas. Frenova’s new genomic registry will contain genetic sequencing data from chronic kidney disease patients worldwide, which will be used by researchers to improve the understanding of kidney disease. Frenova developed the registry after researchers identified the lack of a large-scale, renal-focused registry of genomic and clinical data as a major impediment to kidney disease research.

“The new Frenova registry will close this gap by generating data that adds a clinical and genetic backbone to help support and fuel scientific innovation,” said Franklin W. Maddux, MD, Global Chief Medical Officer of Fresenius Medical Care. “The evidence for genetic drivers in kidney diseases is substantial, but much larger data sets will be needed to untangle the complex interactions that lead to kidney injury. By combining clinical and genetic sequencing data from ethnically and pathologically diverse participants, this genomic and phenotypic research resource will help scientists better understand how genetic variations in patients can lead to more precise diagnoses and therapies that help improve outcomes by individualizing care.”

“Our renal-focused genomic registry will be a sustainable and comprehensive tool for kidney-focused research,” said Kurt Mussina, President of Frenova. “It will bring patients, their families, patient advocacy groups, physicians and researchers together in the common cause of improving the lives of people living with kidney disease.”

Learn more about Frenova Renal Research at www.frenova.com

Diese Mitteilung enthält zukunftsbezogene Aussagen, die verschiedenen Risiken und Unsicherheiten unterliegen. Die zukünftigen Ergebnisse können erheblich von den zurzeit erwarteten Ergebnissen abweichen, und zwar aufgrund verschiedener Risikofaktoren und Ungewissheiten wie z.B. Veränderungen der Geschäfts-, Wirtschafts- und Wettbewerbssituation, Gesetzesänderungen, behördlichen Genehmigungen, Auswirkungen der Covid-19-Pandemie, Ergebnissen klinischer Studien, Wechselkursschwankungen, Ungewissheiten bezüglich Rechtsstreitigkeiten oder Untersuchungsverfahren und die Verfügbarkeit finanzieller Mittel. Diese und weitere Risiken und Unsicherheiten sind im Detail in den Berichten der Fresenius Medical Care AG & Co. KGaA beschrieben, die bei der U.S.-amerikanischen Börsenaufsicht (U.S. Securities and Exchange Commission) eingereicht werden. Fresenius Medical Care übernimmt keinerlei Verantwortung, die in dieser Mitteilung enthaltenen zukunftsbezogenen Aussagen zu aktualisieren.