- Anticipated revenue decrease of around 6% on a reported basis and an increase of around 2% on a comparable basis1 (+3% at constant currency)

- Net income development affected by

- Weaker than expected Dialysis Services business

- Contributions to the campaigns in the U.S. opposing state ballot initiatives

- Year-to-date adjustments for hyperinflation in Argentina

- Increased provision for the ongoing FCPA settlement discussion

- Targets for full year 2018 revised:

- Revenue growth on a comparable basis1: 2 to 3% (from 5 to 7%)

- Net income growth on a comparable basis1: 11 to 12% (from 13 to 15%)

1For a detailed reconciliation, please refer to the table at the end of the press release

2Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

“The underlying growth trends and business drivers remain intact. While we were able to improve profitability in North America, the growth acceleration in the region did not materialize as fast as anticipated. In addition, the business performance in some emerging countries was muted due to a challenging economic environment. Based on these developments, which are not expected to be fully recovered in the fourth quarter, we adjust our targets for fiscal 2018,” said Rice Powell, Chief Executive Officer of Fresenius Medical Care. “To protect the access of our patients to dialysis care, we contributed to the opposition to the ballot initiatives in the U.S.”

Revenue

Revenue in the third quarter 2018 is anticipated to decline by around 6% to approx. EUR 4,058 million (a decrease of around 6% at constant currency), mainly driven by the higher comparable base which included the Q3 2017 revenue contribution from Sound Inpatient Physicians (“Sound”) of EUR 253 million as well as the impact from the IFRS 15 implementation. Excluding these two effects, revenue is expected to increase by around 2% on a comparable basis (~3% at constant currency), mainly driven by an increase in treatment volumes in North America. The increase in revenue is anticipated to come in below expectations due to an overall weaker than expected Health Care Services business in North America and the difficult economic environment in certain emerging countries, including currency fluctuations. The lower than expected increase in North America was mainly driven by an unfavorable payor mix as well as lower than expected volumes in the Dialysis Services and Care Coordination businesses.

Operating income (EBIT)

Total operating income (EBIT) is expected to reach approx. EUR 527 million in the third quarter of 2018, a decrease of around 13% (a decrease of around 20% at constant currency). The anticipated strong decrease was mainly attributable to the higher comparable base which included the Q3 2017 EBIT contribution from Sound of EUR 20 million. In addition, the contributions to the opposition to the ballot initiatives in the U.S. of EUR 23 million (not tax effected) in the third quarter affected the operating income growth. We have also increased the provision for the FCPA related charge by EUR 75 million (not tax effected). This increase reflects an understanding with the U.S. Government on the financial aspects of a potential settlement and an update of ongoing legal costs to reach closure. However, significant non-financial matters are still under discussion and must be resolved to the company’s satisfaction for a settlement to occur.

Excluding the effects of Sound, the contributions to the ballot initiatives as well as the FCPA related charge, EBIT is expected to increase by around 5% on a comparable basis (around 4% at constant currency). The assumed lower than expected EBIT increase on a comparable basis was driven by the weaker Dialysis Services business in North America due to higher patient care and supply cost, in particular for home dialysis. The development was also negatively impacted by charges for hyperinflation in Argentina of around EUR 17 million at constant currency (not tax effected), transactional exchange rate losses and higher bad debt associated with the development in certain emerging countries. These developments could not be fully mitigated in the quarter.

Net income

Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA is expected to decrease by around 8% to approx. EUR 285 million in the third quarter of 2018 (a decrease of around 17% at constant currency). On a comparable basis net income is expected to increase by around 20% to approx. EUR 364 million (around 19% at constant currency). The contributions to the opposition to the ballot initiatives in the U.S., the hyperinflationary adjustment for Argentina and the increase of the provision for the FCPA related charge have not been tax effected.

Outlook 2018

Fresenius Medical Care adjusts its targets for the financial year 2018 as the business development in the third quarter 2018 was below the company’s expectations. The company now expects revenue growth of 2 to 3% at constant currency (previously: 5 to 7%). Net income on a comparable basis is expected to increase by 11 to 12% (previously: 13 to 15%) at constant currency. On an adjusted basis, net income is expected to increase by 2 to 3% (previously: 7 to 9%) at constant currency.

The targets exclude the effect from the planned acquisition of NxStage Medical.

Final Q3 2018 results and conference call

All figures in this press release are still preliminary. The company will publish its Q3 and 9 months 2018 financial results, as scheduled, on October 30, 2018. Fresenius Medical Care will host a conference call to discuss the results of the third quarter on October 30, 2018, at 3:30 p.m. CET / 9:30 a.m. EDT. Details will be available on the company’s website www.freseniusmedicalcare.com in the “Investors/Events” section. A replay will be available shortly after the call.

Disclaimer

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius Medical Care, the world’s largest provider of dialysis products and services, supports the recommendation by the United Kingdom’s National Institute for Health and Care Excellence (NICE) to facilitate population healthcare management for UK patients with end-stage renal disease. In a guideline on renal replacement therapy published on October 3, 2018, NICE, a non-departmental public body of the UK’s Department of Health, advises health and social care professionals to consider hemodiafiltration (HDF) rather than high-flux hemodialysis (HD) if the patient is treated in-center, due to the positive impact on patient outcomes and cost-effectiveness.

High-flux HD is the application of high-flux dialyzers to remove a broad spectrum of small and large uremic toxins in order to contribute towards better management of dialysis patients. HDF adds a convective component to the high-flux HD treatment, making it even more effective in removing larger toxins and further improving patient outcomes.

In order to provide evidence-based guidance, NICE systematically reviewed best available renal replacement therapy studies and conducted an economic evaluation. The assessment identified clear benefits of HDF treatment for both renal disease patients and the national healthcare system, as HDF is not only considered cost-effective but is also expected to decrease mortality rates among patients.

Fresenius Medical Care has a long-standing commitment to make HDF available to patients to achieve the best possible outcomes. The company has developed innovative technologies which automatically maximize substitution rates in HDF and support the application of HighVolumeHDF®. This makes HDF treatments as simple as HD, and allows HDF treatments to be delivered at the same cost as HD in the UK.

Dr. Katarzyna Mazur-Hofsaess, Chief Executive Officer of Fresenius Medical Care for Europe, the Middle East and Africa, said: “The NICE guidelines incorporate the existing evidence base for the benefits of HDF therapy. We are convinced that our HighVolumeHDF® therapy platform provides the easiest way for the user to deliver HDF to patients. Our commitment to make HighVolumeHDF® available to all patients across the UK remains a top priority for us.”

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius Medical Care, the world’s largest provider of dialysis products and services, has been recognized for the 10th consecutive year as a sustainability leader with inclusion in the Dow Jones Sustainability Index (DJSI Europe). The DJSI Europe index represents the top 20 percent of the largest 600 European companies in the S&P Global BMI, based on the international investment company RobecoSAM’s analysis of their economic, environmental and social performance.

This year, Fresenius Medical Care scored particularly highly for its reporting on environmental and social issues as well as its materiality analysis, which identifies issues in the economy, environment and society that may significantly affect a company’s performance. With publication of its first non-financial group report in 2018, Fresenius Medical Care has also established a global sustainability governance structure. This will further improve the coordination and management of sustainability topics across all regions.

Rice Powell, Chief Executive Officer of Fresenius Medical Care and head of the company’s Sustainability Decision Board, said: “Over the past years, we have continuously built up our sustainability efforts, as we are convinced that acting in a responsible and sustainable manner goes hand in hand with our commercial success. Being included in the renowned Dow Jones Sustainability Index for 10 years in a row makes us proud, and confirms that we are on the right track by putting patients first.”

Fresenius Medical Care North America is making a $100,000 contribution to the American Nephrology Nurses Association (ANNA), a professional nursing organization with more than 8,500 members. In recognition of ANNA’s 50th anniversary year and Nephrology Nurses Week, the donation will fund an ongoing scholarship program, help increase awareness of the profession, and strengthen engagement with nurses dedicated to caring for patients with chronic kidney disease.

- Healthy organic growth across the board, North American Products business continues strong growth

- Underlying Care Coordination margin improved

- Results continue to be impacted by strong currency headwinds

- Calcimimetics continue to evolve

- Divestiture of Sound Inpatient Physicians successfully closed

- NxStage acquisition expected to close in the second half of 2018

1 For a detailed reconciliation, please refer to the table at the end of the press release2 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

Rice Powell, Chief Executive Officer of Fresenius Medical Care, stated: “In the second quarter, we have seen solid growth resulting in a strong net income increase of 22 percent at constant currency – excluding the positive impact of the successful and efficient closing of the Sound Inpatient Physicians divestment. On the back of the strong development of our Products business and continued growth of our Services business, we expect growth to further accelerate in the second half of 2018.”

Strong Products growth

Revenue in the second quarter of 2018 was again significantly impacted by foreign currency effects, resulting in a 2% increase at constant currency to EUR 4,214 million (-6% at current rates). Adjusting the second quarter of 2017 for the impact from the IFRS 15 implementation, revenue in the second quarter of 2018 was up by 5% at constant currency. Health Care Services revenue increased by 1% at constant currency to EUR 3,385 million, driven by growth in same market treatments and contributions from acquisitions, partially offset by the effects from the implementation of IFRS 15. Excluding the negative effects from the implementation of IFRS 15 Health Care Service revenue increased by 4% at constant currency. Health Care Products revenue grew by 6% at constant currency to EUR 829 million. The increase was driven by higher sales of hemodialysis products and renal pharmaceuticals. Organic growth for Health Care Services was 3% and for Health Care Products 6%. Dialysis treatments increased by 3%, mainly as a result of growth in same-market treatments.

In the first half of 2018, revenue was stable at constant currency with EUR 8,189 million (-9% at current rates). Excluding the effect from the implementation of IFRS 15 revenue was up by 3% at constant currency. Health Care Services revenue decreased by 1% at constant currency (-11% at current rates) based on a strong comparable first half of 2017 and unfavourably affected by the implementation of IFRS 15 and the VA Agreement. Health Care Products revenue increased by 6% at constant currency (flat at current rates).

Significant contribution from divestitures of Care Coordination activities

Total operating income (EBIT) reached EUR 1,401 million, an increase of 162% at constant currency (+140% at current rates) in the second quarter of 2018. The strongest contributor was the gain related to the divestitures of Care Coordination activities. The significant contribution of EUR 833 million also includes the positive effect of gains from currency translation adjustments. Adjusting for the gain as well as the prior year impact from the VA Agreement, EBIT grew by 2% at constant currency (-4% at current rates) with an EBIT margin of 13.5%.

In the first half of 2018, EBIT increased by 68% at constant currency to EUR 1,898 million (+54% at current rates). Adjusted for the effects described above, EBIT increased by 3% at constant currency (-6% at current rates) and the EBIT margin was 13.2%.

Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA was exceptionally strong in the second quarter of 2018 with EUR 994 million (+270% at current rates), mainly driven by the gain related to the divestitures of Care Coordination activities. Excluding the gain related to the divestitures of Care Coordination activities, the increase in net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA was 22% at constant currency (+15% at current rates). Further adjusting for the prior year impact from the VA Agreement and the positive effect from the U.S. Tax Reform, net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA grew by 6% on a constant currency basis to EUR 273 million (flat at current rates). Based on the number of approximately 306.4 million shares (weighted average number of shares outstanding), basic earnings per share (EPS) amounted to EUR 3.24 (+270% at current rates). On a comparable basis the company generated an EPS of EUR 1.00, up by 22% at constant currency and 15% at current rates. On an adjusted basis EPS increased by 6% to EUR 0.89 at constant currency (flat at current rates).

For the first half of 2018, net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA increased by 141% at constant currency (+121% at current rates) to EUR 1,273 million, mainly driven by the gain related to the divestitures of Care Coordination activities. Adjusted for this effect, net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA reached EUR 599 million, an increase of 13% at constant currency (+4% at current rates). Further adjusting for the prior year impact from the VA Agreement and the positive effect from the U.S. Tax Reform, net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA reached EUR 517 million in the first half of 2018, an increase of 7% at constant currency (-1% at current rates).

Organic growth across all Reporting Segments

North America revenue, which represents 71% of total revenue in the second quarter of 2018, was stable at constant currency and reached EUR 2,971 million (-8% at current rates). Excluding the effect from the implementation of IFRS 15 revenue was up by 4% at constant currency. Organic growth was 3%.

Dialysis Care revenue increased by 4% to EUR 2,232 million at constant currency (-4% at current rates). The growth at constant currency was mainly driven by an increase in organic revenue per treatment, same market treatment growth and contributions from acquisitions, to some extent diluted by the implementation of IFRS 15 and the VA Agreement in the prior year. Adjusted for the implementation of IFRS 15, Dialysis Care revenue increased by 7% at constant currency. Organic revenue per treatment increased by 4%, same-market treatments grew by 2% and acquisitions contributed 1%. At constant currency, Care Coordination revenue decreased by 18% (-24% at current rates), driven by the shift of calcimimetic drugs into the clinical environment and the implementation of IFRS 15, partially offset by improved performance in certain services prior to divestiture. Excluding the effect from the implementation of IFRS 15 Care Coordination revenue decreased by 10% at constant currency.

In the U.S., the average revenue per treatment, adjusted for the implementation of IFRS 15 and excluding the 2017 impact of the VA Agreement, increased by USD 13 from USD 341 to USD 354. The increase was mainly driven by the introduction of calcimimetic drugs in the clinical environment, which is still evolving. The increase was partially offset by lower revenue from commercial payors, as expected, and higher implicit price concessions (IFRS 15).

Cost per treatment in the U.S., adjusted for the implementation of IFRS 15, increased by USD 14 from USD 272 to USD 286. This development was largely a result of the introduction of calcimimetic drugs in the clinical environment as well as increased property and other occupancy related costs, partially offset by lower costs for health care supplies.

At constant currency, Health Care Products revenue showed a strong increase of 10% to EUR 210 million due to higher sales of renal pharmaceuticals, machines and hemodialysis concentrates. Lower external sales in peritoneal dialysis products affected the overall positive development.

Total operating income for the North America segment was EUR 1,286 million in the second quarter of 2018, an increase of 200% at constant currency (+174% at current rates). This increase was mainly driven by the gain related to divestitures of Care Coordination activities. Adjusted for this impact and the 2017 effects from the VA Agreement, operating income (EBIT) was EUR 453 million compared to EUR 471 million in the second quarter of 2017. The adjusted operating income margin was stable at 15.2%.

For the first half of 2018, North America revenue decreased by 3% at constant currency to EUR 5,746 million (-13% at current rates). Adjusted for the implementation of IFRS 15 (EUR 270 million), revenue increased by 1% at constant currency (-9% at current rates). Mainly driven by the gain related to divestitures of Care Coordination activities operating income went up by 83% at constant currency (+66% at current rates) to EUR 1,648 million in the first half of 2018.

As of the end of June 2018, the company was treating 199,527 patients (+3%) at its 2,439 clinics (+4%) in North America. Dialysis treatments increased by 3%.

EMEA revenue increased by 5% at constant currency (+2% at current rates) to EUR 652 million in the second quarter of 2018, mainly driven by the positive development in Health Care Services revenue and Health Care Products revenue, which increased by 5% and 4%, respectively, at constant currency. The increase in Health Care Services revenue was driven by same-market treatment growth and acquisitions. Dialysis Products revenue grew by 5% at constant currency (+2% at current rates) to EUR 319 million, due to higher sales of dialyzers, machines, bloodlines, products for acute care treatments and renal pharmaceuticals.

Non-dialysis Products revenue decreased by 8% at constant currency (-8 % at current rates) to EUR 18 million, primarily due to slightly lower sales volumes.

Operating income was EUR 105 million in the second quarter of 2018. The operating income margin decreased from 17.6% to 16.1%, mainly due to unfavorable impacts from lower income from equity method investees, higher personnel costs in certain countries and an increase in bad debt expenses.

For the first half of 2018, EMEA revenue increased by 5% at constant currency to EUR 1,288 million (+3% at current rates), while operating income of EUR 214 million was 5% below last year´s level at constant currency (-6% at current rates).

As of the end of June 2018, the company had 63,589 patients (+4%) being treated at 758 clinics (+4%) in the EMEA region. Dialysis treatments increased by 4%.

Asia-Pacific revenue grew by 7% at constant currency to EUR 422 million (+1% at current rates) in the second quarter of 2018. Health Care Services revenue in the region increased by 7% at constant currency to EUR 191 million (flat at current rates). Care Coordination activities contributed EUR 49 million (+32% at constant currency, +24% at current rates) to Health Care Services revenue. This strong Care Coordination growth in Asia Pacific was mainly related to acquisitions and a strong organic revenue growth. Health Care Products showed again a solid business performance, growing 6% at constant currency to revenues of EUR 231 million (+2% at current rates). This growth was mainly driven by higher sales of hemodialysis products, partially offset by lower sales of products for acute care treatments. Operating income reached the same level as the previous year’s quarter (EUR 78 million). The operating income margin decreased slightly to 18.4%, driven by unfavorable foreign currency impacts and increased costs for the business growth, mainly in China.

For the first half of 2018, Asia-Pacific revenue increased by 10% at constant currency to EUR 814 million. Operating income decreased by 1% at constant currency with EUR 152 million (-5% at current rates).

As of the end of June 2018, the company had 30,578 patients (+2%) being treated at 385 clinics in Asia-Pacific. Dialysis treatments increased by 2%.

Latin America delivered revenue of EUR 164 million in the second quarter of 2018, an improvement of 11% at constant currency (-10% at current rates). This growth was mainly driven by a strong growth in Health Care Services (+15% at constant currency) due to an increase in organic revenue per treatment, acquisitions and growth in same market treatments. Health Care Products revenue in Latin America increased by 2% at constant currency to EUR 46 million, due to higher sales of machines and peritoneal dialysis products and negatively affected by lower sales of dialyzers. With an operating income of EUR 11 million the segment generated an operating income on previous year’s level. The operating income margin remained at 6.8%.

For the first half of 2018, Latin America revenue increased by 14% at constant currency to EUR 334 million (-7% at current rates). Operating income was EUR 25 million, an increase of 5% at constant currency (-6% at current rates).

As of the end of June 2018, the company was treating 31,494 patients (+4%) at 233 clinics in Latin America (+1%). Dialysis treatments increased by 4%.

Net interest expense was EUR 84 million compared to EUR 95 million in the second quarter of 2017, a decrease of 6% at constant currency (-11% at current rates). The decrease was driven by a replacement of high interest-bearing senior notes by debt instruments at lower rates as well as a decreased debt level. Income tax expense was EUR 262 million for the second quarter of 2018, which translates into an effective tax rate of 19.9%, compared to last year’s Q2 with a tax rate of 30.8%. The strong reduction was largely driven by the U.S. Tax Reform and the gain related to divestitures of Care Coordination activities.

Strong cash flow generation

In the second quarter of 2018, the company generated EUR 656 million of operating cash flow, compared to EUR 883 million provided by operating activities in last year’s second quarter. This decrease was mainly driven by increased accounts receivable related to the addition of calcimimetics into the Medicare ESRD payment bundle and unfavorable foreign currency effects. The number of days sales outstanding (DSOs) decreased sequentially by three days compared with Q1 2018 to reach 82 days. Free cash flow (Net cash used in operating activities, after capital expenditures, before acquisitions and investments) amounted to EUR 429 million for the three months ended June 30, 2018 compared to EUR 690 million for the same period of 2017. Free cash flow in percent of revenue was 10.2% and 15.4% for the three months ended June 2018 and 2017, respectively.

Sound Physicians divestiture successfully closed

On June 28, Fresenius Medical Care announced the closing of the divestiture of Sound Inpatient Physicians Holdings, LLC to an investment consortium led by Summit Partners. In the second half of 2017, the Sound Physicians business generated revenue of EUR 559 million and a net income of EUR 38 million. The 2017 basis has been adjusted accordingly for measuring the performance against the 2018 outlook.

Closing of NxStage Medical acquisition expected for second half 2018

In August 2017, Fresenius Medical Care signed an agreement with NxStage Medical, a U.S.-based medical technology and services company, to acquire all outstanding shares of NxStage Medical through a merger. The merger, which has been approved by NxStage’s board, NxStage stockholders and authorities in Germany, is still subject to regulatory approval by the Federal Trade Commission under the Hart-Scott-Rodino Act. Fresenius Medical Care has exercised its contractual right under the merger agreement to extend the original closing deadline by 90 days from August 7, 2018 to November 5, 2018. Fresenius Medical Care expects to close the transaction in 2018.

Employees

As of June 30, 2018, Fresenius Medical Care had 111,263 employees (full-time equivalents) worldwide, compared to 112,163 employees at the end of June 2017. This decrease was mainly attributable to divestitures of certain Care Coordination activities.

Outlook 2018

The company expects revenue1 growth between 5% and 7% at constant currency. Net income on a comparable basis2 is expected to increase by 13% to 15% at constant currency and on an adjusted basis2,3 to increase by 7% to 9% at constant currency.

The targets exclude the effect from the planned acquisition of NxStage Medical and the gain (loss) related to divestitures of Care Coordination activities.

1 2017 adjusted for the effect of IFRS 15 implementation and the contribution of Sound Physicians in H2 20172 Attributable to shareholders of Fresenius Medical Care AG & Co. KGaA, adjusted for the contribution from Sound Physicians in H2 20173 VA Agreement, Natural Disaster Costs, FCPA related charge, U.S. Tax Reform

Conference call

Fresenius Medical Care will host a conference call to discuss the results of the second quarter today at 3:30 p.m. CEDT / 9:30 a.m. EDT. Details will be available on the company’s website www.freseniusmedicalcare.com in the “Investors/Events” section. A replay will be available shortly after the call.

Please refer to the PDF for a complete overview of the results for the second quarter and first half year 2018.

Disclaimer

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

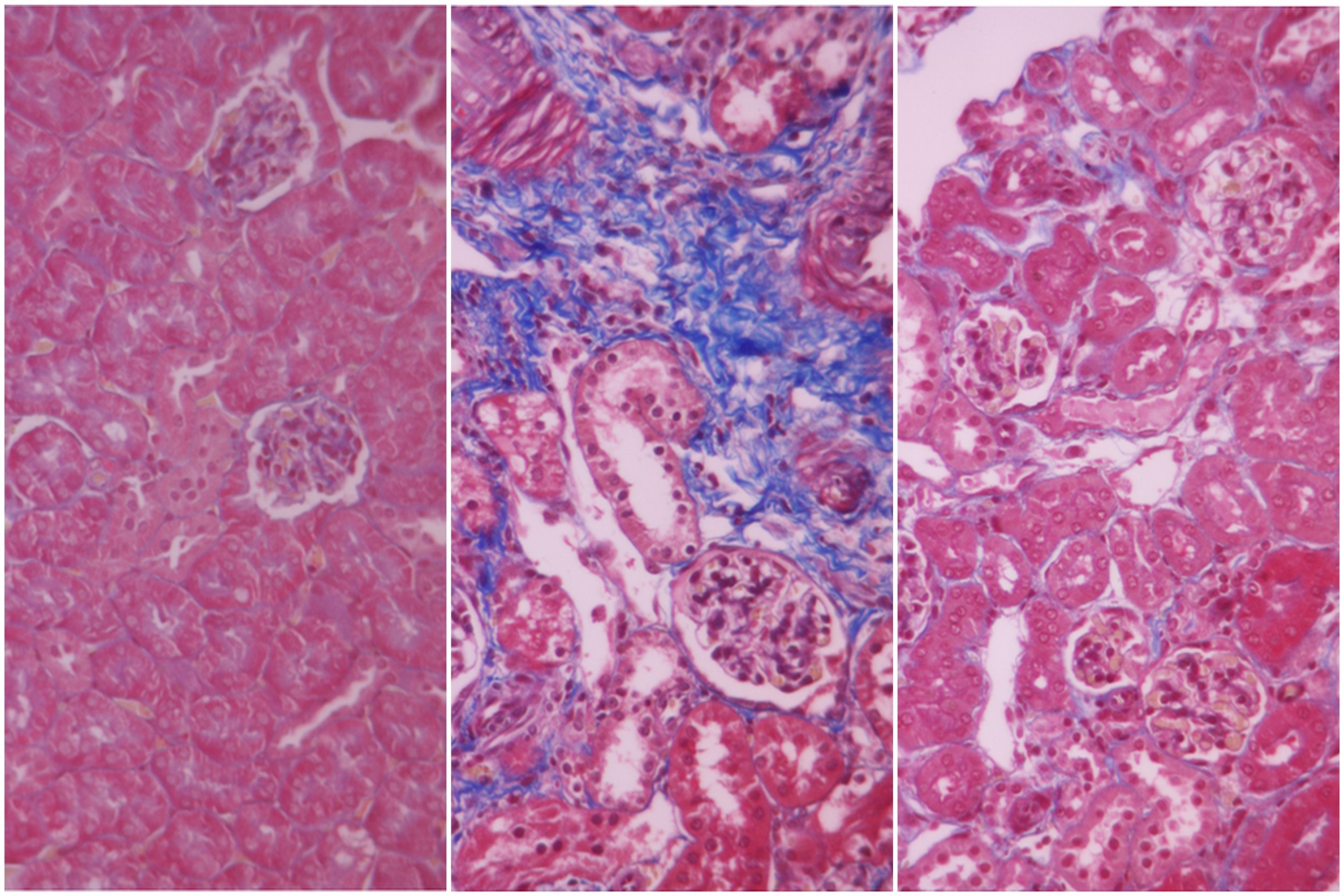

Fresenius Medical Care, the world’s largest provider of dialysis products and services, announced today that its subsidiary Unicyte AG has achieved a key preclinical milestone in its regenerative medicine program for chronic kidney disease. The company was able to confirm a disease modifying potential for its proprietary nano-Extracellular Vesicles (“nEVs” are stem cell-derived particles that support communication between cells) in a second preclinical model of chronic kidney disease.

When administered to mice with fast progressing kidney disease, Unicyte’s nEVs prevented renal fibrosis, a hallmark of chronic kidney disease. In particular, nEVs significantly reduced interstitial fibrosis and tubular necrosis while also inhibiting infiltration of various cells. This resulted in near-to-normal recovery of kidney function. The study conducted in collaboration with Prof. Giovanni Camussi of the University of Turin, Italy, has been accepted for publication in the peer-reviewed journal Frontiers of Immunology (https://doi.org/10.3389/fimmu.2018.01639).

These new results support previous findings in a preclinical model of slowly progressing kidney disease (diabetic nephropathy), a major pathology that often leads to end-stage renal disease. Combined results of these studies demonstrate the efficacy and the underlying mechanism of action of nEVs in preventing renal fibrosis and subsequent progression to end-stage renal disease. Unicyte will continue the preclinical and clinical development of its proprietary nEVs for treatment of chronic and acute kidney diseases.

Dr. Olaf Schermeier, Fresenius Medical Care’s CEO for Global Research and Development, said: “We are very excited about the progress we have made with our research and development activities over the last 30 months since we have established Unicyte. Based on these achievements, Unicyte will continue to explore the potential of nEVs for the treatment of patients in pre-dialysis stages of chronic kidney disease.”

Prof. Giovanni Camussi, Professor Emeritus at the University of Turin and Member of Unicyte’s Scientific Advisory Board, said, “nEVs are a promising regenerative medicine technology platform. Our aim is to develop new and better treatment options for severely and chronically ill patients over time. Achieving this preclinical milestone represents an important step towards testing nEVs in the clinical setting.”

With multiple therapeutic programs at the clinical and preclinical stage, Unicyte has established a broad pipeline in kidney and liver diseases, diabetes and oncology. The company is seeking strategic partnerships for its non-renal programs.

Fresenius Medical Care Ventures, the venture capital unit of Fresenius Medical Care, announced today that it has invested $2 million in the Series B financing round for Vectorious Medical Technologies (“Vectorious”). The Israeli medical device company raised more than $10 million in this financing round, including a recent grant from the European Union’s Horizon 2020 flagship research and development program.

Vectorious has developed the V-LAP, a first of its kind in-heart microcomputer for left-atrial pressure monitoring. Data from this device is transmitted wirelessly to clinicians, enabling heart failure patients to be managed effectively before their disease advances.

The Series B financing will accelerate Vectorious’ ongoing R&D programs, as well as CE Mark and FDA regulatory approval initiatives.

“This first investment we have made outside of the United States demonstrates our confidence in the great innovative potential for medical products in Israel. Based on the pioneering nature of Vectorious’ technology for managing chronic heart failure patients’ care, we see this as a compelling early stage investment opportunity with tremendous potential,” said Florian Jehle, Managing Director of Fresenius Medical Care Ventures and Senior Vice President Global R&D at Fresenius Medical Care.

About Fresenius Medical Care Ventures GmbH

Fresenius Medical Care Ventures was established in 2016 to invest in start-ups and early-stage companies in the healthcare sector. Its investments are targeted to support Fresenius Medical Care’s corporate strategy of growing continuously in the company’s core dialysis business, expanding into new business areas and improving the health of all Fresenius patients. Fresenius Medical Care Ventures complements other corporate innovation initiatives by focusing on early-stage external innovation. For more information, visit www.fmcv.com.

About Vectorious Medical Technologies

Vectorious Medical Technologies has developed an implantable microcomputer-based system that enables optimal management of heart failure patients using direct, daily left-atrial pressure (LAP) measurements. The system’s technological infrastructure is based on use of the first and only sensory implant in the world that is miniature, battery-less and wireless, and that can communicate accurate readings from the heart. The company was founded in 2011 at the RadBioMed incubator by Oren Goldshtein, Dr. Eyal Orion and Roni Weinstein. Vectorious has 15 employees at its offices in Ramat Hahayal in Tel Aviv and at the Cleveland Clinic.

Fresenius Medical Care is the world's largest provider of products and services for individuals with renal diseases of which around 3.2 million patients worldwide regularly undergo dialysis treatment. Through its network of 3,790 dialysis clinics, Fresenius Medical Care provides dialysis treatments for 322,253 patients around the globe. Fresenius Medical Care is also the leading provider of dialysis products such as dialysis machines or dialyzers. Along with its core business, the company provides related medical services in the field of Care Coordination. Fresenius Medical Care is listed on the Frankfurt Stock Exchange (FME) and on the New York Stock Exchange (FMS). For more information visit the Company’s website at www.freseniusmedicalcare.com.

Disclaimer

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

The information and documents contained on the following pages of this website are for information purposes only. These materials do neither constitute an offer nor an invitation to subscribe to or to purchase securities, nor any investment advice or service, and are not meant to serve as a basis for any kind of obligation, contractual or otherwise. Securities may not be offered or sold in the United States of America (“US”) absent registration under the US Securities Act of 1933, as amended, or an exemption from registration. The securities described on the following pages are not offered for sale in the US or to "US persons" (as defined in Regulation S under the US Securities Act of 1933, as amended).

THE FOLLOWING INFORMATION AND DOCUMENTS ARE NOT DIRECTED AT AND ARE NOT INTENDED FOR USE BY (I) PERSONS WHO ARE RESIDENTS OF OR LOCATED IN THE US, CANADA, JAPAN OR AUSTRALIA OR WHO ARE US PERSONS (AS DEFINED IN REGULATION S UNDER THE US SECURITIES ACT OF 1933, AS AMENDED), OR (II) PERSONS IN ANY OTHER JURISDICTION WHERE THE COMMUNICATION OR RECEIPT OF SUCH INFORMATION IS RESTRICTED IN SUCH A WAY THAT PROVIDES THAT SUCH PERSONS SHALL NOT RECEIVE IT. SUCH PERSONS, OR PERSONS ACTING FOR THE BENEFIT OF ANY SUCH PERSONS, ARE NOT PERMITTED TO VISIT THE FOLLOWING PAGES OF THE WEBSITE.

To visit the following parts of this website you must confirm that

(i) you are not a resident of the United States of America, Canada, Japan or Australia or a "US person" (as defined in Regulation S under the US Securities Act of 1933, as amended),

(ii) you are not a person to whom the communication of the information contained on the website is restricted,

(iii) you will not distribute any of the information and documents contained thereon to any such person, and

(iv) you are not acting for the benefit of any such person.

By clicking on the "Accept" button below, you will be deemed to have made this confirmation

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES OF AMERICA, AUSTRALIA, CANADA OR JAPAN.

Fresenius Medical Care, the world’s largest provider of dialysis products and services, today successfully placed notes with an aggregate principal amount of €500 million. The notes have a maturity of 7 years and an annual coupon of 1.5%. The issue price is 99.704% and the resulting yield amounts to 1.545%.

The transaction was very well received by investors and substantially oversubscribed. The proceeds will be used for general corporate purposes, including the refinancing of upcoming maturities.

This is the first issuance of the company since it was upgraded to Investment Grade by the three leading rating agencies Standard & Poor’s, Moody’s and Fitch. The notes were drawn under the newly established European Medium Term Note (EMTN) Program by Fresenius Medical AG & Co. KGaA. The program allows for standardized issuances of notes in various currencies and maturities.

Fresenius Medical Care has applied to the Luxembourg Stock Exchange to admit the notes to trading on its regulated market.

This announcement does not contain or constitute an offer of, or the solicitation of an offer to buy or subscribe for, securities to any person in Australia, Canada, Japan, or the United States of America (the “United States”) or in any jurisdiction to whom or in which such offer or solicitation is unlawful. The securities referred to herein have not been and will not be registered under U.S. Securities Act of 1933, as amended (the “Securities Act”) and may not be offered or sold in the United States or to, or for the account or benefit of, U.S. persons, absent such registration, except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. Subject to certain exceptions, the securities referred to herein may not be offered or sold in Australia, Canada or Japan or to, or for the account or benefit of, any national, resident or citizen of Australia, Canada or Japan. The offer and sale of the securities referred to herein has not been and will not be registered under the Securities Act or under the applicable securities laws of Australia, Canada or Japan. There will be no public offer of the securities in the United States.

This announcement is an advertisement and not a prospectus. Investors should not purchase or subscribe for any securities referred to in this announcement except on the basis of information in the prospectus issued by the company in connection with the offering of such securities. Copies of the prospectus are available free of charge from Fresenius Medical Care AG & Co. KGaA at Else-Kröner Strasse 1, 61352 Bad Homburg, Germany.

This announcement has been prepared on the basis that any offer of Notes in any Member State of the European Economic Area (EEA) which has implemented the Prospectus Directive (2003/71/EC), as amended (each, a Relevant Member State) will be made pursuant the prospectus prepared by Fresenius Medical Care AG & Co. KGaA or pursuant to an exemption under the Prospectus Directive, as implemented in that Relevant Member State, from the requirement to publish a prospectus for offers of securities. Fresenius Medical Care AG & Co. KGaA has not authorized, nor does it authorize, the making of any offer of securities in circumstances in which an obligation arises for Fresenius Medical Care AG & Co. KGaA or any other person to publish or supplement a prospectus for such offer.

This announcement is directed at and/or for distribution in the United Kingdom only to (i) persons who have professional experience in matters relating to investments falling within article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) or (ii) high net worth entities falling within article 49(2)(a) to (d) of the Order (all such persons are referred to herein as “relevant persons”). This announcement is directed only at relevant persons. Any person who is not a relevant person should not act or rely on this announcement or any of its contents. Any investment or investment activity to which this announcement relates is available only to relevant persons and will be engaged in only with relevant persons.

This announcement contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this announcement.

Fresenius Medical Care, the world’s largest provider of dialysis products and services, today announced the closing of the divestiture of Sound Inpatient Physicians Holdings, LLC (Sound) to an investment consortium led by Summit Partners as of June 28, 2018. The total transaction proceeds are $2.15 billion (EUR 1.85 billion1).

The divestment of Sound is aligned with Fresenius Medical Care’s goal of further sharpening the profile of the company’s Care Coordination portfolio. The transaction is expected to generate a positive effect on net income2 for Fresenius Medical Care of around USD 7523 million (EUR 648 million1). This effect includes the half year impact from the increase in valuation of Sound´s share based payment program caused by the divestment of Sound.

The financial targets for 2018 and 2020 do not include the effects of this divestiture. The divestment reduces on a constant currency basis Fresenius Medical Care´s 2018 revenue expectations by around EUR 650 million and net income2 by around EUR 40 million. The growth rates indicated in the financial targets for 2018 will be achieved on a comparable basis4 following the divestiture of Sound.

1 EUR/USD 1.16

2 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

3 Based on the company´s latest available information

4 On a pro-forma basis revenue for Sound in H2 2017 was around EUR 560 million and net income was around EUR 40 million

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius Medical Care, the world’s largest provider of dialysis products and services, and Humacyte, Inc., a medical research, discovery and development company, today announced a strategic, global partnership and a $150M USD equity investment. This agreement has the potential to make Humacyte’s investigational human acellular vessel, HUMACYL®, available to more patients worldwide following approval of the product. HUMACYL is currently being investigated for vascular access for hemodialysis and may prove more effective than current synthetic grafts and fistula. Under the terms of the agreement, Fresenius Medical Care will obtain the exclusive global rights to commercialize HUMACYL.

Fresenius Medical Care will be responsible for the marketing, sales and distribution of HUMACYL following approval by the relevant health authorities. In addition, Fresenius Medical Care will make a $150M USD equity investment in Humacyte to gain a 19% fully diluted ownership stake in the company. With the investment, Fresenius Medical Care will have the opportunity to bring transformative clinical innovation in the form of Humacyte’s bioengineered human acellular vessels to the worldwide end stage renal disease (ESRD) patient population following product approval. The transaction is subject to customary closing conditions, including expiration or termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and is expected to close in July 2018.

“By partnering with Humacyte, Fresenius Medical Care has an opportunity to offer a dialysis vascular access option with the potential for significant clinical efficacy and safety improvements, including the potential to minimize catheter contact time to the benefit of our patients,” said Franklin Maddux, MD, Chief Medical Officer for Fresenius Medical Care North America. “Our exclusive rights to distribute this innovative technology to dialysis patients worldwide may have significant benefits not only to patients, but health systems as well. With the potential for fewer anticipated complications and interventions compared to synthetic grafts, we may see increased safety for patients and reduced medical and economic burdens to the healthcare system.”

The current vascular access modalities necessary to deliver dialysis treatment include fistulas, grafts and central venous catheters. All three options have limitations. Half of fistulas fail and do not mature in patients, delaying vascular access for dialysis treatment. In the meantime, many patients need a central venous catheter, which significantly increases the risk of infection. Humacyte has developed a novel human tissue-based investigational product, HUMACYL, for patients with ESRD requiring hemodialysis. Compared to an arteriovenous fistula, HUMACYL can be available for use in hemodialysis within weeks and may have an overall higher rate of maturation. It also may offer a more durable, biologic alternative to synthetic grafts.

“This is a transformational milestone for Humacyte, giving us the world’s strongest partner to help bring our product to more patients globally,” said Carrie Cox, CEO and Chairman of Humacyte, Inc. “Our partnership will allow Humacyte to focus on advancing the potential for HUMACYL as a substantial breakthrough in the science of regenerative medicine, and to continue our development of an exciting future pipeline.”

Humacyte’s bioengineered blood vessel is currently in Phase III pivotal trials in the U.S. and Europe, and the company plans to seek regulatory approval in both regions upon completion of the trials.

Disclaimer

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, risks and uncertainties in research and development and the regulatory approval process; failure to satisfy the conditions to the consummation of the transaction, including the receipt of regulatory approval; regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Without prejudice to its obligations under capital market laws, neither Fresenius Medical Care AG & Co. KGaA nor Humacyte, Inc. undertakes any responsibility to update the forward-looking statements in this release.