Corporate governance covers all aspects connected with the management, supervision and transparency of companies. Key elements of good corporate governance are efficient company management, the protection of shareholders' interests and transparent corporate communication.

The Supervisory Board of Fresenius SE & Co. KGaA and the Management Board of the general partner of Fresenius SE & Co. KGaA, Fresenius Management SE, issued the Declaration of Conformity pursuant to Section 161 of the German Stock Corporation Act in December 2024.

Current Declaration of Conformity

German Corporate Governance Code

Previous Declarations of Conformity

Please find below the 2024 Corporate Governance Declaration and Report of Fresenius SE & Co. KGaA.

The Management Board takes diversity into account when filling executive positions. At Fresenius, the individual’s qualifications are the paramount consideration in all hiring and promotion decisions. This means that women and men with comparable qualifications and suitability have the same career opportunities. Fresenius will continue to consistently act upon this principle – in compliance with the obligations arising from the Act on the Equal Participation of Women and Men in Leadership Positions in the Private Sector and the Public Sector (FüPoG I) and the Act to Supplement and Amend the Regulations for the Equal Participation of Women in Leadership Positions in the Private Sector and the Public Sector (FüPoG II):

For the Supervisory Board of Fresenius SE & Co. KGaA, the law requires a quota of at least 30% women and 30% men. These mandatory quotas were again met by the Supervisory Board elections in 2021.

The legally stipulated targets for the Management Board do not apply to Fresenius Management SE or to Fresenius SE & Co. KGaA. Due to its legal form, Fresenius SE & Co. KGaA does not have a Management Board. Fresenius Management SE is not listed on the stock exchange and is also not subject to co-determination. In accordance with the legal requirements, the Management Board specifies composition of the two management levels directly below the Management Board as follows:

The first management level includes all Senior Vice Presidents and Vice Presidents who have an employment contract with Fresenius SE & Co. KGaA and who report directly to a Member of the Management Board. Through a decision effective January 1, 2021 the Management Board has set a target, which has to be met by December 31, 2025, and calls for a proportion of women of 30.0% at the first management level.

The second management level includes all Vice Presidents who have an employment contract with Fresenius SE & Co. KGaA and who report directly to a member of the first management level. Through the decision effective January 1, 2021, the Management Board has set a target, which has to be met by December 31, 2025, and calls for a proportion of women of 30.0% at the second management level. The Management Board believes that inclusion in the company-wide long-term incentive programs is a strong indicator that an individual holds a leading executive position. The proportion of women in this group of our top 1,800 executives was approximately 34% as of December 31, 2022.

Compensation of the Management Board and Supervisory Board

For a detailed report on the Management and Supervisory Board members’ compensation please refer to the Compensation Report 2024.

For further information regarding the Compensation System 2023+, please refer to the following document:

Stock Option Plans and Employee Participation Program

Our corporate philosophy "entrepreneur in the enterprise" implies not only that our employees are driven by a spirit of entrepreneurial responsibility but that they also have a stake in the company's performance. The overall remuneration package for Group executives and the members of the Management Board has been linked to the performance of the share price through stock option plans.

As of December 31, 2022, Fresenius SE & Co. KGaA had two share-based compensation plans in place: the Fresenius SE & Co. KGaA Long Term Incentive Program 2013 (2013 LTIP) which is based on stock options and phantom stocks and the Long Term Incentive Plan 2018 (LTIP 2018) which is solely based on performance shares. Currently, solely LTIP 2018 can be used to grant performance shares.

In 2023, the new employee participation program Fresenius SHARE was introduced. The program applies equally to all employees of the participating companies - whether collectively agreed or non-pay-scale employees, executives as well as trainees and temporary workers. The program consists of two components: On the one hand, participants can annually purchase a share package with ordinary shares of Fresenius SE & Co. KGaA at a significant discount. Secondly, four targets have been set, upon achievement of which a certain amount will be issued in ordinary shares of Fresenius SE & Co. KGaA. In addition to increasing the Group's net income, the targets include the topics of cybersecurity and quality. The first shares will be issued in 2024, corresponding to the achievement of the targets in the 2023 financial year.

Management Board

Fresenius SE & Co. KGaA does not have an own Management Board. The Management Board of the general partner, Fresenius Management SE, is responsible for conducting the business of the KGaA. It formulates strategy, coordinates this with the Supervisory Board of Fresenius SE & Co. KGaA, and sees to its implementation. It is guided solely by the best interests of Fresenius SE & Co. KGaA.

Supervisory Board of Fresenius SE & Co. KGaA

The Supervisory Board of Fresenius SE & Co. KGaA supervises the management of the Company’s business by the general partner and the latter’s Management Board. The Supervisory Board of Fresenius SE & Co. KGaA has 12 members – 6 shareholder representatives and 6 employee representatives It supervises whether corporate decisions are compliant, suitable, and financially sound. The members of the Management Board of the general partner are appointed by the Supervisory Board of Fresenius Management SE, not by the Supervisory Board of the KGaA.

The Supervisory Board of Fresenius SE & Co. KGaA has the following committees:

- Audit Committee

- Nomination Committee

- Joint Committee

Supervisory Board of Fresenius Management SE

The Supervisory Board of Fresenius Management SE advises and supervises the Management Board in its management of the Company. The Supervisory Board of Fresenius Management SE appoints the members of the Management Board. He consists of six members who are elected by the annual general meeting of Fresenius Management SE Committees.

Current Publications of transactions that are subject to disclosure requirements are listed, together with the information required by law (before July 3, 2016 pursuant to section 15a of the German Securities Trading Act (WpHG); from July 3, 2016 pursuant to Art. 19 of the Market Abuse Regulation).

2025

2024

2023

2022

2021

Transactions reported during the last 12 months are stored on the Federal Financial Supervisory Authority's central database and can be accessed by clicking on the link Bundesanstalt für Finanzdienstleistungsaufsicht (BAFin).

Members of the Management Board of Fresenius Management SE (General Partner):

Michael Sen, 56, became Chairman of the Management Board of Fresenius (equivalent to President and CEO) on October 1, 2022. He joined Fresenius in April 2021 as Chairman of the Management Board of Fresenius Kabi. Before joining Fresenius Kabi, Michael Sen was a member of the Management Board of Siemens AG, where he was responsible for the healthcare business Siemens Healthineers and for Siemens’ energy business. Prior to that, he was Chief Financial Officer of E.ON SE. At the start of his professional career, Michael Sen completed an apprenticeship at Siemens in Berlin and then studied business administration at the Technical University of Berlin.

Pierluigi Antonelli, 56, joined the Management Board of Fresenius in March 2023 with responsibility for Fresenius Kabi. In his previous role since 2019, he was the CEO of Angelini Pharma, a company of the Italian Angelini Group specializing in brain health and consumer health. Prior to that, he held senior leadership positions at Novartis Oncology, Sandoz, Merck & Co. and Bristol Myers Squibb in the United States and across Europe.

Sara Hennicken (44) was appointed CFO of Fresenius as of September 1, 2022. She joined the Group in 2019 as Senior Vice President Global Treasury & Corporate Finance for Fresenius and Fresenius Medical Care. Previously, she spent 14 years in investment banking, including nine years at Deutsche Bank, lastly as Managing Director and Senior Client Executive in Corporate Finance Coverage before moving to Fresenius. Between 2005 and 2010 she worked for Citigroup in Frankfurt and London. Sara Hennicken studied economics in Germany and in the United States.

Robert Möller, 56, joined the Management Board of Fresenius in September 2023 with responsibility for Fresenius Helios. Robert Möller has been CEO of Helios Kliniken GmbH since 2022. He joined Helios in 2014, where he held the position of Clinic Managing Director at Helios Hanseklinikum Stralsund until 2017. After a short time away, he returned to Helios in 2019 and took over the management of various regions. Möller studied human medicine at the University of Hamburg and practiced as a specialist for internal medicine. After various medical positions and a part-time master's degree in health care management, he switched to hospital management while continuing to work as a physician.

Michael Moser (48) joined the Management Board of Fresenius in July 2023. He is responsible for Legal, Compliance, Risk Management, Sustainability, Human Resources, Corporate Audit and Fresenius Vamed. After starting his career at Baker McKenzie, he joined E.ON SE in 2008. During this time, he inter alia became member of the Management Board of the stock listed company ENEVA in Brazil, steered the listing of Uniper and served as Deputy CEO and CFO of Enerjisa, the stock listed leading energy company in Turkey. He has received university degrees in law and business economics in Germany, USA, UK, Switzerland and China.

Contact

Fresenius SE & Co. KGaA

Else-Kröner-Str. 1

61352 Bad Homburg v.d.H.

Germany

board@fresenius.com

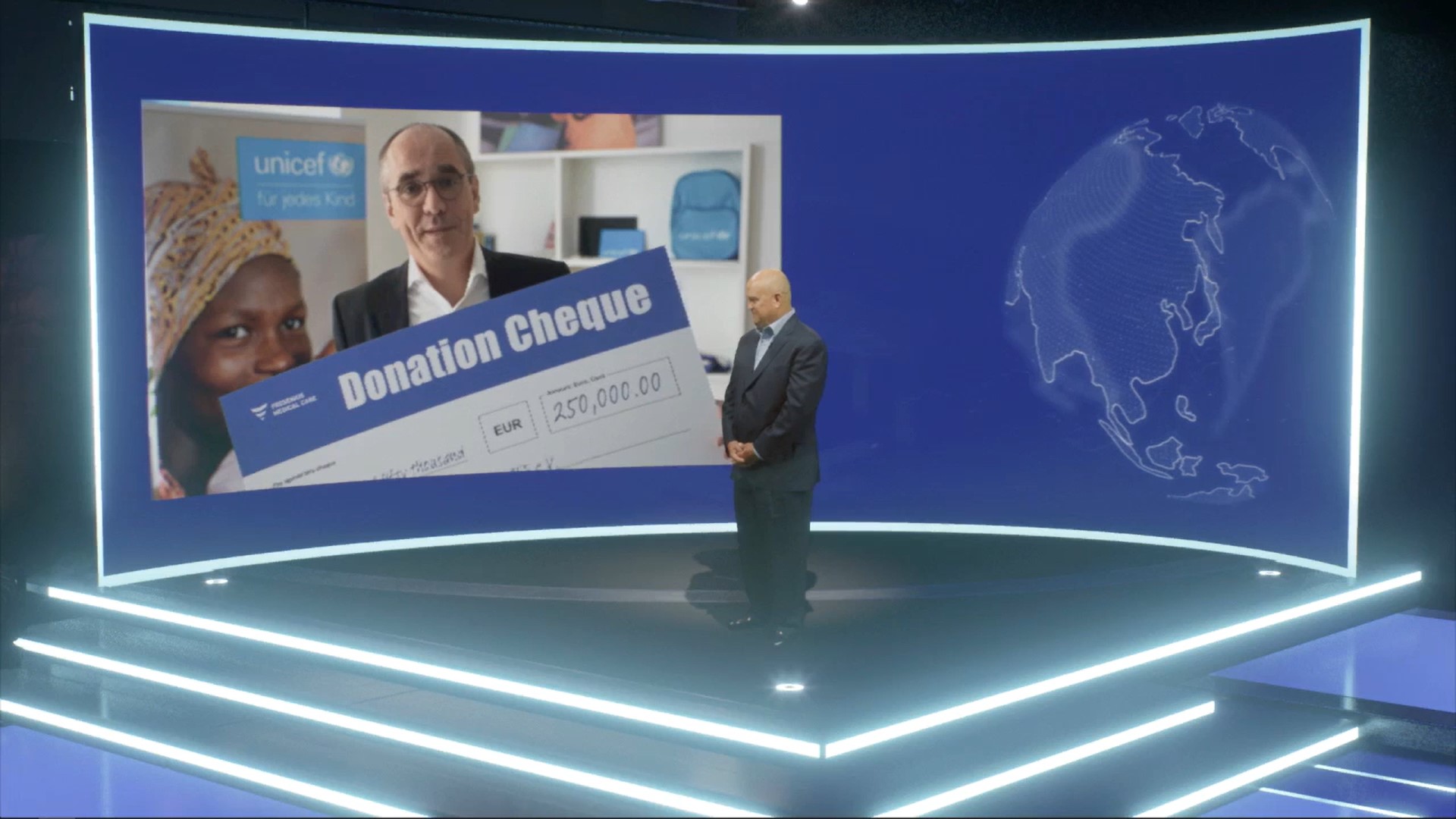

Fresenius Medical Care, the world's leading provider of products and services for individuals with renal diseases, has donated 250,000 euros to UNICEF, the United Nations Children's Fund, to mark the company’s 25th anniversary. UNICEF will use the donation to support the COVAX vaccination initiative to fight the COVID-19 pandemic in about 140 countries. UNICEF delivers COVID-19 vaccines and other equipment around the world. With 250,000 euros UNICEF is able, for example, to protect almost 70,000 teachers or medical personnel from a COVID-19 infection. With every health worker who is protected from the virus the care of numerous children can be ensured. With every vaccinated teacher, more and more children can return to school.

Rice Powell, CEO of Fresenius Medical Care, presented a symbolic check at a virtual ceremony. “As a company in the healthcare branch, we bear a special responsibility to our patients, to our employees and as a member of our society as well,” he said. “In this anniversary year, we must do everything to defeat the global corona pandemic. We are doing this by various means. Our donation to UNICEF is targeted to protect the health of children in less developed and in developing countries. This lives up to our values and our mission for the past 25 years to maintain life and improve the quality of life.”

As the world’s largest single buyer of vaccines, UNICEF has unique experience, gained over many years, in purchasing and delivering goods to children in need. Working on behalf of nearly 100 countries, UNICEF procures more than 2 billion vaccine doses for routine vaccinations and outbreaks of diseases every year. Over the past 20 years, the organization helped provide more than 760 million children with life-saving vaccines.

Christian Schneider, Executive Director of UNICEF Germany said: “The impact of the COVID-19 pandemic threatens children around the world. Their access to health facilities is compromised, many still cannot go to school. Also, violence against children is increasing. The COVAX vaccine initiative plays a decisive role in fighting the pandemic and reducing its consequences, especially in the lower-income regions of the world. The pandemic is not over for anyone until it is over for everyone. To that end, UNICEF provides its unique and longstanding expertise in vaccine procurement and logistics. But we cannot meet this challenge alone. We therefore thank Fresenius Medical Care for their generous support.”

COVAX is a global initiative in which the vaccination alliance Gavi, the World Health Organization (WHO), UNICEF and the Coalition for Epidemic Preparedness Innovations (CEPI) are working together to facilitate the equitable global distribution of COVID-19 vaccines.

From the beginning of the COVID-19 pandemic, Fresenius Medical Care has been intensely engaged on a variety of fronts. In addition to sweeping measures to protect against infection and to ensure continuous operation of our dialysis centers, the company opened its facilities in several countries to allow vaccination of patients and, in some cases, the general public.

Fresenius Medical Care is the world's leading provider of products and services for individuals with renal diseases of which around 3.7 million patients worldwide regularly undergo dialysis treatment. Through its network of more than 4,100 dialysis clinics, Fresenius Medical Care provides dialysis treatments for approximately 346,000 patients around the globe. Fresenius Medical Care is also the leading provider of dialysis products such as dialysis machines or dialyzers. Along with its core business, the Renal Care Continuum, the company focuses on expanding in complementary areas and in the field of critical care. Fresenius Medical Care is listed on the Frankfurt Stock Exchange (FME) and on the New York Stock Exchange (FMS).

For more information visit the Company’s website at www.freseniusmedicalcare.com.

UNICEF is the United Nations Children's Fund. Every child in the world has the right to a childhood – UNICEF is there to make this right a reality. UNICEF was founded in 1946 to help children in devastated Europe after the Second World War. Today, UNICEF works in 190 countries worldwide to ensure that every child can develop healthily, grow up in a protected environment and go to school – regardless of religion, skin colour or origin.

Together with many supporters and partners, UNICEF for example provides every third child worldwide with vaccines, trains teachers, equips schools and advocates for effective child protection laws.

For more information go to: www.unicef.org

Disclaimer:

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to various factors, including, but not limited to, changes in business, economic and competitive conditions, legal changes, regulatory approvals, impacts related to the COVID-19 pandemic results of clinical studies, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Contact

Senior Vice President Investor Relations

Head of Investor Relations

T: +49 (0) 6172 608-97033

nick.stone@fresenius.com

123

MARGINAL CONTENT

Fresenius is a global healthcare company headquartered in Bad Homburg v. d. Höhe, Germany. In fiscal year 2024, Fresenius generated €21.5 billion in annual revenue with around 175,000 employees (excluding Fresenius Medical Care). As a healthcare company focused on therapy, Fresenius offers system-critical products and services for leading therapies for the care of critically and chronically ill patients.

Our Mission

We save and improve human lives with affordable, accessible, and innovative healthcare products and the highest quality in clinical care.

Our Vision

We are the trusted, market-leading healthcare company that unites cutting-edge technology and human care to shape next-level therapies.

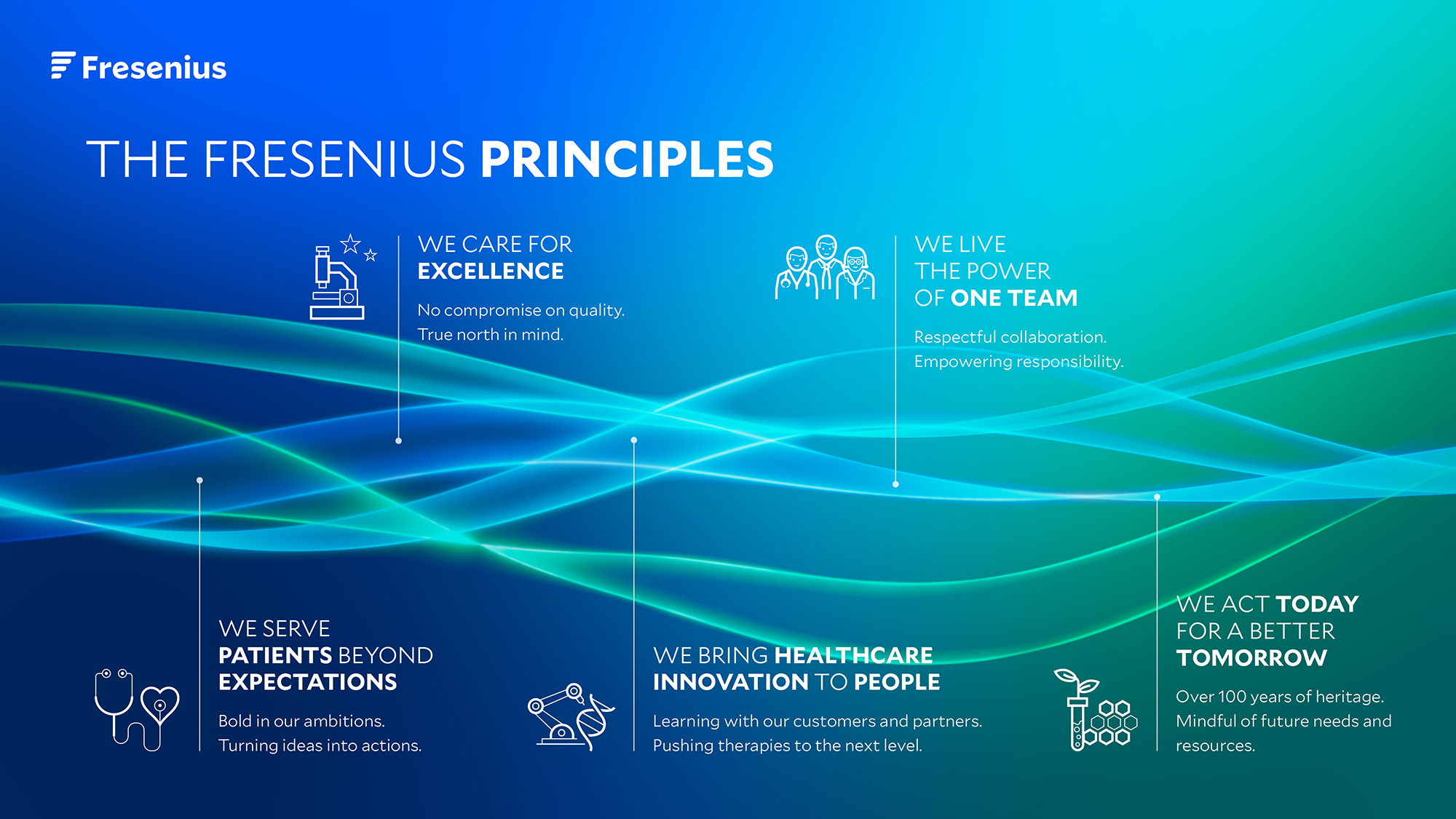

Our Principles form the basis of our company culture. They describe what we stand for and how we operate, collaborate, approach challenges and make decisions.

We serve patients beyond expectations

Bold in our ambitions. Turning ideas into actions.

We care for excellence

No compromise on quality. True north in mind.

We bring healthcare innovation to people

Learning with our customers and partners. Pushing therapies to the next level.

We live the power of One Team

Respectful collaboration. Empowering responsibility.

We act today for a better tomorrow

Over 100 years of heritage. Mindful of future needs and resources.

The Fresenius Group comprises the Operating Companies Fresenius Kabi and Fresenius Helios as well as the Investment Company Fresenius Medical Care.

- Fresenius Kabi supplies healthcare products for critically and chronically ill patients

- Fresenius Helios is Europe’s leading private hospital operator

Fresenius continuously develops its business areas. With the #FutureFresenius program, the focus will be on three therapy platforms:

- (Bio)Pharma including clinical nutrition

- MedTech

- Care Provision

With these platforms, Fresenius caters to major trends in healthcare and becomes a more therapy-focused company. The health and quality of life of patients who the company serves with high-quality, affordable products and services is at the core.

At Fresenius, the patient always comes first. For more than 100 years now we have been working to save lives and improve the quality of life of our critically and chronically ill patients. A clear focus on innovation and efficiency has helped us to make world-class therapies accessible to a steadily increasing number of people. Yet we never get complacent about our successes, and never stop looking for better solutions. This is how Fresenius is contributing to medical progress and better patient care.

Success in our business is the key for investing in high-quality yet affordable healthcare. In this way we are meeting our social responsibility to help patients, while ensuring that Fresenius remains successful over the long term. As a global healthcare group with a diverse workforce, we are committed to an open and pluralistic society. We are convinced that extremism, populism and intolerance threaten the free and democratic basic order, our way of life and our prosperity.

Fresenius leads by recognizing important trends and developments early, then working with our partners to help shape healthcare systems. Aging populations and the expansion of healthcare provision in countries worldwide are driving demand for medical products and services, and Fresenius is excellently positioned for continuous and profitable growth in the future.

"Committed to Life" - We save and improve human lives with affordable, accessible, and innovative healthcare products and the highest quality in clinical care.

Contact

Fresenius SE & Co. KGaA

Else-Kröner-Str. 1

61352 Bad Homburg

Germany

T: +49 6172 608-0

pr-fre@fresenius.com

Fresenius

1462

Opening of the Hirsch Pharmacy

The Hirsch Pharmacy opens in Frankfurt am Main. The Fresenius family assumes ownership in the 19th century.

Fresenius

1912

Founding of the company

The pharmacist Dr. Eduard Fresenius, proprietor of the Hirsch Pharmacy, establishes the pharmaceutical company Dr. E. Fresenius. He expands the pharmacy laboratory into a small manufacturing operation. Its main products are pharmaceutical specialties such as injection solutions, serologic reagents and Bormelin nasal ointment.

Fresenius

1933

Production in Bad Homburg

The manufacturing company is separated from the Hirsch Pharmacy and moves to Bad Homburg, just outside of Frankfurt. Dr. Fresenius devotes more and more time to the company, which grows to around 400 employees.

Fresenius

1946

Founder Eduard Fresenius dies

The unexpected death of Eduard Fresenius endangers the further existence of the pharmacy and manufacturing company, which now has only 40 employees.

Fresenius

1952

Else Kröner takes over

Else Fernau (later Else Kröner (*1925; †1988)), the foster daughter of Eduard Fresenius, assumes responsibility for the pharmacy and company after obtaining her degree in pharmacy studies.

Fresenius

1955

Expansion of infusion solutions

The infusion solutions product range is expanded.

Fresenius

1966

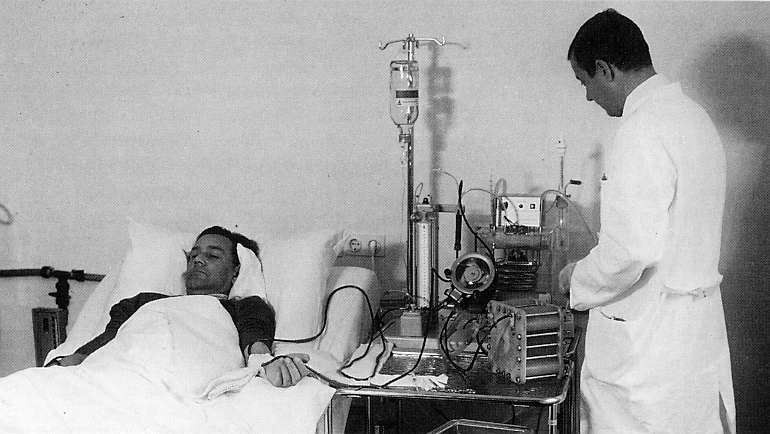

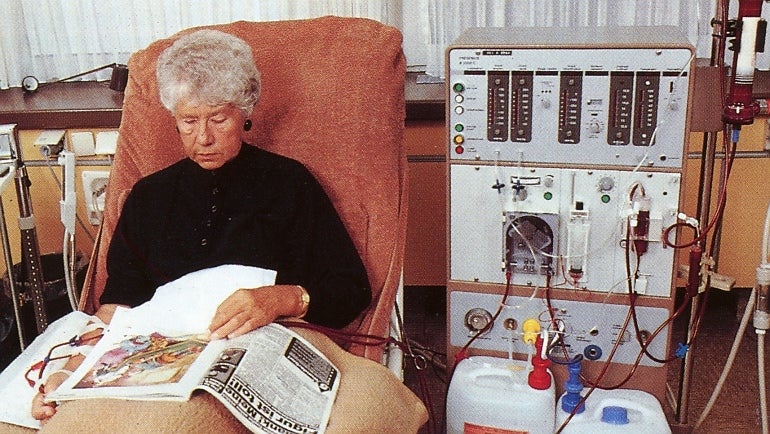

Dialysis machines

Fresenius starts to sell dialysis machines and dialyzers manufactured by various foreign companies and gains substantial market shares.

Fresenius

1974

St. Wendel plant

Fresenius begins manufacturing infusion solutions and medical disposables in St. Wendel, in Germany's Saarland region. Today, Fresenius Medical Care produces highly innovative polysulfone dialyzers in the St. Wendel plant.

Fresenius

1979

Schweinfurt plant

Production of the A2008 dialysis machine begins in a newly acquired factory in Schweinfurt. The machine is awarded a gold medal at the Leipzig Trade Fair that year.

Fresenius

1982

Joint stock company

The company is converted into a joint stock company. The Supervisory Board is headed by Else Kröner.

Fresenius

1983

Polysulfone fiber membrane

Fresenius begins producing synthetic polysulfone fiber membranes for blood purification. These membranes still set the quality standards for dialyzers today.

Fresenius

1986

Stock market flotation

Fresenius launches preference shares on the Frankfurt stock exchange.

Fresenius

1990

Sales surpass one billion marks

Fresenius employs 5,200 people; total sales exceed 1 billion deutsche marks.

Fresenius Vamed

1994

Entry into project business

With the acquisition of Hospitalia International, Fresenius enters the project business for developing hospitals and other healthcare facilities.Two years later, Fresenius acquires a majority stake in the hospital services provider VAMED AG.

Fresenius Medical Care

1996

Founding of Fresenius Medical Care

In 1996, the merger of Fresenius' dialysis business with the U.S. dialysis provider National Medical Care resulted in the creation of Fresenius Medical Care, the world's leading dialysis provider. Its shares are traded on the Frankfurt and New York stock exchanges.

Fresenius

1997

Friedberg plant

Fresenius opens a highly modern production plant for infusion solutions in Friedberg, just north of Frankfurt.

Consolidated sales amount to approximately 7.5 billion deutsche marks.

Fresenius

1998

New headquarters in Bad Homburg

Fresenius moves into new headquarters in Bad Homburg. The company has nearly 39,000 employees worldwide.

Fresenius Kabi

1999

Founding of Fresenius Kabi

After acquiring the international nutrition business of Pharmacia & Upjohn the year before, Fresenius merges it with Fresenius Pharma to form a new company: Fresenius Kabi. Fresenius Kabi becomes the European leader in nutrition and infusion therapy, with subsidiaries and distributors worldwide.

At Fresenius Medical Care, the 100,000th dialysis machine comes off the production line.

Fresenius

2001

Acquisition of Wittgensteiner Kliniken

Fresenius acquires Wittgensteiner Kliniken AG, one of the major nationwide operators of private hospitals in Germany.

Fresenius, a health care group with worldwide operations and over 60,000 employees, achieves sales of around 7.3 billion euros.

Fresenius Medical Care

2003

50 million dialyzers a year

With an output of more than 50 million dialyzers per year, Fresenius Medical Care sets a new record.

Fresenius Helios

2005

Acquisition of Helios

Fresenius acquires Helios, one of the top three private hospital operators in Germany.

Fresenius Medical Care

2006

Acquisition of Renal Care Group

Fresenius Medical Care takes over U.S. dialysis care provider Renal Care Group. Through its network of approximately 2,000 dialysis clinics in North America, Europe, Latin America, Asia-Pacific and Africa, Fresenius Medical Care provides dialysis treatment to approximately 157,000 patients around the globe.

Fresenius

2007

Fresenius becomes a European company

Fresenius is converted into a European company (Societas Europaea, or SE). This allows Fresenius to act as a legal entity anywhere inside the European Union.

Fresenius Kabi

2008

Expansion of I.V. generics

Fresenius Kabi strengthens its business with intravenously administered generic drugs (I.V. generics) and expands into oncology drugs with the acquisition of the Indian company Dabur Pharma.

Fresenius Kabi enters the North American pharmaceuticals market, and becomes a globally leading company in the field of I.V. generics through the acquisition of the U.S.-based APP Pharmaceuticals.

Fresenius

2009

Fresenius joins the DAX

Fresenius SE's preferred shares are admitted into the DAX, which already includes Fresenius Medical Care shares.

Fresenius

2011

Share conversion and change of legal form

Conversion of all preference shares into ordinary shares in combination with a change of the company's legal form into a partnership limited by shares – Kommanditgesellschaft auf Aktien (KGaA). Fresenius SE becomes Fresenius SE & Co. KGaA.

Fresenius

2012

Fresenius turns 100

As Fresenius turns 100, the company is active in some 100 countries and has more than 160,000 employees.

Fresenius Medical Care produces the 500,000th dialysis machine.

Fresenius Medical Care

2013

One billion dialyzers produced

Fresenius Medical Care produces its 1,000,000,000th dialyzer.

Fresenius Helios

2014

Acquisition of 41 Rhön hospitals

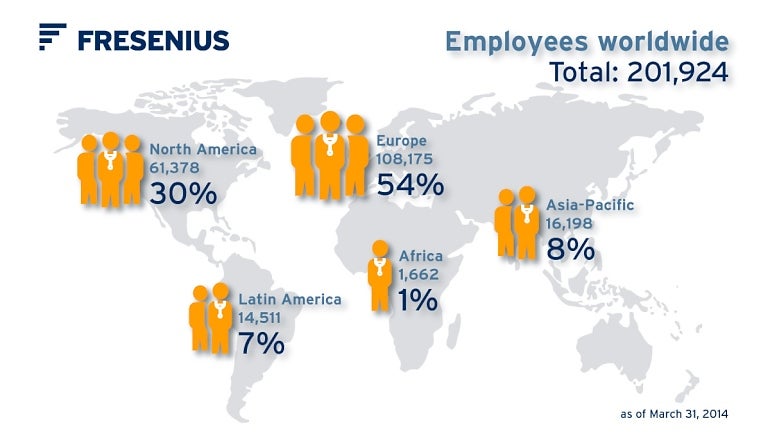

Fresenius Helios completes the acquisition of 41 hospitals and 13 outpatient facilities from Rhön-Klinikum AG. Fresenius Helios now owns 111 hospitals in Germany and is Europe's largest private hospital operator.

Fresenius also passes the milestone of 200,000 employees.

Fresenius Helios

2017

Acquisition of Quirónsalud

Fresenius Helios acquires Quirónsalud, Spain’s largest private hospital operator.

Fresenius Kabi

2019

First Biosimilar

Fresenius Kabi launches its first biosimilar Idacio®. Biosimilars are drugs that are highly similar to other approved biologic drugs.

Fresenius Medical Care acquires NxStage Medical, Inc. NxStage develops, produces and markets an innovative product portfolio of medical devices for use in home dialysis and critical care.

Fresenius

2023

Fresenius with new strategy and clear focus

The Operating Companies Fresenius Kabi and Fresenius Helios are at the center of the Group’s ambitions under #FutureFresenius. They are both geared for significant value creation and catering to system-critical areas of healthcare.

The company deconsolidates Fresenius Medical Care by changing Fresenius Medical Care’s legal form to a German Stock Corporation (“Aktiengesellschaft”).

Video

100 years of Fresenius

Fresenius has been working for over 100 years to improve the lives of seriously ill people around the world. This film, made on the occasion of the company's Centennial in 2012, tells the company's history through the stories of people who have been helped and are still being helped by Fresenius.

Fresenius Medical Care, the world's leading provider of products and services for individuals with renal diseases, announced publication of its 2021 Global Annual Medical Report. Titled “Embracing the Complexity of Global Healthcare,” the report focuses on addressing healthcare complexities by driving meaningful advances in kidney disease care.

“The volume of thought leadership, ideas and expertise in the report demonstrates our company’s continued leadership in kidney care, our innovation through lifelong learning and our commitment to our patient-centered mission,” said Franklin W. Maddux, MD, Global Chief Medical Officer of Fresenius Medical Care.

The 2021 Global Annual Medical Report comprises 25 chapters by more than 40 authors from across the company. Six different sections each focus on a core theme of Fresenius Medical Care’s Clinical & Quality Agenda. An additional COVID-19 section is dedicated to the company’s ongoing efforts to address the pandemic.

The core themes are:

- Cardiovascular Health

- Precision Medicine

- Communication and Medical Education

- Global Research

- Patient-Centered Care

- Innovation and Transformation

The 2021 Global Annual Medical Report is published by the Global Medical Office of Fresenius Medical Care. The full report is now available online at: https://www.freseniusmedicalcare.com/en/about-us/sustainability/medical-responsibility/

Disclaimer:

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to various factors, including, but not limited to, changes in business, economic and competitive conditions, legal changes, regulatory approvals, impacts related to the COVID-19 pandemic results of clinical studies, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.