Fresenius has decided to focus on its four established business segments Fresenius Medical Care, Fresenius Kabi, Fresenius Helios and Fresenius Vamed, which offer significant growth opportunities. The Fresenius Biotech subsidiary will be discontinued.

The company is in talks with several parties about a sale of Fresenius Biotech, while simultaneously assessing the equally viable option of continuing the immunosuppressive drug ATG-Fresenius S within the Fresenius group. ATG-Fresenius S has been well established in the hospital market for decades, and is consistently profitable. Fresenius will divest the trifunctional antibody Removab (catumaxomab) business. The final decision on how to proceed will be made in the first quarter of 2013.

In the first nine months of 2012, Fresenius Biotech's sales increased by 15% to €26 million. ATG-Fresenius S sales grew by 14% to €22.5 million. Removab sales rose by 22% to €3.3 million. Fresenius Biotech's EBIT was -€15 million (Q1-3 2011: -€19 million). For the full year 2012, an EBIT of about -€25 million is expected. Withdrawing from Removab will have a positive effect on Group earnings starting in 2013.

Fresenius Biotech received the only Europe-wide approval to date for a monoclonal antibody developed in Germany when the European Commission approved Removab in 2009 for treating malignant ascites. The company subsequently obtained reimbursement approvals for Removab from the national health care systems of several European countries, providing the opportunity to expand marketing of the drug.

With ATG-Fresenius S, Fresenius Biotech offers a polyclonal antibody that has been used since 1981, for both organ and stem-cell transplantation.

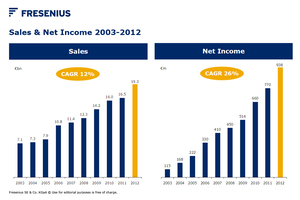

Fresenius will focus on the attractive growth opportunities of its four core business segments, which have grown strongly over the last years and offer outstanding prospects. Between 2001 and 2011, Group sales increased from €7.3 billion to €16.5 billion, and Group net income from €93 million to €770 million. For the full year 2012, Fresenius expects sales1 of more than €19 billion, corresponding to an increase of 12% to 14% in constant currency. Net income2 is forecast to exceed €900 million, an increase of 14% to 16% in constant currency.

1 Previous year's sales were adjusted according to a U.S. GAAP accounting change. The sales adjustment of -€119 million in the first three quarters of 2011 and of -€161 million for the full year 2011 solely relates to Fresenius Medical Care North America.

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA – adjusted for a non-taxable investment gain (€34 million) and potential special charges (up to €17 million) at Fresenius Medical Care as well as for one-time costs (€31 million) related to the offer to the shareholders of RHÖN-KLINIKUM AG. 2011 adjusted for the effects of mark-to-market accounting of the Mandatory Exchangeable Bonds and the Contingent Value Rights.

# # #

About malignant ascites

Malignant ascites can be caused by various kinds of tumors. The peritoneal spread of tumor cells leads to an accumulation of fluid in the peritoneal cavity and is associated with an unfavorable prognosis for the patient. The most common method of treatment is paracentesis, which generally must be repeated at intervals of one to two weeks and can lead to complications such as infections or elevated losses of fluids and proteins. Removab® destroys the peritoneal cancer cells and thus directly attacks the cause of malignant ascites.

Fresenius is a health care group with international operations, providing products and services for dialysis, hospital and outpatient medical care. In 2011, Group sales were €16.5 billion. On September 30, 2012, the Fresenius Group had 163,463 employees worldwide.

For more information visit the Company's website at www.fresenius.com.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius SE & Co. KGaA

Registered Office: Bad Homburg, Germany

Commercial Register: Amtsgericht Bad Homburg, HRB 11852

Chairman of the Supervisory Board: Dr. Gerd Krick

General Partner: Fresenius Management SE

Registered Office: Bad Homburg, Germany

Commercial Register: Amtsgericht Bad Homburg, HRB 11673

Management Board: Dr. Ulf M. Schneider (Chairman), Rainer Baule, Dr. Francesco De Meo,

Dr. Jürgen Götz, Dr. Ben Lipps, Stephan Sturm, Dr. Ernst Wastler

Chairman of the Supervisory Board: Dr. Gerd Krick

Fresenius Kabi has successfully closed the acquisition of Fenwal Holdings, Inc., a leading U.S.-based provider of transfusion technology products for blood collection, separation and processing. The Fenwal acquisition was announced on July 20, 2012, and the closing now follows completion of the review by the antitrust authorities. Fenwal will be consolidated as of December 1, 2012.

For the fiscal year 2011, Fenwal reported sales of US$614 million and an adjusted EBITDA of US$90 million.

Fresenius expects one-time integration costs of approx. €100 million. Cost synergies should reach approx. €60 million annually in the medium term.

Fresenius Kabi fully confirms its 2015 outlook, which was raised on August 1, 2012. The company expects sales of approx. €6 billion and EBIT of >€1.1 billion at current exchange rates. Previously, Fresenius Kabi had targeted sales of approx. €5.5 billion and EBIT of >€1 billion.

Fresenius is a health care group with international operations, providing products and services for dialysis, hospital and outpatient medical care. In 2011, Group sales were €16.5 billion. On September 30, 2012, the Fresenius Group had 163,463 employees worldwide.

For more information visit the Company's website at www.fresenius.com.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius SE & Co. KGaA

Registered Office: Bad Homburg, Germany

Commercial Register: Amtsgericht Bad Homburg, HRB 11852

Chairman of the Supervisory Board: Dr. Gerd Krick

General Partner: Fresenius Management SE

Registered Office: Bad Homburg, Germany

Commercial Register: Amtsgericht Bad Homburg, HRB 11673

Management Board: Dr. Ulf M. Schneider (Chairman), Rainer Baule, Dr. Francesco De Meo,

Dr. Jürgen Götz, Dr. Ben Lipps, Stephan Sturm, Dr. Ernst Wastler

Chairman of the Supervisory Board: Dr. Gerd Krick

Fresenius Kabi has signed an agreement to sell its subsidiary Calea France SAS to The Linde Group. Calea is active in the French homecare market and focuses on respiratory therapy, which is not a core business of Fresenius Kabi.

Ulf Mark Schneider, CEO of Fresenus, said: "Calea is a successful business and will be a great fit in a global respiratory homecare organization. The divestiture underlines our strong commitment to focused growth in our four core business segments, where prospects for further expansion are bright."

In 2011, Calea France had sales of €28 million. The transaction is expected to be completed at the start of 2013.

Fresenius is a health care group with international operations, providing products and services for dialysis, hospital and outpatient medical care. In 2011, Group sales were €16.5 billion. On September 30, 2012, the Fresenius Group had 163,463 employees worldwide.

For more information visit the company's website at www.fresenius.com.

Fresenius Kabi is focused on the therapy and care of critically and chronically ill patients inside and outside the hospital. Its portfolio comprises a wide range of IV drugs, infusion therapies, clinical nutrition products as well as the related medical devices. With a corporate philosophy of "caring for life," the company's goal is to improve the patient's quality of life. In 2011, Fresenius Kabi's sales were €3,964 million and the company's EBIT was €803 million. Fresenius Kabi has 25,521 employees worldwide (September 30, 2012).

Fresenius Kabi AG is a 100% subsidiary of the health care group Fresenius SE & Co. KGaA.

For more information visit the company's website at www.fresenius-kabi.com.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius SE & Co. KGaA

Registered Office: Bad Homburg, Germany

Commercial Register: Amtsgericht Bad Homburg, HRB 11852

Chairman of the Supervisory Board: Dr. Gerd Krick

General Partner: Fresenius Management SE

Registered Office: Bad Homburg, Germany

Commercial Register: Amtsgericht Bad Homburg, HRB 11673

Management Board: Dr. Ulf M. Schneider (Chairman), Rainer Baule, Dr. Francesco De Meo, Dr. Jürgen Götz, Dr. Ben Lipps, Stephan Sturm, Dr. Ernst Wastler

Chairman of the Supervisory Board: Dr. Gerd Krick

Fresenius successfully agreed the refinancing of the revolving facilities and Term Loan A of its 2008 syndicated credit agreement. The financing, structured as a Delayed Draw Syndicated Credit Agreement, was very well received in the bank market and substantially oversubscribed. Fresenius was therefore able to significantly increase the originally targeted transaction volume and to improve the pricing.

The company entered into a €2.25 billion syndicated credit agreement, comprised of 5-year revolving facilities (US$300 million and €600 million) and a 5-year Term Loan A (US$1.0 billion and €650 million).

Proceeds will be used to refinance the company's existing revolving facilities and Term Loan A, both maturing in September 2013, as well as for general corporate purposes. The refinancing through a Delayed Draw Syndicated Credit Agreement allows Fresenius to take advantage of the currently favorable financing conditions in the bank market. Funding of the transaction is projected for June 2013.

Going forward, the refinancing of the credit agreement will considerably reduce Group interest expenses.

Fresenius is a health care group with international operations, providing products and services for dialysis, hospital and outpatient medical care. In 2011, Group sales were €16.5 billion. On September 30, 2012, the Fresenius Group had 163,463 employees worldwide.

For more information visit the Company's website at www.fresenius.com.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius SE & Co. KGaA

Registered Office: Bad Homburg, Germany

Commercial Register: Amtsgericht Bad Homburg, HRB 11852

Chairman of the Supervisory Board: Dr. Gerd Krick

General Partner: Fresenius Management SE

Registered Office: Bad Homburg, Germany

Commercial Register: Amtsgericht Bad Homburg, HRB 11673

Management Board: Dr. Ulf M. Schneider (Chairman), Rainer Baule, Dr. Francesco De Meo, Dr. Jürgen Götz, Dr. Ben Lipps, Stephan Sturm, Dr. Ernst Wastler

Chairman of the Supervisory Board: Dr. Gerd Krick

Fresenius Medical Care AG & Co. KGaA, the world's largest provider of dialysis products and services, announced today that the United States government's litigation against its United States subsidiary (the "company") in connection with "Method II" Medicare reimbursement has successfully concluded with the Department of Justice's filing yesterday of a stipulation of dismissal. The end of this litigation also concludes the broader investigation begun by the government in St. Louis, Missouri in 2005.

The Department of Justice investigated many areas of the company's operations under subpoenas issued in St. Louis beginning in April 2005. In July 2007, after two years of investigation, the Department initiated litigation on a single topic of the investigation: that Renal Care Group, which the company had acquired by merger, violated the False Claims Act by maintaining a "Method II" subsidiary.

In 2011, a federal trial court in Tennessee entered judgment against the company for $83 million. In October 2012, however, the United States Court of Appeals reversed and vacated the judgment. The Court of Appeals further ruled against the Department of Justice on several significant issues of law raised by the case, agreeing with the company that it was not unlawful for Renal Care Group to maintain a subsidiary that billed under Method II. The Court of Appeals then remanded the case to the trial court to allow the Department to proceed to trial on remaining, unresolved issues. By its filing yesterday, the Department confirmed that it would not pursue the remand and would litigate no further.

Ben Lipps, chief executive officer of Fresenius Medical Care, commented: "We are pleased to have this lengthy litigation successfully concluded."

Fresenius Medical Care is the world's largest integrated provider of products and services for individuals undergoing dialysis because of chronic kidney failure, a condition that affects more than 2.1 million individuals worldwide. Through its network of 3,135 dialysis clinics in North America, Europe, Latin America, Asia-Pacific and Africa, Fresenius Medical Care provides dialysis treatment to 256,521 patients around the globe. Fresenius Medical Care is also the world's leading provider of dialysis products such as hemodialysis machines, dialyzers and related disposable products.

For more information about Fresenius Medical Care, visit the Company's website at www.fmc-ag.com.

Disclaimer

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius will exercise the call option for its 5.5% Senior Notes due 2016 (ISIN: XS0240919372, WKN: A0GMAY). The aggregate principal amount of €650 million will be redeemed on February 7, 2013 at a price of 100.916% plus accrued and unpaid interest.

The redemption will be financed initially by utilizing existing credit lines, and from the end of June by drawings under the Senior Secured Credit Agreement arranged in December 2012. At current rates, this will result in annual interest savings of approximately €20 million. For 2013, these savings will be partially offset by one-time expenses of around €14 million in connection with the early redemption.

Fresenius is a health care group with international operations, providing products and services for dialysis, hospital and outpatient medical care. In 2011, Group sales were €16.5 billion. On September 30, 2012, the Fresenius Group had 163,463 employees worldwide.

For more information visit the Company's website at www.fresenius.com.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

This announcement does not contain or constitute an offer of, or the solicitation of an offer to buy or subscribe for, securities to any person in the United States of America (the "United States") or in any jurisdiction to whom or in which such offer or solicitation is unlawful. The securities referred to herein may not be offered or sold in the United States absent registration under the U.S. Securities Act of 1933, as amended (the "Securities Act") except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. The offer and sale of the securities referred to herein has not been and will not be registered under the Securities Act. There will be no public offer of the securities in the United States.

Fresenius SE & Co. KGaA

Registered Office: Bad Homburg, Germany

Commercial Register: Amtsgericht Bad Homburg, HRB 11852

Chairman of the Supervisory Board: Dr. Gerd Krick

General Partner: Fresenius Management SE

Registered Office: Bad Homburg, Germany

Commercial Register: Amtsgericht Bad Homburg, HRB 11673

Management Board: Dr. Ulf M. Schneider (Chairman), Dr. Francesco De Meo, Dr. Jürgen Götz,

Mats Henriksson, Rice Powell, Stephan Sturm, Dr. Ernst Wastler

Chairman of the Supervisory Board: Dr. Gerd Krick

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES OF AMERICA, AUSTRALIA, CANADA OR JAPAN.

Fresenius intends to issue €500 million of senior unsecured notes with a maturity of 7 years.

The proceeds will be used to refinance the €500 million 5.0% senior notes due January 2013 (ISIN: XS0240918218, WKN: A0GMAX). Given the currently favorable market conditions, Fresenius expects to reduce its interest expense as a result of the refinancing.

Fresenius Finance B.V., a wholly owned subsidiary of Fresenius SE & Co. KGaA, will issue and offer the senior notes through a private placement to institutional investors.

Fresenius has applied to the Luxembourg Stock Exchange to admit the senior notes to trading on its regulated market.

Fresenius is a health care group with international operations, providing products and services for dialysis, hospital and outpatient medical care. In 2011, Group sales were €16.5 billion. On September 30, 2012, the Fresenius Group had 163,463 employees worldwide.

For more information visit the Company's website at www.fresenius.com.

This announcement does not contain or constitute an offer of, or the solicitation of an offer to buy or subscribe for, securities to any person in Australia, Canada, Japan, or the United States of America (the "United States") or in any jurisdiction to whom or in which such offer or solicitation is unlawful. The securities referred to herein may not be offered or sold in the United States or to, or for the account or benefit of, U.S. persons, absent registration under the U.S. Securities Act of 1933, as amended (the "Securities Act") except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. Subject to certain exceptions, the securities referred to herein may not be offered or sold in Australia, Canada or Japan or to, or for the account or benefit of, any national, resident or citizen of Australia, Canada or Japan. The offer and sale of the securities referred to herein has not been and will not be registered under the Securities Act or under the applicable securities laws of Australia, Canada or Japan. There will be no public offer of the securities in the United States.

This announcement is an advertisement and not a prospectus. Investors should not purchase or subscribe for any securities referred to in this announcement except on the basis of information in the prospectus to be issued by the company in connection with the offering of such securities. Copies of the prospectus will, following publication, be available free of charge from Fresenius SE & Co. KGaA at Else-Kröner Strasse 1, 61352 Bad Homburg, Germany.

This announcement is directed at and/or for distribution in the United Kingdom only to (i) persons who have professional experience in matters relating to investments falling within article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the "Order") or (ii) high net worth entities falling within article 49(2)(a) to (d) of the Order (all such persons are referred to herein as "relevant persons"). This announcement is directed only at relevant persons. Any person who is not a relevant person should not act or rely on this announcement or any of its contents. Any investment or investment activity to which this announcement relates is available only to relevant persons and will be engaged in only with relevant persons.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius SE & Co. KGaA

Registered Office: Bad Homburg, Germany

Commercial Register: Amtsgericht Bad Homburg, HRB 11852

Chairman of the Supervisory Board: Dr. Gerd Krick

General Partner: Fresenius Management SE

Registered Office: Bad Homburg, Germany

Commercial Register: Amtsgericht Bad Homburg, HRB 11673

Management Board: Dr. Ulf M. Schneider (Chairman), Dr. Francesco De Meo, Dr. Jürgen Götz, Mats Henriksson, Rice Powell, Stephan Sturm, Dr. Ernst Wastler

Chairman of the Supervisory Board: Dr. Gerd Krick

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES OF AMERICA, AUSTRALIA, CANADA OR JAPAN.

Fresenius successfully placed €500 million of senior unsecured notes. The notes have a coupon of 2.875%, a maturity of seven years and were issued at par. The proceeds will be used to refinance the €500 million senior notes due January 2013. The offering was extremely well received by investors and substantially oversubscribed.

Fresenius Finance B.V, a wholly owned subsidiary of Fresenius SE & Co. KGaA, issued and offered the senior notes through a private placement to institutional investors. Fresenius has applied to the Luxembourg Stock Exchange to admit the senior notes to trading on its regulated market.

Fresenius is a health care group with international operations, providing products and services for dialysis, hospital and outpatient medical care. In 2011, Group sales were €16.5 billion. On September 30, 2012, the Fresenius Group had 163,463 employees worldwide.

For more information visit the Company's website at www.fresenius.com.

This announcement does not contain or constitute an offer of, or the solicitation of an offer to buy or subscribe for, securities to any person in Australia, Canada, Japan, or the United States of America (the "United States") or in any jurisdiction to whom or in which such offer or solicitation is unlawful. The securities referred to herein may not be offered or sold in the United States or to, or for the account or benefit of, U.S. persons, absent registration under the U.S. Securities Act of 1933, as amended (the "Securities Act") except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. Subject to certain exceptions, the securities referred to herein may not be offered or sold in Australia, Canada or Japan or to, or for the account or benefit of, any national, resident or citizen of Australia, Canada or Japan. The offer and sale of the securities referred to herein has not been and will not be registered under the Securities Act or under the applicable securities laws of Australia, Canada or Japan. There will be no public offer of the securities in the United States.

This announcement is an advertisement and not a prospectus. Investors should not purchase or subscribe for any securities referred to in this announcement except on the basis of information in the prospectus to be issued by the company in connection with the offering of such securities. Copies of the prospectus will, following publication, be available free of charge from Fresenius SE & Co. KGaA at Else-Kröner Strasse 1, 61352 Bad Homburg, Germany.

This announcement is directed at and/or for distribution in the United Kingdom only to (i) persons who have professional experience in matters relating to investments falling within article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the "Order") or (ii) high net worth entities falling within article 49(2)(a) to (d) of the Order (all such persons are referred to herein as "relevant persons"). This announcement is directed only at relevant persons. Any person who is not a relevant person should not act or rely on this announcement or any of its contents. Any investment or investment activity to which this announcement relates is available only to relevant persons and will be engaged in only with relevant persons.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius SE & Co. KGaA

Registered Office: Bad Homburg, Germany

Commercial Register: Amtsgericht Bad Homburg, HRB 11852

Chairman of the Supervisory Board: Dr. Gerd Krick

General Partner: Fresenius Management SE

Registered Office: Bad Homburg, Germany

Commercial Register: Amtsgericht Bad Homburg, HRB 11673

Management Board: Dr. Ulf M. Schneider (Chairman), Dr. Francesco De Meo, Dr. Jürgen Götz, Mats Henriksson, Rice Powell, Stephan Sturm, Dr. Ernst Wastler

Chairman of the Supervisory Board: Dr. Gerd Krick

Full Year 2012 Summary:

Reported

Net Revenue: $13,800 million, +10%

Operating income (EBIT): $2,219 million, +7%

Net income*: $1,187 million, +11%

Earnings per ordinary share: $3.89, +10%

Adjusted**

Operating income (EBIT): $2,329 million, +12%

Net income*: $1,118 million, +4%

Earnings per ordinary share: $3.66, +4%

Dividend proposal

Ordinary Share: €0.75, +9%

Preference Share: €0.77, +8%

*Attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

** Fresenius Medical Care´s net income guidance for 2012 was based on adjusted numbers. For further details see PDF-File.

Fourth Quarter of 2012

Revenue

Net revenue for the fourth quarter of 2012 increased by 13% to $3,706 million (+14% at constant currency) compared to the fourth quarter of 2011. Organic revenue growth worldwide was 8%. Dialysis services revenue grew by 18% to $2,804 million (+19% at constant currency) and dialysis product revenue increased by 2% to $902 million and increased by 4% at constant currency.

North America revenue for the fourth quarter of 2012 increased by 19% to $2,429 million. Dialysis services revenue grew by 22% to $2,222 million with a same store growth of 4%. Average revenue per treatment for U.S. services increased to $368 in the fourth quarter of 2012 compared to $351 for the corresponding quarter in 2011. Dialysis product revenue decreased by 3% to $207 million.

International revenue increased by 4% to $1,270 million and increased by 6% at constant currency. Organic revenue growth was 6%. Dialysis services revenue increased by 5% to $582 million and increased by 8% at constant currency. Dialysis product revenue increased by 3% to $688 million and increased by 5% at constant currency.

Earnings

Operating income (EBIT) for the fourth quarter of 2012 decreased by 5% to $559 million compared to $587 million in the fourth quarter of 2011. The operating income includes charges in the amount of $110 million related to the amendment of the agreement for our iron product Venofer in North America and a donation to the American Society of Nephrology. Excluding those charges the operating income for the fourth quarter increased by 14% to $ 669 million, translating into an operating margin of 18.1% for the fourth quarter of 2012 as compared to 18.0% for the corresponding quarter in 2011.

Excluding the above mentioned charges, the operating margin for North America increased from 19.6% to 21.2%. Average costs per treatment for U.S. services increased to $286 in the fourth quarter of 2012 as compared to $279 in the fourth quarter of 2011. In the International segment, the operating margin decreased from 18.7% to 16.7%.

Net interest expense for the fourth quarter of 2012 was $115 million, compared to $82 million in the fourth quarter of 2011. This development was mainly attributable to the higher level of indebtedness as a result of the issuance of various tranches of senior notes over the course of 2011 and 2012 to finance dialysis clinic acquisitions.

Income tax expense was $143 million for the fourth quarter of 2012 compared to $165 million in the fourth quarter of 2011, reflecting effective tax rates of 32.1% and 32.7%, respectively.

Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA for the fourth quarter of 2012 was $257 million, a decrease of 17% compared to the corresponding quarter of 2011. Excluding after tax charges in the amount of $71 million related to the amendment of the agreement for Venofer and a donation to the American Society of Nephrology, net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA for the fourth quarter was $327 million, an increase of 5%.

Earnings per ordinary share (EPS) for the fourth quarter of 2012 was $0.84 compared to $1.02 for the fourth quarter of 2011. The weighted average number of shares outstanding for the fourth quarter of 2012 was approximately 306.4 million shares, compared to 303.9 million shares for the fourth quarter of 2011. The increase in shares outstanding resulted from stock option exercises in the past 12 months. Excluding the above mentioned charges earnings per ordinary share for the fourth quarter 2012 was $1.07.

Cash flow

In the fourth quarter of 2012, the company generated $572 million in cash from operations, an increase of 15% compared to the corresponding figure last year and representing 15.4% of revenue. The cash flow generation was mainly supported by the favorable development of working capital items.

A total of $227 million was spent for capital expenditures, net of disposals. Free cash flow before acquisitions was $345 million (representing 9.3% of revenue) compared to $306 million in the fourth quarter of 2011. A total of $59 million in cash was spent for acquisitions and investments, net of divestitures. Free cash flow after acquisitions and divestitures was $286 million, compared to minus $298 million in the fourth quarter of 2011.

Full Year 2012

Revenue and Earnings

Net revenue for the full year 2012 increased by 10% to $13,800 million (+12% at constant currency) compared to the full year 2011. Organic revenue growth worldwide was 5%.

Operating income (EBIT) for the full year 2012 increased by 7% to $2,219 million compared to $2,075 million for the full year 2011. The operating income includes charges in the amount of $110 million related to the amendment of the agreement for Venofer and a donation to the American Society of Nephrology. Excluding those charges the operating income for the full year 2012 increased by 12% to $2,329 million, translating into an operating margin of 16.9% as compared to 16.5% for the full year 2011.

Net interest expense for the full year 2012 was $426 million compared to $297 million in the same period of 2011.

For the full year 2012, net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA increased by 11% to $1,187 million. This includes a non-taxable investment gain of $140 million related to the acquisition of Liberty Dialysis Holdings, Inc., including its 51% stake in Renal Advantage Partners, LLC (RAI). The gain is a result of measuring the 49% equity interest in RAI held by the company at its fair value at the time of the Liberty acquisition. It also includes after tax charges in the amount of $71 million related to the amendment of the agreement for Venofer and a donation to the American Society of Nephrology. Excluding the investment gain and the before mentioned charges net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA was $1,118 million, an increase of 4% compared to 2011.

Income tax expense for the full year 2012 was $605 million compared to $601 million in the same period in 2011, reflecting effective tax rates of 31.3% and 33.8%, respectively.

In the full year 2012, earnings per ordinary share rose by 10% to $3.89. The weighted average number of shares outstanding during the full year 2012 was approximately 305.1 million compared to 303.0 million shares for the full year 2011. Excluding the investment gain and the above mentioned charges earnings per ordinary share was $3.66.

Cash Flow

For the full year 2012, the company generated $2,039 million in cash from operations, an increase of 41% compared to the corresponding figure last year and representing 14.8% of revenue.

A total of $666 million in cash was spent for capital expenditures, net of disposals. Free cash flow before acquisitions for the full year 2012 was $1,373 million compared to $876 million in the same period in 2011. A total of $1,615 million in cash was spent for acquisitions, net of divestitures. Free cash flow after acquisitions and divestitures was minus $242 million compared to minus $899 million in the last year.

Please refer to the PDF-File for a complete overview on the fourth quarter and the full year 2012.

Patients – Clinics – Treatments

As of December 31, 2012, Fresenius Medical Care treated 257,916 patients worldwide, which represents an increase of 11% compared to the previous year's figure. North America provided dialysis treatments for 164,554 patients, an increase of 16%. Including 32 clinics managed by Fresenius Medical Care North America, the number of patients in North America was 166,920. The International segment provided dialysis treatment to 93,362 patients, an increase of 3% over the prior year's figure.

As of December 31, 2012, the company operated a total of 3,160 clinics worldwide, which represents an increase of 9% compared to the previous year's figure. The number of clinics is comprised of 2,082 clinics in North America (2,114 including managed clinics), and 1,078 clinics in the International segment, representing an increase of 13% and 2%, respectively.

During the full year 2012, Fresenius Medical Care delivered approximately 38.6 million dialysis treatments worldwide. This represents an increase of 12% compared to the previous year's figure. North America accounted for 24.4 million treatments, an increase of 13%. The International segment delivered 14.2 million treatments, an increase of 11%.

Employees

As of December 31, 2012, Fresenius Medical Care had 86,153 employees (full-time equivalents) worldwide, compared to 79,159 employees at the end of 2011. This increase of approximately 7,000 employees is due to overall growth in the company's business and acquisitions including Liberty Dialysis Holdings, Inc.

Dividend

The company intends to continue its earnings-driven policy. At the Annual General Meeting to be held on May 16, 2013, shareholders will be asked to approve a dividend of €0.75 per ordinary share, an increase of 9% from 2011 (€0.69). For the 16th consecutive year, shareholders can expect to receive an increased annual dividend.

Debt/EBITDA ratio

The ratio of debt to earnings before interest, taxes, depreciation and amortization (EBITDA) increased from 2.69 at the end of 2011 to 2.83 at the end of 2012. The debt/EBITDA ratio at the end of the third quarter 2012 was 2.81.

Rating

Both Standard & Poor's and Fitch rate the company's corporate credit as ‘BB+' with a ‘stable' outlook. Moody's rates the company's corporate credit as ‘Ba1' with a ‘stable' outlook. For further information on Fresenius Medical Care's credit ratings and credit instruments, please visit our website at www.fmc-ag.com / Investor Relations/ Credit Relations.

Outlook for 2013

For the year 2013 the company expects revenue to grow to more than $14.6 billion. Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA is expected to be between $1.1 billion and $1.2 billion. For 2013, the company expects to spend around $700 million on capital expenditures and around $300 million on acquisitions. The debt/EBITDA ratio is expected to be equal or below 3.0 by the end of 2013.

Targets for 2013 (in US$ million)

2012 Goal 2013 Growth rate

Revenue 13,800 > 14,600 > 6%

Operating income (EBIT) 2,219 2,300 – 2,500 4% - 13%

Net income (comparable basis)* 1,047 1,100 – 1,200 5% - 15%

*excluding investment gain

Rice Powell, chief executive officer of Fresenius Medical Care, commented: "Fresenius Medical Care looks back on another successful year. We once again achieved new records both in terms of revenue and earnings despite challenging global conditions. We were able to sustain our growth path but more importantly we made very good progress with our quality initiatives in both products and services. Quality and growth remain our top priorities in the future. With our strong management team and dedicated employees, Fresenius Medical Care remains very well positioned for great success in 2013 and beyond."

Press Conference

Fresenius Medical Care will hold a press conference at its headquarters in Bad Homburg, Germany to discuss the results of the fourth quarter and full year of 2012 on Tuesday, February 26, 2013, at 10 am CET. The Company cordially invites journalists to view the live video webcast at "News and Press / Video service". A replay will be available shortly after the meeting.

Fresenius Medical Care is the world's largest integrated provider of products and services for individuals undergoing dialysis because of chronic kidney failure, a condition that affects more than 2.2 million individuals worldwide. Through its network of 3,160 dialysis clinics in North America, Europe, Latin America, Asia-Pacific and Africa, Fresenius Medical Care provides dialysis treatment to 257,916 patients around the globe. Fresenius Medical Care is also the world's leading provider of dialysis products such as hemodialysis machines, dialyzers and related disposable products.

For more information about Fresenius Medical Care, visit the company's website at www.fmc-ag.com.

Disclaimer

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Fiscal year 2012:

- Sales*: €19.3 billion (+18% at actual rates, +13% in constant currency)

- EBIT**: €3.1 billion (+20% at actual rates, +14% in constant currency)

- Net income***: €938 million (+22% at actual rates, +17% in constant currency)

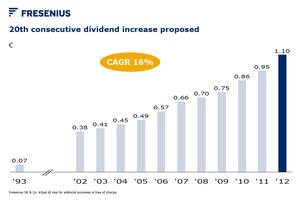

- 16% dividend increase to €1.10 per share proposed

Positive Group outlook for 2013:

- Sales growth of 7% to 10% in constant currency

- Net income**** growth of 7% to 12% in constant currency

- Fresenius expects to reach 2014 Group net income target of more than €1 billion one year ahead of plan****.

*2011 sales were adjusted according to a U.S. GAAP accounting change. The sales adjustment of -€161 million solely relates to Fresenius Medical Care North America.

**2012 adjusted for one-time costs of €6 million (non-financing expenses) related to the offer to RHÖN-KLINIKUM AG shareholders and other one-time costs of €86 million at Fresenius Medical Care.

***Net income attributable to shareholders of Fresenius SE & Co. KGaA – adjusted for a non-taxable investment gain of €34 million and other one-time costs of €17 million at Fresenius Medical Care and for one-time costs of €29 million related to the offer to RHÖN-KLINIKUM AG shareholders. 2011 adjusted for the effects of mark-to-market accounting of the Mandatory Exchangeable Bonds and the Contingent Value Rights.

****Net income attributable to shareholders of Fresenius SE & Co. KGaA; 2013 adjusted for one-time integration costs of Fenwal, Inc. (~€ 50 million pre tax); 2012 adjusted as per footnote ***

Ulf Mark Schneider, CEO of Fresenius, said: "Fresenius has a proven track record of dynamic growth, with an eightfold increase in net income over the last decade. In its centennial year, our growth story continued with new records for sales and earnings. We saw strong organic growth, double-digit earnings increases and significant acquisitions in all our business segments. The pursuit of medical progress with affordable high-quality products and services and helping seriously ill people is at the heart of everything we do. We will continue to pursue this goal as we enter our second century with confidence and commitment."

New Dividend Policy

The Management Board will propose to the Supervisory Board a dividend of €1.10 per share (2011: €0.95). The total dividend distribution is expected to be €196 million. This marks our 20th consecutive dividend increase.

The 16% increase reflects our new dividend policy, which aligns dividend with earnings per share growth (before special items) and broadly maintains a pay-out ratio of 20% to 25%.

Positive Group outlook 2013

For 2013, Fresenius projects sales growth of 7% to 10% in constant currency. Net income* is expected to increase by 7% to 12% in constant currency.

The Group plans to invest ~5% of sales in property, plant and equipment.

The net debt/EBITDA ratio is projected to be at the lower end of the targeted range of 2.5 to 3.0 by the end of 2013.

*Net income attributable to shareholders of Fresenius SE & Co. KGaA; 2013 adjusted for one-time integration costs of Fenwal, Inc. (~€ 50 million pre tax); 2012 adjusted for a non-taxable investment gain and other one-time costs at Fresenius Medical Care as well as for one-time costs related to the offer to RHÖN-KLINIKUM AG shareholders.

Continued strong sales growth

Group sales increased by 18% (constant currency: 13%) to €19,290 million (2011 : €16,361 million), fully in line with the June 2012 guidance increase. Organic sales growth was 6%. Acquisitions contributed a further 8%. Divestitures reduced sales growth by 1%. Currency translation had a positive effect of 5%. This is mainly attributable to the strengthening of the U.S. dollar against the euro by an average of 8% in 2012 compared to the previous year.

Sales in the business segments developed as follows:

Organic sales growth was 5% in North America and 4% in Europe. In Asia-Pacific organic sales growth reached 12%. In Latin America organic sales growth was 22%, driving sales to more than €1 billion for the first time. The sales decrease in Africa was due to the volatility in Fresenius Vamed's project business.

*2011 sales were adjusted according to a U.S. GAAP accounting change. The sales adjustment of -€161 million solely relates to Fresenius Medical Care North America.

Excellent earnings growth

Group EBITDA* grew by 19% (constant currency: 13%) to €3,851 million (2011: €3,237 million). Group EBIT* increased by 20% (constant currency: 14%) to €3,075 million (2011: €2,563 million). The EBIT margin improved by 20 basis points

to 15.9% (2011: 15.7%).

Group net interest was -€666 million (2011: -€531 million), primarily driven by higher incremental debt due to acquisition financing and currency translation effects. Interest expense in the fourth quarter included a special charge related to the early refinancing of the Company's Credit Agreement.

The other financial result of -€35 million comprises one-time costs related to the offer to RHÖN-KLINIKUM AG shareholders, primarily related to financing commitments.

The Group tax rate** improved to 29.1% (2011: 30.7%).

Noncontrolling interest increased to €769 million (2011: €638 million), of which 92% was attributable to the noncontrolling interest in Fresenius Medical Care.

Group net income*** increased by 22% (constant currency: 17%) to €938 million (2011: €770 million). Earnings per share3 improved by 15% to €5.42 (2011: €4.73). The average number of shares increased to approx. 173 million in 2012, primarily due to capital increase in May.

A reconciliation to adjusted earnings according to U.S. GAAP can be found on page 16 in the pdf of this press release.

Group net income attributable to shareholders of Fresenius SE & Co. KGaA was €926 million or €5.35 per share including the non-taxable investment gain and other one-time costs at Fresenius Medical Care as well as one-time costs related to the offer to RHÖN-KLINIKUM AG shareholders.

*Adjusted for one-time costs of €6 million (non-financing expenses) related to the offer to RHÖN-KLINIKUM AG shareholders and other one-time costs of €86 million at Fresenius Medical Care.

**Adjusted for the non-taxable investment gain and one-time costs at Fresenius Medical Care and for one-time costs related to the offer to RHÖN-KLINIKUM AG shareholders. 2011 adjusted for the effects of mark-to-market accounting of the Mandatory Exchangeable Bonds and the Contingent Value Rights.

***Net income attributable to shareholders of Fresenius SE & Co. KGaA – adjusted for a non-taxable investment gain of €34 million and other one-time costs of €17 million at Fresenius Medical Care and for one-time costs of €29 million related to the offer to RHÖN-KLINIKUM AG shareholders. 2011 adjusted for the effects of mark-to-market accounting of the Mandatory Exchangeable Bonds and the Contingent Value Rights.

Continued investment in growth

The Fresenius Group spent €1,007 million on property, plant and equipment (2011: €783 million). Acquisition spending was €3,172 million (2011: €1,612 million). This relates primarily to the acquisitions of Liberty Dialysis Holdings, Inc., Damp Group and Fenwal Holdings, Inc.

Excellent cash flow development

Operating cash flow increased by 44% to €2,438 million (2011: €1,689 million).

This was mainly driven by strong earnings growth and tight working capital management, especially regarding trade accounts receivable. The cash flow margin improved to 12.6% (2011: 10.3%). Net capital expenditure was €952 million (2011: €758 million).

Free cash flow before acquisitions and dividends increased by 60% to €1,486 million (2011: €931 million). Free cash flow after acquisitions and dividends was -€1,259 million (2011: -€748 million).

Solid balance sheet structure

The Group's total assets increased by 17% (constant currency: 18%) to €30,664 million (Dec. 31, 2011: €26,321 million). Current assets grew by 13% to €8,113 million (Dec. 31, 2011: €7,151 million). Non-current assets increased by 18% to €22,551 million (Dec. 31, 2011: €19,170 million), mainly due to acquisitions.

Total shareholders' equity increased by 21% to €12,758 million (Dec. 31, 2011: €10,577 million), mainly due to the excellent earnings development and the capital increase from May 2012. The equity ratio was 41.6% (Dec. 31, 2011: 40.2%).

Group debt grew by 13% to €11,028 million (Dec. 31, 2011: €9,799 million), due to acquisition financing. Net debt increased by 11% to €10,143 million (Dec. 31, 2011: €9,164 million). As of December 31, 2012, the net debt/EBITDA ratio* was 2.56 (Dec. 31, 2011: 2.83).

*Pro forma including Damp Group, Liberty Dialysis Holdings, Inc. and Fenwal Holding, Inc., adjusted for one-time costs of €6 million (non-financing expenses) related to the offer to RHÖN-KLINIKUM AG shareholders, and one-time costs of €86 million at Fresenius Medical Care.

Number of employees increases

As of December 31, 2012, the Fresenius Group increased the number of its employees by 13% to 169,324 (Dec. 31, 2011: 149,351), mainly due to acquisitions.

Fresenius Biotech

Fresenius Biotech develops innovative therapies with trifunctional antibodies for the treatment of cancer. In the field of polyclonal antibodies, Fresenius Biotech has successfully marketed ATG-Fresenius S for many years. ATG-Fresenius S is an immunosuppressive agent used to prevent and treat graft rejection following organ transplantation.

Fresenius Biotech's sales increased by 14% to €34.9 million (2011: €30.7 million).

Removab sales grew by 3% to €4.1 million (2011: €4.0 million). ATG Fresenius S sales increased by 15% to €30.8 million (2011: €26.7 million). Fresenius Biotech's EBIT was -€26 million (2011: -€30 million).

In December 2012, Fresenius announced the decision to discontinue its Fresenius Biotech subsidiary. The Company is in talks with several parties about a sale of Fresenius Biotech, while simultaneously assessing the equally viable option of continuing the immunosuppressive drug ATG-Fresenius S within the Fresenius Group. ATG-Fresenius S has been well established in the hospital market for decades, and is consistently profitable. Fresenius will divest the trifunctional antibody Removab (catumaxomab) business. Withdrawing from Removab will have a positive effect on Group earnings starting in 2013.

Business Segments

Fresenius Medical Care

Fresenius Medical Care is the world's leading provider of services and products for patients with chronic kidney failure. As of December 31, 2012, Fresenius Medical Care was treating 257,916 patients in 3,160 dialysis clinics.

- Strong sales growth of 10% and EBIT growth of 12%

- Excellent operating cash flow margin of 14.8%

- Outlook 2013: sales >US$14.6 billion; net income in the range of

US$1.1 billion and US$1.2 billion

Sales increased by 10% to US$13,800 million (20111: US$12,571 million). Organic sales growth was 5%. Acquisitions contributed a further 8%. Divestitures reduced sales growth by 1%. Currency translation had a negative effect of 2%.

Sales in dialysis services increased by 13% (constant currency: 15%) to US$10,492 million (2011: US$9,283 million). Dialysis product sales grew by 1% (constant currency: 5%) to US$3,308 million (2011: US$3,288 million).

In North America sales grew by 14% to US$9,031 million (2011: US$7,926 million). Dialysis services sales grew by 16% to US$8,230 million (2011: US$7,113 million). Average revenue per treatment in the United States was US$355 (2011: US$348). Dialysis product sales were US$801 million (2011: US$813 million).

Sales outside North America ("International" segment) grew by 2% (constant currency: 9%) to US$4,740 million (2011: US$4,628 million). Sales in dialysis services increased by 4% (constant currency: 11%) to US$2,262 million (2011: US$2,170 million). Dialysis product sales grew by 1% to US$ 2,478 million (2011: US$2,458 million) at actual rates. In constant currency, dialysis product sales grew by 7%.

EBIT** increased by 12% to US$2,329 million (2011: US$2,075 million), partially due to special collection efforts for dialysis services performed in prior years. The EBIT margin increased to 16.9% (2011: 16.5%) primarily due to the improved EBIT margin in North America of 19.0% (2011: 18.1%). In the International segment the EBIT margin was 17.1% (2011: 17.4%).

Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA increased by 11% to US$1,187 million (2011: US$1,071 million). This includes a non-taxable investment gain of US$140 million related to the acquisition of Liberty Dialysis Holdings, Inc., including its 51% stake in Renal Advantage Partners, LLC (RAI), as well as other one-time costs of US$71 million after tax. The latter comprises the effects regarding the amendment of the agreement for Venofer and a donation to the American Society of Nephrology. Excluding these effects, net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA increased by 4% to US$1,118 million.

The operating cash flow increased by 41% to US$2,039 million (2011: US$1,446 million) , driven by ongoing excellent receivables management and including other one-time costs of US$71 million after tax. The cash flow margin improved to 14.8% (2011: 11.5%).

For 2013, Fresenius Medical Care expects sales to grow to more than US$14.6 billion. Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA is expected to be between US$1.1 billion and US$1.2 billion.

For further information, please see Fresenius Medical Care's press release at www.fmc-ag.com.

*2011 sales were adjusted according to a U.S. GAAP accounting change. The sales adjustment of -US$224 million solely relates to Fresenius Medical Care North America.

**2012 adjusted for other one-time costs of US$110 million related to the amendment of the agreement for Venofer and a donation to the American Society of Nephrology.

***Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA – 2012 adjusted for a non-taxable investment gain of US$140 million and other one-time costs of US$71 million as per footnote **

Fresenius Kabi

Fresenius Kabi offers infusion therapies, intravenously administered generic drugs and clinical nutrition for seriously and chronically ill patients in the hospital and outpatient environments. The company is also a leading supplier of medical devices and transfusion technology products.

- Excellent organic sales growth of 9%

- EBIT margin of 20.6% at all-time high – exceeding outlook

- Outlook 2013: Sales growth of 12% to 14% in constant currency;

EBIT margin of 19% to 20% excl. Fenwal and 18% to 19% incl. Fenwal

Sales increased by 15% to €4,539 million (2011: €3,964 million). Organic sales growth was 9%. Currency translation had an effect of 5%. Acquisitions contributed a further 1%.

Sales in North America increased by 23% to €1,236 million (2011: €1,002 million). Excellent organic growth of 11% was mainly supported by product launches and continued competitor supply constraints. In Europe sales grew by 7% (organic growth: 6%) to €1,953 million (2011: €1,826 million). In Asia-Pacific sales increased by 23% (organic growth: 13%) to €863 million (2011: €702 million). Sales in Latin America and Africa increased by 12% (organic growth: 14%) to €487 million (2011: €434 million).

EBIT grew by 16% to €934 million (2011: €803 million). EBIT growth was driven in particular by excellent earnings growth in North America and in emerging markets. The EBIT margin increased by 30 basis points to 20.6% (2011: 20.3%).

Net income* increased by 25% to €444 million (2011: €354 million).

Fresenius Kabi's operating cash flow increased by 29% to €596 million (2011: €462 million). Incoming payments of overdue trade accounts receivable contributed to the strong increase. The cash flow margin reached 13.1% (2011: 11.7%). Cash flow before acquisitions und dividends increased to €357 million (2011: €289 million).

In December 2012, Fresenius Kabi successfully closed the acquisition of Fenwal Holdings, Inc.

Over the last three years, Fresenius Kabi achieved outstanding organic sales growth with CAGR of 10%, reaching the very top of its 7% to 10% mid-term target range. In 2013, Fresenius Kabi expects further significant growth supported by the full-year consolidation of Fenwal and continued organic growth in emerging markets and Europe. In North America, we expect the I.V. drug supply constraints to alleviate and competitors to re-enter the U.S. market for Propofol. Fresenius Kabi has been sole supplier for Propofol in the United States. since the end of March 2012. For 2013, Fresenius Kabi projects sales growth of 12% to 14% in constant currency. Organic sales growth is expected in the range of 3% to 5%. The company projects an EBIT margin of 19% to 20% excluding Fenwal and of 18% to 19% including Fenwal. EBIT in constant currency is expected to exceed 2012 EBIT. The guidance includes expected one-time charges to remediate manufacturing issues following recent FDA audits at the Grand Island, USA, and Kalyani, India, facilities. It also includes a gain related to the sale of the respiratory homecare business in France.

For the mid-term, Fresenius Kabi targets annual organic sales growth of 7% to 10% and an EBIT margin in the range of 18% to 21%. By 2015, the company expects sales to reach approx. €6 billion and EBIT to reach more than €1.1 billion.

Fresenius Kabi guidance adjusted for one-time integration costs of Fenwal, Inc. (~€50 million pre tax); also see Group guidance

*Net income attributable to shareholders of Fresenius Kabi AG

Fresenius Helios

Fresenius Helios is one of the largest private hospital operators in Germany. HELIOS owns 72 hospitals, including six maximum care hospitals in Berlin-Buch, Duisburg, Erfurt, Krefeld, Schwerin and Wuppertal. HELIOS treats more than 2.9 million patients per year, thereof more than 770,000 inpatients, and operates more than 23,000 beds.

- Organic sales growth of 5% – at upper end of guidance

- EBIT of €322 million – exceeding outlook

- Outlook 2013: Organic sales growth of 3% to 5%;

EBIT in the range of €360 to €380 million

Sales increased by 20% to €3,200 million (2011: €2,665 million). Organic sales growth was 5%, while acquisitions contributed 17% to sales growth. Divestitures reduced sales growth by 2%.

EBIT grew by 19% to €322 million (2011: €270 million). The EBIT margin was at previous year's level of 10.1% despite the consolidation of Damp Group and Duisburg.

Net income* increased by 25% to €203 million (2011: €163 million).

Sales of the established hospitals grew by 5% to €2,743 million. EBIT improved by 18% to €321 million. The EBIT margin increased to 11.7% (2011: 10.3%). Sales of the acquired hospitals (consolidation ≤1 year) were €457 million, EBIT was €1 million. Restructuring of these hospitals is on track.

In November 2012, Fresenius Helios announced that it had agreed to acquire a hospital in North-Rhine Westphalia with 2011 sales of approximately €20 million. HELIOS anticipates closing of the transaction at the end of the first or at the beginning of the second quarter 2013.

For 2013, Fresenius Helios expects to achieve organic sales growth of 3% to 5%. EBIT is projected to increase to between €360 million and €380 million.

Fresenius Helios targets sales of €4 billion to €4.25 billion by 2015, driven by organic growth and acquisitions.

One-time costs relating to the offer to the shareholders of RHÖN-KLINIKUM AG are included in the segment "Corporate/Other".

*Net income attributable to shareholders of HELIOS Kliniken GmbH

Fresenius Vamed

Fresenius Vamed offers engineering and services for hospitals and other health care facilities.

- Strong sales growth of 15% and EBIT growth of 16% - significantly exceeding outlook

- Order intake at all-time high

- Outlook 2013: Sales growth of 8% to 12%; EBIT growth of 5% to 10%

Sales increased by 15% to €846 million (2011: €737 million). Organic sales growth was 5%, acquisitions contributed a further 10% to sales growth. Sales in the project business increased by 2% to €506 million (2011: €494 million). Sales in the service business grew by 40% to €340 million (2011: €243 million). Acquisitions contributed 29% due to the acquisition of H.C. Hospital Consulting in Italy and the transfer of HELIOS' post-acute care clinic Zihlschlacht in Switzerland. Organic sales growth in the service business reached 11%.

EBIT improved by 16% to €51 million (2011: €44 million). The EBIT margin remained at the previous year's level of 6.0%. Net income was €35 million (2011: €34 million).

Order intake increased by 9% to €657 million (2011: €604 million). In the fourth quarter, order intake rose to a quarterly all-time high of €335 million. This includes two contracts for the construction of health care facilities in Africa with a total order volume of €157 million. As of December 31, 2012, Fresenius Vamed's order backlog was at an all-time high of €987 million (Dec. 31, 2011: €845 million).

In 2013, Fresenius Vamed expects to achieve sales growth of 8% to 12%. EBIT is projected to increase by 5% to 10%.

Fresenius Vamed targets sales of €1 billion by 2014.

*Net income attributable to shareholders of VAMED AG

Press Conference and Video Webcast

As part of the publication of the results for fiscal year 2012, a press conference will be held at the Fresenius headquarters in Bad Homburg on February 26, 2012 at 10 a.m. CET. You are cordially invited to follow the conference in a live broadcast over the Internet at www.fresenius.com (see Press / Audio-Video Service). Following the meeting, a recording of the conference will be available as video-on-demand.

Fresenius is a health care group with international operations, providing products and services for dialysis, hospital and outpatient medical care. In 2012, Group sales were €19.3 billion. On December 31, 2012, the Fresenius Group had 169,324 employees worldwide.

For more information visit the Company's website at www.fresenius.com.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius SE & Co. KGaA

Registered Office: Bad Homburg, Germany

Commercial Register: Amtsgericht Bad Homburg, HRB 11852

Chairman of the Supervisory Board: Dr. Gerd Krick

General Partner: Fresenius Management SE

Registered Office: Bad Homburg, Germany

Commercial Register: Amtsgericht Bad Homburg, HRB 11673

Management Board: Dr. Ulf M. Schneider (Chairman), Dr. Francesco De Meo, Dr. Jürgen Götz, Mats Henriksson, Rice Powell, Stephan Sturm, Dr. Ernst Wastler

Chairman of the Supervisory Board: Dr. Gerd Krick