September 03, 2015

Brussels, Belgium

48. Annual Scientific Meeting of the European Society for Paediatric Nephrology (ESPN)

03.09. - 05.09.2015

If no timeframe is specified, information refers to H1/2015

For a detailed overview of special items please see the reconciliation tables in the PDF file on pages 15-16.

Q2/2015:

- Sales: €6.9 billion (+26% at actual rates, +13% in constant currency)

- EBIT1: €971 million (+28% at actual rates, +12% in constant currency)

- Net income2: €350 million (+35% at actual rates, +22% in constant currency)

H1/2015:

- Sales: €13.4 billion (+25% at actual rates, +13% in constant currency)

- EBIT1: €1.8 billion (+30% at actual rates, +15% in constant currency)

- Net income2: €642 million (+32% at actual rates, +19% in constant currency)

Ulf Mark Schneider, CEO of Fresenius, said: “Our strong growth trend continues in all four business segments. In times of economic volatility, our broad geographic presence and well-diversified business provide reliable growth and continue to contribute to Fresenius’ overall success. We are highly confident of our Company’s growth prospects and raise our Group earnings guidance.”

1Before special items

2Net income attributable to shareholders of Fresenius SE & Co. KGaA; before special items

2015 Group earnings guidance1 raised

Based on the Group’s excellent financial results in the first half of 2015 and excellent prospects for the remainder of the year, Fresenius raises its 2015 Group earnings guidance. Net income2 is now expected to grow by 18% to 21% in constant currency. Previously, Fresenius expected net income2 growth of 13% to 16% in constant currency. Sales guidance is narrowed to 8% to 10% in constant currency within the previously guided range of 7% to 10%.

The net debt/EBITDA3 ratio is expected to be approximately 3.0 at the end of 2015.

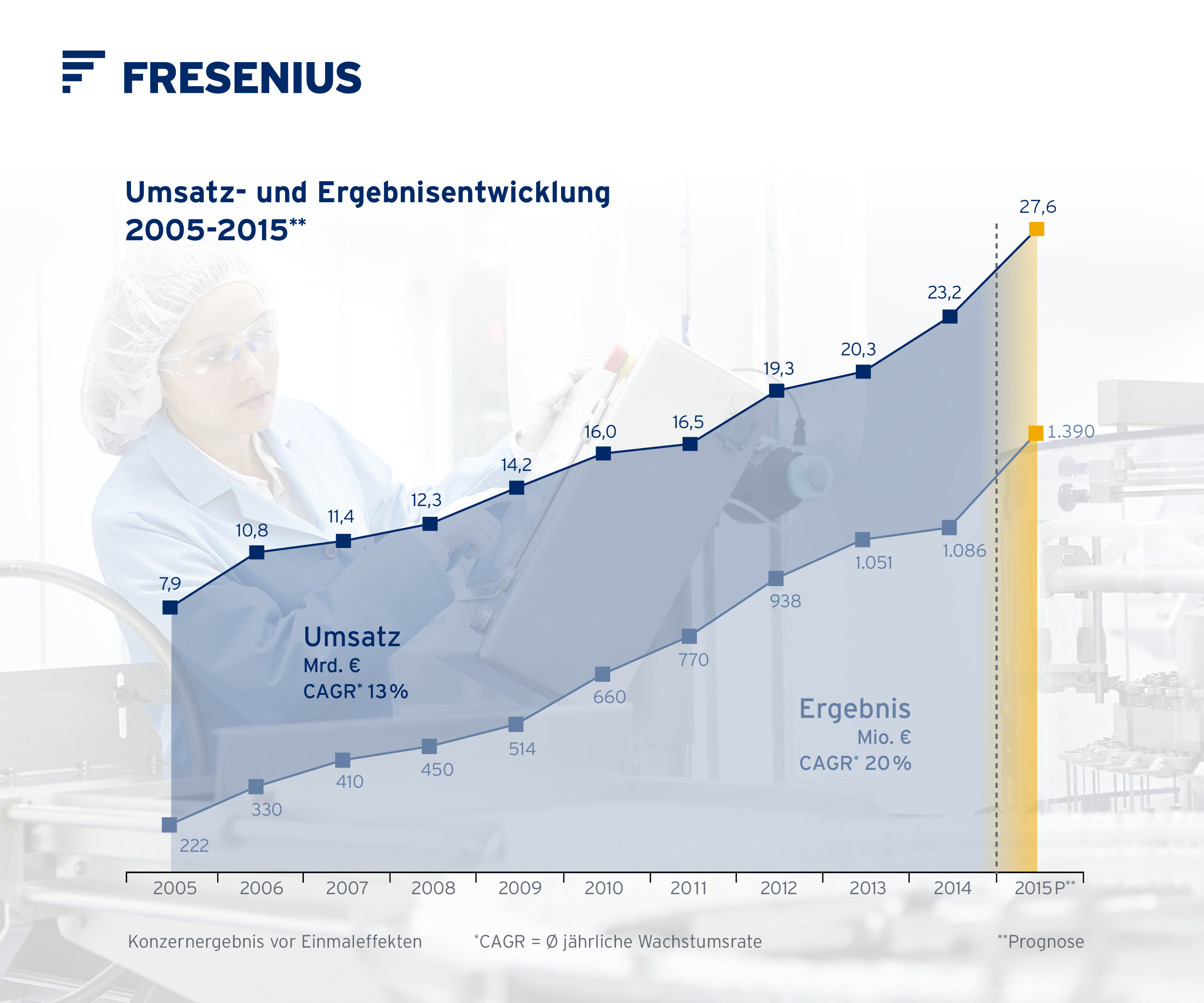

1Based on the average exchange rates through July 24 and the exchange rates of July 24 applied to the remainder of the year, this implies sales of ~€27.6 billion and net income of ~€1.39 billion, at the lower end of the respective guidance range.

2Net income attributable to shareholders of Fresenius SE & Co. KGaA; 2015 before integration costs (~€10 million before tax for hospitals acquired from Rhön-Klinikum AG), before costs for the efficiency program at Fresenius Kabi (~€100 million before tax), and before the disposal gains from the divestment of two HELIOS hospitals (€34 million before tax); 2014 before special items

3At annual average exchange rates for both net debt and EBITDA; without major unannounced acquisitions; before special items

13% sales growth in constant currency

Group sales increased by 25% (13% in constant currency) to €13,429 million (H1/2014: €10,733 million). Organic sales growth was 7%. Acquisitions contributed 7%, while divestitures reduced sales by 1%. In Q2/2015, Group sales increased by 26% (13% in constant currency) to €6,946 million (Q2/2014: €5,521 million). Organic sales growth was 8%. Acquisitions contributed 6%, while divestitures reduced sales by 1%.

Group sales by region:

19% Group net income1 growth in constant currency

Group EBITDA2 increased by 28% (13% in constant currency) to €2,364 million (H1/2014: €1,854 million). Group EBIT2 increased by 30% (15% in constant currency) to €1,822 million (H1/2014: €1,403 million). The EBIT margin was 13.6% (H1/2014: 13.1%). In Q2/2015 Group EBIT2 increased by 28% (12% in constant currency) to €971 million (Q2/2014: €760 million), the EBIT margin was 14.0% (Q2/2014: 13.8%).

Group net interest increased to -€330 million (H1/2014: -€283 million). Interest rate savings were more than offset by interest on incremental debt for acquisitions completed in 2014 and by currency translation effects.

The Group tax rate2 was 29.6% (H1/2014: 29.6%). In Q2/2015, the Group tax rate was 29.0% (Q2/2014: 32.4%, due to a special tax effect at Fresenius Medical Care).

Noncontrolling interest was €409 million (H1/2014: €301 million), of which 95% was attributable to the noncontrolling interest in Fresenius Medical Care.

Group net income3 before special items increased by 32% (19% in constant currency) to €642 million (H1/2014: €487 million). Earnings per share1 increased by 31% (19% in constant currency) to €1.18 (H1/2014: €0.90). In Q2/2015, Group net income3 before special items increased by 35% (22% in constant currency) to €350 million (Q2/2014: €259 million). Earnings per share1 increased by 33% (21% in constant currency) to €0.64 (Q2/2014: €0.48).

Group net income3 including special items increased by 20% (9% in constant currency) to €642 million (H1/2014: €534 million). Earnings per share3 increased by 19% (8% in constant currency) to €1.18 (H1/2014: € 0.99). In Q2/2015, Group net income3 including special items increased by 14% (2% in constant currency) to €325 million (Q2/2014: €286 million). Earnings per share3 increased by 13% (0% in constant currency) to €0.60 (Q2/2014: €0.53).

A reconciliation to earnings according to U.S. GAAP can be found on pages 15-16 of this press release.

1Net income attributable to shareholders of Fresenius SE & Co. KGaA; before special items

2Before special items

3Net income attributable to shareholders of Fresenius SE & Co. KGaA

Continued investment in growth

Spending on property, plant and equipment was €611 million (H1/2014: €522 million), primarily for the modernization and expansion of dialysis clinics, production facilities and hospitals. Total acquisition spending was €194 million (H1/2014: €1,216 million).

Increase in operating cash flow

Operating cash flow increased to €1,251 million (H1/2014: €750 million). The cash flow margin increased to 9.3% (H1/2014: 7.0%). Operating cash flow in H1/2014 was reduced by the US$1151 million payment for the W.R. Grace bankruptcy settlement. Operating cash flow in Q2/2015 increased to €720 million (Q2/2014: €610 million). The cash flow margin decreased to 10.4% (Q2/2014: 11.0%).

Net capital expenditure increased to €605 million (H1/2014: €532 million). Free cash flow before acquisitions and dividends improved to €646 million (H1/2014: €218 million). Free cash flow after acquisitions and dividends increased to €107 million (H1/2014: €1,275 million).

1See Annual Report 2014, page 152 f.

Solid balance sheet structure

The Group’s total assets increased by 6% (1% in constant currency) to €42,271 million (Dec. 31, 2014: €39,897 million). Current assets grew by 5% (1% in constant currency) to €10,513 million (Dec. 31, 2014: €10,028 million). Non-current assets increased by 6% (1% in constant currency) to €31,758 million (Dec. 31, 2014: € 29,869 million).

Total shareholders’ equity increased by 9% (4% in constant currency) to €16,909 million (Dec. 31, 2014: €15,483 million). The equity ratio increased to 40.0% (Dec. 31, 2014: 38.8%).

Group debt grew by 1% (decreased by 3% in constant currency) to €15,661 million (Dec. 31, 2014: € 15,454 million). As of June 30, 2015, the net debt/EBITDA ratio was 3.191 (3.071 at LTM average exchange rates for both net debt and EBITDA).

1Pro forma acquisitions; before special items

Increased number of employees

As of June 30, 2015, the number of employees increased by 2% to 220,339 (Dec. 31, 2014: 216,275).

Business Segments

Fresenius Medical Care

Fresenius Medical Care is the world's largest integrated provider of products and services for individuals undergoing dialysis because of chronic kidney failure. As of June 30, 2015, Fresenius Medical Care was treating 289,610 patients in 3,421 dialysis clinics. Along with its core business, the company seeks to expand the range of medical services in the field of care coordination.

- 8% organic sales growth in Q2

- Sales outside North America impacted by currency development

- 2015 outlook confirmed

Sales increased by 10% (16% in constant currency) to US$8,159 million (H1/2014: US$7,398 million). Organic sales growth was 8%. Acquisitions contributed 9%, while divestitures reduced sales by 1%. Currency effects reduced sales by 6%. In Q2/2015, sales increased by 9% (15% in constant currency) to US$4,199 (Q2/2014: US$3,835).

Health Care services sales (dialysis services and care coordination) increased by 14% (18% in constant currency) to US$6,527 million (H1/2014: US$5,731 million). Dialysis product sales decreased by 2% (increased by 9% in constant currency) to US$1,631 million (H1/2014: US$1,667 million).

In North America, sales increased by 16% to US$5,717 million (H1/2014: US$4,914 million). Health Care services sales grew by 17% to US$5,293 million (H1/2014: US$4,517 million). Dialysis product sales increased by 7% to US$424 million (H1/2014: US$397 million).

Sales outside North America decreased by 1% (increased by 16% in constant currency) to US$2,427 million (H1/2014: US$2,458 million). Health Care services sales increased by 2% (21% in constant currency) to US$1,234 million (H1/2014: US$1,214 million). Dialysis product sales decreased by 4% (increased by 11% in constant currency) to US$1,193 million (H1/2014: US$1,244 million).

EBIT increased by 5% (12% in constant currency) to US$1,051 million (H1/2014: US$1,001 million). The EBIT margin was 12.9% (H1/2014: 13.5%). In Q2/2015, EBIT decreased by 2% (increased by 4% in constant currency) to US$547 million (Q2/2014: US$556 million). EBIT margin was 13.0% (Q2/2014: 14.5%).

Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA increased by 3% (10% in constant currency) to US$450 million (H1/2014: US$439 million). In Q2/2015, net income grew by 3% (11% in constant currency) to US$241 million (Q2/2014: US$234 million).

Operating cash flow increased to US$832 million (H1/2014: US$562 million). Operating cash flow in H1/2014 was reduced by the US$115 million2 payment for the W.R.Grace bankruptcy settlement. The cash flow margin increased to 10.2% (H1/2014: 7.6%). In Q2/2015, operating cash flow decreased to US$385 million (Q2/2014: US$449 million), the cash flow margin was 9.2% (Q2/2014: 11.7%).

Fresenius Medical Care confirms its outlook for 2015. The company expects sales to grow by 5% to 7%, which equals a growth rate of 10% to 12% in constant currency. Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA is expected to increase by 0% to 5% in 2015.

The outlook is based on current exchange rates. Savings from the global efficiency program are included, while earnings contributions from potential acquisitions are not. The outlook reflects further operating cost investments within the Care Coordination segment.

For further information, please see Fresenius Medical Care’s press release at www.freseniusmedicalcare.com.

1Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

2See Annual Report 2014, page 152 f.

Fresenius Kabi

Fresenius Kabi offers intravenously administered generic drugs, clinical nutrition and infusion therapies for seriously and chronically ill patients in the hospital and outpatient environments. The company is also a leading supplier of medical devices and transfusion technology products.

- 11% organic sales growth in Q2

- 26% EBIT growth in constant currency in Q2

- 2015 outlook raised

Sales increased by 19% (8% in constant currency) to €2,932 million (H1/2014: €2,466 million). Organic sales growth was 8%. Acquisitions contributed 1% while divestitures reduced sales by 1%. Positive currency translation effects (11%) were mainly related to the Euro’s depreciation against the U.S. dollar and the Chinese yuan. In Q2/2015, sales increased by 23% (11% in constant currency) to €1,538 million (Q2/2014: €1,253 million). Organic sales growth was 11%.

Sales in Europe grew by 3% (organic growth: 5%) to €1,052 million (H1/2014: €1,024 million). Sales in North America increased by 37% (organic growth: 13%) to €1,026 million (H1/2014: €747 million). Sales growth was driven by persisting IV drug shortages and new product launches. Asia-Pacific sales increased by 22% (organic growth: 4%) to €564 million (H1/2014: €464 million). Sales in Latin America/Africa grew by 25% (organic growth: 11%) to €290 million (H1/2014: €231 million).

EBIT1 increased by 39% (18% in constant currency) to €571 million (H1/2014: €411 million). The EBIT margin was 19.5% (H1/2014: 16.7%). In Q2/2015, EBIT1 increased by 50% (26% in constant currency) to €314 million (Q2/2014: €210 million). The EBIT margin was 20.4% (Q2/2014: 16.8%).

Net income2 increased by 42% (22% in constant currency) to €309 million (H1/2014: €217 million). In Q2/2015, net income2 increased by 52% (30% in constant currency) to €169 million (Q2/2014: €111 million).

Operating cash flow increased by 65% to €354 million (H1/2014: €215 million) with a margin of 12.1% (H1/2014: 8.7%). In Q2/2015, operating cash flow increased to €271 million (Q2/2014: €173 million) with a margin of 17.6% (Q2/2014: 13.8%).

Fresenius Kabi’s initiatives to increase production efficiency and streamline administrative structures are well on track. Costs of €40 million before tax were incurred in the first half of 2015 (Q2/2015: €30 million). These costs are reported in the Group segment Corporate/Other.

Fresenius Kabi raises its outlook3 for 2015 and now expects organic sales growth of 6% to 8% and EBIT growth in constant currency in the range of 18% to 21%. The implied EBIT margin is 19.0% to 20.0%. Previously, Fresenius Kabi projected organic sales growth of 4% to 7% and an EBIT growth in constant currency in the range of 11% to 14% with an implied EBIT margin in the range of 18.5% to 19.5%.

Fresenius Kabi’s outlook excludes ~€100 million costs before tax for the efficiency program. For segment reporting purposes, these costs will not be reported in the Fresenius Kabi segment but as special items in the Group segment Corporate/Other.

1Before special items

2Net income attributable to shareholders of Fresenius Kabi AG; before special items

3Based on the average exchange rates through July 24 and the exchange rates of July 24 applied to the remainder of the year, this implies sales of ~€5.9 billion and EBIT of ~€1.17 billion, at the lower end of the respective expected range

Fresenius Helios

Fresenius Helios is Germany’s largest hospital operator. HELIOS operates 111 hospitals, thereof 87 acute care clinics (including seven maximum care hospitals in Berlin-Buch, Duisburg, Erfurt, Krefeld, Schwerin, Wiesbaden and Wuppertal) and 24 post-acute care clinics. HELIOS treats approximately 4.5 million patients per year, thereof 1.2 million inpatients, and operates more than 34,000 beds.

- 18% EBIT increase in Q2

- 100 bps sequential EBIT margin increase

- 2015 outlook fully confirmed

Sales increased by 10% to €2,774 million (H1/2014: €2,521 million). Organic sales growth was 3% (H1/2014: 3%). Acquisitions contributed 8% while divestitures reduced sales by 1%. In Q2/2015, sales increased by 7% to €1,383 million (Q2/2014: €1,294 million), organic sales growth was 2% (Q2/2014: 3%).

EBIT1 grew by 23% to €307 million (H1/2014: €250 million). The EBIT margin increased to 11.1% (H1/2014: 9.9%). In Q2/2015, EBIT1 increased by 18% to €160 million (Q2/2014: €136 million). Sequentially, the EBIT margin increased by 100 bps to 11.6%.

Net income2 increased by 26% to €226 million (H1/2014: €179 million). In Q2/2015, net income2 increased by 17% to €119 million (Q2/2014: €102 million).

Sales of the established hospitals, including the former Rhön-Klinikum facilities consolidated for more than one year, grew by 3% to €2,583 million (H1/2014: €2,504 million). EBIT1 increased by 20% to €298 million (H1/2014: €248 million). The EBIT margin increased to 11.5% (H1/2014: 9.9%). Sales of the acquired hospitals consolidated for less than one year were €191 million. EBIT1 was €9 million with a margin of 4.7%.

The integration of the hospitals acquired from Rhön-Klinikum AG is fully on track. Amount and timing of targeted near-term cost synergies (€85 million p.a.) are confirmed. Integration costs were €8 million in H1/2015 (Q2/2015: €6 million) taking the total to date to €59 million. Total integration costs for 2014 and 2015 are confirmed at approximately €60 million.

Fresenius Helios fully confirms its outlook for 2015. Fresenius Helios projects organic sales growth of 3% to 5% and reported sales growth of 6% to 9%. EBIT is expected to increase to €630 to €650 million.

Fresenius Helios’ outlook excludes integration costs for the hospitals acquired from Rhön-Klinikum AG (~€10 million before tax) and the disposal gains from the divestment of two HELIOS hospitals (€34 million before tax). For segment reporting purposes, these items will not be reported in the Fresenius Helios segment, but as special items in the Group segment Corporate/Other.

1Before special items

2Net income attributable to shareholders of HELIOS Kliniken GmbH; before special items

Fresenius Vamed

Fresenius Vamed manages projects and provides services for hospitals and other health care facilities worldwide. The portfolio ranges along the entire value chain: from project development, planning, and turnkey construction, via maintenance and technical management, to total operational management.

- 20% organic sales growth in Q2

- Sequential growth acceleration in project business

- 2015 outlook fully confirmed

Sales increased by 16% (15% in constant currency) to €463 million (H1/2014: €398 million). Organic sales growth was 13%. Acquisitions contributed 2%. Sales in the project business increased by 17% to €202 million (H1/2014: € 173 million). Sales in the service business grew by 16% to €261 million (H1/2014: €225 million). In Q2/2015, sales increased by 23% to €255 million (Q2/2014: €207 million). Organic sales growth was 20%.

EBIT grew by 7% to €16 million (H1/2014: €15 million). The EBIT margin decreased to 3.5% (H1/2014: 3.8%). In Q2/2015, EBIT remained unchanged at €9 million (Q2/2014: €9 million). Sequentially, the EBIT margin increased by 10 bps to 3.5%.

Net income1 was unchanged at €10 million (H1/2014: €10 million). In Q2/2015, net income1 of €6 million was also at prior-year level (Q2/2014: €6 million).

Order intake decreased by 5% to €284 million (H1/2014: €300 million). As of June 30, 2015, order backlog was €1,479 million (Dec. 31, 2014: €1,398 million).

Fresenius Vamed fully confirms its outlook for 2015 and expects to achieve single-digit organic sales growth and EBIT growth of 5% to 10%.

1Net income attributable to shareholders of VAMED AG

Conference Call

As part of the publication of the results for the first half of 2015, a conference call will be held on July 30, 2015 at 2 p.m. CEDT (8 a.m. EDT). You are cordially invited to follow the conference call in a live broadcast over the Internet at www.fresenius.com, see Press, Audio/Video-Service. Following the call, a replay will be available on our website.

###

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

- Second quarter performance on track to achieve full year guidance for 2015

- Strong year to date revenue and earnings growth

- International performance mainly masked by currencies in the second quarter

- Strong year to date cash flow generation

Second quarter 2015 key figures:

Net revenue: $4,199 million, +9%

Operating income (EBIT): $547 million, -2%

Net income*: $241 million, +3%

Basic earnings per share: $0.79, +2%

First half 2015 key figures:

Net revenue: $8,159 million, +10%

Operating income (EBIT): $1,051 million, +5%

Net income*: $450 million, +3%

Basic earnings per share: $1.48, +2%

*attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

Rice Powell, chief executive officer of Fresenius Medical Care stated: “Our second quarter 2015 results showed a positive underlying performance. We are pleased with our revenue and earnings growth considering the negative currency impact on our International operations in the second quarter. We have made further progress with the integration of our Care Coordination operations. Our performance is in line with our full year guidance for 2015 and we are confident to achieve our long-term targets for 2020.”

Second quarter 2015

Revenue

Net revenue for the second quarter of 2015 increased by 9% to $4,199 million (+15% at constant currency) as compared to the second quarter of 2014. Organic revenue growth worldwide was 8%. Net Health Care revenue grew by 13% to $3,345 million (+18% at constant currency). The dialysis product revenue decreased by 4% to $854 million as compared to the second quarter of 2014 mainly due to negative currency developments in the International product business. On a constant currency basis the dialysis product revenue increased by 8%.

North America revenue for the second quarter of 2015 increased by 17% to $2,946 million. Organic revenue growth was 7%. Net Health Care revenue grew by 17% to $2,722 million with a same market treatment growth of 4%. Net Dialysis Care revenue increased by 6% to $2,254 million while the Care Coordination revenue increased by 149% to $468 million (organic growth of 24%). Dialysis product revenue increased by 9% to $224 million as compared to the second quarter of 2014.

International revenue decreased by 4% to $1,247 million. On a constant currency basis revenue increased by 14%. Organic revenue growth was 9%. Net Health Care revenue decreased by 1% to $623 million (+18% at constant currency). Dialysis product revenue decreased by 6% to $624 million (+10% at constant currency).

International segments:

Europe, Middle East and Africa (EMEA) revenue decreased by 15% to $668 million (+4% at constant currency). Organic revenue growth was 5%. Net Health Care revenue decreased by 17% to $309 million (+3% at constant currency). Dialysis product revenue decreased by 14% to $359 million (+5% at constant currency).

Asia-Pacific revenue increased by 22% to $376 million (+32% at constant currency). Organic revenue growth was 12%. Net Health Care revenue increased by 37% to $164 million (+55% at constant currency). Dialysis product revenue increased by 12% to $212 million (+18% at constant currency).

Latin America revenue increased by 2% to $203 million (+22% at constant currency). Organic revenue growth was 19%. Net Health Care revenue increased by 6% to $150 million (+25% at constant currency). Dialysis product revenue decreased by 8% to $53 million (+15% at constant currency).

Earnings

Operating income (EBIT) decreased by 2% from $556 million in the second quarter of 2014 to $547 million in the second quarter of 2015.

Operating income for North America for the second quarter of 2015 was $428 million, an increase of 7% as compared to the second quarter of 2014.

In the International segments, operating income for the second quarter of 2015 decreased by 11% to $217 million as compared to $243 million in the second quarter of 2014.

International segments: Operating income for EMEA for the second quarter of 2015 was $134 million, a decrease of 20% as compared to the second quarter of 2014. Operating income for Asia-Pacific for the second quarter of 2015 was $67 million, an increase of 22% as compared to the second quarter of 2014. Operating income for Latin America for the second quarter of 2015 was $16 million, a decrease of 20% as compared to the second quarter of 2014.

Net interest expense for the second quarter of 2015 was $102 million as compared to $98 million in the second quarter of 2014 which mainly reflects the financing costs of the acquisitions made in the second half of 2014.

Income tax expense was $135 million for the second quarter of 2015, which translates into an effective tax rate of 30.4%. On an adjusted basis the tax rate for the second quarter of 2014 was 34.8%*.

*The tax rate in the second quarter of 2014 was influenced by a special tax impact which resulted in an expense of $18 million.

Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA for the second quarter of 2015 was $241 million, an increase of 3% compared to $234 million for the second quarter of 2014 and in line with our full year guidance for 2015.

Basic earnings per share (EPS) for the second quarter of 2015 was $0.79, an increase of 2% compared to the corresponding number for the second quarter of 2014. The weighted average number of shares outstanding for the second quarter of 2015 was approximately 304.2 million shares, compared to approximately 301.8 million shares for the second quarter of 2014. The increase in shares outstanding resulted from stock option exercises during the second quarter of 2015.

Cash flow

In the second quarter of 2015, the company generated $385 million, representing 9.2% of revenue, in net cash provided by operating activities, compared to the corresponding figure of last year of $449 million.

A total of $214 million was spent for capital expenditures, net of disposals. Free cash flow was $171 million compared to $231 million in the second quarter of 2014.

A total of $55 million in cash was spent for acquisitions, net of divestitures. Free cash flow after investing activities was $116 million as compared to ($66) million in the second quarter of 2014.

First half 2015

Revenue and earnings

Net revenue for the first half of 2015 increased by 10% to $8,159 million (+16% at constant currency) as compared to the first half of 2014. Organic revenue growth worldwide was 8%.

Operating income (EBIT) for the first half of 2015 was $1,051 million as compared to $1,001 million in the first half of 2014. This represents an increase of 5% on a reported basis.

Net interest expense for the first half of 2015 was $204 million as compared to $195 million in the first half of 2014.

Income tax expense for the first half of 2015 was $273 million, which translates into an effective tax rate of 32.2%. On an adjusted basis the tax rate for the first half of 2014 was 32.3%*. For the full year, the company expects the tax rate to be on the lower end of its guidance range of 33 to 34%.

*The tax rate in the second quarter of 2014 was influenced by a special tax impact which resulted in an expense of $18 million.

For the first half of 2015, net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA was $450 million, up by 3% from the corresponding number of $439 million for the first half of 2014.

In the first half of 2015, basic earnings per share (EPS) was $1.48, an increase of 2% compared to the corresponding number for the first half of 2014. The weighted average number of shares outstanding during the first half of 2015 was approximately 303.9 million shares.

Cash flow

In the first half of 2015, the company generated $832 million in net cash provided by operating activities, representing 10.2% of revenue, as compared to $562 million for the same period in 2014.

A total of $411 million was spent for capital expenditures, net of disposals. Free cash flow for the first half of 2015 was $421 million as compared to $147 million in the first half of 2014.

A total of $66 million in cash was spent for acquisitions and investments, net of divestitures. Free cash flow after investing activities was $355 million as compared to a ($285) million in the first half of 2014.

Employees

As of June 30, 2015, Fresenius Medical Care had 102,893 employees (full-time equivalents) worldwide, compared to 94,401 employees at the end of June 2014. This increase of ~8,500 employees was mainly attributable to acquisitions as well as our continued organic growth.

Balance sheet structure

The company´s total assets of $25,410 million remained on a similar level (Dec. 31, 2014: $25,447 million). Current assets were virtually flat at $6,702 million (Dec. 31, 2014: $6,725 million). Non-current assets remained almost unchanged at $18,708 million (Dec. 31, 2014: $18,722 million). Total equity increased by 2% to $10,182 million (Dec. 31, 2014: $10,028 million). The equity ratio was 40% as compared to 39% at the end of 2014. Total debt was $9,270 million (Dec. 31, 2014: $9,532 million). As of June 30, 2015, the debt/EBITDA ratio was 3.0 (Dec. 31, 2014: 3.1).

Please refer to the attachments for a complete overview of the results for the second quarter and first half of 2015.

Outlook* confirmed

*The outlook/projection provided for 2015/2016 is based on current exchange rates. Savings from the global efficiency program are included, while potential acquisitions are not. In addition the outlook reflects further operating cost investments within the Care Coordination business for future growth in line with our 2020 strategy.

For the 2015 outlook the company expects revenue to grow at 5-7%, which at constant currency is a growth rate of 10-12%. Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA is expected to increase by 0-5% in 2015.

The company expects to spend around $1.0 billion on capital expenditures and around $400 million on acquisitions in 2015. The debt/EBITDA ratio is expected to be around 3.0 by the end of 2015.

For the 2016 projections we expect revenue to increase around 7-10%TBD (previously 9-12%). This is due to the fact that we expect some of the initiatives in Care Coordination operations to be delayed into the following years. The net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA is still expected to grow by 15-20% (unchanged).

As disclosed in the company’s long-term target for 2020, the company expects revenue to grow at an average annual growth rate of approx. 10% and net income attributable to shareholders in the high single digits.

Conference call

Fresenius Medical Care will hold a conference call to discuss the results of the second quarter 2015 on Thursday, July 30, 2015 at 3.30 p.m. CEDT/ 9.30 a.m. EDT. The company invites investors to follow the live webcast of the call at the company’s website www.freseniusmedicalcare.com in the “Investors/Events” section. A replay will be available shortly after the call.

###

Disclaimer

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Annual Report 2014 (US-GAAP)

Please wait. You will be forwarded in a few seconds.

Please wait. You will be forwarded in a few seconds.

Everybody who has to fulfill demanding tasks with the help of technical devices during their daily clinical routine needs a sense of safety and reliability. The more extensive the tasks are the more important is the easy and intuitive handling of the complex technology. Fresenius Medical Care’s multiFiltratePRO is specifically tailored to meet these needs.

Dominik Wehner, chief executive officer for Europe, Middle East and Africa commented: “User-friendly operations, reliability as well as the usage for various extracorporeal therapies are the key strengths of this new therapy system multiFiltratePRO. This powerful technology increases efficiency and ergonomics and is equally easy to operate.”

A multitude of features supports physicians and caregivers who are increasingly experiencing raising workloads and high working pressure: a large touch screen monitor comprehensively displays all needed information; intuitive handling; fully integrated fluid heaters reliably provide the right temperature of the fluid; a “Care-Mode” prevents unnecessary alarms and a functional chassis allows easy mobility also in the narrow space at the bedside.

The multiFiltratePRO platform is based on modern technology and builds on substantial experience with our successfully established Ci-Ca® regional anticoagulation which results in less bleeding for the patients.

Dr. Olaf Schermeier, chief executive officer for Global Research and Development stated: “Over the time we expect to expand this new therapy platform. The reliable and simple user interface helps reducing the demand on personnel while providing the highest treatment quality. And spending less time with handling complex technology offers the opportunity to pay more attention to the patient itself.”

Fresenius Medical Care AG & Co. KGaA (the "Company" or "Fresenius Medical Care"), the world's largest provider of dialysis products and services, today announced that it intends to sell €250 million of senior unsecured notes due 2016 (the "Senior Notes") issued by FMC Finance VI S.A., a wholly owned subsidiary of the Company. The Senior Notes will be offered through a private placement directed to institutional investors outside the United States. There will be no public offering of the Senior Notes. Proceeds from the offering will be used to repay short-term indebtedness and for general corporate purposes.

The Senior Notes will be guaranteed on a senior basis jointly and severally by the Company, Fresenius Medical Care Holdings, Inc. and Fresenius Medical Care Deutschland GmbH.

The proposed offering will not be registered under the Securities Act of 1933. The offering will be made in an "offshore transaction" pursuant to Regulation S under the Securities Act and will be offered in the United States to "qualified institutional buyers" pursuant to the exemption from registration under Rule 144A under the Securities Act.

Fresenius Medical Care is the world's largest integrated provider of products and services for individuals undergoing dialysis because of chronic kidney failure, a condition that affects more than 1,770,000 individuals worldwide. Through its network of 2,509 dialysis clinics in North America, Europe, Latin America, Asia-Pacific and Africa, Fresenius Medical Care provides dialysis treatment to 192,804 patients around the globe (as of 30 September 2009). Fresenius Medical Care is also the world's leading provider of dialysis products such as hemodialysis machines, dialyzers and related disposable products. Fresenius Medical Care is listed on the Frankfurt Stock Exchange (FME, FME3) and the New York Stock Exchange (FMS, FMS/P).

For more information about Fresenius Medical Care visit the Company's website at www.fmc-ag.com.

This release does not constitute or form part of, and should not be construed as, an offer or invitation to subscribe for, underwrite or otherwise acquire, any securities of FMC Finance VI S.A. or Fresenius Medical Care or any present or future member of its group nor should it or any part of it form the basis of, or be relied on in connection with, any contract to purchase or subscribe for any securities of FMC Finance VI S.A. or Fresenius Medical Care or any member of its group. In particular, this release is not an offer of securities in the United States of America (including its territories and possessions), and securities of FMC Finance VI S.A. and Fresenius Medical Care may not be offered or sold in the United States of America absent registration under the Securities Act of 1933, as amended, (which FMC Finance VI S.A. and Fresenius Medical Care do not intend to effect) or pursuant to an applicable exemption from registration.

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.