The price increase for hospital services in Germany has been set at 2.97% for 2018. This is in line with the level of past years.

The price increase for hospital services in Germany has been set at 2.97% for 2018. This is in line with the level of past years.

Fresenius Medical Care has expanded its regional manufacturing plant in Bandar Enstek, Malaysia. Dato' Seri Dr. Chen Chaw Min, Secretary General of the Malaysian Ministry of Health graced the opening ceremony. The plant is a state-of-the-art facility and will be Fresenius Medical Care's regional manufacturing hub for Southeast Asia. In addition to supplying high-quality hemodialysis concentrates and disinfectants, the plant produces peritoneal dialysis (PD) products necessary for advanced continuous ambulatory PD treatment.

Caspofungin, an antifungal medicine, expands the company's sterile injectable anti-infective portfolio.

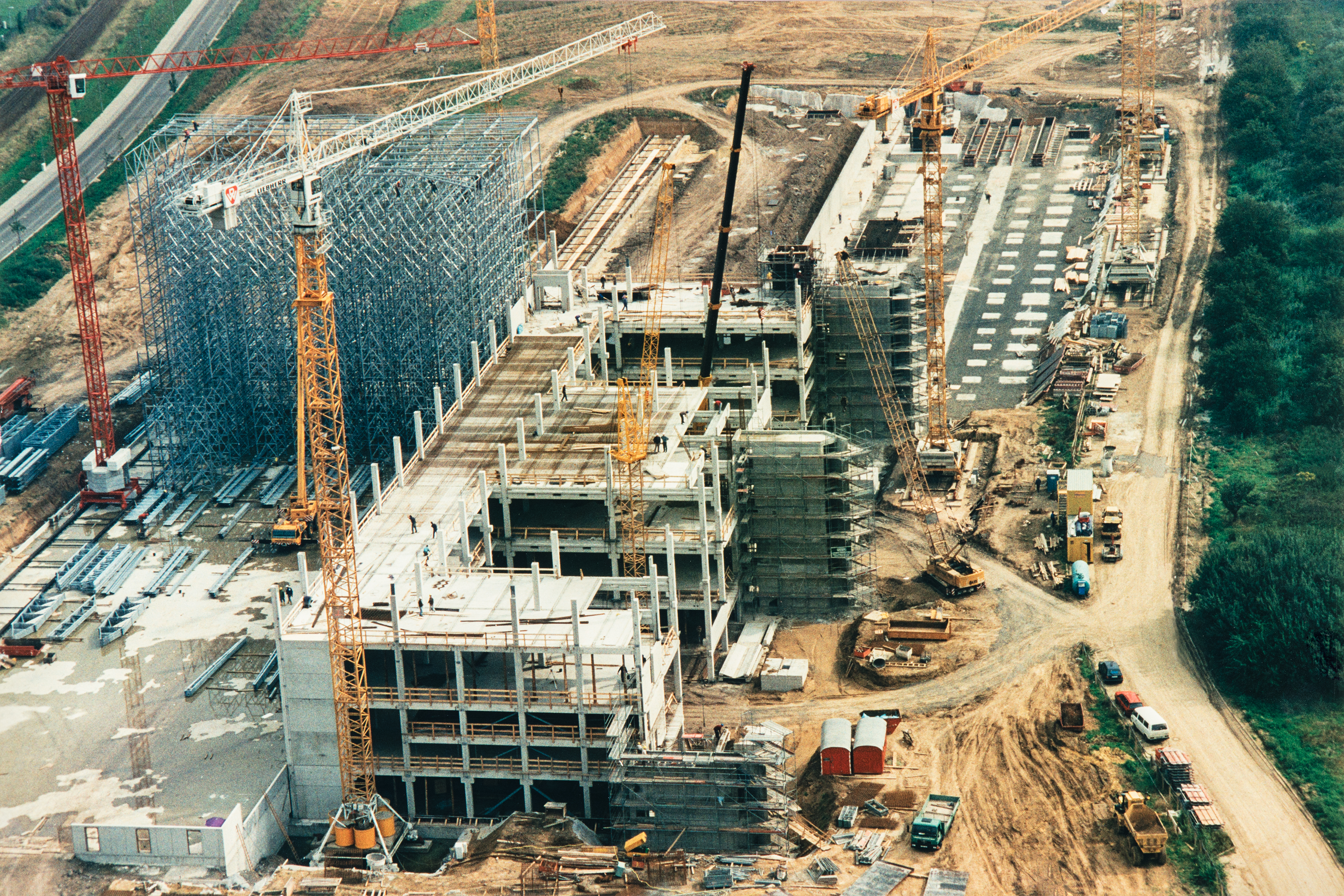

Fresenius Kabi celebrated the 20-year anniversary of its Friedberg plant in the state of Hesse today. Since production began in 1997, the Fresenius Kabi site has produced more than two billion bottles and bags with infusion solutions, blood volume substitution agents and liquid drugs. These products are used in the therapy and treatment of critically and chronically ill patients.

The adjoining logistics center is the international hub for the company’s entire product line. Each day employees here fill roughly 2,000 orders. The logistics depot is equipped with a fully automated high-rack warehouse with space for 75,000 pallets. Shipments are assembled and packed in the semi-automated pick-and-drop area. From there they are shipped to wholesalers, pharmacies and hospitals in Germany, and worldwide to national subsidiaries of Fresenius Kabi.

Fresenius Kabi has invested about €150 million in the site – and continues to invest. The next step is expansion of the logistics center in response to increasing volume. The building will be expanded by 4,500 square meters (about 50.000 square feet) at a cost of six million euros. The expansion should be completed by early 2019.

Joachim Arnold, County Commissioner of the Wetterau region, acknowledged the importance of the plant for the region: “Fresenius Kabi has for many years been an important company and major employer. The ongoing investment represents job security and is also a tribute to the quality of this site.”

“We will continue the success story of Fresenius Kabi in Friedberg. The new investment expands the capacity of the logistics center to ship our products throughout the world. This means we can help more patients”, said Dr. Michael Schönhofen, member of the Fresenius Kabi Management Board and President of the Pharmaceuticals Division.

Fresenius Kabi currently employs about 750 people at the production site and logistics center in Friedberg, making it one of the largest employers in the Wetterau region. There are also roughly 40 trainees engaged as, for example, chemistry lab assistants, freight forwarders, logistics service providers and mechatronics technicians.

Fresenius Kabi has successfully closed the acquisition of Merck KGaA’s biosimilars business. The transaction comprises the entire development pipeline of Merck’s biosimilars and an experienced team of employees located in Aubonne and Vevey, Switzerland. The product pipeline has a focus on oncology and autoimmune diseases, and addresses a market with current annual branded sales of around US$30bn. The biosimilars business will be consolidated as of September 1, 2017.

The purchase price of €656 million will be mainly cash flow financed. Thereof, €156 million have been paid upon closing. Up to €500 million are milestone payments strictly tied to achievements of development targets in the coming years. The slight reduction in purchase price is related to phasing of R&D expenditures between signing and closing of the acquisition. These are now expected to amount to around €60 million from closing until year-end 2017. All clinical studies for the product pipeline are on track.

The transaction is estimated to be EBITDA break-even in 2022. From 2023 onwards, the acquisition is expected to be significantly accretive to Group net income1 and Group EPS1.

The relevant antitrust authorities have approved the transaction without imposing conditions.

1 Net income attributable to shareholders of Fresenius SE & Co. KGaA

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius Kabi has successfully closed the acquisition of Merck KGaA’s biosimilars business. The transaction comprises the entire development pipeline of Merck’s biosimilars and an experienced team of employees located in Aubonne and Vevey, Switzerland. The product pipeline has a focus on oncology and autoimmune diseases, and addresses a market with current annual branded sales of around US$30bn. The biosimilars business will be consolidated as of September 1, 2017.

The purchase price of €656 million will be mainly cash flow financed. Thereof, €156 million have been paid upon closing. Up to €500 million are milestone payments strictly tied to achievements of development targets in the coming years. The slight reduction in purchase price is related to phasing of R&D expenditures between signing and closing of the acquisition. These are now expected to amount to around €60 million from closing until year-end 2017. All clinical studies for the product pipeline are on track.

The transaction is estimated to be EBITDA break-even in 2022. From 2023 onwards, the acquisition is expected to be significantly accretive to Group net income and Group EPS1.

The relevant antitrust authorities have approved the transaction without imposing conditions.

1 Net income attributable to shareholders of Fresenius SE & Co. KGaA

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

The amended 2013 Credit Agreement streamlines Fresenius’ financing structure by replacing the existing senior secured facilities with unsecured facilities. Concurrently, the guarantor structure was aligned, with Fresenius SE & Co KGaA now being sole guarantor. The Credit Agreement has an aggregate amount of approximately €3.8 billion and consists of revolving facilities and term loans with maturities in 2021 and 2022. The transaction was well received by investors and substantially oversubscribed. On the basis of the unsecured structure and consistent with the corporate credit rating of Fresenius, S&P has raised the rating of the Fresenius bonds to BBB- from BB+.