The United States District Court of the Eastern District of Texas on Wednesday issued a preliminary injunction prohibiting the Centers for Medicare and Medicaid Services (CMS) from implementing an interim rule that would seriously curtail the American Kidney Fund’s program for insurance premium assistance to dialysis patients.

In a joint lawsuit, dialysis providers, including Fresenius Medical Care, and the patient advocacy group Dialysis Patient Citizens have challenged the CMS’s interim rule on the grounds that it would disadvantage kidney failure patients compared with other patient groups.

The preliminary injunction follows the court’s granting of a temporary restraining order on January 12, 2017. The preliminary injunction is indefinite in duration and therefore will remain in effect as long as the court does not change it.

Fresenius Medical Care is the world's largest provider of products and services for individuals with renal diseases of which around 2.8 million patients worldwide regularly undergo dialysis treatment. Through its network of 3,579 dialysis clinics, Fresenius Medical Care provides dialysis treatments for 306,366 patients around the globe. Fresenius Medical Care is also the leading provider of dialysis products such as dialysis machines or dialyzers. Along with the core business, the company focuses on expanding the range of related medical services in the field of Care Coordination. Fresenius Medical Care is listed on the Frankfurt Stock Exchange (FME) and on the New York Stock Exchange (FMS).

For more information visit the Company’s website at www.freseniusmedicalcare.com.

Disclaimer

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius Medical Care, the world’s largest provider of dialysis products and services, today announced a leadership change in North America. William (Bill) Valle (56) has been appointed the new Chief Executive Officer (CEO) of North America, effective January 16, 2017. Bill Valle will succeed Ronald (Ron) Kuerbitz (57), who is joining agilon health as Chief Executive Officer. agilon health is a healthcare services and technology company formed in 2016 that partners with physicians to create value-based healthcare delivery systems.

“Fresenius Medical Care and agilon health share a vision for making healthcare more effective by empowering patients and caregivers with the administrative, technology and management resources that enable them to focus the right resources on the right patient at the right time and place although in different areas of the health care sector. That focus is essential to the transition from fee-for-service to value-based care – and is the path to better outcomes, better experiences and better economics for all participants in the system. I am very proud of the accomplishments of the remarkably capable and dedicated team at Fresenius Medical Care and I am thrilled to join an equally creative and dedicated team at agilon,” said Ron Kuerbitz, who will remain with the company until mid-February and will assist in the leadership transition during that time.

Bill Valle serves since 2014 as Executive Vice President responsible for the Dialysis Service Business of Fresenius Medical Care North America (FMCNA) – the largest business segment of the company as well as our Vascular Access business. In that position he was responsible for the successful management of more than 2,400 outpatient facilities and home programs and 1,400 inpatient programs across the United States and Puerto Rico. Approximately 187,000 dialysis patients receive life-sustaining dialysis therapy in these facilities.

Bill Valle joined FMCNA in 2009 with 22 years' experience in the dialysis industry, holding executive positions at several dialysis companies including Gambro Healthcare, Inc.

Before 2014 Bill Valle served as President of Fresenius Medical Care Integrated Renal Services. In that capacity, he oversaw Fresenius Vascular Care and our Services Business Development team, and also had responsibility for integrating our other key areas of provider operations, including the FreseniusRx pharmacy, Inpatient Services and Spectra Laboratories.

“I want to thank Ron for his many years of outstanding contributions – most notably his strong stewardship of our strategic shift toward building a coordinated care network for patients and we wish Ron all the best in his future endeavors” said Rice Powell, Chief Executive Officer of Fresenius Medical Care and Chairman of the Management Board. “I am incredibly proud of the world class executive and operations team we have assembled and the unparalleled care network we have built. Bill’s successful record and his extensive management experience within FMCNA and the health care field qualify him superbly for the position. I am confident he is the right leader for FMCNA as we continue to grow and integrate our businesses into a coordinated care network”.

Stephan Sturm, Chairman of the Supervisory Board of Fresenius Medical Care Management AG, said: “Bill Valle has made outstanding contributions to the success of Fresenius Medical Care over the years. With his excellent understanding of the strategic opportunities and challenges ahead of us, Bill’s leadership will ensure the continued success of the company”.

Fresenius Medical Care is the world's largest provider of products and services for individuals with renal diseases, of which around 2.8 million patients worldwide regularly undergo dialysis treatment. Through its network of 3,579 dialysis clinics, Fresenius Medical Care provides dialysis treatments for 306,366 patients around the globe. Fresenius Medical Care is also the leading provider of dialysis products such as dialysis machines or dialyzers. Along with the core business, the company focuses on expanding the range of additional medical services in the field of care coordination.

For more information about Fresenius Medical Care, visit the Company’s website at www.freseniusmedicalcare.com.

Disclaimer

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Following a hearing on Thursday, the United States District Court of the Eastern District of Texas has granted a temporary restraining order (TRO) requested by Dialysis Patients Citizens (a patient advocacy organization), Fresenius Medical Care, DaVita, and US Renal, with the support of the American Kidney Fund.

The TRO will remain effective until the earlier of January 26, 2017 or the date the court is able to conclude further proceedings and rule on the plaintiffs’ motion for a preliminary injunction. A hearing on the motion for preliminary injunction is scheduled for January 18, 2017.

The TRO request, and the underlying complaint, sought relief from the administration’s Interim Final Rule (IFR) that would constrain charitable contributions to the American Kidney Foundation and similar charitable organizations benefiting dialysis patients.

Fresenius Medical Care is the world's largest provider of products and services for individuals with renal diseases of which around 2.8 million patients worldwide regularly undergo dialysis treatment. Through its network of 3,579 dialysis clinics, Fresenius Medical Care provides dialysis treatments for 306,366 patients around the globe. Fresenius Medical Care is also the leading provider of dialysis products such as dialysis machines or dialyzers. Along with the core business, the company focuses on expanding the range of related medical services in the field of Care Coordination. Fresenius Medical Care is listed on the Frankfurt Stock Exchange (FME) and on the New York Stock Exchange (FMS).

For more information visit the Company’s website at www.freseniusmedicalcare.com.

Disclaimer

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius Medical Care Holdings, Inc. (FMCNA) has joined other United States dialysis providers and patient advocates in filing a lawsuit challenging the rulemaking process used by the United States Centers for Medicare and Medicaid Services (CMS) to promulgate a new regulation regarding premium assistance programs that help to fund health insurance premiums for U.S. patients with end stage renal disease (ESRD). Many financially needy Americans receive grants from nonprofit charities to help them obtain health insurance. For decades, the American Kidney Fund (AKF) has provided such premium assistance to ESRD patients, and we have supported their mission with charitable contributions made in accordance with guidelines established by the HHS Office of Inspector General.

The new regulation, which is scheduled to become effective on January 13, 2017, threatens to put an end to premium assistance for certain ESRD patients in the United States, including those who access individual market plan coverage both on and off the marketplace exchanges. The lawsuit describes how CMS promulgated this rule without providing patients, healthcare providers, issuers and the public the opportunity to review and comment, as required by law. If finalized, the rule will cause severe and immediate harm to those patients who are among the most vulnerable in society: individuals suffering from kidney failure, which is a life-threatening condition.

We joined this lawsuit to ensure that Americans with kidney failure have the same right as every other American to receive charitable assistance to pay their health insurance premiums. The issue before the Court is whether CMS engaged in a proper rulemaking process as required by the Administrative Procedures Act. While we are supportive of CMS’ efforts to preserve patient independence in making decisions about healthcare coverage, it is clear that the new regulation is not a thoughtful or well-reasoned step forward. Instead, it heightens the potential for discrimination by issuers against dialysis patients and it increases the potential for disruption in access to dialysis care by the neediest Americans. We are urging the Court to stay the effectiveness of the regulation so that CMS can engage in the deliberative and informed rulemaking as required by the Administrative Procedures Act. We have asked the Court to issue an order blocking this “midnight” regulation from taking effect days before the inauguration of the new U.S. President. While we cannot predict the outcome of litigation, we believe that our claims have merit.

The regulation, should it become effective, and the continuing efforts by insurers – through their discussions with CMS and otherwise – to reject premium assistance for ESRD patients in the United States, may result in a material adverse effect on our business. The factors that may impact the future use of premium assistance by FMCNA ESRD patients include (i) how the regulation is interpreted, (ii) the status of the regulation, (iii) federal regulatory, legislative and/or executive action, (iv) state regulatory, legislative and/or executive action, (v) the status of the Patient Protection and Affordable Care Act generally, including the viability of the marketplace exchanges, (vi) legal challenges to the regulation, its interpretation or application, and (vii) responses to the regulation by issuers, providers, and patients. Between 700 and 2,000 FMCNA ESRD patients who currently use premium assistance in connection with individual market plans on and off the exchanges may be impacted by the regulation and/or continuing insurer efforts to reject premium assistance, but that range could also be impacted materially by the above factors.

On January 3, 2017, FMCNA accepted service of a subpoena from the United States Attorney for the District of Massachusetts calling for the production of information related to the premium assistance program operated by the AKF. FMCNA is cooperating with this investigation.

Fresenius Medical Care is the world's largest provider of products and services for individuals with renal diseases of which around 2.8 million patients worldwide regularly undergo dialysis treatment. Through its network of 3,579 dialysis clinics, Fresenius Medical Care provides dialysis treatments for 306,366 patients around the globe. Fresenius Medical Care is also the leading provider of dialysis products such as dialysis machines or dialyzers. Along with the core business, the company focuses on expanding the range of related medical services in the field of Care Coordination. Fresenius Medical Care is listed on the Frankfurt Stock Exchange (FME) and on the New York Stock Exchange (FMS).

For more information visit the Company’s website at www.freseniusmedicalcare.com.

Disclaimer

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Dr. Dominik Heger will join Fresenius Medical Care, the world’s largest provider of dialysis products and services, as Senior Vice President and Head of Investor Relations and Corporate Communications effective January 5, 2017. Reporting to Chief Executive Officer Rice Powell, he succeeds Oliver Maier, who after serving Fresenius Medical Care for nearly 17 years will leave the Company at his own request at the end of February 2017 in order to pursue a new opportunity.

Dominik Heger joins Fresenius Medical Care from Linde AG, one of the leading industrial gases and engineering companies in the world, with approximately 65,000 employees working in more than 100 countries worldwide also listed in the German DAX index where he headed the Investor Relations department since 2011. Prior to that, Dominik held various positions at the Linde Group from 2003-2010 among which he headed the procurement department for Germany, Austria and Switzerland. Dominik also spent several years in the Engineering Division as commercial manager for the Middle East and India.

Dominik Heger studied business administration at the Ludwig-Maximilian University (LMU) in Munich and at the University of Chicago (GSB) receiving his doctorate degree in business administration in 2003.

"We wish to thank Oliver Maier for so many years of outstanding commitment to Fresenius Medical Care. Oliver has been instrumental in raising the profile of our company to today's very high level and contributed considerably to the corporate success. We wish Oliver all the best in his future endeavors", commented Rice Powell, Chief Executive Officer of Fresenius Medical Care. "At the same time, we are extremely happy that we have gained with Dominik Heger a highly experienced and competent capital markets expert as successor for this important corporate function in our company. We wish him a good start and every success in his new role."

Note to the media: Photos of Dr. Dominik Heger and Oliver Maier for editorial use can be requested from Corporate Communications: matthias.link@fresenius.com

Fresenius Medical Care is the world's largest provider of products and services for individuals with renal diseases of which around 2.8 million patients worldwide regularly undergo dialysis treatment. Through its network of 3,579 dialysis clinics, Fresenius Medical Care provides dialysis treatments for 306,366 patients around the globe. Fresenius Medical Care is also the leading provider of dialysis products such as dialysis machines or dialyzers. Along with the core business, the company focuses on expanding the range of related medical services in the field of Care Coordination. Fresenius Medical Care is listed on the Frankfurt Stock Exchange (FME) and on the New York Stock Exchange (FMS).

For more information visit the Company’s website at www.freseniusmedicalcare.com.

Disclaimer

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius Medical Care AG & Co. KGaA will focus its reporting on financial statements in accordance with International Financial Reporting Standards (IFRS) in Euro currency starting with the 2017 fiscal year on January 1, 2017. The company will then no longer provide U.S. GAAP financial information.

Fresenius Medical Care AG & Co. KGaA, as a publicly traded company based in a European Union member country, is required to prepare and publish its consolidated financial statements in accordance with IFRS in Euro, pursuant to Section 315a of the German Commercial Code (HGB).

In addition to this compulsory IFRS accounting, Fresenius Medical Care AG & Co. KGaA was required to publish consolidated U.S. GAAP financial statements by its so called Pooling Agreement. However, an amendment to this pooling agreement was approved at the 2016 Annual General Meeting of Fresenius Medical Care AG & Co. KGaA. This amendment allows for the preparation and reporting of financial statements under U.S. GAAP or IFRS to the Securities and Exchange Commission. In the interest of streamlining the management and accounting, Fresenius Medical Care Group will concentrate its reporting, including its filings with the U.S. Securities and Exchange Commission, on financial statements in accordance with IFRS starting with the 2017 fiscal year on January 1, 2017.

For fiscal year 2016, Fresenius Medical Care AG & Co. KGaA will, as in past years, provide both U.S. GAAP and IFRS consolidated financial statements.

The discontinuation of U.S. GAAP reporting will not affect the sponsored Level 2 American Depositary Receipt (ADR) program of Fresenius Medical Care AG & Co. KGaA in the United States. The ADRs will continue to trade under the FMS US ticker on the New York Stock Exchange.

Past reporting showed only limited differences between the consolidated U.S. GAAP and IFRS accounts of Fresenius Medical Care AG & Co. KGaA. We provide historic IFRS figures and a currency reconciliation for Fresenius Medical Care on our Investor Relations website.

Fresenius Medical Care is the world's largest provider of products and services for individuals with renal diseases of which around 2.8 million patients worldwide regularly undergo dialysis treatment. Through its network of 3,579 dialysis clinics, Fresenius Medical Care provides dialysis treatments for 306,366 patients around the globe. Fresenius Medical Care is also the leading provider of dialysis products such as dialysis machines or dialyzers. Along with the core business, the company focuses on expanding the range of related medical services in the field of Care Coordination. Fresenius Medical Care is listed on the Frankfurt Stock Exchange (FME) and on the New York Stock Exchange (FMS).

For more information visit the Company’s website at www.freseniusmedicalcare.com.

Disclaimer

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

- Group revenue +9% (+9% at constant currency), driven by a strong performance in Health Care services

- EBIT growth in line with revenue growth, supported by very good development in Latin America and Asia-Pacific

- Significant net income growth of 27% (+17% excluding special items1)

- Care Coordination with positive growth momentum (revenue +29%) and improved sequential margin of 5% (+60 basis points) in line with expectations

- Full year 2016 guidance confirmed

Key figures - third quarter 2016

| $ million | Q3 2016 | Q3 2015 | |

| Net revenue | 4,598 | 4,231 | +9% |

| Operating income (EBIT) | 670 | 614 | +9% |

| Net income2 | 333 | 262 | +27% |

| Net income (excl. special items)1,2 | 333 | 284 | +17% |

| Basic earnings per share (in $) | 1.09 | 0.86 | +26% |

Key figures – first nine months 2016

| $ million | 9m 2016 | 9m 2015 | |

| Net revenue | 13,224 | 12,390 | +7% |

| Operating income (EBIT) | 1,851 | 1,665 | +11% |

| Net income2 | 855 | 713 | +20% |

| Net income (excl. special items)1,2 | 855 | 735 | +16% |

| Basic earnings per share (in $) | 2.80 | 2.34 | +19% |

“We are very pleased with our performance in the third quarter of 2016, which is the result of a strong execution in all regions, the success of our Global Efficiency Program as well as further expansion of our global footprint,” said Rice Powell, Chief Executive Officer of Fresenius Medical Care. “Care Coordination services maintain excellent growth momentum which will help us to extend our range of health care services even further. Based on our strong result for the third quarter, we hereby confirm our guidance for the full-year 2016.”

Revenue & earnings

Net revenue for the third quarter improved by 9% and reached $4,598 million (+9% at constant currency), mainly driven by a strong performance in Health Care services. Contributing revenues of $3,734 (+10%), Health Care services was largely supported by an improvement in US revenue per treatment (+$3) as well as a strong organic growth. Dialysis products revenue increased by 4% to $864 million in the third quarter, mainly driven by higher sales of machines, dialyzers and products for acute care.

Net revenue in the first nine months of 2016 increased by 7% (Health Care services revenue +8%/+9% at constant currency; dialysis products revenue +2%/+4% at constant currency).

In the third quarter, operating income (EBIT) increased by 9% to $670 million, in line with revenue growth. The operating income margin increased by 10 basis points to 14.6%, underlining a stable earnings quality. The increase in EBIT margin was mainly driven by the positive development in Latin America after the divestiture of our dialysis service business in Venezuela in the previous year’s third quarter as well as a strong performance in Asia-Pacific. The EBIT margin in North America was impacted by higher personnel expenses for dialysis services, partially offset by lower costs for health care supplies and a higher volume with commercial payers.

For the first nine months of 2016, operating income (EBIT) increased by 11% to $1,851 million.

Net interest expense in the third quarter remained at the previous year’s level ($100 million). For the first nine months of 2016, net interest expense increased by 1% to $308 million, mainly due to lower interest income as a result of the repayment of interest bearing notes receivables in the fourth quarter of 2015, partially offset by a lower debt level.

Income tax expense decreased by 2% to $164 million in the third quarter. This translates into an effective tax rate of 28.8%, a decrease of 400 basis points compared to the third quarter of 2015 (32.8%). This decrease was mainly driven by a lower tax expense as a result of released tax liabilities in the third quarter of 2016 due to tax audit settlements with tax authorities, as well as a favorable impact from the prior-year non-tax deductible loss from the divestiture of our dialysis service business in Venezuela.

For the first nine months of 2016, income tax expense increased to $471 million, translating into an effective tax rate of 30.5% (-190 basis points).

Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA increased by 27% to $333 million in the third quarter. Excluding the 2015 impacts of (i) the after tax loss, $26.9 million, from the divestment of our dialysis service business in Venezuela and (ii) the realized portion of the after tax gain, $4.8 million, from the sale of our European marketing rights for certain renal pharmaceuticals to our joint venture, Vifor Fresenius Medical Care Renal Pharma, net income increased from $284 million to $333 million (+17%) in the third quarter. Based on approximately 306.0 million shares (weighted average number of shares outstanding), basic earnings per share (EPS) increased from $0.86 to $1.09 (+26%); EPS excluding special items increased from $0.93 to $1.09 (+17%).

For the first nine months of 2016, net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA increased by 20% to $855 million.

Segment development

In the third quarter, North America revenue increased by 10% to $3,300 million (72% of total revenue). Health Care services revenue grew by 10% to $3,068 million, of which Care Coordination contributed $618 million (+29%), supported by significant organic revenue growth of 24%. Dialysis care revenue contributed $2,450 million (+6%), driven by increased revenue per treatment and higher volumes of dialysis treatments with commercial payers. Dialysis products revenue grew by 7% to $232 million, due to increased product sales (especially machines and dialyzers). Operating income in North America came in at $536 million (+4%). The operating income margin of 16.2% was in line with the second quarter of 2016, but weaker than the previous year’s third quarter ( 90 basis points). This decline was mainly attributable to higher personnel expenses, a cost impact related to the vesting of long term incentive plan grants and growth in lower-margin Care Coordination, partially offset by lower cost for health care supplies. The operating income margin in Care Coordination came in at 5.0%, an increase of 60 basis points over the second quarter 2016, but below the previous year’s third quarter margin of 6.8%.

For the first nine months of 2016, North America revenue increased by 9% to $9,512 million. Operating income increased by 16% to $1,486 million.

EMEA revenue increased by 2% to $675 million in the third quarter of 2016 (+4% at constant currency). Health Care services revenue for the EMEA segment increased by 8% (+10% at constant currency) to $335 million. This was mainly the result of contributions from acquisitions (8%), partially offset by the negative effect of exchange rate fluctuations (2%). Dialysis treatments increased by 9% in the third quarter. Dialysis products revenue decreased by 3% (-1% at constant currency) to $340 million. The decrease was driven by lower sales of renal drugs (whose marketing rights were sold in 2015) and dialyzers, partially offset by higher sales of machines and bloodlines. Operating income in the EMEA segment decreased by 4% to $125 million in the third quarter due to the prior-year impact from the gain resulting from the sale of European marketing rights for certain renal pharmaceuticals, an unfavorable impact from manufacturing costs as well as higher bad debt expense. This was partially offset by favorable foreign exchange effects. The operating income margin decreased to 18.5% ( 120 basis points).

For the first nine months of 2016, EMEA revenue increased by 1% to $1,982 million (+4% at constant currency) and operating income decreased by 3% to $395 million.

Asia-Pacific revenue grew by 13% (+8% at constant currency) to $427 million in the third quarter. The region recorded $192 million in Health Care services revenue, based on an increase of 5% in dialysis treatments. With an 11% growth in revenue to $235 million (+12% at constant currency), the product business showed an excellent sales performance across the entire dialysis products range. Operating income showed a significant increase (+25%) to $85 million. The operating income margin increased substantially to 19.8% (+190 basis points). This was primarily driven by the positive impact from overall business growth and favorable foreign exchange effects.

For the first nine months of 2016, Asia-Pacific revenue grew by 8% to $1,198 million (+8% at constant currency) and operating income increased by 3% to $225 million.

Latin America delivered revenue of $192 million, an increase of 9% and an impressive improvement of 27% at constant currency. Health Care services revenue increased by 6% to $139 million (+31% at constant currency) as a result of higher organic revenue per treatment primarily driven by a retrospective reimbursement rate increase, contributions from acquisitions and growth in same market treatments, partially offset by the effect of the divested dialysis care business in Venezuela. Dialysis treatments increased by 1% in the third quarter. Dialysis products revenue increased by 19% to $53 million (+18% at constant currency), as a result of higher sales of dialyzers, concentrates and bloodlines. Operating income came in at $20 million supported by the impact from higher revenue in the region, partially offset by unfavorable foreign currency effects and higher costs mainly related to inflation. The operating margin increased to 10.5%.

For the first nine months of 2016, Latin America revenue decreased by 10% to $520 million (+13% at constant currency) and operating income increased by 86% to $47 million.

Cash flow

In the third quarter of 2016, the company generated $439 million in net cash provided by operating activities, representing 9.5% of revenue ($579 million in the third quarter of 2015). The decrease was primarily attributable to a discretionary cash contribution of $100 million to Fresenius Medical Care’s pension plan assets in the United States. The number of DSO (days sales outstanding) came in at 72 days, an increase of 2 days compared to the second quarter of 2016.

In the first nine months of 2016, the company generated net cash provided by operating activities of $1,296 million, representing 9.8% of revenue.

Employees

As of September 30, 2016, Fresenius Medical Care had 108,851 employees (full-time equivalents) worldwide, compared to 102,591 employees at the end of September 2015. This increase of 6% was primarily attributable to our continued organic growth.

Recent events: Acquisition of Sandor Nephro Services in India

In September 2016, Fresenius Medical Care acquired 85% of equity interest in the Indian dialysis group Sandor Nephro Services from a group of investors. Established in 2011, Sandor Nephro Services is India’s second largest dialysis care provider. Under the brand name “Sparsh Nephrocare” the company operates a network of more than 50 dialysis centers across the country. With the acquisition, Fresenius Medical Care has clearly strengthened its core business in one of the fastest growing economies of the world. Sandor Nephro Services is expected to generate revenue of around $3 million in full year 2016. Fresenius Medical Care expects the investment to be accretive in 2017 on earnings after tax.

Outlook 2016 confirmed

Based on the positive business development in the first nine months 2016, Fresenius Medical Care confirms its full year outlook 2016. The company expects a currency-adjusted revenue growth between +7% and +10% for 2016. Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA is expected to increase by +15% to +20% over the previous year.

Conference call

Fresenius Medical Care will hold a conference call to discuss the results of the third quarter & first nine months 2016 on Thursday, October 27, 2016 at 3.30 p.m. CEDT/ 9.30 a.m. EDT. The company invites investors to follow the live webcast of the call at the company’s website www.freseniusmedicalcare.com in the “Investors/Events” section. A replay will be available shortly after the call.

Please refer to the PDF document for a complete overview of the results for the third quarter and first nine months of 2016.

12015 basis adjusted for special items (net income effect): divestiture of dialysis service business in Venezuela (-$27m), sale of European marketing rights for certain renal pharmaceuticals (+$5m)

2Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

Fresenius Medical Care is the world's largest provider of products and services for individuals with renal diseases of which around 2.8 million patients worldwide regularly undergo dialysis treatment. Through its network of 3,579 dialysis clinics, Fresenius Medical Care provides dialysis treatments for 306,366 patients around the globe. Fresenius Medical Care is also the leading provider of dialysis products such as dialysis machines or dialyzers. Along with the core business, the company focuses on expanding the range of related medical services in the field of Care Coordination. Fresenius Medical Care is listed on the Frankfurt Stock Exchange (FME) and on the New York Stock Exchange (FMS).

For more information visit the Company’s website at www.freseniusmedicalcare.com.

Disclaimer

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius Medical Care, the world’s largest provider of dialysis products and services, is celebrating its 20th anniversary. The company, founded in 1996 when Fresenius merged its dialysis business with the U.S.-based dialysis services provider National Medical Care, now has more than 100,000 employees, operates approximately 3,500 dialysis clinics in over 45 countries, and treats some 300,000 patients. Every 0.7 seconds Fresenius Medical Care starts a dialysis treatment for a patient somewhere in the world. Over the past 20 years the number of patients under treatment in the company’s dialysis clinics has more than quintupled while the production of dialysis filters (dialyzers) has increased ten-fold, earnings more than eleven-fold, and sales almost twelve-fold.

The start of this success story dates back to the 1960s, when Fresenius began importing dialysis machines and dialyzers made by different companies and distributing them in Germany, gaining significant market share. The company launched its own dialysis machine in 1979 – the A2008, which became the world's top seller. Fresenius Medical Care subsequently expanded this market-leading position with successor models, and now produces more than half of all the dialysis machines sold in the world. In the early 1980s the company developed the first dialysis filters out of polysulfone, opening up a new era in the treatment of kidney disease: Dialyzers made from polysulfone are especially effective at cleaning the patient’s blood, and remain the industry standard today.

Success in dialysis products ultimately paved the way for the entry into dialysis services, which came in 1996, when Fresenius acquired National Medical Care and combined it with its own dialysis business to give birth to Fresenius Medical Care. The new company was listed on the Frankfurt and New York exchanges that year, and joined Germany’s benchmark DAX index in 1999.

Since its founding, Fresenius Medical Care has been the world’s leading provider of products and services for people with chronic kidney failure. The company has steadily strengthened this position as it consistently set new milestones: In 1999, the 100,000th dialysis machine was produced at the company’s Schweinfurt, Germany plant. In 2003, for the first time, the company treated more than 100,000 patients and made over 50 million dialyzers in a single year. Its 500 millionth dialyzer was produced in 2007 and, in 2013, its billionth. The year before, the 500,000th Fresenius Medical Care dialysis machine had come off the assembly line in Schweinfurt.

The company is constantly improving dialysis technology and introducing new, innovative treatment concepts. Earlier this year it launched the latest generation in hemodialysis machines, the 6008 CAREsystem, which delivers the highest therapy standards while optimizing dialysis treatment and improving economic efficiency.

A number of major strategic acquisitions over the years have contributed to Fresenius Medical Care’s strong growth. The company acquired Renal Care Group, the third-largest operator of dialysis centers in the United States, in 2006, followed by the purchase of another major U.S. dialysis center operator, Liberty Dialysis, in 2011. That same year, the acquisition of Euromedic significantly expanded Fresenius Medical Care’s presence in Central and Eastern Europe.

Fresenius Medical Care expects continued strong growth, with annual sales forecast to increase from $16.7 billion in 2015 to $28 billion in 2020. The company expects that, along with continued strong growth in its core business of dialysis products and the treatment of dialysis patients, dialysis-related medical services will contribute to achieving this target. These services include the provision of vascular access as well as in-patient and acute care by specialist physicians.

Rice Powell, Chief Executive Officer of Fresenius Medical Care, said: “We are committed to enhancing the quality of life of people suffering from kidney disease. Achieving advances in dialysis by providing our patients with innovative therapies and the best possible products has been our motivation for 20 years, and it remains so today. We are in an outstanding position to continue Fresenius Medical Care’s unique success story in the coming years.”

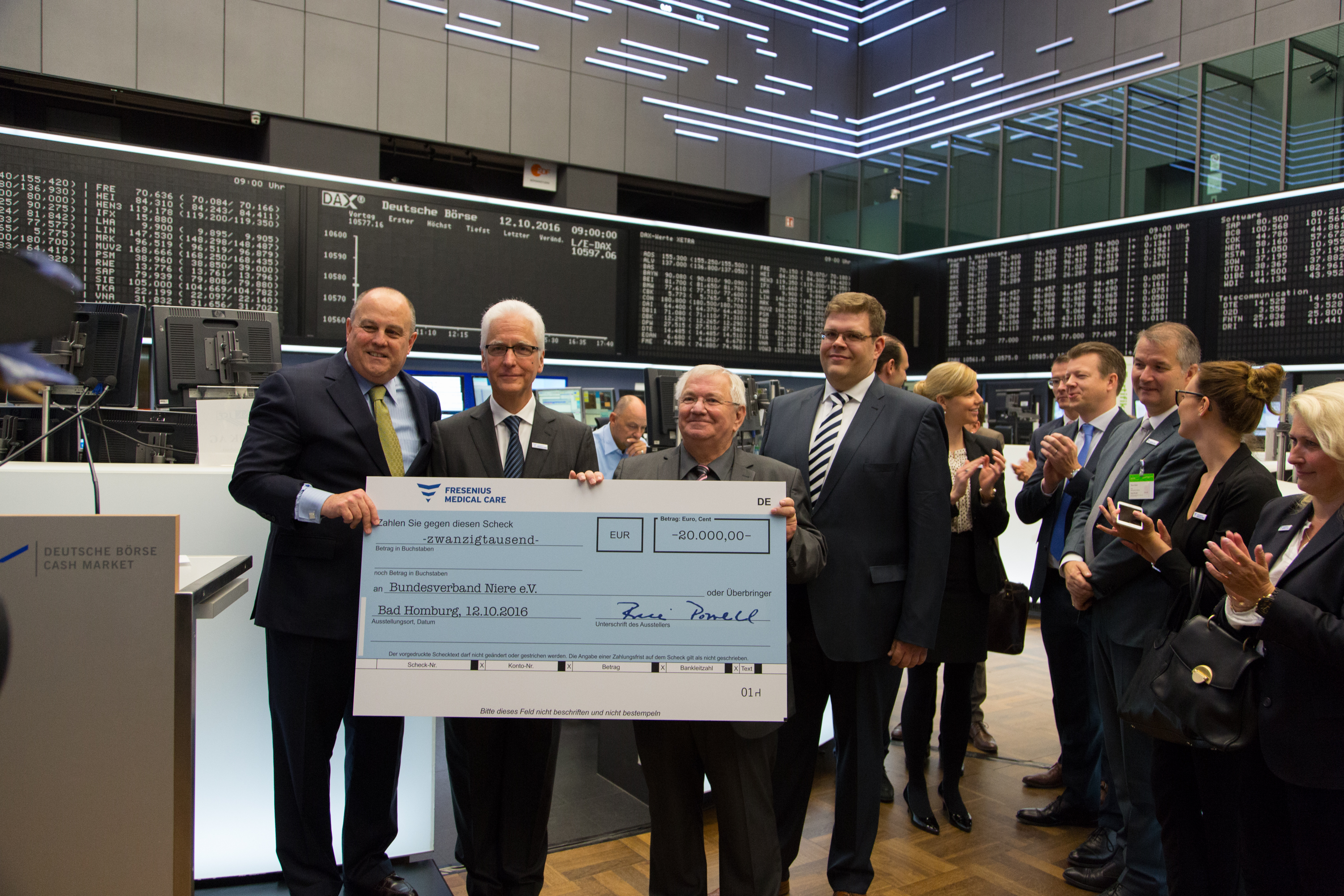

To mark 20 years since the founding of Fresenius Medical Care and the company’s listing on the stock exchange, Rice Powell will ring in the start of the Frankfurt Stock Exchange’s daily trading on October 12. Immediately after, he will present a €20,000 donation to “Bundesverband Niere,” a German charity that works to improve the lives of chronic kidney disease patients. The event can be seen live on the Internet at 8:50 a.m. under the following link: https://youtu.be/yjkSYGORuwo (Replay)

Message to Editors: An electronic press kit on the 20th anniversary of Fresenius Medical Care, containing texts, photos and videos for editorial use can be found under:

http://www.freseniusmedicalcare.com/en/media-center/events/20-years-fresenius-medical-care/

Fresenius Medical Care is the world's largest provider of products and services for individuals with renal diseases of which about 2.8 million patients worldwide regularly undergo dialysis treatment. Through its network of 3,504 dialysis clinics, Fresenius Medical Care provides dialysis treatments for 301,548 patients around the globe. Fresenius Medical Care is also the leading provider of dialysis products such as dialysis machines or dialyzers. Along with the core business, the company focuses on expanding the range of related medical services in the field of Care Coordination. Fresenius Medical Care is listed on the Frankfurt Stock Exchange (FME) and on the New York Stock Exchange (FMS).

For more information visit the Company’s website at www.freseniusmedicalcare.com.

Disclaimer

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius Medical Care, the world’s largest provider of dialysis products and services, today announced to acquire 85% of equity interest in Indian dialysis group Sandor Nephro Services from a group of investors. The parties involved agreed not to disclose financial terms of the transaction.

Established in 2011, Sandor Nephro Services is India’s second largest dialysis care provider. Under the brand name “Sparsh Nephrocare” the company operates a network of more than 50 dialysis centers across the country. With the acquisition, Fresenius Medical Care will clearly strengthen its core business in one of the fastest growing economies of the world.

Sandor Nephro Services is expected to generate revenue of around $3 million in full year 2016. Fresenius Medical Care expects the investment to be accretive in 2017 on earnings after tax.

India’s economy is characterized by a rising middle class and a healthcare spending which grows at an average rate of 12% per year. According to estimates, within India’s population of around 1.3 billion people, there are about 1 million people suffering from chronic kidney disease. A major part of this patient base still has no sufficient access to dialysis treatments.

Rice Powell, Chief Executive Officer of Fresenius Medical Care, said: “With the acquisition of Sandor Nephro Services we will reach a new scale in the dialysis business in India. We have been in India for more than 15 years primarily with our product portfolio and we are now taking the next important step. This is a unique opportunity to become one of the major players in a market where we expect a strong growth in the overall economy and where we will help treating chronically ill dialysis patients.”

“We are very pleased to join the Fresenius Medical Care Group. After building up one of the most successful dialysis chains in India, we now have a strong partner on our side to further grow the business,” said Saurav Panda who co-founded Sparsh Nephrocare together with Gaurav Porwal. Both committed themselves to stay with the company for at least three years.

Fresenius Medical Care is the world's largest provider of products and services for individuals with renal diseases of which about 2.8 million patients worldwide regularly undergo dialysis treatment. Through its network of 3,504 dialysis clinics, Fresenius Medical Care provides dialysis treatments for 301,548 patients around the globe. Fresenius Medical Care is also the leading provider of dialysis products such as dialysis machines or dialyzers. Along with the core business, the company focuses on expanding the range of related medical services in the field of Care Coordination. Fresenius Medical Care is listed on the Frankfurt Stock Exchange (FME) and on the New York Stock Exchange (FMS).

For more information visit the Company’s website at www.freseniusmedicalcare.com.

Disclaimer

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

- Group revenue +5% (+7% at constant currency), driven by very good results in health care services

- Considerable net income growth of 22%, supported by lower costs for health care supplies and Global Efficiency Program

- Strong operating performance in North America: revenue +8%, operating income (EBIT) +20%

- Care Coordination maintains significant revenue growth (+21%) and continues to invest in infrastructure

- Fresenius Medical Care on track to achieve full year guidance

Key figures – second quarter 2016

Net revenue: $4,420 million, +5 %

Operating income: (EBIT) $641 million, +17 %

Net income1: $294 million, +22 %

Basic earnings per share: $0.96, +22 %

Key figures – first half 2016

Net revenue: $8,626 million, +6 %

Operating income (EBIT): $1,181million, +12 %

Net income1: $522 million, +16 %

Basic earnings per share: $1.71, +15 %

1 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

“Following a solid start to the year, we have accelerated our growth in the second quarter”, said Rice Powell, Chief Executive Officer of Fresenius Medical Care. “Our strong earnings growth demonstrates our ability to further improve our cost base and the success of our Global Efficiency Program. I am extremely pleased with our excellent operational performance in the core dialysis services business. Care Coordination maintains strong topline growth and we continue to invest in the infrastructure of this business. Despite unfavorable foreign currency developments and continuous cost pressure, we are confident we will achieve our full year guidance.”

Revenue & earnings

Net revenue for the second quarter improved by 5% and reached $4,420 million (+7% at constant currency), driven by very good health care services revenue growth in North America. Health care services revenue increased by 7% to $3,571 million, mainly due to organic revenue growth. Dialysis products revenue decreased by 1% to $849 million in the second quarter, impacted by negative currency developments (+2% at constant currency) and compared to an exceptionally strong performance in the previous year’s second quarter. The revenue increase at constant exchange rates was driven by higher sales of dialyzers and machines.

Net revenue in the first half of 2016 increased by 6% (health care services revenue +7%/+9% at constant currency; dialysis products revenue +1%/+4% at constant currency).

In the second quarter, operating income (EBIT) increased by 17% to $641 million. The operating income margin increased to 14.5%, due to strong operating performance across all segments. The increase in North America was supported by lower costs for health care supplies and a favorable impact from higher volume with commercial payors. This was partially offset by higher personnel expenses related to dialysis services in the North America segment. The increase in the Asia-Pacific segment was driven by favorable exchange rate effects and higher business growth.

For the first half of 2016, operating income (EBIT) increased by 12% to $1,181 million.

Net interest expense in the second quarter remained at the previous year’s level ($102 million). For the first half of 2016, net interest expense increased by 2% to $208 million.

Income tax expense increased to $169 million in the second quarter. This translates into an effective tax rate of 31.3%, an increase of 90 basis points compared to Q2 2015 (30.4%). This increase was mainly driven by a relative to income before taxes lower increase of tax-free income attributable to noncontrolling interests.

For the first half of 2016, tax expense increased to $306 million, translating into an effective tax rate of 31.5% (-70 basis points).

Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA increased by 22% to $294 million in the second quarter, mainly driven by the strong performance of the North America segment. Based on approximately 305.5 million shares (weighted average number of shares outstanding), basic earnings per share (EPS) increased accordingly to $0.96 (+22%), compared to $0.79 in the previous year’s second quarter.

For the first half of 2016, net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA increasead by 16% to $522 million.

Segment development

In the second quarter, North America revenue increased by 8% to $3,168 million (72% of total revenue). Health care services revenue grew by 8% to $2,938 million, of which Care Coordination contributed $564 million (+21%), supported by considerable organic revenue growth of 17%. Dialysis care revenue contributed $2,374 million (+5%), driven by growth in dialysis treatments and increases in revenue per treatment. Dialysis products revenue grew by 2% to $230 million, due to increased product sales (especially machines and dialyzers). Operating income in North America came in at $513 million (+20%). The substantially improved operating income margin of 16.2% (+170 basis points) was attributable to lower costs for health care supplies, a favorable impact from commercial payors, lower legal expenses and increased income from equity method investees. This was partially offset by higher personnel expenses related to dialysis services and a lower margin in Care Coordination. The margin decrease in Care Coordination was driven by increased costs for hospitalist and intensivist services due to further infrastructure development, partially offset by one-time gains from the endovascular and cardiovascular services business.

For the first half of 2016, North America revenue increased by 9% to $6,212 million. Operating income increased by 24% to $949 million.

EMEA revenue increased by 1% to $676 million in the second quarter of 2016 (+3% at constant currency). Health care services revenue for the EMEA segment increased by 7% (+9% at constant curreny) to $331 million. This was the result of contributions from acquisitions (7%) and organic revenue growth (3%), partially offset by the negative effect of exchange rate fluctuations (2%) and the effect of closed or sold clinics (1%). Dialysis treatments increased by 9% in the second quarter. Dialysis products revenue decreased by 4% (-3% at constant currency) to $345 million. The decrease was driven by lower sales of dialyzers, machines, renal pharmaceuticals and bloodlines, partially offset by higher sales of products for acute care treatments and peritoneal dialysis products. Operating income in the EMEA segment increased by 4% to $139 million in the second quarter, due to favorable foreign exchange effects and a positive impact from manufacturing driven by higher volumes and production efficiencies. The operating income margin increased to 20.6% (+50 basis points).

For the first half of 2016, EMEA revenue increased by 1% to $1,307 million and operating income decreased by 2% to $269 million.

Asia-Pacific revenue grew by 5% (+6% at constant currency) to $397 million in the second quarter. The region recorded $177 million in health care services revenue, based on an increase of 4% in dialysis treatments. With a 4% growth in revenue to $220 million (+9% at constant currency), the product business showed a very good sales performance across the entire dialysis products range. Operating income showed a strong increase (+12%) to $75 million. The operating income margin increased to 18.9% (+110 basis points). This was driven by favorable foreign currency effects and the positive underlying business performance, in particular in China and India.

For the first half of 2016, Asia-Pacific revenue grew by 6% to $771 million (+8% at constant currency) and operating income decreased by 8% to $140 million.

Latin America delivered revenue of $175 million, a decrease of 14% and an improvement of 9% at constant currency. Health care services revenue decreased by 17% to $125 million (+9% at constant currency) as a result of negative foreign currency effects and the effect of closed or sold clinics (mainly in Venezuela). Dialysis treatments decreased accordingly by 7% in the second quarter. This was partially offset by the strong organic revenue growth of 19%. Dialysis products revenue decreased by 5% to $50 million (+8% at constant currency). The 8% increase at constant curreny was driven by higher sales of dialyzers, hemodialysis solutions and concentrates, machines and bloodlines, partially offset by lower sales of peritoneal dialysis products. Operating income came in at $16 million (+4%) with the operating margin increasing to 9.3%. The margin increase was primarily driven by favorable foreign exchange effects.

For the first half of 2016, Latin America revenue decreased by 18% to $328 million (+7% at constant currency) and operating income decreased by 19% to $27 million.

Cash flow

In the second quarter of 2016, the company generated $678 million in net cash provided by operating activities, representing 15.3% of revenue ($385 million in Q2 2015). The strong increase was primarily driven by an adjustment during the first quarter which impacted invoicing and was largely resolved during the second quarter. In addition, the timing of working capital items and higher earnings had a positive effect on cash flow. These effects were partially offset by higher income tax payments. The number of DSO (days sales outstanding) came in at 70 days, a reduction of 4 days compared to the first quarter of 2016.

In the first half of 2016, the company generated net cash provided by operating activities of $857 million, representing 9.9% of revenue.

Employees

As of June 30, 2016, Fresenius Medical Care had 106,556 employees (full-time equivalents) worldwide, compared to 102,893 employees at the end of June 2015. This increase was attributable to our continued organic growth.

Recent events: 6008 CAREsystem

In May 2016, Fresenius Medical Care launched the 6008 CAREsystem, a new innovative hemodialysis therapy system enabling better care for chronic patients. To enable significantly reduced complexity in therapy delivery, the system uses a new, all-in-one disposable with completely pre-connected bloodlines for all treatment modalities. More than 150,000 treatments have already been performed with the system.

Outlook 2016 confirmed

Based on the positive business development in the first half of 2016, Fresenius Medical Care confirms its full year outlook 2016. The company expects a currency-adjusted revenue growth between +7% and +10% for 2016. Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA is expected to increase by +15% to +20% over the previous year.

Conference call

Fresenius Medical Care will hold a conference call to discuss the results of the second quarter/first half 2016 on Tuesday, August 2, 2016 at 3.30 p.m. CEDT/ 9.30 a.m. EDT. The company invites investors to follow the live webcast of the call at the company’s website www.freseniusmedicalcare.com in the “Investors/Events” section. A replay will be available shortly after the call.

Please refer to the attachments for a complete overview of the results for the second quarter and first half of 2016.

Fresenius Medical Care is the world's largest provider of products and services for individuals with renal diseases of which about 2.8 million patients worldwide regularly undergo dialysis treatment. Through its network of 3,504 dialysis clinics, Fresenius Medical Care provides dialysis treatments for 301,548 patients around the globe. Fresenius Medical Care is also the leading provider of dialysis products such as dialysis machines or dialyzers. Along with the core business, the company focuses on expanding the range of related medical services in the field of Care Coordination. Fresenius Medical Care is listed on the Frankfurt Stock Exchange (FME) and on the New York Stock Exchange (FMS).

For more information visit the Company’s website at www.freseniusmedicalcare.com.

Disclaimer

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.