November 2, 2021

Fresenius Medical Care confirms outlook for 2021 while considering the continued negative impact of COVID-19

- Stronger than projected headwind from COVID-19 effects with significantly increased patient excess mortality due to global spread of Delta variant

- Organic growth continued with 1%

- Financial targets for FY 2021 confirmed, expectation to reach lower end of the guidance ranges for revenue and net income

- FME25 transformation update to achieve EUR 500 million savings by 2025

Rice Powell, Chief Executive Officer of Fresenius Medical Care, said: “The COVID-19 pandemic is an unprecedented situation for all of us and still costs many lives day by day. The existence of the Delta variant has caused excess mortality among our patients to rise again in the third quarter. This means that we must absorb a sizably larger COVID-19 effect on our business than we projected at the beginning of the year and, at the same time, manage through an increasingly inflationary cost environment. Against this backdrop, we now expect to reach the lower end of our guidance ranges for both revenue and net income.”

Spread of Delta variant caused resurgence of excess mortality

As a result of the global spread of the Delta variant, COVID-19-related incremental excess mortality3 among Fresenius Medical Care’s patients has increased again to around 2,700 in the third quarter of 2021 (Q1 2021: ~3,200; Q2 2021: ~1,900). Thus, excess mortality amounted to approximately 11,500 patients in the past 12 months (as of September 30, 2021) and approximately 18,200 since the start of the pandemic.

The increase in excess mortality in the third quarter has led to a more negative impact on Fresenius Medical Care’s growth compared to the second quarter. The overall adverse effect of accumulated COVID-19-related excess mortality on organic growth in the Health Care Services business amounted to around 390 basis points in the third quarter and 330 basis points in the first nine months of 2021.

At the end of the third quarter, approximately 78% of Fresenius Medical Care’s patients in the U.S. had received at least one dose of COVID-19 vaccine. Also on a global basis, approximately 78% of Fresenius Medical Care’s patients have received at least one vaccination.

1 Costs related to the FME25 program

2 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

3 Historical excess mortality updated for late entries

Outlook

When giving guidance in February 2021, Fresenius Medical Care assumed an accumulation of COVID-19-related excess mortality in the first half and a return to normal mortality patterns in the second half of the year. The continued and increasing presence of COVID-19 has led to a significant increase in excess mortality in the third quarter which was not included in the Company’s outlook for 2021. Due to decreasing infection rates since the end of the third quarter, the Company is now projecting excess mortality to decline in the fourth quarter.

Based on Fresenius Medical Care’s current projections, the Company confirms its outlook for revenue to grow at a low- to mid-single digit percentage rate and net income to decline at a high-teens to mid-twenties percentage rate against the 2020 base and is now expecting to be at the lower end of these guidance ranges.4

4 These targets are based on the 2020 results excluding the impairment of goodwill and trade names in the Latin America Segment of EUR 195 million. They are inclusive of anticipated COVID-19 effects, in constant currency and exclude special items. Special items include costs related to FME25 and other effects that are unusual in nature and have not been foreseeable or not foreseeable in size or impact at the time of giving guidance.

Revenue and earnings development affected by COVID-19 pandemic

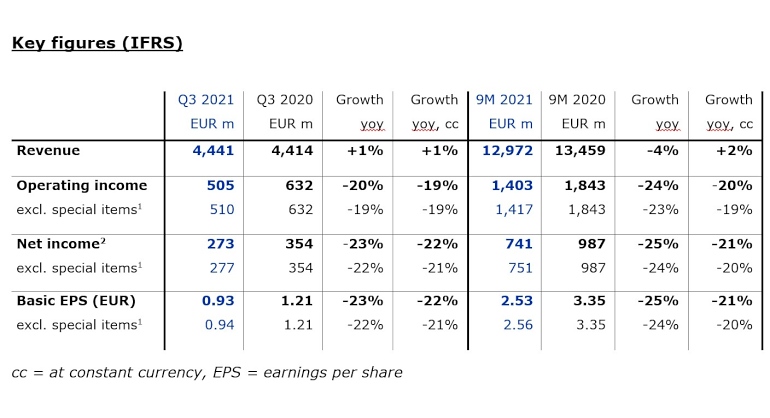

Revenue in the third quarter increased by 1% to EUR 4,441 million (+1% at constant currency, +1% organic).

Health Care Services revenue in the third quarter increased by 1% to EUR 3,530 million (+2% at constant currency, +1% organic). Organic growth was achieved despite the adverse effects of the COVID-19 pandemic and a lower reimbursement for calcimimetics.

Health Care Products revenue was stable and amounted to EUR 911 million (-1% at constant currency, 0% organic). Lower sales of in-center disposables and peritoneal dialysis products were offset by positive exchange rate effects and higher sales of machines for chronic treatment.

In the first nine months, revenue declined by 4% to EUR 12,972 million (+2% at constant currency, +1% organic). Health Care Services revenue decreased by 4% to

EUR 10,255 million (+2% at constant currency, +1% organic); Health Care Products revenue declined by 1% to EUR 2,717 million (+2% at constant currency, +2% organic).

Operating income decreased by 20% to EUR 505 million in the third quarter (-19% at constant currency), resulting in a margin of 11.4% (Q3 2020: 14.3%). Operating income excluding special items declined by 19% to EUR 510 million (-19% at constant currency), resulting in a margin of 11.5% (Q3 2020: 14.3%). The decline was mainly due to adverse COVID-19-related effects, inflationary materials cost increases and higher labor costs. These effects were slightly mitigated by an improved U.S. payor mix, in particular due to an increased number of patients with Medicare Advantage coverage.

Operating income for the first nine months decreased by 24% to EUR 1,403 million (-20% at constant currency), resulting in a margin of 10.8% (9M 2020: 13.7%). Operating income excluding special items declined by 23% to EUR 1,417 million (-19% at constant currency), resulting in a margin of 10.9% (9M 2020: 13.7%).

Net income2 decreased by 23% to EUR 273 million in the third quarter (-22% at constant currency) mainly due to the explained effects on operating income and a higher tax rate. Net income excluding special items declined by 22% to EUR 277 million (-21% at constant currency).

In the first nine months, net income decreased by 25% to EUR 741 million (-21% at constant currency). Net income excluding special items declined by 24% to EUR 751 million (-20% at constant currency).

Basic earnings per share (EPS) decreased by 23% to EUR 0.93 (-22% at constant currency) in the third quarter. EPS excluding special items declined by 22% to EUR 0.94 (-21% at constant currency).

In the first nine months, EPS decreased by 25% to EUR 2.53 (-21% at constant currency). EPS excluding special items declined by 24% to EUR 2.56 (-20% at constant currency).

Cash flow development

In the third quarter, Fresenius Medical Care generated EUR 692 million of operating cash flow (Q3 2020: EUR 746 million), resulting in a margin of 15.6% (Q3 2020: 16.9%). The decrease was mainly due to continued recoupment of the U.S. federal government’s payments in the second quarter of 2020 under the CARES Act. In the first nine months, operating cash flow amounted to EUR 1,820 million (9M 2020: EUR 3,649 million), resulting in a margin of 14.0% (9M 2020: 27.1%).

Fresenius Medical Care generated EUR 511 million of free cash flow5 (Q3 2020: EUR 507 million) in the third quarter, resulting in a margin of 11.5% (Q3 2020: 11.5%). In the first nine months, Free cash flow amounted to EUR 1,259 million (9M 2020: EUR 2,913 million), resulting in a margin of 9.7% (9M 2020: 21.6%).

5 Net cash provided by / used in operating activities, after capital expenditures, before acquisitions, investments, and dividends

Regional developments

In North America, revenue was stable and amounted to EUR 3,080 million in the third quarter (+1% at constant currency, +1% organic). The low growth was mainly due to the adverse COVID-19 impact on both the Health Care Services and Health Care Products businesses along with associated downstream and negative exchange rate effects. These effects were partially offset by contributions from acquisitions. In the first nine months, revenue decreased by 6% to EUR 8,931 million (0% at constant currency, 0% organic).

Operating income in North America decreased by 13% to EUR 446 million in the third quarter (-13% at constant currency), resulting in a margin of 14.5% (Q3 2020: 16.8%). The decline was mainly due to the adverse impact of COVID-19, including a high prior-year base mainly driven by government relief funding, as well as inflationary cost increases. This was partially offset by an improved U.S. payor mix, in particular due to an increased number of patients with Medicare Advantage coverage. In the first nine months, operating income declined by 22% to EUR 1,242 million (-17% at constant currency), resulting in a margin of 13.9% (9M 2020: 16.7%).

Revenue in the EMEA region decreased by 2% to EUR 671 million in the third quarter (-2% at constant currency, -2% organic). The decrease was mainly due to adverse COVID-19-related impacts in Health Care Services as well as lower sales of in-center disposables and peritoneal dialysis products, partially offset by higher sales of products for acute care treatment and machines for chronic treatment. In the first nine months, revenue declined by 1% to EUR 2,033 million (+1% at constant currency, 0% organic).

Operating income in EMEA decreased by 21% to EUR 79 million in the third quarter (-21% at constant currency), resulting in a margin of 11.7% (Q3 2020: 14.6%). The decline was mainly due to inflationary cost increases, adverse COVID-19-related effects, an unfavorable mix in the Products business and timing of export sales. This was partially offset by favorable transactional exchange rate effects and an increase in reimbursement rates in certain countries. In the first nine months, operating income decreased by 17% to EUR 232 million (-16% at constant currency), resulting in a margin of 11.4% (9M 2020: 13.6%).

In Asia-Pacific, revenue increased by 4% to EUR 501 million in the third quarter (+3% at constant currency, +2% organic). This was mainly driven by organic growth in Health Care Services, including a recovery in elective procedures, as well as positive exchange rate effects, contributions from acquisitions and higher sales of machines for chronic treatment, partially offset by lower sales of in-center disposables. In the first nine months, revenue grew by 6% to EUR 1,458 million (+8% at constant currency, +8% organic).

Operating income decreased by 11% to EUR 86 million in the third quarter (-10% at constant currency), resulting in a margin of 17.2% (Q3 2020: 20.0%). The decline was mainly due to adverse COVID-19-related effects and inflationary cost increases, partially offset by business growth including the above-mentioned effect from the recovery of elective procedures. In the first nine months, operating income grew by 8% to

EUR 256 million (+10% at constant currency), resulting in a margin of 17.5% (9M 2020: 17.2%).

Despite a significant headwind from exchange rates and the adverse impact of COVID-19, Latin America revenue increased by 5% to EUR 178 million in the third quarter (+13% at constant currency, +12% organic). This was mainly driven by organic growth in the Services business, contributions from acquisitions and higher sales of in-center disposables. In the first nine months, revenue was stable and amounted to EUR 508 million (+16% at constant currency, +14% organic).

Operating income in Latin America decreased by 61% to EUR 4 million in the third quarter (-62% at constant currency), resulting in a margin of 2.4% (Q3: 2020: 6.6%). The decline was due to inflationary cost increases and adverse COVID-19 effects. In the first nine months, operating income declined by 53% to EUR 14 million (-54% at constant currency), resulting in a margin of 2.7% (9M 2020: 5.7%).

Patients, clinics and employees

As of September 30, 2021, Fresenius Medical Care treated 344,872 patients in 4,151 dialysis clinics worldwide. At the end of the third quarter, the Company had 123,528 employees (full-time equivalents) worldwide, compared to 126,463 employees as of September 30, 2020.

FME25 Update

For the update on the FME25 transformation program, a separate press release is issued.

Conference call

Fresenius Medical Care will host a two-hour conference call to discuss the results of the third quarter and first nine months of 2021 on November 2, 2021 at 3:30 p.m. CET / 10:30 a.m. EDT. Please note that this will be an extended call, as the Company will additionally provide an update on the FME25 transformation program. Details will be available on the Fresenius Medical Care website www.freseniusmedicalcare.com in the “Investors” section. A replay will be available shortly after the call.

Please refer to our statement of earnings included in the PDF file for a complete overview of the results of the third quarter and first nine months of 2021. Our 6-K disclosure provides more details.

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to various factors, including, but not limited to, changes in business, economic and competitive conditions, legal changes, regulatory approvals, impacts related to the COVID-19 pandemic, results of clinical studies, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.