May 6, 2021

Fresenius with good start to 2021 despite ongoing COVID-19 impact

-

Guidance for 2021 confirmed

-

Fresenius Medical Care delivers solid first quarter

-

Fresenius Kabi shows strong performance in Emerging Markets whilst headwinds continue to impact North American business

-

Helios Germany continues to be compensated by government for foregone elective treatments; Helios Spain delivers significant sales and earnings growth given recovery of treatment activity

-

Fresenius Vamed continues to suffer from COVID-19 related project delays; technical high-end service business remains robust

-

Preparation of Group-wide initiatives to improve efficiency and profitability progressing

If no timeframe is specified, information refers to Q1/2021.

In Q1/2021 no special items incurred.

1Before special items

2Net income attributable to shareholders of Fresenius SE & Co. KGaA

Stephan Sturm, CEO of Fresenius, said: “In view of the adversity and uncertainties that COVID-19 continues to bring, we are satisfied with our start in 2021. We achieved continued organic growth, although the pandemic had a lesser impact on the prior-year quarter. That makes me optimistic that we can reach our targets. The progress being made with vaccinations worldwide is another reason for confidence, even though it is too early to sound the all-clear. In the coming months, we will still be dealing with the pandemic’s many and wide-ranging effects. As before, we will do this with full responsibility for the patients entrusted to us. At the same time, we are moving ahead with our planning for cost and efficiency measures. These measures will create a strong foundation for accelerated and sustainable growth against the backdrop of long-term growth trends supporting our core businesses. Growth that contributes to ever better medicine for ever more people.”

COVID-19 assumptions for guidance FY/21

Q1/21 was characterized by a regionally varying development of the COVID-19 pandemic. Given continued high infection numbers as well as an increasing number of virus mutations, large-scale constraints of public and private life have been re-enacted in various countries. Vaccination programs are progressing worldwide at, however, varying pace.

COVID-19 will continue to impact Fresenius’ operations in 2021. Current burdens and constraints caused by COVID-19 are expected to recede only in H2/21. The expected improvement in the Group’s relevant business environment from H2/21 is heavily dependent on continuously increasing levels of vaccination coverage in Fresenius’ relevant markets. These assumptions are subject to considerable uncertainty.

A deterioration of the situation requiring further containment measures in one or more of Fresenius’ major markets, although becoming somewhat less likely does remain a risk. Any resulting significant and direct impact on the health care sector without any appropriate compensation is not reflected in the Group’s FY/21 guidance.

FY/21 Group guidance confirmed

For FY/21, Fresenius continues to project sales growth1 in a low-to-mid single-digit percentage range and at least broadly stable net income2,3 year-over-year, both in constant currency. Implicitly, net income2 for the Group excluding Fresenius Medical Care is expected to grow in a mid-to-high single-digit percentage range in constant currency.

Fresenius projects net debt/EBITDA4 to be around the top-end of the self-imposed target corridor of 3.0x to 3.5x by the end of FY/21.

To sustainably enhance profitability, Fresenius is preparing group-wide strategic efficiency initiatives. These initiatives are expected to consist of operational excellence and cost-saving measures, targeted strengthening of future growth areas and portfolio optimizations. They are targeted to result in cost savings of at least €100 million p.a. after tax and minority interest in 2023 with some further potential to increase thereafter. Achieving these sustainable efficiencies will require significant up-front expenses. On average for the years 2021 to 2023, those expenses are expected to be in the order of magnitude of €100 million p.a. after tax and minority interest. They will be classified as special items.

1 FY/20 base: €36,277 million

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

3 FY/20 base: €1,796 million, before special items; FY/21: before special items

4 At LTM average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures; excluding further potential acquisitions; before special items

For a detailed overview of special items please see the reconciliation table in the PDF document.

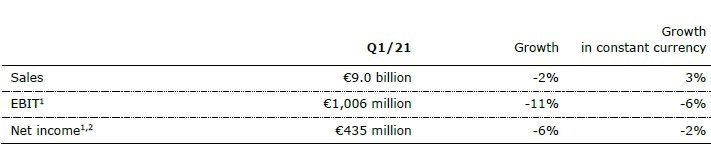

3% sales increase in constant currency

Group sales decreased by 2% (increased by 3% in constant currency) to €8,984 million (Q1/20: €9,135 million). Organic growth was 2%. Acquisitions/divestitures contributed net 1% to growth. Currency translation reduced sales growth by 5%. Excluding estimated COVID-19 effects1, Group sales growth would have been 4% to 5% in constant currency (Q1/20: 7% to 8%).

2% net income2,3 decrease in constant currency

Group EBITDA before special items and reported Group EBITDA decreased by 7% (-2% in constant currency) to €1,628 million (Q1/20: €1,755 million).

Group EBIT before special items and reported Group EBIT decreased by 11% (-6% in constant currency) to €1,006 million (Q1/20: €1,125 million). The constant currency decrease is primarily due to COVID-19 related headwinds. Both the EBIT margin before special items and the reported EBIT margin were 11.2% (Q1/20: 12.3%).

Group net interest before special items improved to -€137 million (Q1/202: -€174 million) mainly due to successful refinancing activities, lower interest rates as well as currency translation effects. Reported Group net interest also improved to -€137 million (Q1/20: -€182 million).

Both the Group tax rate before special items and the reported tax rate were 22.8% (Q1/20: 22.6%).

Both Noncontrolling interests before special items and reported noncontrolling interests were -€236 million (Q1/20: -€271 million) of which 95% were attributable to the noncontrolling interests in Fresenius Medical Care.

1 For estimated COVID-19 effects in Q1/21 and Q1/20 please see table in the PDF document.

2 Before special items

3 Net income attributable to shareholders of Fresenius SE & Co. KGaA

For a detailed overview of special items please see the reconciliation table in the PDF document.

Group net income1 before special items decreased by 6% (-2% in constant currency) to €435 million (Q1/202: €465 million). The absolute negative COVID-19 effect was more pronounced in Q1/21 compared to the prior-year quarter. Excluding estimated COVID-19 effects3, Group net income1 before special items would have grown 0% to 4% in constant currency (Q1/20: 6% to 10%). Reported Group net income1 decreased to €435 million (Q1/20: €459 million).

Earnings per share1 before special items decreased by 6% (-2% in constant currency) to €0.78 (Q1/202: €0.83). Reported earnings per share1 were also €0.78 (Q1/20: €0.82).

Continued investment in growth

Spending on property, plant and equipment was €384 million corresponding to 4% of sales (Q1/20: €547 million; 6% of sales). These investments served primarily for the modernization and expansion of dialysis clinics, production facilities as well as hospitals and day clinics.

Total acquisition spending was €149 million (Q1/20: €412 million), mainly for the acquisition of dialysis clinics at Fresenius Medical Care.

Cash flow development

Group operating cash flow decreased to €652 million (Q1/20: €878 million) with a margin of 7.3% (Q1/20: 9.6%), driven by a seasonal fluctuation in Fresenius Medical Care's invoicing and working capital movements in North America. Free cash flow before acquisitions and dividends decreased to €241 million (Q1/20: €305 million). Free cash flow after acquisitions and dividends increased to €117 million (Q1/20: -€40 million).

1 Net income attributable to shareholders of Fresenius SE & Co. KGaA

2 Before special items

3 For estimated COVID-19 effects in Q1/21 and Q1/20 please see table in the PDF document.

For a detailed overview of special items please see the reconciliation table in the PDF document.

Solid balance sheet structure

Group total assets increased by 3% (1% in constant currency) to €68,966 million (Dec. 31, 2020: €66,646 million) given currency translation effects and the expansion of business activities. Current assets increased by 6% (4% in constant currency) to €16,693 million (Dec. 31, 2020: €15,772 million), mainly driven by the increase of trade accounts receivables. Non-current assets increased by 3% (0% in constant currency) to €52,273 million (Dec. 31, 2020: €50,874 million).

Total shareholders’ equity increased by 6% (3% in constant currency) to €27,514 million (Dec. 31, 2020: €26,023 million). The equity ratio was 39.9% (Dec. 31, 2020: 39.0%).

Group debt increased by 2% (1% in constant currency) to €26,508 million (Dec. 31, 2020: € 25,913 million). Group net debt increased by 2% (1% in constant currency) to € 24,631 million (Dec. 31, 2020: € 24,076 million).

As of March 31, 2021, the net debt/EBITDA ratio increased to 3.52x1,2 (Dec. 31, 2020: 3.44x1,2) driven by COVID-19 effects weighing on EBITDA as well as increased net debt.

Number of employees

As of March 31, 2021, the Fresenius Group had 310,842 employees worldwide (December 31, 2020: 311,269).

1 At LTM average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures

2 Before special items

For a detailed overview of special items please see the reconciliation table in the PDF document.

Business Segments

Fresenius Medical Care (Financial data according to Fresenius Medical Care press release)

Fresenius Medical Care is the world's largest provider of products and services for individuals with renal diseases. As of March 31, 2021, Fresenius Medical Care was treating 344,476 patients in 4,110 dialysis clinics. Along with its core business, the Renal Care Continuum, the company focuses on expanding in complementary areas and in the field of critical care.

• Organic treatment growth impacted by COVID-19 pandemic as expected

• Reported revenue and earnings continued to be adversely affected by exchange rate effects

• Earnings development supported by phasing and expected lower SG&A expense anticipated to reverse throughout the year

• Financial targets for FY 2021 confirmed

Sales of Fresenius Medical Care decreased by 6% (increased by 1% in constant currency) to €4,210 million (Q1/20: €4,488 million). Thus, currency translation had a negative effect of 7%. Organic growth was 1%.

EBIT decreased by 15% (-8% in constant currency) to €474 million (Q1/20: €555 million) resulting in a margin of 11.3% (Q1/20: 12.4%). The decrease was mainly driven by effects from COVID-19 across all regions, higher personnel expenses and a significant negative exchange rate effect. Additionally, EBIT was negatively affected by a positive prior-year effect from the divestiture of cardiovascular clinics and a prior-year partial reversal of a revenue recognition adjustment. These negative effects were partially offset by an improved payor mix mainly driven by Medicare Advantage and expected lower SG&A expenses, which are anticipated to reverse in the remainder of the year.

1 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

Net income1 decreased by 12% (-6% in constant currency) to €249 million (Q1/20: €283 million). Besides the above-mentioned operating earnings effects, net income was supported by a 27% decrease of net interest expense to €76 million (Q1/20: €104 million).

The first quarter 2020 included negative COVID-19 effects that reversed in Q2 2020, including the compensation received under the CARES Act, and therewith increase the base for the second quarter 2021. These base effects impact the phasing of net income growth in 2021.

Operating cash flow was €208 million (Q1/20: €584 million) with a margin of 4.9% (Q1/20: 13.0%). The decline was driven by the seasonality in invoicing and periodic delays in payment of public health care organizations.

For FY/21, Fresenius Medical Care confirms its outlook as outlined on February 23, 2021. The Company expects revenue2 to grow at a low-to-mid single-digit percentage range and net income1,3 to decline at a high-teens to mid-twenties percentage range against the 2020 base4.

For further information, please see Fresenius Medical Care’s press release at www.freseniusmedicalcare.com.

1 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

2 FY/20 base: €17,859 million

3 FY/20 base: €1,359 million, before special items; FY/21: before special items

4 These targets are based on the 2020 results excluding the impairment of goodwill and trade names in the Latin America Segment of €195 million. They are inclusive of anticipated COVID-19 effects, in constant currency and exclude special items. Special items include costs related to FME25 and other effects that are unusual in nature and have not been foreseeable or not foreseeable in size or impact at the time of giving guidance.

Fresenius Kabi

Fresenius Kabi offers intravenously administered generic drugs, clinical nutrition and infusion therapies for seriously and chronically ill patients in the hospital and outpatient environments. The company is also a leading supplier of medical devices and transfusion technology products. In the biosimilars business, Fresenius Kabi develops products with a focus on oncology and autoimmune diseases.

• North America performance impacted by COVID-19 and temporary manufacturing issues

• Solid performance in Europe masked by prior-year COVID-19 related demand spike

• Emerging Markets showed strong sales and earnings growth; China with excellent performance given dynamic recovery of elective treatment activity

Sales decreased by 2% (increased by 4% in constant currency) to €1,761 million (Q1/20: €1,789 million). Organic growth was 3%. Negative currency translation effects of 6% were mainly related to weakness of the US dollar, the Brazilian real and the Argentinian peso.

Sales in North America decreased by 17% (organic growth: -9%) to €558 million (Q1/20: €669 million). The decrease was driven by fewer elective treatments, competitive pressure, missing sales from a customer in Chapter 11 as well as temporary manufacturing issues which outweighed extra demand for COVID-19 related products.

Sales in Europe decreased by 1% (organic growth: -1%) to €626 million (Q1/20: €631 million) mainly related to the strong demand for COVID-19 related drugs in the prior year quarter.

Sales in Asia-Pacific increased by 23% (organic growth: 26%) to €392 million (Q1/20: €319 million). The growth is mainly due to a dynamic recovery of elective procedures and a meaningful COVID-19 impact lowering the prior year basis in China as well as a growing recovery in other Asian markets.

1 Before special items

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

Sales in Latin America/Africa increased by 9% (organic growth: 28%) to €185 million (Q1/20: €170 million) due to ongoing COVID-19 related extra demand.

EBIT1 decreased by 4% (increased by 2% in constant currency) to €276 million (Q1/20: €289 million) with an EBIT margin of 15.7% (Q1/20:16.2%). The increase in constant currency was tempered by underutilized production capacities in the US, competitive pressure coupled with selective supply constraints due to temporary manufacturing issues and the missing contribution from sales to a customer now in Chapter 11. EBIT was supported by positive COVID-19 effects, lower corporate costs due to travel restrictions and phasing of projects.

Net income1,2 decreased by 4% (increased by 3% in constant currency) to €190 million (Q1/201: €197 million).

Operating cash flow increased to €278 million (Q1/20: €174 million) with a margin of 15.8% (Q1/20: 9.7%) mainly due to working capital improvements driven by cash collections.

For FY/21, Fresenius Kabi confirms its outlook and expects organic sales3 growth in a low-to-mid single-digit percentage range. Constant currency EBIT4 is expected to show a stable development up to low single-digit percentage growth. Both sales and EBIT outlook include expected COVID-19 effects.

1 Before special items

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

3 FY/20 base: €6,976 million

4 FY/20 base: €1,095 million, before special items; FY/21: before special items

Fresenius Helios

Fresenius Helios is Europe's leading private hospital operator. The company comprises Helios Germany and Helios Spain. Helios Germany operates 89 hospitals, ~130 outpatient centers and 6 prevention centers. Helios Spain operates 47 hospitals, 74 outpatient centers and around 300 occupational risk prevention centers. In addition, the company is active in Latin America with 6 hospitals and as a provider of medical diagnostics.

• Helios Spain delivers significant organic sales and earnings growth given recovery of treatment activity

• Helios Germany continues to be compensated by government for foregone elective treatments

• Growth additionally fueled by contributions from acquisitions in Germany and Latin America

Sales increased by 7% (8% in constant currency) to €2,649 million (Q1/20: €2,466 million). Organic growth was 4%. Acquisitions contributed 4% to sales growth.

Sales of Helios Germany increased by 4% (organic growth: 0%) to €1,673 million (Q1/20: €1,603 million). COVID-19 effects were mitigated by government compensation in regions with high COVID-19 incidences. The hospital acquisitions from the Order of Malta contributed 4% to sales growth.

Sales of Helios Spain increased by 13% (14% in constant currency) to €976 million (Q1/20: €863 million). Organic growth of 11% was driven by a strong recovery of elective procedures, a consistently high level of outpatient treatments and strong demand for occupational risk prevention (ORP) services. In addition, the hospitals in Latin America showed a strong performance. The hospital acquisitions in Colombia contributed 3% to sales growth.

EBIT of Fresenius Helios decreased by 2% (-1% in constant currency) to €268 million (Q1/20: €274 million) with an EBIT margin of 10.1% (Q1/20: 11.1%).

1 Net income attributable to shareholders of Fresenius SE & Co. KGaA

EBIT of Helios Germany decreased by 9% to €150 million (Q1/20: €165 million) with an EBIT margin of 9.0% (Q1/20: 10.3%). Government compensation broadly mitigated COVID-19 effects. The decrease was primarily caused by the impact of the carve-out of nursing expenses from the overall DRGs and the positive development of January and February last year.

EBIT of Helios Spain increased by 13% (14% in constant currency) to €126 million (Q1/20: €112 million) with an EBIT margin of 12.9% (Q1/20: 13.0%). Healthy organic sales growth led to a meaningfully improved coverage of the fixed cost base. The hospital acquisitions in Colombia made an additional contribution.

Net income1 decreased by 2% (-1% in constant currency) to €173 million (Q1/20: €176 million).

Operating cash flow increased to €215 million (Q1/20: €145 million) with a margin of 8.1% (Q1/20: 5.9%), mainly due to working capital improvements driven by cash collections.

For FY/21, Fresenius Helios confirms its outlook and expects organic sales2 growth in a low-to-mid single-digit percentage range and constant currency EBIT3 growth in a mid-to-high single-digit percentage range. Both sales and EBIT outlook include expected COVID-19 effects.

1 Net income attributable to shareholders of Fresenius SE & Co. KGaA

2 FY/20 base: €9,818 million

3 FY/20 base: €1,025 million; FY/21 before special items

Fresenius Vamed

Fresenius Vamed manages projects and provides services for hospitals and other health care facilities worldwide and is a leading post-acute care provider in Central Europe. The portfolio ranges along the entire value chain: from project development, planning, and turnkey construction, via maintenance and technical management to total operational management.

• Continued significant negative COVID-19 impact

• Project business marked by COVID-19 related delays, cancellations and global supply chain restraints

• Rehabilitation business remains impacted by fewer elective surgeries

• Technical high-end service business remains robust

Sales decreased by 4% (-4% in constant currency) to €477 million (Q1/20: €499 million). Organic growth was -4%.

Sales in the service business increased by 2% (2% in constant currency) to €363 million (Q1/20: €357 million). Sales in the project business decreased by 20% (-20% in constant currency) to €114 million (Q1/20: €142 million), driven by postponements and cancellations of projects.

EBIT decreased by 129% (-129% in constant currency) to -€4 million (Q1/20: €14 million) with an EBIT margin of -0.8% (Q1/20: 2.8%). Large parts of the post-acute care clinic capacities were left partially empty given a generally lower intake of elective surgery patients from acute-care hospitals. Health-authority-induced restrictions or even closures of facilities also had a negative effect. In the project business, project delays and global supply chain restraints triggered incremental expenses.

1 Net income attributable to shareholders of VAMED AG

Net income1 decreased to -€7 million (Q1/20: €7 million).

Order intake was €138 million (Q1/20: €124 million). As of March 31, 2021, order backlog was at €3,082 million (December 31, 2020: €3,055 million). Order intake continued to be marked by COVID-19 related cancellations and project delays.

Operating cash flow decreased to -€44 million (Q1/20: -€20 million) with a margin of -9.2% (Q1/20: -4.0%), mainly related to the lower net income contribution.

For FY/21, Fresenius Vamed confirms its outlook and expects organic sales2 growth in a mid-to-high single-digit percentage range and EBIT3 to grow to a high double-digit Euro million amount. Both sales and EBIT outlook include expected negative COVID-19 effects.

1 Net income attributable to shareholders of VAMED AG

2 FY/20 base: €2,068 million

3 FY/20 base: €29 million; FY/21 before special items

Conference Call

As part of the publication of the results for Q1/2021, a conference call will be held on May 6, 2021 at 1:30 p.m. CEDT (7:30 a.m. EDT). You are cordially invited to follow the conference call in a live broadcast over the Internet at www.fresenius.com/media-calender. Following the call, a replay will be available on our website.. Following the call, a replay will be available on our website.

For additional information on the performance indicators used please refer to our website https://www.fresenius.com/alternative-performance-measures.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.