February 20, 2020

Fresenius reports 16th consecutive record year – After significant investments in 2019, company expects healthy growth in 2020 and confirms medium-term growth targets

• Good organic sales growth across all business segments

• Fresenius Kabi’s excellent Emerging Markets growth partially offsets softer development in North America

• Fresenius Helios shows continued stabilization in Germany and strong growth in Spain

• Fresenius Medical Care expects to show strong growth in 2020

• 27th consecutive dividend increase proposed

If no timeframe is specified, information refers to Q4/2019

1 Adjusted for IFRS 16

2 Q4/18 and FY/18 before special items and adjusted for divestitures of Care Coordination activities at Fresenius Medical Care (FMC)

3 Net income attributable to shareholders of Fresenius SE & Co. KGaA

For a detailed overview of special items and adjustments please see the reconciliation tables on pages 20-28 of the PDF document.

Stephan Sturm, CEO of Fresenius, said: “2019 was a good year for Fresenius. A year of challenges, but also of many successes. We have treated even more patients, launched new products, and increased our sales to more than 35 billion euros. We made the planned, significant investments in our future growth, yet have still achieved a slight increase in earnings. Fresenius is well positioned to stay successful into the future. We can look ahead with confidence, and confirm our ambitious medium-term targets.”

Group guidance for FY/20

For FY/20, Fresenius projects sales growth1 of 4% to 7% in constant currency. Net income2,3 growth is expected to be in a 1% to 5% range in constant currency. Contributions from signed, but not yet closed acquisitions are included in this guidance.

The FY/20 guidance does not include any effects from the coronavirus (Covid-19) outbreak, since it is too early to quantify those. From the current perspective Fresenius does not expect a significant negative financial impact4.

Fresenius expects net debt/EBITDA5 to be towards the top-end of the self-imposed target corridor of 3.0x to 3.5x at the end of 2020.

Growth targets for 2020 – 2023 confirmed

Fresenius continues to expect Group sales to grow organically with a compounded annual growth rate (CAGR) of 4% to 7% during 2020 to 2023. Group net income2 is projected to increase organically with a CAGR of 5% to 9% during 2020 to 2023. Fresenius expects its sales growth and efficiency improvement initiatives as well as Fresenius Kabi’s biosimilars business to drive an acceleration of Group earnings growth over that period. Small and medium-sized acquisitions are expected to contribute an incremental CAGR of approx. 1%-point to both sales and net income growth.

27th consecutive dividend increase proposed

The Management Board of Fresenius will propose to the Supervisory Board a dividend increase of 5% to €0.84 per share for FY/19 (FY/18: €0.80). The proposed total dividend payout to Fresenius SE & Co. KGaA shareholders amounts to €468 million (FY/18: €445 million).

1 FY/19 base: €35,409 million, including IFRS 16 effect

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

3 FY/19 base: €1,879 million, including IFRS 16 effect; FY/19 before special items (transaction-related expenses, revaluations of biosimilars contingent purchase price liabilities, gain related to divestitures of Care Coordination activities at FMC, expenses associated with the cost optimization program at FMC); FY/20: before special items

4 Taking into account minority interest structures across the Group

5 Both net debt and EBITDA including IFRS 16 effect and calculated at expected annual average exchange rates; excluding further potential acquisitions

For a detailed overview of special items and adjustments please see the reconciliation tables on pages 20-28 of the PDF document.

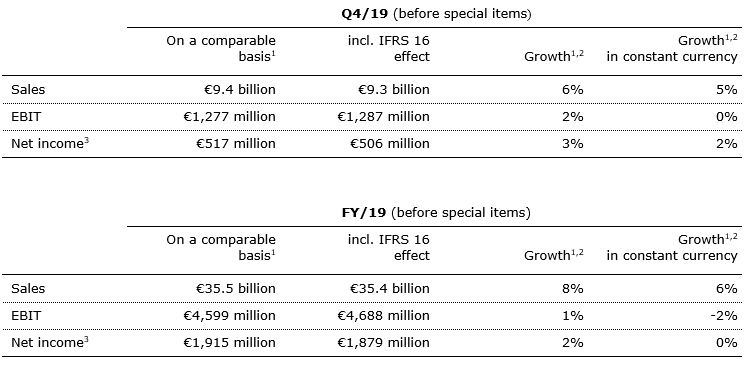

5% sales growth1 in constant currency

In Q4/19, Group sales were €9,311 million including an IFRS 16 effect of -€40 million. Group sales1 on a comparable basis increased by 6% (5% in constant currency) to €9,351 million in Q4/19 (Q4/18: €8,830 million). Organic sales growth was 4%. Acquisitions/divestitures contributed net 1% to growth. In FY/19, Group sales were €35,409 million including an IFRS 16 effect of -€115 million. On a comparable basis, Group sales1 increased by 8% (6% in constant currency) to €35,524 million (FY/18: €33,009 million). Organic sales growth was 5%. Acquisitions/divestitures contributed net 1% to growth. Positive currency translation effects of 2% were mainly driven by the U.S. dollar strengthening against the euro.

2% net income2,3 growth in constant currency

In Q4/19, Group EBITDA before special items was €1,937 million including an IFRS 16 effect of €235 million. On a comparable basis, Group EBITDA2 increased by 1% (0% in constant currency) to €1,702 million (Q4/18: €1,680 million). Reported Group EBITDA4 was €1,937 million. In FY/19, Group EBITDA before special items was €7,104 million including an IFRS 16 effect of €934 million. On a comparable basis, Group EBITDA2 increased by 2% (0% in constant currency) to €6,170 million (FY/18: €6,032 million). Reported Group EBITDA4 was €7,083 million.

In Q4/19, Group EBIT before special items was €1,287 million including an IFRS 16 effect of €10 million. On a comparable basis, Group EBIT2 increased by 2% (0% in constant currency) to €1,277 million (Q4/18: €1,250 million). The EBIT margin2 on a comparable basis was 13.7% (Q4/18: 14.2%). Reported Group EBIT4 was €1,269 million.

In FY/19, Group EBIT before special items was €4,688 million including an IFRS 16 effect of €89 million. On a comparable basis, Group EBIT2 increased by 1% (-2% in constant currency) to €4,599 million (FY/18: €4,547 million). The EBIT margin2 on a comparable basis was 12.9% (FY/18: 13.8%). Reported Group EBIT4 was €4,631 million. Adjustments on accounts receivable in legal dispute paired with reduced patient attribution and a decreasing savings rate for ESCOs at Fresenius Medical Care weighed on earnings. In addition, the missing tailwinds from drug shortages in North America triggered a softer development at Fresenius Kabi. Moreover, investments to counter the regulatory headwinds at Helios Germany continued to weigh on Group EBIT. These effects were partially offset by the remeasurement effect of the fair value of Fresenius Medical Care’s investment on Humacyte, Inc.

1 On a comparable basis: Q4/18 and FY/18 adjusted for divestitures of Care Coordination activities at FMC; Q4/19 and FY/19 adjusted for IFRS 16 effect

2 On a comparable basis: Q4/19 and FY/19 before special items and adjusted for IFRS 16 effect; Q4/18 and FY/18 before special items and adjusted for divestitures of Care Coordination activities at FMC

3 Net income attributable to shareholders of Fresenius SE & Co. KGaA

4 After special items and including IFRS 16 effect

For a detailed overview of special items and adjustments please see the reconciliation tables on pages 20-28 of the PDF document.

In Q4/19, Group net interest before special items was -€182 million including an IFRS 16 effect of -€51 million. On a comparable basis, net interest1 increased to -€131 million in Q4/19 (Q4/18: -€129 million). Reported Group net interest2 was -€184 million. In FY/19, Group net interest before special items was -€714 million including an IFRS 16 effect of -€204 million. On a comparable basis, net interest1 improved to -€510 million (FY/18: -€549 million) mainly due to successful refinancing activities and lower interest rates. Reported Group net interest2 was -€719 million.

In Q4/19, the Group tax rate before special items and adopting IFRS 16 was 23.8%, in FY/19 it was 23.3%. On a comparable basis, the Group tax rate1 was 24.0% in Q4/19 and 23.4% in FY/19 (Q4/18: 22.7%; FY/18: 22.1%). The YoY increase was driven by positive one-time effects in the prior-year relating to the US tax reform.

In Q4/19, Noncontrolling interest before special items was -€336 million including an IFRS 16 effect of €18 million. On a comparable basis, noncontrolling interest1 was -€354 million (Q4/18: -€363 million). In FY/19, noncontrolling interest before special items was -€1,170 million including an IFRS 16 effect of €49 million. On a comparable basis, noncontrolling interest1 was -€1,219 million (FY/18: -€1,243 million), of which 96% was attributable to the noncontrolling interest in Fresenius Medical Care.

In Q4/19, Group net income3 before special items was €506 million including an IFRS 16 effect of -€11 million. On a comparable basis, Group net income1,3 increased by 3% (2% in constant currency) to €517 million (Q4/18: €504 million). Reported Group net income2,3 was €515 million.

In FY/19, Group net income3 before special items was €1,879 million including an IFRS 16 effect of -€36 million. On a comparable basis, Group net income1,3 increased by 2% (0% in constant currency) to €1,915 million (FY/18: €1,872 million). Reported Group net income2,3 was €1,883 million.

1 On a comparable basis: Q4/19 and FY/19 before special items and adjusted for IFRS 16 effect; Q4/18 and FY/18 before special items and adjusted for divestitures of Care Coordination activities at FMC

2 After special items and including IFRS 16 effect

3 Net income attributable to shareholders of Fresenius SE & Co. KGaA

For a detailed overview of special items and adjustments please see the reconciliation tables on pages 20-28 of the PDF document.

In Q4/19, Earnings per share1 before special items were €0.90 including an IFRS 16 effect of -€0.03. On a comparable basis, Earnings per share1,2 increased by 2% (1% in constant currency) to €0.93 (Q4/18: €0.91). Reported Earnings per share1,3 were €0.92. In FY/19, Earnings per share1 before special items were €3.37 including an IFRS 16 effect of -€0.07. On a comparable basis, earnings per share1,2 increased by 2% (0% in constant currency) to €3.44 (FY/18: €3.37). Reported Earnings per share1,3 were €3.38.

Continued investment in growth

2019 was an investment year for the Fresenius Group with a variety of initiatives to secure long-term sustainable growth. In Q4/19, spending on property, plant and equipment was €871 million corresponding to 9% of sales (Q4/18: €793 million; 9%). In FY/19, spending on property, plant and equipment was €2,463 million corresponding to 7% of sales (FY/18: €2,163 million; 6%). The 2019 investments served primarily for the modernization and expansion of dialysis clinics, production facilities as well as hospitals, and day clinics.

In Q4/19, total acquisition spending was €331 million (Q4/18: €210 million). In FY/19, total acquisition spending was €2,623 million (FY/18: €1,086 million), mainly for the acquisition of NxStage by Fresenius Medical Care.

Cash flow development

In Q4/19, Group operating cash flow was €1,286 million including an IFRS 16 effect of €211 million. On a comparable basis, Group operating cash flow was €1,075 million (Q4/18: €1,193 million) with a margin of 11.5% (Q4/18: 13.5%). Free cash flow before acquisitions and dividends adjusted for IFRS 16 was €231 million (Q4/18: €472 million). Free cash flow after acquisitions and dividends adjusted for IFRS 16 was -€122 million (Q4/18: €202 million). The IFRS 16 effect amounts to €211 million. Correspondingly, cash flow from financing activities decreased by €211 million.

In FY/19, Group operating cash flow was €4,263 million including an IFRS 16 effect of €749 million. On a comparable basis, Group operating cash flow was €3,514 million

(FY/18: €3,742 million) with a margin of 9.9% (FY/18: 11.2%). The decrease was primarily driven by the FCPA-related charge of €206 million at Fresenius Medical Care. As a consequence, and in combination with the increased investments, free cash flow before acquisitions and dividends adjusted for IFRS 16 of €1,081 million was below the previous year (FY/18: €1,665 million). Free cash flow after acquisitions and dividends adjusted for IFRS 16 was -€2,294 million (FY/18: €1,374 million). The IFRS 16 effect amounts to €749 million. Correspondingly, cash flow from financing activities decreased by €749 million.

1 Net income attributable to shareholders of Fresenius SE & Co. KGaA

2 On a comparable basis: Q4/19 and FY/19 before special items and adjusted for IFRS 16 effect; Q4/18 and FY/18 before special items and adjusted for divestitures of Care Coordination activities at FMC

3 After special items and including IFRS 16 effect

For a detailed overview of special items and adjustments please see the reconciliation tables on pages 20-28 of the PDF document.

Solid balance sheet structure

The Group’s total assets were €67,006 million including an IFRS 16 effect of €5,769 million. Adjusted for IFRS 16, Group total assets increased by 8% (7% in constant currency) to €61,237 million (Dec. 31, 2018: €56,703 million). Current assets increased by 3% (3% in constant currency) to €15,264 million (Dec. 31, 2018: €14,790 million). Non-current assets1 increased by 10% (9% in constant currency) to €45,973 million (Dec. 31, 2018: € 41,913 million).

Total shareholders’ equity was €26,580 million including an IFRS 16 effect of -€256 million. Adjusted for IFRS 16, total shareholders’ equity increased by 7% (6% in constant currency) to €26,836 million (Dec. 31, 2018: €25,008 million). The equity ratio was 39.7%. Adjusted for IFRS 16, the equity ratio was 43.8% (Dec. 31, 2018: 44.1%).

Group debt was €27,258 million including an IFRS 16 effect of €6,025 million. Adjusted for IFRS 16, Group debt increased by 12% to €21,233 million (11% in constant currency) (Dec. 31, 2018: € 18,984 million). Group net debt was €25,604 million including an IFRS 16 effect of €6,025 million. Adjusted for IFRS 16, Group net debt increased by 20% (20% in constant currency) to € 19,579 million (Dec. 31, 2018: € 16,275 million) mainly due to the acquisition of NxStage by Fresenius Medical Care.

As of December 31, 2019, the reported net debt/EBITDA ratio was 3.61x2,3,4. Adjusted for IFRS 16, the net debt/EBITDA ratio was 3.14x1,2,3,4 (Dec. 31, 2018: 2.71x2,4).

1 Adjusted for IFRS 16

2 At LTM average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures

3 Including acquisition of NxStage

4 Before special items

For a detailed overview of special items and adjustments please see the reconciliation tables on pages 20-28 of the PDF document.

Increased number of employees

As of December 31, 2019, the number of employees was 294,134 (Dec. 31, 2018: 276,750).

Business Segments

Fresenius Medical Care (Financial data according to Fresenius Medical Care press release)

Fresenius Medical Care is the world's largest provider of products and services for individuals with renal diseases. As of December 31, 2019, Fresenius Medical Care was treating 345,096 patients in 3,994 dialysis clinics. Along with its core business, the company provides related medical services in the field of Care Coordination.

• 5 % organic sales growth in Q4/19

• Investments in home dialysis and growth markets in 2019

• FY/20 outlook : Sales4 and net income5 growth6 within a mid to high single digit percentage range expected

Adjusted for IFRS 16, the contribution from the divested Care Coordination activities and NxStage, sales increased by 6% (4% in constant currency) to €4,546 million in Q4/19 (Q4/18: €4,294 million). Organic sales growth was 5%. Positive currency translation effects of 2% were mainly related to the U.S. dollar strengthening against the euro. In FY/19, sales adjusted for IFRS 16, the contributions from the divested Care Coordination activities and NxStage increased by 8% (5% in constant currency) to €17,329 million (FY/18: €16,026 million). Organic sales growth was 5%.

In Q4/19, EBIT7 increased by 3% (0% in constant currency) to €655 million (Q4/18: €636 million). The EBIT6 margin was 14.4% (Q4/18: 14.8%).

1 On an adjusted basis: before special items (transaction-related expenses, gain related to divestitures of Care Coordination activities, expenses associated with the cost optimization program), adjusted for IFRS 16 effect, excluding effects from NxStage transaction

2 Q4/18 and FY/18 before special items and adjusted for divestitures of Care Coordination activities

3 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

4 FY/19 base: €17,477 million, including IFRS 16 effect

5 FY/19 base: €1,236 million, before special items, including IFRS 16 effect; FY/20: before special items

6 In constant currency

7 Q4/18 and FY/18 before special items items and after adjustments

Q4/19 and FY/19 before special items (transaction-related expenses, gain related to divestitures of Care

Coordination activities, expenses associated with the cost optimization program), adjusted for IFRS 16 effect,

excluding effects from NxStage transaction

For a detailed overview of special items and adjustments please see the reconciliation tables on pages 20-28 of the PDF document.

In FY/19, EBIT1 of €2,296 million remained at prior-year’s level (decreased by 4% in constant currency; FY/18: €2,292 million). The EBIT1 margin decreased to 13.2% (FY/18: 14.3%). Adjustments on accounts receivable in legal dispute paired with reduced patient attribution and a decreasing savings rate for ESCOs weighed on earnings. These effects were partially offset by the remeasurement effect of the fair value of the investment on Humacyte, Inc.

In Q4/19, net income1,2 increased by 3% (0% in constant currency) to €408 million (Q4/18: €395 million). In FY/19, net income1,2 increased by 2% (-2% in constant currency) to €1,369 million (FY/18: €1,341 million).

In Q4/19, operating cash flow was €597 million3 (Q4/18: €698 million) with a margin of 13.1% (Q4/18: 16.2%). In FY/19, operating cash flow was €1,947 million4 (FY/18: €2,062 million) with a margin of 11.2% (FY/18: 12.5%).

For FY/20, Fresenius Medical Care expects sales5 to grow within a mid to high single digit percentage range in constant currency. Net income2,6 is also expected to grow within a mid to high single digit percentage range in constant currency.

For further information on the IFRS 16 reconciliation of Fresenius Medical Care, please see page 18 of the PDF document.

For further information, please see Fresenius Medical Care’s press release at www.freseniusmedicalcare.com.

1 Q4/18 and FY/18 before special items and after adjustments;

Q4/19 and FY/19 before special items (transaction-related expenses, gain related to divestitures of care coordination activities, expenses associated with the cost optimization program), adjusted for IFRS 16 effect, excluding effects from NxStage transaction

2 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

3 €771 million including an IFRS 16 effect of €174 million

4 €2,567 million including an IFRS 16 effect of €620 million

5 FY/19 base: €17,477 million, including IFRS 16 effect

6 FY/19 base: €1,236 million, before special items (transaction-related expenses, gain related to divestitures of care coordination activities, expenses associated with the cost optimization program), including IFRS 16 effect;

FY/20: before special items

For a detailed overview of special items and adjustments please see the reconciliation tables on pages 20-28 of the PDF document.

Fresenius Kabi

Fresenius Kabi offers intravenously administered generic drugs, clinical nutrition and infusion therapies for seriously and chronically ill patients in the hospital and outpatient environments. The company is also a leading supplier of medical devices and transfusion technology products. In the biosimilars business, Fresenius Kabi develops products with a focus on oncology and autoimmune diseases.

• 4% organic sales growth in Q4/19

• Excellent Emerging Markets growth partially offsets softer development in North America

• FY/20 outlook: organic sales3 growth of 3% to 6% and EBIT development4 of -4% to 0% expected

In Q4/19, sales of Fresenius Kabi increased by 5% (4% in constant currency) to €1,766 million (Q4/18: €1,687 million). Organic sales growth was 4%. In FY/19, sales increased by 6% (4% in constant currency) to €6,919 million (FY/18: €6,544 million). Organic sales growth was 4%. Positive currency translation effects of 2% were mainly related to the U.S. dollar strengthening against the euro.

In Q4/19, sales in North America increased by 2% (organic growth: 1%; Q4/18: €599 million) to €609 million. In FY/19, sales in North America increased by 3% (organic growth: -2%) to €2,424 million (FY/18: €2,359 million). Intensified competition on selected molecules, missing tailwinds from drug shortages as well as a shift in clinical practice towards non-opiods in the hospital-based pain management weighed on the sales development.

In Q4/19, sales in Europe grew by 2% (organic growth: 2%) to €604 million (Q4/18: €590 million). In FY/19, sales in Europe increased by 3% (organic growth: 2%) to €2,313 million

(FY/18: €2,248 million).

1 On a comparable basis: before special items and adjusted for IFRS 16 effect

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

3 FY/19 base: €6,919 million, including IFRS 16 effect

4 FY/19 base: €1,205 million; FY/19 before special items (transaction-related expenses, revaluations of biosimilars contingent purchase price liabilities), including IFRS 16 effect; FY/20: before special items, in constant currency

For a detailed overview of special items and adjustments please see the reconciliation tables on pages 20-28 of the PDF document.

In Q4/19, sales in Asia-Pacific increased by 15% (organic growth: 13%) to €385 million (Q4/18: €336 million). In FY/19, sales in Asia-Pacific increased by 16% (organic growth: 14%) to €1,506 million (FY/18: €1,300 million).

In Q4/19, sales in Latin America/Africa increased by 4% (organic growth: 10%) to €168 million (Q4/18: €162 million). In FY/19, sales in Latin America/Africa increased by 6% (organic growth: 14%) to €676 million (FY/18: €637 million).

In Q4/19, EBIT1 decreased by 1% (-1% in constant currency) to €283 million (Q4/18: €285 million) with an EBIT margin of 16.0% (Q4/18: 16.9%). In FY/19, EBIT1 increased by 5% (3% in constant currency) to €1,200 million (FY/18: €1,139 million) with an EBIT margin of 17.3% (FY/18: 17.4%).

In Q4/19, net income1,2 decreased by 2% (-3% in constant currency) to €184 million (Q4/18: €188 million). In FY/19, net income1,2 increased by 8% (5% in constant currency) to €802 million (FY/18: €742 million).

In Q4/19, operating cash flow3 was €273 million (Q4/18: €220 million) with a margin3 of 15.5% (Q4/18: 13.0%). In FY/19, operating cash flow3 was €968 million (FY/18: €1,040 million) with a margin3 of 14.0% (FY/18: 15.9%).

For FY/20, Fresenius Kabi expects organic sales growth4 of 3% to 6% and an EBIT development5 of -4% to 0% in constant currency.

For further information on the IFRS 16 reconciliation of Fresenius Kabi, please see page 18 of the PDF document of the PDF document.

1 On a comparable basis: before special items and adjusted for IFRS 16

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

3 Adjusted for IFRS 16 (operating cash flow after special items)

4 FY/19 base: €6,919 million, including IFRS 16 effect

5 FY/19 base: €1,205 million; FY/19 before special items (transaction-related expenses, revaluations of biosimilars contingent purchase price liabilities), including IFRS 16 effect; FY/20: before special items

For a detailed overview of special items and adjustments please see the reconciliation tables on pages 20-28 of the PDF document.

Fresenius Helios

Fresenius Helios is Europe's leading private hospital operator. The company comprises Helios Germany and Helios Spain (Quirónsalud). Helios Germany operates 86 hospitals, ~125 outpatient centers and 8 prevention centers. Quirónsalud operates 47 hospitals, 71 outpatient centers and around 300 occupational risk prevention centers. In addition, the company is active in Latin America with 4 hospitals and as a provider of medical diagnostics.

• Helios Germany with solid organic sales growth of 3% in Q4/19; return to EBIT growth in Q4/19

• Helios Spain with excellent organic sales growth of 7% in Q4/19; acquisitions in Latin America support further growth

• FY/20 outlook: organic sales4 growth of 3% to 6% and EBIT growth of 3% to 7% (in constant currency) expected

In Q4/19, sales increased by 5% (organic growth: 4%) to €2,344 million (Q4/18: €2,231 million). In FY/19, sales increased by 3% (5%1; organic growth: 5%) to €9,234 million (FY/18: €8,993 million).

In Q4/19, sales of Helios Germany increased by 3% (organic growth: 3%) to €1,475 million (Q4/18: €1,439 million). Organic sales growth was positively influenced by pricing effects and slight admissions growth. In FY/19, sales of Helios Germany decreased by 1% (increased by 3%1; organic growth: 3%) to €5,940 million (FY/18: €5,970 million). The reclassification of nursing staff funding from other income to sales also contributed to growth.

In Q4/19, sales of Helios Spain increased by 9% (organic growth: 7%) to €867 million (Q4/18: €792 million). Organic sales growth was positively influenced by admission growth and excellent execution within the existing hospital and service offerings. In FY/19, sales of Helios Spain increased by 9% (organic growth: 7%) to €3,292 million (FY/18: €3,023 million).

1 Adjusted for the post-acute care business transferred to Fresenius Vamed as of July 1, 2018

2 Adjusted for IFRS 16 effect

3 Net income attributable to shareholders of Fresenius SE & Co. KGaA

4 FY/19 base: €9,234 million, including IFRS 16 effect

5 FY/19 base: €1,025 million, including IFRS 16 effect

For a detailed overview of special items and adjustments please see the reconciliation tables on pages 20-28 of the PDF document.

In Q4/19, EBIT1 of Fresenius Helios increased by 5% to €292 million (Q4/18: €277 million) with an EBIT margin of 12.5% (Q4/18: 12.4%). In FY/19, EBIT1 decreased by 4% (-3% ) to €1,015 million (FY/18: €1,052 million) with an EBIT margin of 11.0% (FY/18: 11.7%).

In Q4/19, EBIT1 of Helios Germany increased by 4% to €143 million (Q4/18: €137 million) with an EBIT margin of 9.7% (Q4/18: 9.5%). In FY/19, EBIT1 of Helios Germany decreased by 8% (-6%2) to €576 million (FY/18: €625 million) with an EBIT margin of 9.7% (FY/18: 10.5%). Ongoing investments to counter regulatory headwinds continued to weigh on Helios Germany’s financial performance.

In Q4/19, EBIT1 of Helios Spain increased by 6% to €134 million (Q4/18: €127 million) with an EBIT margin of 15.5% (Q4/18: 16.0%). In FY/19, EBIT1 of Helios Spain increased by 5% to €434 million (FY/18: €413 million) with an EBIT margin of 13.2% (FY/18: 13.7%).

In Q4/19, net income1,3 increased by 16% to €198 million (Q4/18: €170 million). In FY/19, net income1,3 decreased by 2% to €670 million (FY/18: €686 million).

In Q4/19, operating cash flow1 increased to €212 million (Q4/18: €167 million) with a margin of 9.0% (Q4/18: 7.5%). In FY/19, operating cash flow1 increased to €683 million (FY/18: €554 million) with a margin of 7.4% (FY/18: 6.2%).

For FY/20, Fresenius Helios expects organic sales4 growth of 3% to 6% and EBIT5 growth of 3% to 7% in constant currency.

For further information on the IFRS 16 reconciliation of Fresenius Helios, please see page 18 of the PDF document.

1 Adjusted for IFRS 16 effect

2 Adjusted for the post-acute care business transferred to Fresenius Vamed as of July 1, 2018

3 Net income attributable to shareholders of Fresenius SE & Co. KGaA

4 FY/19 base: €9,234 million, including IFRS 16 effect

5 FY/19 base: €1,025 million, including IFRS 16 effect

For a detailed overview of special items and adjustments please see the reconciliation tables on pages 20-28 of the PDF document.

Fresenius Vamed

Fresenius Vamed manages projects and provides services for hospitals and other health care facilities worldwide and is a leading post-acute care provider in Central Europe. The portfolio ranges along the entire value chain: from project development, planning, and turnkey construction, via maintenance and technical management to total operational management.

• Dynamic sales growth of service business of 11% in Q4/19

• Record order backlog supports future sales development of the project business

• FY/20 outlook: organic sales4 growth of 4% to 7% and EBIT5 growth of 5% to 9% (in constant currency) expected

In Q4/19, sales of Fresenius Vamed increased by 6% to €737 million (Q4/18: €697 million). Organic sales growth was 4%. Acquisitions and currency translation effects contributed each 1% to growth. In FY/19, sales increased by 31% (19%1) to €2,206 million (FY/18: €1,688 million). Organic sales growth was 16%. Acquisitions contributed 14% and currency translation effects contributed 1% to growth. Both the service and the project business showed strong growth momentum.

In Q4/19, sales in the service business grew by 11% to €374 million (Q4/18: €337 million). Sales of the project business increased by 1% to €363 million (Q4/18: €360 million).

In Q4/19, EBIT2 increased by 8% to €66 million (Q4/18: €61 million) with an EBIT margin of 9.0% (Q4/18: 8.8%). In FY/19, EBIT2 increased by 19% (6%1) to €131 million (FY/18: €110 million) with an EBIT margin of 5.9% (FY/18: 6.5%).

In Q4/19, net income2,3 increased by 13% to €44 million (Q4/18: €39 million). In FY/19, net income2,3 increased by 18% to €85 million (FY/18: €72 million).

1 Adjusted for German post-acute care business acquired from Fresenius Helios as of July 1, 2018

2 Adjusted for IFRS 16 effect

3 Net income attributable to shareholders of VAMED AG

4 FY/19 base: €2,206 million, including IFRS 16 effect

5 FY/19 base: €134 million, including IFRS 16 effect

For a detailed overview of special items and adjustments please see the reconciliation tables on pages 20-28 of the PDF document.

In Q4/19, order intake was €576 million (Q4/18: €660 million). FY/19 order intake increased by 7% to €1,314 million (FY/18: €1,227 million). As of December 31, 2019, order backlog reached an all-time high at €2,865 million (December 31, 2018: €2,420 million).

In Q4/19, operating cash flow1 decreased to -€8 million (Q4/18: €108 million) with a margin of -1.1% (Q4/18: 15.5%). In FY/19, operating cash flow1 decreased to -€46 million (FY/18: €106 million) with a margin of -2.1% (FY/18: 6.3%) given timing of payments in the project business as well as increased working capital.

For FY/20, Fresenius Vamed expects organic sales2 growth of 4% to 7% and EBIT3 growth of 5% to 9% in constant currency.

For further information on the IFRS 16 reconciliation of Fresenius Vamed, please see page 18 of the PDF document.

1 Adjusted for IFRS 16 effect

2 FY/19 base: €2,206 million, including IFRS 16 effect

3 FY/19 base: €134 million, including IFRS 16 effect

For a detailed overview of special items and adjustments please see the reconciliation tables on pages 20-28 of the PDF document.

Press Conference

As part of the publication of the results for FY 2019, a press conference will be held on February 20, 2020 at 10 a.m. CET. You are cordially invited to follow the press conference in a live broadcast over the Internet at www.fresenius.com/media-calender. Following the press conference, a replay will be available on our website.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.