February 26, 2025

Fresenius FY/24: Strong Fourth Quarter concludes successful Fiscal Year; Fresenius moving to next level of performance with #FutureFresenius Rejuvenate phase

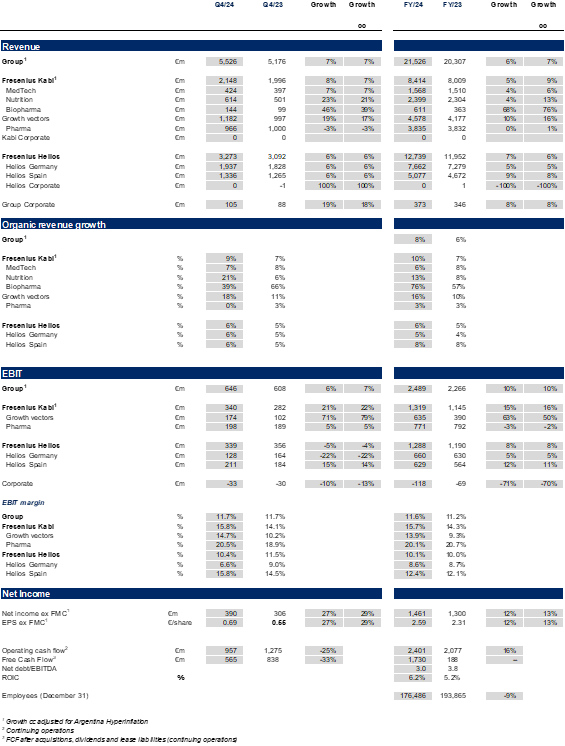

An overview of key financial figures is available at the end of the release.

FY/24: Upgraded outlook achieved, consistent financial performance with profitable growth.

- Group revenue1 at €21.5 billion with strong organic growth1,2 of 8%

- Group EBIT1 at €2.5 billion, increase of 10%3 in constant currency; EBIT margin1 of 11.6%, 40 bps above prior year

- Net income1,4 grew by 13%3 in constant currency to €1,461 million, outpacing revenue growth

- EPS1,4 grew to €2.59

- Accumulative Group structural productivity savings ahead of plan reached €474 million (planned €400 million)

- Excellent Group operating cash flow of €2.4 billion resulting from focused cash management

- Deleveraging continued: net debt/EBITDA ratio further improved to 3.0x1,5 driven by excellent cash flow. Decline of more than 70 bps since YE/23

- Dividend proposal of €1.00 per share

1 Before special items

2 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation.

3 Growth rate adjusted for Argentina hyperinflation.

4 Excluding Fresenius Medical Care

5 At average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures, including lease liabilities, including Fresenius Medical Care dividend

Q4/2024: Continued growth and further deleveraging

- Group revenue1 at €5.5 billion with organic growth of 7%1,2 driven by consistent positive development of Kabi and a strong performance at Helios

- Group EBIT1 at €646 million with solid constant currency growth of 7%3 on the back of significant operational improvements at Kabi; end of energy relief payments weighing on Helios Germany; Group EBIT margin1 of 11.7%

- EPS1,4 with outstanding constant currency growth of 29%3 to €0.69; upward impact due to high tax rate in prior-year quarter

- Strong operating cashflow of close to €1 billion in Q4

1 Before special items

2 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation.

3 Growth rate adjusted for Argentina hyperinflation

4 Excluding Fresenius Medical Care

Michael Sen, CEO of Fresenius: “Thanks to a tremendous team effort, Fresenius delivered outstanding results in 2024 with high-single-digit organic revenue growth and double-digit EBIT and EPS growth. Our growth vectors – Nutrition, MedTech and Biopharma – and consistent performance from Helios paced this strong development. On top of this operating success, we ended the year with a significant reduction in leverage, which is at the lowest level in seven years.

The momentum for success will continue through 2025, as we move to the next phase of #FutureFresenius and take the company to the next level of performance. For 2025 we expect 4% to 6% in revenue growth and 3% to 7% in EBIT growth. We have also upgraded our ambition level of the Fresenius Financial Framework. This includes higher margin ambitions for Kabi, and for the Group a lower leverage corridor.

We also want to pass on our improving financial strength to our shareholders. Thus, we want to recommend a dividend payment for the year of 1 Euro per share.

As we move forward, we continue to focus on performance and delivery. Our mission to save and improve human lives is unwavering: Fresenius is Committed to Life."

Outlook for Fiscal Year 2025

Fresenius Group1: Organic revenue growth3,5 of 4% to 6%,

constant currency EBIT growth4 in the range of 3% to 7%

Fresenius Kabi2: Organic revenue growth3 in the mid- to high-single-digit percentage range; EBIT margin5 of 16.0% to 16.5%

Fresenius Helios6: Organic revenue growth5 in the mid-single-digit percentage range; EBIT margin5 around 10%

Assumptions to guidance: Guidance assumes current factors and known uncertainties, but it does not reflect potential extreme scenarios from a fast-moving geopolitical environment.

Fresenius Financial Framework – Ambitions further raised

- Structural EBIT margin5 ambition raised for Kabi to 16 to 18% (previously 14 to 17%).

- Self-imposed leverage target7 corridor upgraded to 2.5 to 3.0x net debt/EBITDA (previously 3.5 to 3.0x)

New dividend policy reflects capital allocation priorities

Fresenius’ new dividend policy is designed to ensure attractive shareholder returns while at the same time providing strategic flexibility. Going forward, Fresenius will pay out 30 to 40% of its Group core net income excluding Fresenius Medical Care and before special items as dividend.

For fiscal year 2024, Fresenius wants to propose a dividend of €1.00 per share. The dividend proposal is a strong increase over the 2022 base and demonstrates Fresenius’ improving financial strength and its commitment to delivering shareholder value.

For fiscal year 2023, Fresenius’ dividend payment was interrupted by legal restrictions due to the receipt of the energy relief payments at Helios in Germany.

1 2024 base: €21,526 million (revenue) and €2,489 million (EBIT)

2 2024 base: €8,414 million (revenue) and €1,319 million (EBIT)

3 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation

4 Growth rate adjusted for Argentina hyperinflation

5 Before special items

6 2024 base: €12,739 million (revenue) and €1,288 million (EBIT)

7 At expected average exchange rates for both net debt and EBITDA; pro forma closed

acquisitions/divestitures; excluding further potential acquisitions/divestitures; before

special items; including lease liabilities, including Fresenius Medical Care dividend

Fresenius Group – Business development FY/24

Fresenius closed fiscal year 2024 with a strong fourth quarter and achieved its twice-upgraded full-year guidance. The consistent positive delivery of Fresenius Kabi and the strong performance at Fresenius Helios drove an 8%1 year-on-year group organic revenue2 increase to €21.5 billion. Due to an improved operating business performance, Group EBIT before special items increased 10%3 in constant currency to €2.5 billion. Earnings per share2,4 rose by 13%3 in constant currency to €2.59.

End of 2024, the #FutureFresenius Revitalize phase has been successfully concluded, resulting in significant financial progress driven by a simpler Group structure, improved steering, an optimized portfolio and a refined operating model. In 2025, the focus will be on continued value creation by entering the Rejuvenate phase, which also aims to pursue platform-driven growth. In 2025 the emphasis will be on further debt reduction, delivering higher Kabi margins, drive Helios’ program and fostering innovation.

A dedicated performance programme for Helios has been set up to increase efficiency and productivity, and to counteract the end of the energy relief funding. The programme is expected to contribute ~€100 million at EBIT level by 2025 at Helios Germany. Combined with further incremental growth of Helios in Germany and Spain, the Fresenius Helios EBIT margin is expected to be around 10% in FY/25. Contributions from the performance programme will be weighted to the second half of 2025, in particular, as some of the levers are process-related and will take time to deliver and realize benefits. Some of the performance measures are likely to materialize fully beyond 2025. This sets an excellent basis for further improving productivity within the 10 to 12% structural margin band in 2026 and beyond.

1 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation.

2 Before special items

3 Growth rate adjusted for Argentina hyperinflation

4 Ex Fresenius Medical Care

Operating Companies – Business development FY/24 and Q4

Fresenius Kabi

In FY/24, Fresenius Kabi delivered consistent financial performance over the course of the year with excellent organic revenue growth of 10%1 above the top-end of the structural growth band and an impressive EBIT margin2 expansion of 140 bps to 15.7%.

Q4/24: Fresenius Kabi delivered a strong finish to the year

- Organic revenue growth of 9%1 driven by positive pricing effects, particularly in Argentina, revenue increased by 8% to €2,148 million.

- Growth vectors with strong organic revenue1 increase of 18%: MedTech 7%, Nutrition 21%, Biopharma 39%.

- Nutrition revenue: €614 million, benefited from positive pricing effects in Argentina and the good development in the U.S., driven by the ongoing roll-out of lipid emulsions.

- Biopharma revenue: €144 million, driven by the overall good rollout of Tyenne in Europe and the U.S.

- MedTech revenue: €424 million, driven by a broad-based positive development across most regions, including the U.S. and Europe

- Pharma revenue: €966 million, flat organic revenue development1; the positive development in many regions was offset by a softer development in China.

- China business continued to be impacted by a general economic weakness, price declines in connection with tenders, and indirect effects of the government’s countrywide anti-corruption campaign.

- EBIT2 of Fresenius Kabi grew 21% to €340 million, driven by good revenue development and improved structural productivity. The EBIT-margin2 was 15.8%, a 170 bps expansion.

- EBIT2 of the Growth Vectors increased by 71% on a positive development across the board; EBIT margin2 was 14.7%. EBIT positive in Biopharma in FY/24.

- EBIT2 of Pharma increased by 5% to €198 million. EBIT margin2 was 20.5% driven in particular by cost discipline.

1 Organic growth rate adjusted for the accounting effects related to Argentina hyperinflation.

2 Before special items

Fresenius Helios

In FY 2024, Fresenius Helios delivered organic revenue growth of 6% driven by solid activity growth and favorable price developments in Germany and Spain. EBIT margin1 of 10.1% within the structural margin band ambition.

Q4/24: Fresenius Helios with strong EBIT development in Spain; end of energy relief payments weighing on Helios Germany

- Strong 6% organic revenue growth at the top-end of structural growth band driven equally by Helios Germany (6% organic growth) and Helios Spain (6% organic growth); revenue before special items increased 6% to €3,273 million.

- Helios Germany with revenue of €1,937 million; growth driven by pricing effects and admissions growth.

- Helios Spain with revenue before special items of €1,336 million, driven by solid activity levels and favourable price effects. The clinics in Latin America also showed a good performance.

- EBIT1 of Fresenius Helios declined 5% to €339 million as the energy relief funds ended in Q4. EBIT margin1 was solid at 10.4% driven by the excellent profitability at Helios Spain with a margin of 15.8% and 15% EBIT growth.

- EBIT1 of Helios Germany decreased by 22% to €128 million as the prior-year quarter was significantly supported by energy relief funds.

- Dedicated Helios performance programme initiated to drive further operational excellence and compensate end of energy relief funding in Germany. Fresenius Helios EBIT margin is expected to be around 10% in FY/25.

1 Before special items

Financial figures and growth rates adjusted for the divestment of the fertility services group

Eugin and the hospital stake in Peru.

Group figures Q4 & FY 2024

Note on the presentation of financial figures

- If no timeframe is specified, information refers to Q4/2024.

- Consolidated results for Q4/24 as well as for Q4/23 include special items. An overview of the results for Q4/2024 - before and after special items – is available on our website.

- The results of Fresenius Helios and accordingly of the Fresenius Group for Q4/24 and Q4/23 are adjusted by the sale of the fertility services group Eugin and the divestment of the majority stake in the hospital Clínica Ricardo Palma hospital in Lima, Peru.

- Growth rates in constant currency of Fresenius Kabi are adjusted. Adjustments relate to the hyperinflation in Argentina. Accordingly, in constant currency growth rates of the Fresenius Group are also adjusted.

- Information on the performance indicators is available on our website at https://www.fresenius.com/alternative-performance-measures.

* * *

Conference call and Audio webcast

As part of the publication Fourth Quarter and Full Year 2024 results, a conference call will be held on February 26, 2025 at 1:30 p.m. CET (7:30 a.m. EST). All investors are cordially invited to follow the conference call in a live audio webcast at www.fresenius.com/investors. Following the call, a replay will be available on our website.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, the availability of financing and unforeseen impacts of international conflicts. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius SE & Co. KGaA

Registered Office: Bad Homburg, Germany / Commercial Register: Amtsgericht Bad Homburg, HRB 11852

Chairman of the Supervisory Board: Wolfgang Kirsch

General Partner: Fresenius Management SE

Registered Office: Bad Homburg, Germany / Commercial Register: Amtsgericht Bad Homburg, HRB 11673

Management Board: Michael Sen (Chairman), Pierluigi Antonelli, Sara Hennicken, Robert Möller, Dr. Michael Moser

Chairman of the Supervisory Board: Wolfgang Kirsch